Cisco Systems (CSCO) is a stock many people do not know about but should. During the dot-com boom, Cisco was, at one point, the largest company by market capitalization. The dot-com crash changed that. However, Cisco had actual products, revenue, and profits and could continue to grow. Today, the company is still a global market leader in Internet Protocol networking. In addition, Cisco is a prominent dividend growth stock with 13 years of increases, making the company a Dividend Contender. Cisco is yielding 3.1%, backed by excellent dividend safety. The stock is trading below its 5-year price-to-earnings ratio (P/E ratio) range. Hence, I view Cisco as a buy now.

Overview of Cisco

Cisco was founded in 1984 and became the world’s largest Internet Protocol networking company. The firm operates in two business segments: Products and Services, selling hardware and software for switching, routing, data centers, and wireless applications. Cisco also sells software for networking, analytics, collaboration, security, and firewalls. The company focuses on six product categories: Secure, Agile Networks (46% of total revenue); Internet for the Future (10% of total revenue); Collaboration (9% of total revenue); End-to-End Security (7% of total revenue); Optimized Application Experiences (1% of total revenue); and Services (26% of total revenue). Cisco is ranked 15th in the 2022 Interbrand’s Best Global Brand list.

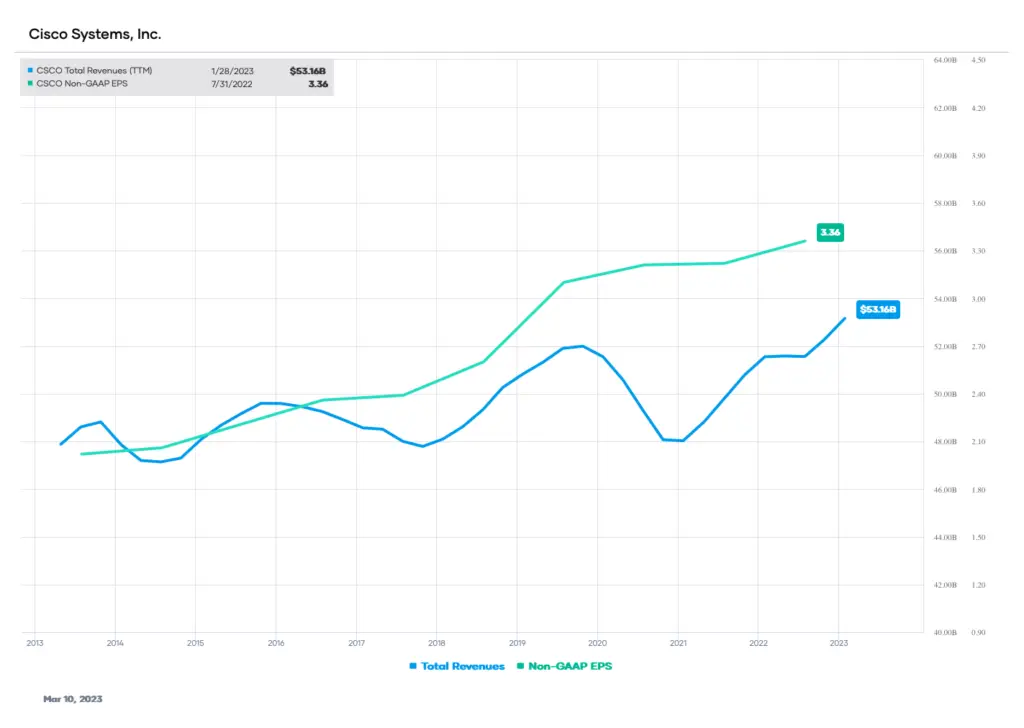

Total revenue was $53,161 million in the past 12 months and $51,557 million in the fiscal year 2022.

Cisco’s Growth

Cisco has struggled to generate growth in the past decade because of competition. However, the company has increased revenue in the past few years through new products, services, and acquisitions. As a result, earnings per share increased on a significant decline in share count from roughly 5,389 million in 2013 to about 4,170 million in 2022. Cisco uses its prodigious free cash flow to buy back shares, lowering the total share count.

Source: Portfolio Insight

The networking giant brings out new products and services annually. They often have new features, improved security, and existing customers upgrade. Cisco is an acquisitive company. The firm acts as a consolidator in the technological space, acquiring startups and smaller competitors. Since 2020, Cisco has acquired 18 companies. More recent acquisitions are Valtix, Syrmia Networks, Opsani, replex, and Epsagon.

In addition, Cisco has been moving customers to a subscriber model to generate recurring revenue. This effort is proving successful. At the end of the most recent quarter, Cisco reported $23.3 billion in annualized recurring revenue (ARR), with subscription revenue representing 44% of total revenue.

Competition and Risks

Cisco will likely continue the same strategy in a mature and competitive market. But Cisco faces significant competition from many large and small competitors, such as Arista Network (ANET), Juniper Networks (JNPR), Aruba Networks, and Huawei.

But besides networking, companies compete in market niches with Cisco. For instance, Palo Alto Networks (PANW), Checkpoint Technologies (CHKP), Fortinet (FTNT), F5 Networks (FFIV), and FireEye (FEYE) are primary players in networking security and software.

The list of competitors is even longer if one includes the many smaller privately held companies and startups.

That said, Cisco has positioned itself as a provider of complete solutions for customer networking needs. No other corporation, public or private, can do that at the same scale.

Dividend Analysis

Cisco presents investors with a solid combination of dividend yield, growth, and safety. The firm pays an annual forward dividend of $1.56 per share, yielding approximately 3.20% as of this writing. The 5-year average is about 3.0%, but the current yield is nearly double that of the S&P 500 Index's average.

Cisco has a 13-year track record for paying and increasing the dividend, making the stock a Dividend Contender. However, the dividend growth rate has slowed because the payout ratio has risen. It is 11.69% CAGR in the past decade and 5.97% CAGR in the trailing five years. The most recent quarterly dividend increase was 2.6% to $0.39 per share in February 2023.

Source: Portfolio Insight

Cisco has excellent dividend safety from the view of earnings, free cash flow, and the balance sheet.

From an earnings perspective, the dividend was safe in the fiscal year 2022 (fiscal year ending July 30, 2022). Cisco's non-GAAP diluted earnings per share were $3.36. The dividend required $1.51, giving a payout ratio of ~45%. The forward payout ratio is moderate to at ~44%. These percentages are well below our cutoff of 65% for an unsafe dividend.

The dividend is also safe from the perspective of cash flow. In fiscal 2022, the free cash flow was $12,749 million. The dividend required $6,224 million, giving a dividend-to-FCF ratio of roughly 49%. This value is below our threshold of 70% and reinforces the idea that Cisco’s dividend is safe. Notably, Cisco could still maintain excellent FCF even when challenged by inflation and supply chain constraints caused by the COVID-19 pandemic. As these forces abate, FCF may increase in fiscal 2023 and 2024.

The net cash position on the balance sheet reinforces Cisco's dividend safety. Total debt was $10,561 million at the end of FY 2022. This amount was offset by $22,061 million in cash, equivalents, and short-term investments. Despite rising interest rates, Cisco should not struggle with debt. Moreover, Cisco has AA-/A1 high-grade and upper-medium invest grade credit ratings from S&P Global and Moody's. Also, it has a dividend quality grade of an ‘A,’ further adding to confidence.

Valuation

Cisco is currently undervalued based on consensus FY 2023 earnings of $3.75 per share. At the current stock price, Cisco trades at a forward P/E ratio of approximately 13.0X. The stock price is slightly up in the calendar year 2023 but down nearly (-13%) in the past year. Assuming a fair value multiple of 14X gives a target price of $52.50 per share.

Other valuation models give similar results. For example, the Gordon Growth Model gives a price target of $52, assuming an 8% return and 5% dividend growth rate. The blended fair value model provides $52.75.

The average of these three models is $52.42, indicating Cisco is undervalued at the current stock price of $48.81.

Final Thoughts

Dividend growth investors should certainly be interested in Cisco because of its growing dividend, nice yield, and excellent dividend safety. The firm has maintained its leadership in a competitive market. Granted, the company is no longer a high-growth one. But it should grow in low-single digits on average each year. Cisco is undervalued based on the historical P/E average, making it a buy.

Disclosure: Long CSCO.

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.

Author Bio: Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.