- The recent unrest in the country fueled by protests along with the Russian invasion of Ukraine has pushed Kaspi to a very attractive valuation.

- Dominant market position with plenty of possibilities to grow in the region.

- An attractive valuation offers a steep discount to intrinsic value, with plenty of growth ahead.

Kaspi (OTC: KAKZF) has been one of the most impressive emerging market growth stories. Located in Kazhakstan, it has been able to create an ecosystem that easily attracts and retains customers.

The recent protests in the country, as well as the Russian-Ukrainian conflict, have pushed Kaspi to trade like a penny stock. These macroeconomic developments have led Kaspi to be one of the most attractive growth opportunities in emerging markets for long-term focused investors.

It is clearly a high-risk stock, but given the growth, and its market-leading position it is extremely attractive.

It currently has a dividend yield of over 6%, allowing investors to get paid while they wait. Given the low price-to-earnings, and with growth expected to continue over the coming years, Kaspi should be on your watchlist.

Kaspi is trading like a penny stock

With the recent European volatility caused by the war in Ukraine, some of the former USSR nations and Russian allies have seen added geopolitical risk to their markets. Kaspi was no exception.

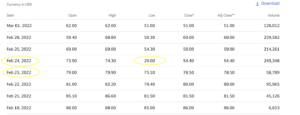

On the 24th of February, soon after news broke out that Russia had invaded Ukraine, Kaspi was in for one of the wildest trading sessions the stock will ever see.

On the 23rd the stock closed at around $79. The preceding day it started to dip, until what was most likely a market order by several large institutional holders. This pushed the stock to $20, a decline of nearly 75%. However, it quickly recovered and closed at $54.4.

Double-digit daily moves could continue, as the stock bounces around the $20-$50 levels. At this point, with the ongoing conflict and uncertainty towards what comes next, it is likely that the stock will continue to be extremely volatile.

Kaspi overview

Kaspi is the largest payments, marketplace, and fintech ecosystem in Kazakhstan. The company is headquartered in Almaty, Kazakhstan. An important component of Kaspi is the partner ecosystem, which brings together services for individuals and retailers. This allows the company to easily combine its different segments, and retain customers.

Kaspi offers a broad range of financial services, that include online car loans, online payments, and money transfers using payment cards just to name a few. While its marketplace segment has the largest regional online platform for buying and selling goods that allows Kaspi to combine it with its fintech and payment segments.

The ability to cross-sell has allowed the company to establish itself as the market leader. While increasing customer retention, and its customer lifetime value (CLV).

Based on assets, Kaspi is the 3rd largest bank in Kazakhstan. Although Kaspi has originally been a bank, the company’s wide online presence has allowed lower costs, and has a reduced number of branches across the country. It has just 34 branches across the country and 148 service offices.

Kaspi bank branch locations

Kaspi Segments

The company’s operations are broken down into three segments:

- Payments

- Marketplace

- Fintech

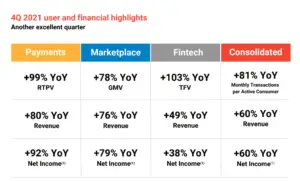

Each segment is growing revenues substantially with net income margins holding steady at nearly 40% in 2021, although they are expected to decline to the low 30s in 2022.

What is impressive about Kaspi is how all the segments were growing revenues at triple-digits not too long ago.

Since then growth has slowed down but the top line is still growing at over 78% in the marketplace segment. While the payments and fintech segment are still growing at ~100%.

Here is a breakdown of the growth of each segment over the last quarter:

Source: Investor Presentation

While the fintech segment was always the core contributor for net income and revenues, the payments, and marketplace segment now represent ~51% of net income.

Kaspi segments

Payments

The Payments Platform allows clients to make online and in-store purchases. As well as pay for regular household needs, and make comfortable online P2P payments within and outside the Kaspi ecosystem.

This includes Kazakhstan and abroad to any Mastercard or Visa. The connection to the global financial ecosystem is a key point for Kaspi customers. In fact, Kaspi represents ~70% of all electronic transactions.

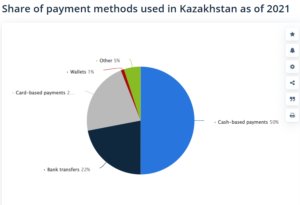

Since the Kazaki economy still relies heavily on cash-based payments, that makes up 50% of all of the transactions. This shows that there is further growth for the payment segment.

Source: Statista

By comparison, in the US, ~19% of the payments are in cash. This shows that going forward Kaspi’s payment segment could still double, and reach levels similar to the US.

Marketplace

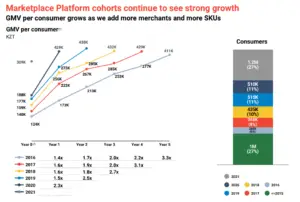

Kaspi is Kazakhstan's largest ecommerce marketplace, with Alibaba ranking second. What makes Kaspi’s marketplace so attractive is the large number of merchants, and the wide variety of products offered. With SKUs increasing 310% YoY as of 4Q21, it increased 25% QoQ.

Combining this with the company’s fintech, and payment segment makes it a very compelling value proposition for both customers and merchants. The number of merchants is up 353% YoY, and it reached 242,000 as of last quarter. GMV continues to grow especially as the number of merchants and SKUs also increases.

Source: Investor Presentation

According to PwC the total size of the retail ecommerce market in Kazakhstan was estimated at ~$1B. Considering revenues for the segment in 2021 were $310M it roughly translates into a market share of over 30%. Showing the company’s dominant position in the region.

Marketplace growth

Similar to the payment segment, the local economy is still based on physical retail. The shift towards ecommerce is clearly in its early stages. Ecommerce in the region is expected to grow at a CAGR of 20% until 2025.

Ecommerce in Kazhakstan represented 9.7% of the total retail turnover. By comparison in the US, ecommerce sales as of Q4 represented 12.9% of total sales. Signaling that there is still some room to grow.

Fintech

Because of its highly advanced infrastructure, Kaspi can make a high-quality credit judgment in real-time, frequently within seconds, ensuring a flawless client experience.

The fintech segment is also deliberately structured around product selection, which means clients may first choose the goods they want to buy, and then access various financing options via the Kaspi’s app. The Kaspi fintech ecosystem includes a digital bank instant deposit and P2P payments resembling Block, formerly known as Square (NYSE: SQ).

Kaspi focuses on consumer financing, and buy-now-pay-later, which allows the company to combine it with its marketplace segment. Its ability to cross-sell, and retain customers in its ecosystem remains a strong competitive advantage. It also offers online car finance, and other services.

Kaspi is earning a spread of 13.66% between its cost of deposit and the yield generated on its loan portfolio. As of Q4, Kaspi continues to grow its number of consumers both in deposit (32% YoY), and financing (34% YoY). Kaspi currently has 2.8M deposit consumers and 4.9M loan consumers.

Fintech shift

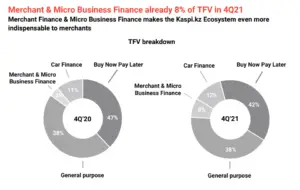

What Kaspi denominates as Total Finance Value (TFV), or the total amount of loans during 2021 reached ~$8.8B. This is an increase of 137% YoY. Kaspi also seems to be reducing the risk, by focusing on car and SMB financing. These categories provide the company with more guarantees, in case of delinquencies rising.

Over the last year, the merchant and SMB financing more than doubled in terms of nominal value, and they now represent 20% of the total loans granted.

While BNPL, and consumer credit still represent 80% of the Fintech segment, the company seems to be moving into more attractive areas. Car finance, as well merchant and SMB financing solutions clearly carry less risk.

Source: Investor Presentation

Financials by segment

Revenues and net income during 2021 divided by segment show that the fintech segment is still the most relevant, accounting for over 60% of revenues, and ~48% of net income.

| Segment | Fintech | Marketplace | Payments | Total |

| Revenues | ~$1.160B | ~$310M | ~$440M | ~$1.91B |

| Net income | ~$450M | ~$210M | ~$270M | ~$930M |

While the marketplace is not the most significant segment, it is clearly the one growing the fastest. Compared with 2020, the marketplace grew revenues by 133%, and net income by a staggering 157%.

The payments segment revenues grew by 80% compared with the results in FY20, and net income was 108% higher.

Kaspi guidance

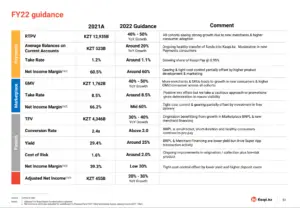

Kaspi recently reported its 21FY results, and its guidance for FY22 is showing that growth is slowing down. Despite being lower than in 2021, management still expects to grow the top line between 40% and 50% and the bottom line by at least 20%.

Source: Investor Presentation

Kaspi expansion approach

Kaspi has taken an acquisition approach to continue to grow outside its core market. This allows the company to establish a direct presence in the new region that it is expanding into, and incorporate its business model on the acquired company.

Another clear advantage is that due to how business is conducted in these regions, and the endless bureaucracy, it is easier and faster to acquire another established business that already has licenses approved.

There is also the advantage of already having a customer base, and the valuations in those regions are much more attractive when compared with say Europe or US. Sometimes even combining several acquired vertical solutions.

Acquisitions so far have been focused on Azerbaijan due to the fact that is one of the largest economies in the region. However, Kaspi has also been trying to get into the Ukrainian market.

Kaspi ties to Ukraine

With Kaspi’s intention of expanding to Ukraine, the company acquired Portmone Group. A payment processing company in Ukraine, that intended to combine with another one of its targets - BTA Bank.

However, the deal was already involved in some controversy. Due to the sanctions imposed by the EU, Ukraine’s National Bank did not approve the transaction initially. It is too soon to say if the deal will still go through.

This clearly is a risk, since it is unknown if BTA Bank will still be acquired.

The expansion into Ukraine has proven to be an unfortunate decision, but it should not comprise the strength of Kaspi’s business.

Past growth

Full-year revenues have grown 163% from 2018 to 2020 from$536 million to $863 million. That is a CAGR of 28% in revenues alone.

| In Thousands | 2018 FY | 2019 FY | 2020 FY |

| Period Ended | 12/31/18 | 12/31/19 | 12/31/20 |

| Average Exchange Rate ($) | 0.002908 | 0.002613 | 0.002422 |

| Total Revenue ($000) | 536,530 | 752,125 | 863,936 |

| Total Revenues, 1 Year Growth (%) | 32.03 | 56.01 | 23.95 |

| EBT Excl Unusual Items ($000) | 351,377 | 550,265 | 654,384 |

| EBT Excluding Non-Recurring Items Margin (%) | 65.49 | 73.16 | 75.74 |

| Earnings from Cont. Ops. ($000) | 289,475 | 456,053 | 548,619 |

| Earnings from Cont Ops Margin (%) | 53.95 | 60.64 | 63.50 |

| Net Income ($000) | 289,475 | 456,053 | 548,619 |

| Net Income Margin (%) | 53.95 | 60.64 | 63.50 |

| Diluted EPS Excl. Extra Items ($) | 15.62 | 24.49 | 29.31 |

| Diluted EPS Before Extra, 1 Year Growth (%) | 47.04 | 74.52 | 29.15 |

| Total Assets ($000) | 4,424,238 | 5,666,044 | 6,612,927 |

| Total Assets, 1 Year Growth (%) | 15.41 | 27.67 | 28.45 |

Estimates for the next 2 years, using extremely conservative expectations and incorporating management's own estimates for 2022.

| In Thousands | 2021FY A | 2022FY E | 2023FY E |

| Period Ended | 12/31/21 | 12/31/22 | 12/31/23 |

| Average Exchange Rate (KZT/$) | 0.00200 | N.A. | N.A |

| Total Revenue (millions of dollars) | 1,910 | 2,674 | 3,342 |

| Total Revenues, 1 Year Growth | 46.8% | 40% | 25% |

| Net Income (millions of dollars) | 930 | 802 | 1,002 |

| Net Income Margin | 48.7% | 30% | 30% |

| Diluted EPS Excl. Extra Items ($) | 4.8 | 4.17 | 5.21 |

Revenue growth is expected to continue above 40% over the next year, while net income and EPS might decline in 2022 due to the lower margins, and increased currency devaluation.

Further expansion of its digital payments platform in Kazakhstan as well as Central Asia and the Caucasus region will allow Kaspi to continue its considerable growth.

Kaspi valuation

Besides the growth, competitive advantages, effective ecosystem, and market-leading position, the valuation could not be more attractive.

It obviously reflects the risks of investing in that part of the globe, along with the wave of protests in Kazhakstan and the recent Russian-Ukrainian conflict that could spread into other regions.

It seems that given the valuation, and even the lower growth expected for 2022, Kapsi is still the market leader, and one of the most attractive growth stocks in emerging markets.

Let’s look at some ratios based on the 2021 results:

- Market cap: ~$6.75B

- Price-to-earnings: 7.25

- Price-to-sales: 3.53

- Price-to-book: 6.55

Operating cash flow before changes in operating assets and liabilities reached ~$1.13B. Most of the cash flow was then used to provide loans to the customers ~$2.16B, which was offset by customer deposits of ~$1.221B.

It currently has ~$700M in cash and equivalents over 10% of its market cap.

If we consider management’s lowest expectation of growing net income by 20% in 2022, it would reach ~$1.116B, that is a price-to-earnings of 6.

Kaspi is currently trading at ~$35 close to its IPO price of $33.75 a share. Increased volatility is expected, and there is no telling whether the stock will be at $10-$20 or $50-$60 in a matter of days or weeks.

Net income margins are expected to be lower in 2022 around the low 30s. Even with the top-line growth, management expects EPS to decline in 2022.

Kaspi clearly has a margin of safety, even when we take into consideration all the risks associated.

Even if we assume a fair valuation with a price-to-earnings of 12 in 2023, where the EPS is expected to be over $5, we arrive at a fair value of around $60 per share, showing at least 70% upside from these levels.

A possible de-escalation of the conflict between Ukraine and Russia, along with the stabilization of the Kazakh regime could create a scenario where multiples could expand.

Risks

Kaspi is not a free lunch, and it comes with its own specific sets of risks that should be considered.

Currency risk

The Kazakhstani Tenge has been losing its value against the dollar at a fast pace over the last decade, and the beginning of this one.

The Russian invasion of Ukraine has also contributed negatively, with the KZT declining by 13% against the dollar, in just a week. Obviously, this presents a risk, and until the situation in the region stabilizes volatility and further declines are expected.

Recent protests in Kazakhstan

In the first days of 2022 mass protests erupted in Kazakhstan. Against this backdrop, Kaspi stock prices plummeted by a combined 20%. The lowest values were reached on January 6: $71 per Kaspi share.

Kaspi's 20 branches were affected across Kazakhstan during the emergency. The company said this and specified that the police asked not to touch anything in the affected branches in order to conduct investigative measures.

Kaspi noted that it is not involved in calculating the damage caused by the looters. The bank is focusing on getting things back on track and giving customers access to their money. Kaspi has 1990 ATMs across the country, of which 1,435 are online and physically accessible.

Kazakhstan’s link to Russia

It’s important to mention that Kazakhstan has a similar history to Ukraine. Once a part of the USSR, Kazakhstan declared independence in 1991. Although independent, Kazakhstan still has a close strategic relationship with Russia.

A significant section of the population is ethnically Russian and still supports the Kremlin. Of the estimated 19 million Kazakhs, 63% are ethnic Kazakh but 23% are ethnic Russian.

It would not be unthinkable that like in Ukraine, Russia used this minority group to justify a similar invasion. Russian troops have moved into the area during the recent protests, but have started to return.

The population is substantially more supportive of a strong relationship with Russia. This relationship can come with disadvantages if other nations limit involvement with Russian allies.

With the unprecedented package of EU and US sanctions, there is no guarantee that countries close to Russia will not be affected. Kazakhstan has also abstained during the UN vote over the Russian invasion of Ukraine.

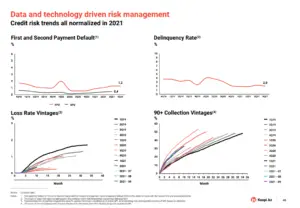

Credit risk

Concerning credit risk, we have observed very low delinquency rates at around 2%. It should also be noted that first, and second payment defaults have remained low at 1.2% and 0.4% respectively.

Credit risk remains one of the decisive factors for any investor considering investing in Kaspi.

Source: Investor Presentation

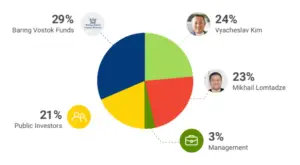

Ownership structure

Kaspi is mainly controlled by its CEO, and chairman of the board. Both their stakes represent 47% of the company’s outstanding shares. The private equity firm Baring Vostok owns 29%, with management owning 3%.

Given that most of the company’s ownership is in the hands of a few investors, and with the recent volatility the stock has been experiencing, the company could be taken private.

Additionally, given the importance of Kaspi to the Kazhak economy, as well as its close ties to government officials we cannot rule out the possibility of the government taking control of the company.

There is also some controversy surrounding the ownership structure of the company prior to its IPO, leaving investors with a few unanswered questions.

Conclusion

The geopolitical risks surrounding Kazakhstan have made Kaspi quite attractive for long-term focused investors.

Kaspi has a striking risk/reward profile given its impressive growth and strong position to expand in Central Asia and the Caucasus region. A properly hedged position is likely to do well over the long term as tensions ease, and the management continues to execute on its growth and efficiency objectives.

Kaspi has been able to create a very interesting business ecosystem that hardly can be replicated. Its strong competitive advantages make it very difficult for competitors to compete directly. Additionally, the ecosystem offers great value to its customers.

The economy in Kazakhstan is still pivoting into the online world. Meaning that there is a lot of growth ahead for Kaspi. Even considering the risks, and with limited exposure, the stock is worth investing in as a small part of the portfolio.