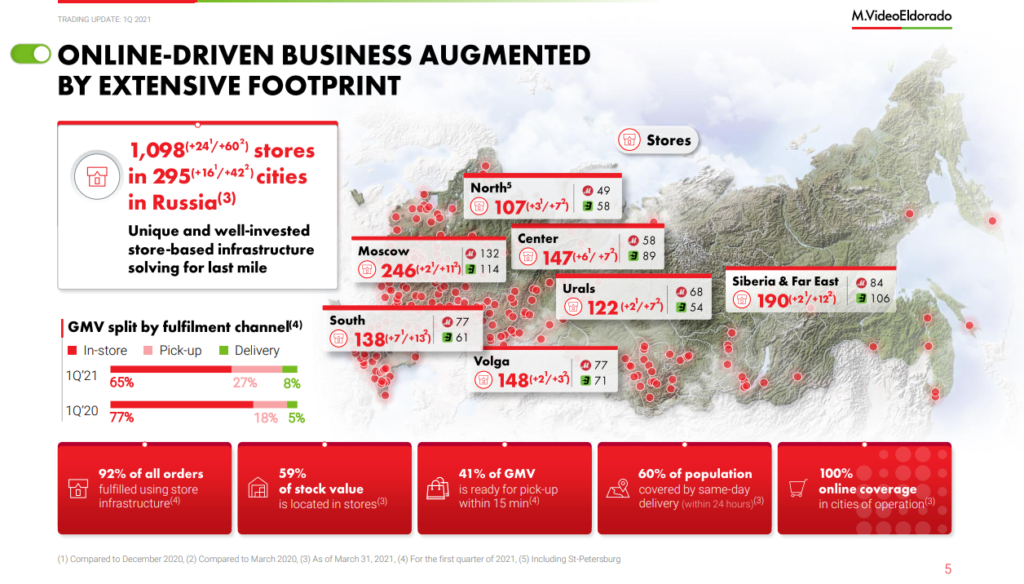

M.video, PJSC (ME: MVID) is the largest consumer electronics, and home appliances retailer in Russia. It operates 1,098 stores in 295 Russian cities, and it also has a strong online presence. Although Russia is a large country, M.video offers same-day delivery to ~60% of the population. M.video tends to have the lowest prices, and this makes it easier for them to keep growing and acquiring market share. We think the stock is fairly priced, and investors should add it to their watchlist.

M.video Overview

When investing, we like to get as much global exposure as possible. We believe that the best way to construct a portfolio is to diversify across sectors and geographically. It also allows to include riskier uncorrelated stocks, that can provide you with hefty returns. For that reason, we tend to look in places where most investors do not dare to venture. One of the most exciting markets in our view is Russia. It offers growth and value at the same time. Out of all the emerging markets, Russia seems to have the highest dividend yield.

Russia has also remained among the cheapest markets to find value stocks. It is certainly a contrarian approach, but with the right, due diligence you can find extreme bargains. There are also plenty of growth stocks at the right price. Due to the high valuation across American, Chinese, Japanese, and even European markets, Russia has remained the ideal place to hunt for growth at fair valuations.

Russian market

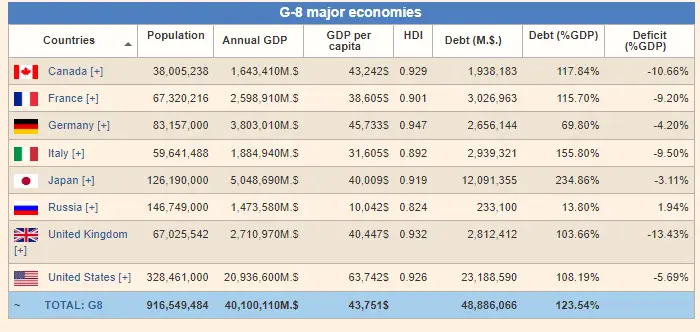

There are a few reasons that make Russia such an attractive place to find investments. One and perhaps the most important, is the low debt of Russia, especially when compared with other countries. Although this does not directly affect the business prospects of a particular company, it just ensures that corporate tax rates are more likely to stay flat or even decrease. As we have seen this week, there is a global push for a minimum corporate tax rate, by G-7 leaders.

Russia, which was initially suspended in 2014, would permanently leave the G-8 in 2017 following the annexation of Crimea. It is a mere coincidence that Russia seems to be by far the country with the strictest budget management. It has the lowest debt-to-GDP out of the group, and although some of the G-7 members see a minimum corporate tax rate as a way out of their increasing government spending, Russia does not depend on global tax alliances to make up for their lavish government spending.

Source: Countryeco

Russia’s GDP is expected to reach 2019 levels by the end of this year. Although the growth projections for the next five years are modest, the long-term prospects are good. Russia also seems to be the only country to raise interest rates.

Consumer behavior

Throughout most of 2020, Russian consumers increased their spending on consumer electronics and home appliances. According to the survey, nearly 8% of Russians' monthly budget is spent on consumer electronics and home appliances.

Source: Deloitte

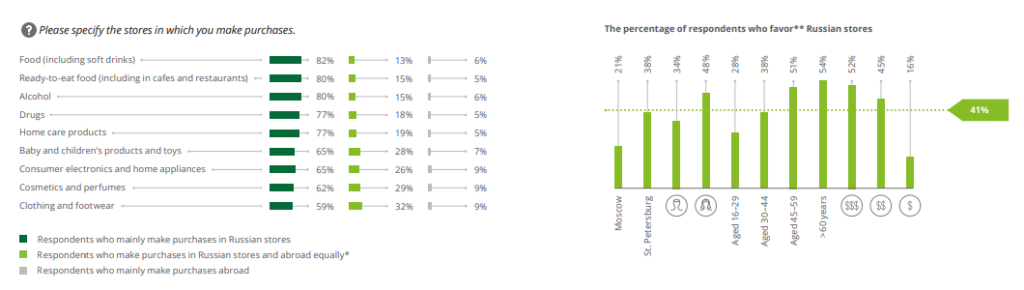

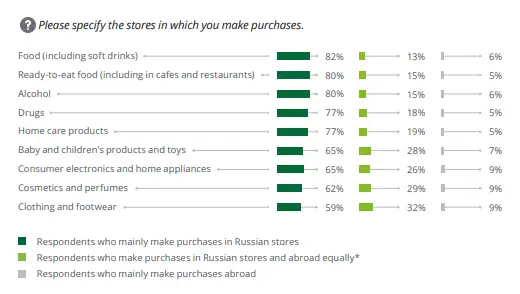

Another trend that was boosted by the pandemic, is the large number of online purchases made across various categories, in particular in consumer electronics.

Source: Deloitte

At this point, it is unsure how the consumer electronics market in Russia will behave in 2021 and throughout 2022. The Deloitte survey seems to point out that most of the consumers’ desired spending in electronics is somewhere close to 11% of their monthly budget. This leads us to believe that although we could witness a slump in sales this year and into the next - the long-term will remain positive. The Russian consumer seems to have a strong preference for shopping in Russian stores.

Source: Deloitte

M.video results

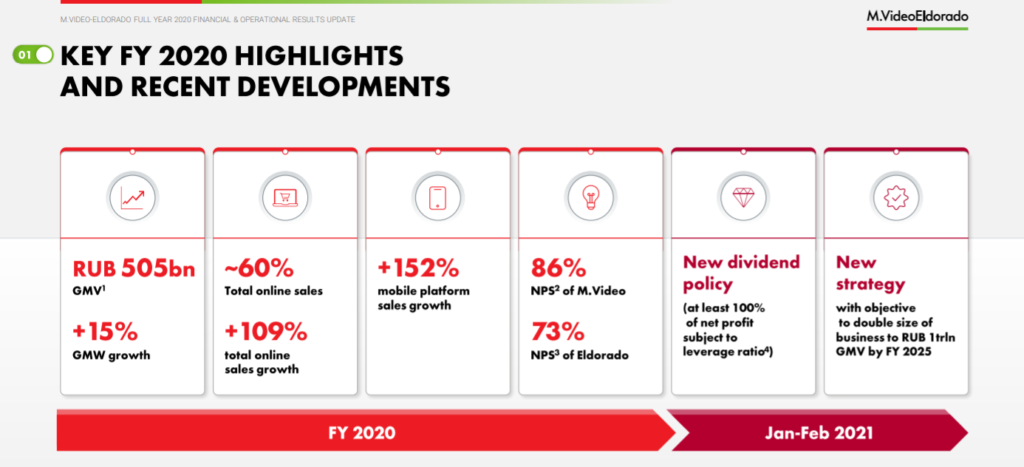

M.video FY20 Results

Preceded by the great results of 2020, the Q1 results show that the electronics demand in Russia continued through 2021. In 2020 M.video saw an increased demand for its products and a surge in online sales. Online sales accounted for 60% of the total revenues, an increase from 33% in 2019. Management defined a new dividend policy, in which it intends to pay 100% of its net profit. It expects to grow GMV by ~100% to RUB1000B in FY25.

Total active customers at the end of 2020 were 19M, out of a 72M solid customer base. Nearly ~50% of the Russian population has purchased an item through M.video. It generated 1.2B total visits on its stores and online/mobile platforms. Its web platform traffic also grew by 29%.

Source: FY20 Presentation

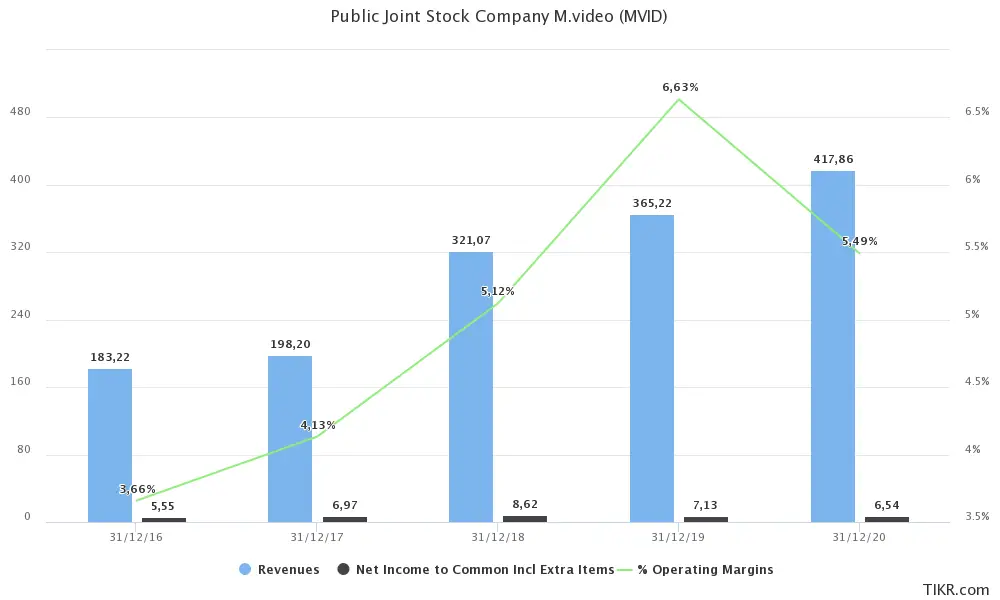

With revenues increasing 14.4% to ~RUB417.9B when compared with 2019. Net profit of ~RUB12.2B a 9.3% increase from the previous year. Gross margins decreased by 160bps due to an increase of lower-margin product sales, and higher inventory turnover. Rent and utility costs decreased due to rent optimization, and personnel expenses were also lower. Selling and marketing expenses of ~RUB5.69B, 3.7% lower than in 2019.

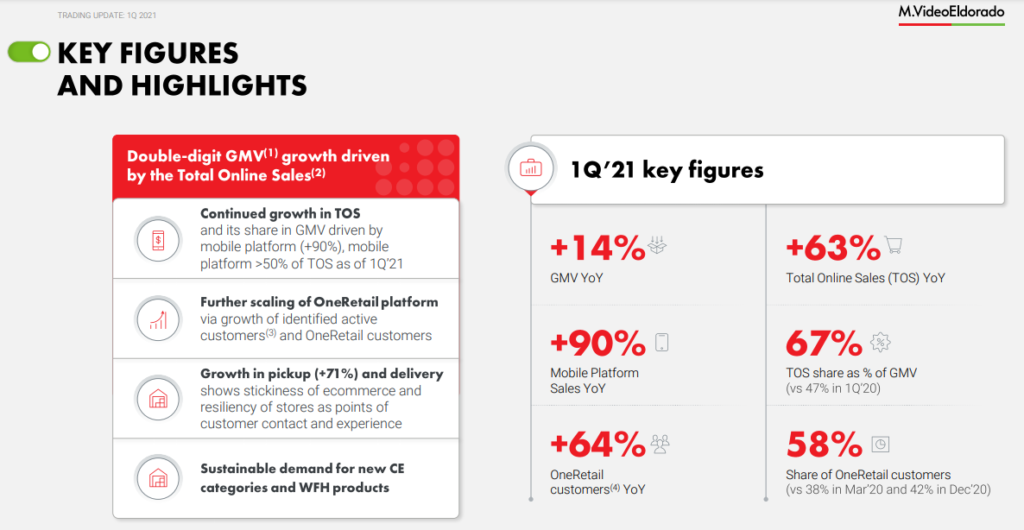

1Q21

The great performance in 2020, has continued in the first quarter of 2021. Active customers increased in the first quarter to 18.8M, with traffic continuing to grow to 343M visits. GMV increased 14% to ~RUB138B, driven by increased sales from the app. Sales on the mobile platform grew by 90% YoY.

Source: 1Q21 Presentation

The average purchase price also increased YoY by 14.5%. The increase in online sales is pushing M.video to adapt its infrastructure.

Source: 1Q21 Presentation

M.video valuation

M.video is growing revenues in the low single-digits, this should continue into the years ahead. It would be fair to assume a growth rate of 10%, given that the company continues to increase its GMV, number of active customers, and average customer spending. While at the same time increasing sales on its online channel will allow M.video to eventually reduce some of its stores and lower its fixed costs. After acquiring MediaMarkt’s business in Russia, M.video was able to consolidate operations and strengthen its market-leading position. Its market share is estimated at 33%.

With a market cap of ~RUB117B, and based on the net income in 2020 of ~RUB6.54B the price-to-earnings ratio is ~17.8. Not bad considering the growth expected.

Operating margins have been in the middle single-digits. They have increased up until 2019. A slight contraction in 2020 due to pent-up demand, and constraints in sourcing some of the inventory due to the lockdowns. Due to the low margins, M.video’s price-to-sales ratio has historically been low. Based on 2020 revenues it is currently at 0.28.

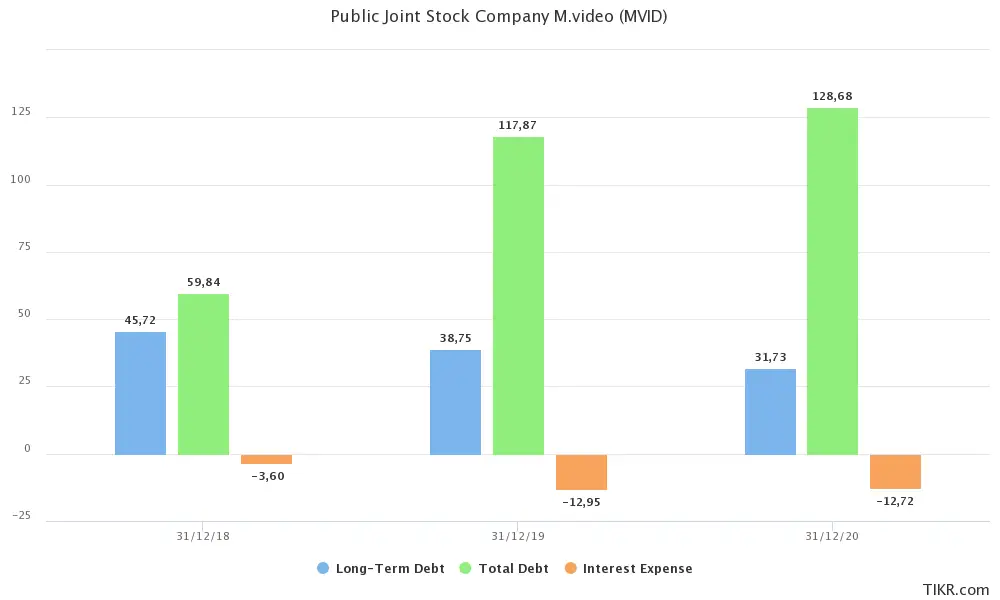

When we look at the balance sheet, we see the increase in debt following the acquisition of MediaMarkt in 2018. Also a considerable increase in interest expense related to the acquisition. The debt-to-equity ratio is also fairly high, at close to 4. Looking at net debt to EBITDA, it is at ~2.75x which is a little higher than what we would like to see, but it shows the debt is manageable.

The only thing that seems to be overstated to a certain extent is goodwill. At ~RUB48.98B of goodwill, it is ~41.8% of the market cap. A possible impairment is something that could happen in the future.

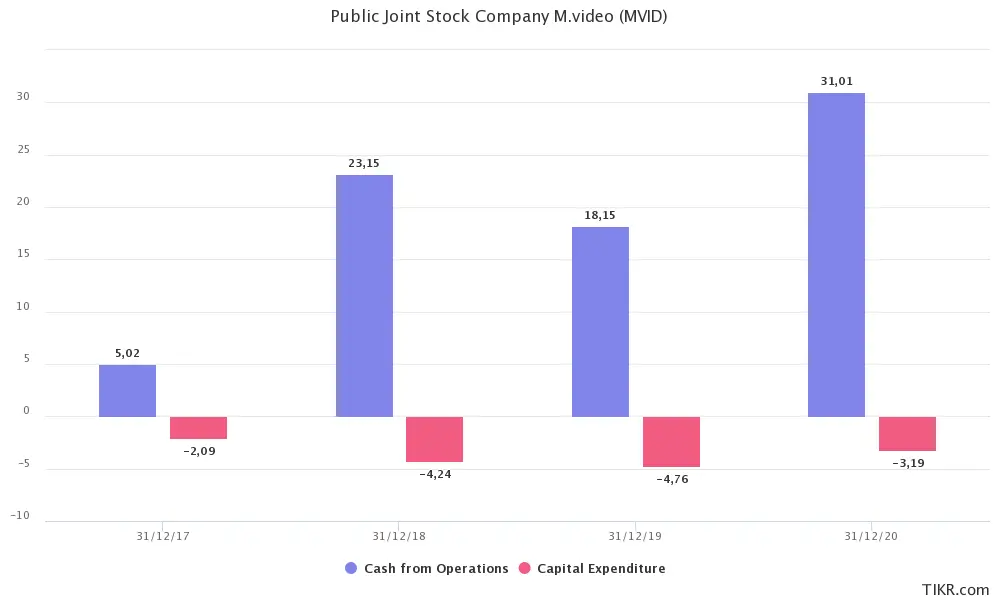

M.video Cash Flow

Operating cash flow of ~RUB31B, and modest capital expenditures that even decreased ~33% in 2020. In 2020, free cash flow was ~RUB23B. Given the market cap, it trades at ~5.1x free cash flow.

At ~3.8x operating cash flow, the stock seems fairly undervalued. Given the growth and management intention of paying most of the profits in dividends, shareholders should be handsomely rewarded. The EV/EBITDA ratio is 5.28 which also shows the company has a very attractive valuation.

At the current price per share of ~RUB650 shares are attractive. Possible lower demand in the next quarters of 2021, could push the price near RUB500 and that would offer a margin of safety. Taking into account that this is a Russian company, the risk tends to be higher than investing in European or American equities.

M.video Risks

Ruble

Besides the political, and regulatory constraints, there is also the ruble. The ruble has been declining in value over the past. For that reason, investors should keep in mind the additional currency and geographical risks

Lower demand in 2021

Due to the late arrival of inventory, some industry analysts are predicting a possible oversupply of products during the rest of 2021. This tied with the increased costs of some computer components like semiconductors could mean that revenues either stay flat or decrease slightly. For now, 1Q21 has shown us that the demand is still there. Although we could see a temporary slump in sales it does not materially affect the long-term outlook for M.video and the consumer electronics industry in Russia

Conclusion

Taking into consideration the high valuations across most markets, if you want to find attractive stocks - you might have to look in places overlooked by others. M.video strikes us as a well-run company with further growth ahead. Going forward the company could improve its margins as online revenue as a percentage of total revenue continues to increase. It will be able to keep the most profitable stores and eventually reduce its fixed costs. Another important aspect is that M.video has most of its stores under a lease agreement. This is another positive sign, as they will be easier to terminate, and as an investor, you do not have to overanalyze the commercial real estate market in Russia.

The risk/reward profile of M.video seems very attractive at this point. Even considering the somewhat high debt, and possible goodwill impairments going forward the company should remain the market leader. Taking advantage of its high customer loyalty to continue to grow. We will monitor the stock price, as the RUB500-RUB550 level offers a more attractive valuation, and provides enough margin of safety to justify the investment.

We have no position in any of the stocks mentioned. Read our disclosure.

Featured image source: premier