- Coca-Cola is clearly overpriced, with a price-to-earnings of 32, there is very little upside for investors looking for high returns.

- We propose that investors looking for stocks with ties to Coca-Cola look at bottlers, who also tend to be high-quality companies and offer more value.

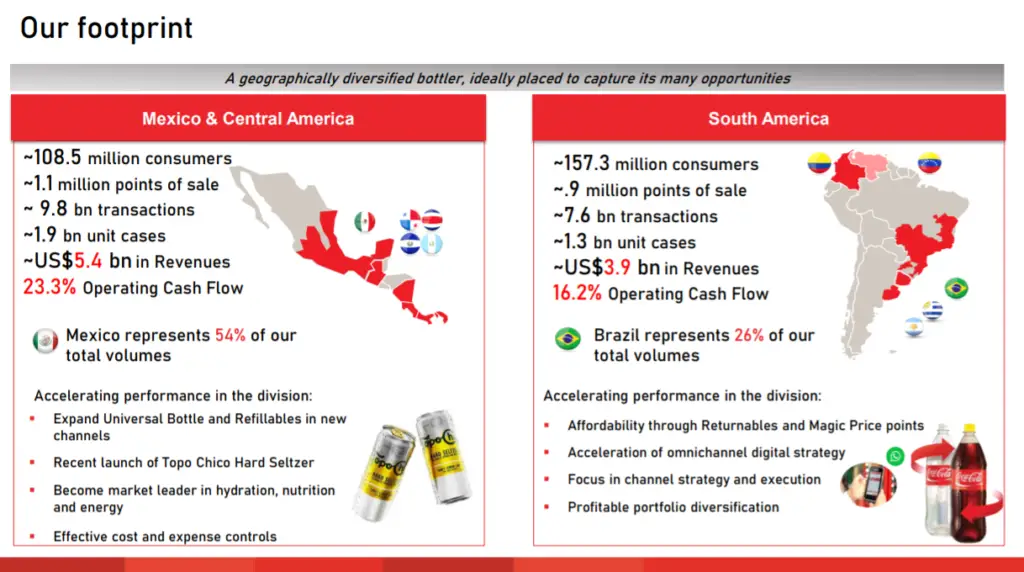

- Coca-Cola FEMSA is the largest Coca-Cola bottler by volume and has a strong presence in South and Central America.

- It trades at a discount to its peers, and it is a compelling long-term investment for patient investors.

The Coca-Cola Company (NYSE: KO) is a great stock to own for the long-term, which has been thoroughly analyzed here. A stable dividend payer that has been among Buffett’s favorite picks for years. It trades at a high valuation, with a price-to-earnings over 32. A valuation that is so high that it will be difficult for investors to get meaningful returns.

Although we like the company, at these levels the investment makes very little sense from a value perspective. There are far better opportunities in the same space, namely coca-cola bottlers, which are trading at fair valuations. We will look at Coca-Cola FEMSA, which is trading at an attractive valuation.

Coca-Cola FEMSA

Coca-Cola FEMSA (NYSE: KOF) has been one of our favorite picks since last year. When we first analyzed the stock, it was trading at a slight discount to its fair value. Given the brand, and its strong and consistent revenues and profits, the stock deserves a higher valuation. Coca-Cola FEMSA is the largest Coca-Cola bottler in the world.

Covering the South America region, it is present in Mexico, Brazil, Guatemala, Venezuela, Argentina, Uruguay, Costa Rica, Panama, Colombia, and Nicarágua. Over the years it consistently acquired other bottlers and continued to grow revenues. Although Coca-Cola is by far the most important drink and accounts for over 60% of sales, Coca-Cola FEMSA also distributes other beverages. Coca-Cola Femsa accounts for 11% of global sales of the beloved fizzy drink.

Source: Investor Presentation

More than just Coca-Cola

Coca-Cola FEMSA is the market leader in South and Central America of fizzy drinks and non-carbonated soft drinks. Coca-Cola FEMSA is also engaged in the distribution of Heineken (OTC: HEINY). A long-going dispute between the companies has recently turned out favorably for Coca-Cola FEMSA.

The distribution contract with Heineken was about to end in 2022. In fact, Heineken tried to end the contract earlier, which started the dispute between the companies. Heineken acquired Kirin and set up its own distribution in Brazil.

Coca-Cola FEMSA had a distribution agreement with Heineken that was in place until 202. The company filed a lawsuit alleging Heineken acquired Kirin with the intent of breaking the contract with Coca-Cola FEMSA. The court ruled in Coca-Cola FEMSA’s favor.

The contract was expected to expire in 2022, and although it is not the most important sales segment for Coca-Cola FEMSA, it would be important to keep the agreement in place. The contract was eventually extended until 2026, earlier this year and this is one of the reasons the stock has been trading higher. It is unforeseeable if it will extend past 2026.

Sales and figures

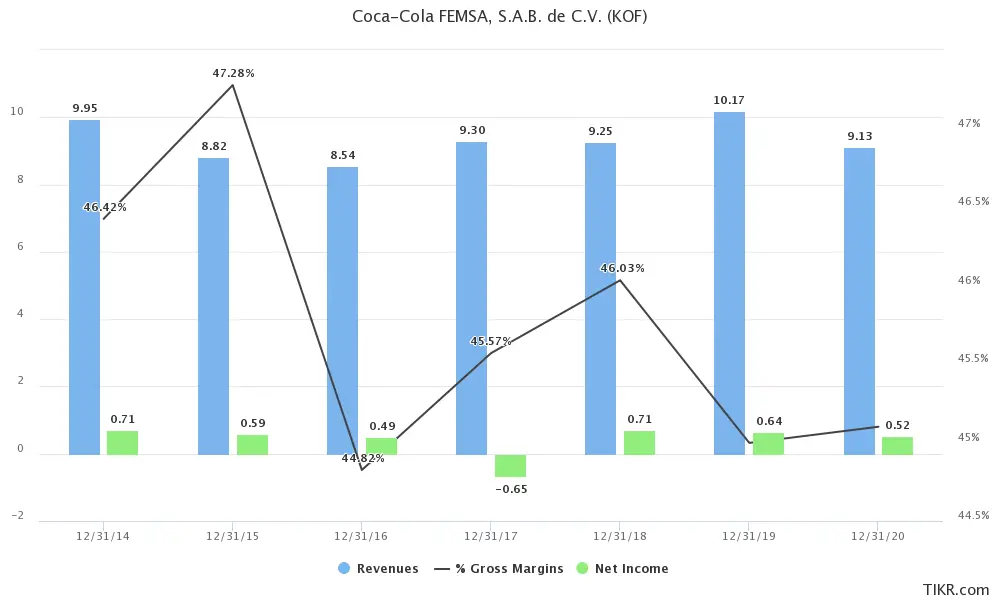

Coca-Cola FEMSA tends to have stable revenues, and margins that lead to consistent profits. Although the growth is not astonishing, it slowly compounds over time. From 2009 to 2019, Coca-Cola FEMSA grew revenues and EBITDA at a CAGR of 7%.

Source: TIKR

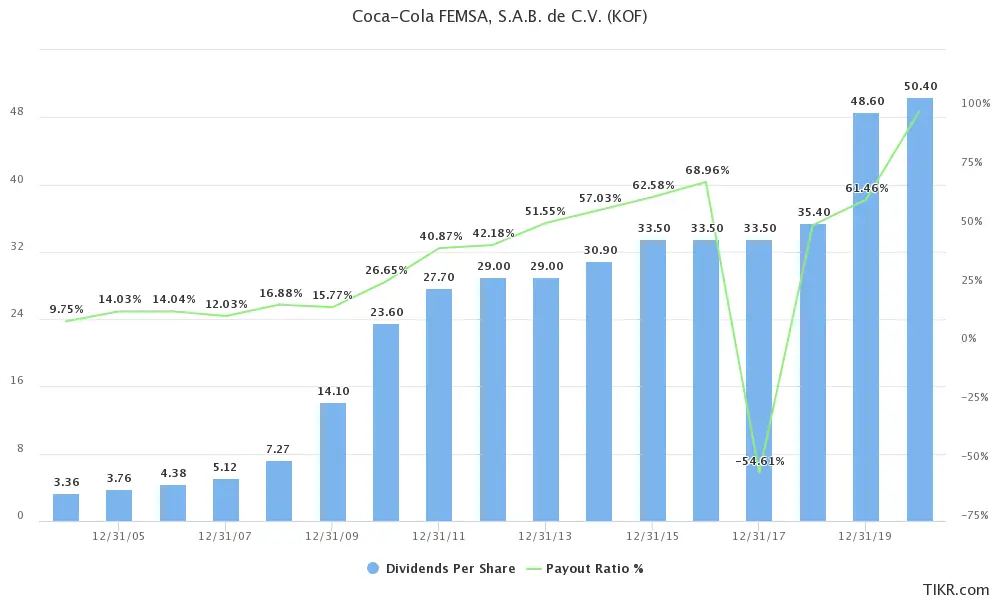

It has also increased dividends consistently in Mexican pesos. Due to the conversion rate, and devaluing of the Mexican currency, in dollar amounts the dividend actually decreased slightly in some years.

Source: TIKR

Growth ahead

Although it has been able to grow revenues, and profits in the single digits yearly. Most of the impactful growth has been achieved through M&A. Consolidating bottling and distributing operations across South and Central America. Although there are some organic ways that the company might grow, there are also possible acquisitions that would be key to increasing its market-dominant position.

Embotelladora Andina (NYSE:AKO-A) is one of these companies. With a market cap under $2B, and with a meaningful presence in South America, it is one of the major competitors of Coca-Cola FEMSA. This could be an interesting acquisition, and it is certainly a possibility that Coca-Cola FEMSA’s management has studied.

Devalued currencies across South American countries have pushed the stock price lower over the years. Although it is certainly a risk, at the end of the day we think companies such as Coca-Cola FEMSA, and Embotelladora Andina have pricing power. They can easily raise prices in local currency, without meaningfully affecting demand.

Valuation

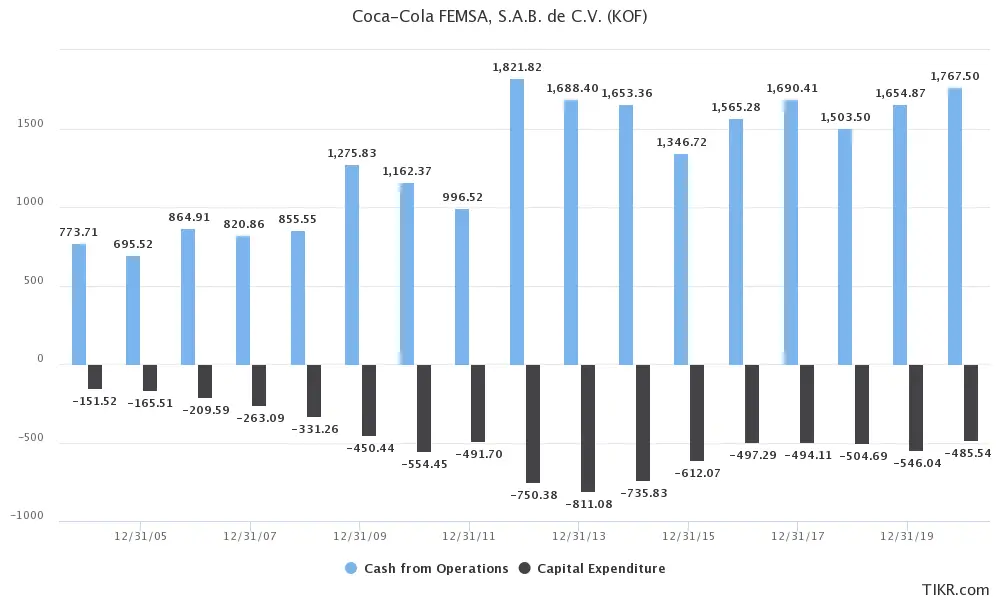

Coca-Cola FEMSA generates roughly $1B in free cash flow every year, with a market cap just shy of $11B. Considering the competitive advantages it has in the South America region, and the possibility to grow through acquisition and deals with other brands, we see this as a very attractive price. Trading under 11x free cash flow seems undervalued.

Source: TIKR

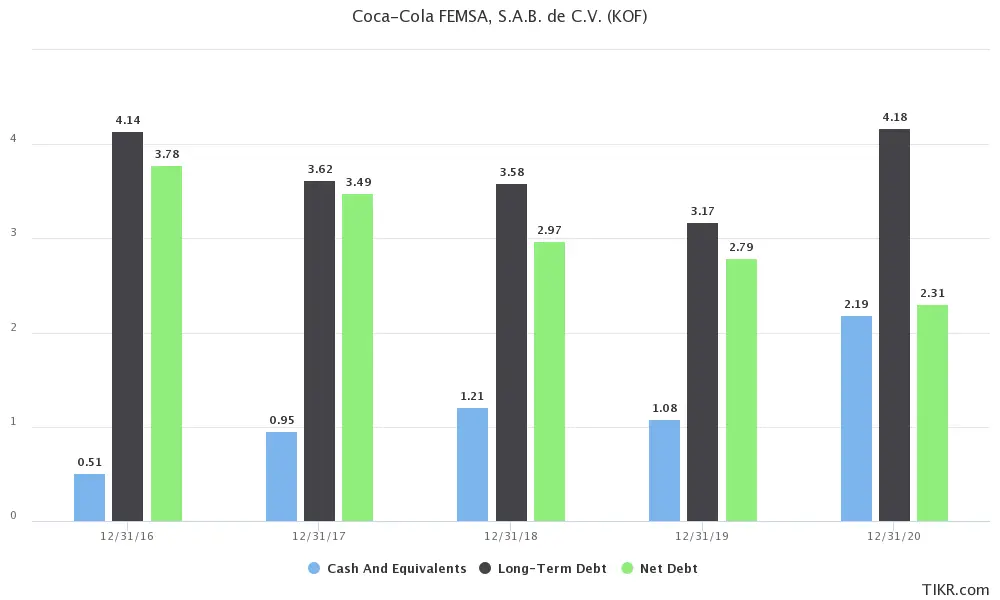

Coca-Cola FEMSA trades at 2x book value, and at 1.2x sales, which is attractive given the strong competitive position in the South American region. Looking at the balance sheet, we can also see that Coca-Cola FEMSA has a strong cash position. It has been able to reduce its net debt over the last few years.

Source: TIKR

Although comparison with peers is certainly not the best way to value companies, in this case, there are very similar companies. Coca-Cola Europacific Partners (NYSE: CCEP) is the Coca-Cola distributor in Europe and the Pacific region. It trades at much higher multiples, with a price-to-earnings of ~46, and its market cap is ~153% higher than Coca-Cola FEMSA. Coca-Cola Europacific Partners sales are slightly higher, but despite that Coca-Cola FEMSA has higher sales volumes, representing 11% of global Coca-Cola sales.

Given the slight difference in financial results, there is no reason why Coca-Cola FEMSA should trade at such a discount to its Europacific counterpart. The only reason is the weakening South American currencies that increase the cost of capital, and pose a challenge to the company.

Bottom line

A stable company, with a strong presence in South America with competitive advantages. Although the expected growth will most likely be in the single digits going forward, it provides enough downside protection to investors. While at the same time generating a generous dividend and free cash flow yield. It trades at a little over $50, which remains undervalued. Our price target is $60 which is closer to its fair value.

Given the high valuations in most markets, and especially in Coca-Cola, we see Coca-Cola FEMSA, as a high conviction long-term investment. Although it might not produce the best returns, it is less volatile and generates a consistent cash flow.

There is room for growth mainly through acquisitions. Another interesting fact about Coca-Cola FEMSA is that it was one of the main holdings of the Bill and Melinda Gates Foundation. Some of the shares were initially acquired in 2007. Following the divorce of the couple, the shares have been transferred to Melinda French Gates, which now controls 4.9% of Coca-Cola FEMSA.

We are long KOF. Read our disclosure.

Featured image source: businessinsider