- In the first quarter of 2021, HelloFresh grew active customers by 74.2% YoY to 7.28M.

- The number of orders also grew by 98.6% YoY.

- A customer acquisition cost of ~€109.4 in 1Q21.

- Marketing expenses remain a high percentage of revenue at over 15%.

HelloFresh (XETRA: HFG) is a company based in Germany, focused on delivering prepared meals. It is present in Germany, the UK, Netherlands, Australia, Austria, the US, Belgium, Canada, Switzerland, Luxembourg, and France. In 2019 and 2020, the company has targeted Scandinavian countries, moving into the Swedish and Danish markets. It relies on fulfillment centers across different countries, to prepare and deliver its products.

The most popular choice among customers is 3 meals for 2 people. Which equates to a total of $62.93 or ~€51.60. In line with the average cost of each order of €49.3.

If we assume that each person has two meals a day, that equates to roughly 180 meals in a quarter. The average active HelloFresh customer makes 4 orders each quarter, which should be close to 24 meals. On average customers are using HelloFresh for 13.33% of their meals. It seems that customers are not fully adopting HelloFresh as their main option. This leads me to believe there is a certain novelty aspect surrounding the product.

Prepared Meals Trend

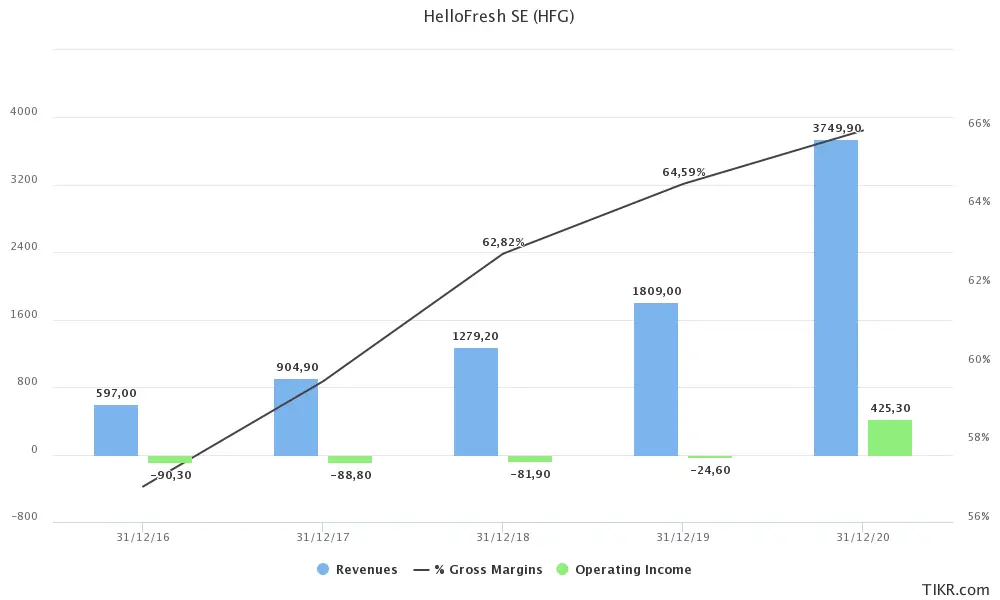

Covid-19 has helped HelloFresh acquire new customers and expand its business. Obviously, with more people staying at home and avoiding shopping in large food retailers, HelloFresh was able to present itself as a very interesting alternative. Prior to 2020, HelloFresh had been growing steadily. In 2020 it saw revenues increase by 107% to €3.75B. The company which had been unprofitable until 2020, booked €369M in net income.

Growth Opportunities

Although it is present in a lot of different markets across Europe, North America, and Australia. There are still countries where HelloFresh can expand to. The total addressable market is considerably large, as it fights with competitors for a place at the customer’s table.

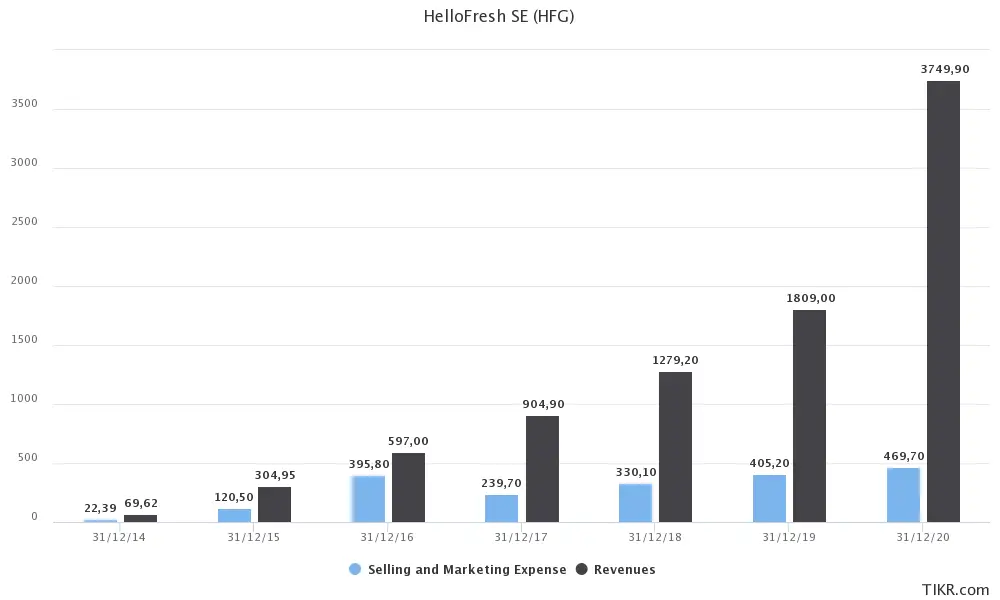

Over the past HelloFresh has been able to grow mainly through marketing. Since its inception, it has used a rather large portion of revenue towards promoting its products and acquiring new customers.

From the beginning of 2017 until the end of 2020, HelloFresh has burned through €1.444B in marketing expenses. Quite a large sum if we consider that at the end of 2016 it had 860k active customers and it had 5.29M at the end of 2020. It amounts to a customer acquisition cost (CAC) of €326 over that time period.

Marketing expenses for Q1 were €217.8M. The number of active customers increased 37.6% QoQ, from 5.29M active customers in 4Q20 to 7.28M in 1Q21. It acquired 1.99M, new customers. Simply based on the selling and marketing expenses, and excluding COGS. We arrive at a CAC of ~€109.4 for 1Q21. Far lower than it had been over the last four years.

HelloFresh Customer Retention

Although CAC has decreased, it does not paint the full picture, understanding customer lifetime value and comparing it with CAC seems to be more insightful. In fact, during earnings calls some of the most common questions by analysts have been regarding customer retention and churn rate. Although management has been asked about these metrics, there is not a clear answer.

This makes it difficult to create an accurate model for HelloFresh.

Here are some remarks from the transcripts:

“I think it's also important to note that if you look at our average retention rate, that there -- that we benefit from very high order rates right in the beginning. And then kind of like settle on the same pace as other leading e-commerce companies. So putting the 2 together, making our payback period much, much quicker. And making the overall cash efficiency much, much better than in foods delivery or in overall e-commerce. So that is something that is, I think, structurally, really important to understand.” - Dominik Richter, CEO, on the 4th of May 2021

“Marcus Diebel, JPMorgan Analyst

Very impressive customer numbers there, I have to say, so congratulate on that. One question is on churn. The disclosure you gave in the past was one number that you highlighted that you retain about 20% of cohort revenues after 8 quarters. I think that's the number you've given a while ago, and obviously, well pre-COVID.

Could you tell us roughly, if you would give this today -- or where would that be roughly in terms of the percentage? I'm just trying to find out what really the change in consumer behavior so far has been. So if you can just update us on this, that would be helpful.

And then if you could let us know maybe broadly where we are tracking on customer acquisition costs for in the third quarter.

Christian Gartner, CFO

Marcus, it's Christian here. So on your 2 points, first one on net revenue retention after 8 quarters. Sort of one thing that we can say and also confirmed period in the past is that certainly, it's not worse, yes, than what we had put out there 3 years ago at the time of our IPO.

On your second question on customer acquisition costs, we don't give that out on a quarterly basis. But as I've mentioned in my presentation, certainly, very attractive, also attractive versus some of the historic levels that we had discussed. Certainly, COVID has helped, but on top of that, this is something you've really seen from us over the last 5 quarters now. That from the very strong customer acquisition cost levels we had sometimes beginning of 2019, we, since Q2 2019, brought that down successively every quarter, and Q3 was basically a continuation of that trend.

Marcus Diebel, JPMorgan Analyst

Okay. But I won't get anything more, Christian, on the numbers. Just not worse than the IPO.”

HelloFresh 1Q21 Results

HelloFresh had a great start in 2021, with active customers growing 74.2% YoY. Expanded EBITDA margin tp 11%, and EBITDA grew 161% YoY. The free cash flow for the first quarter was €171.9M, and it is on track to generate over €600M at the end of 2021. Net income of €101.6M, with diluted EPS of €0.56.

Due to higher than expected growth in the first quarter, management has raised their estimates. Revenue growth is now expected to be 35% to 45% in 2021. Adjusted EBITDA margin to be in between 10% and 12%.

Marketing costs as a percentage of sales have declined to 15.1% during Q1.

HelloFresh Valuation

The average HelloFresh customer makes 4 orders each quarter, and the average order value for the group as a whole is €49.3. With 29.28M orders in Q1, we can expect FY21 total orders to be ~120M. Management is expecting revenue for FY21 to be between €5B and €5.44B. EPS in 1Q21 was €0.56, and analysts were estimating EPS of €1.94 for the FY21.

Given the better than expected results in 1Q21, and increased guidance estimates by management, we could see an FY21 EPS above €2. Considering the current stock price of 74.24, the price-to-earnings ratio is around 37, and the high growth in the past year, and a stellar first quarter. Investors have bid up the price expecting further growth. It is also generating a free cash flow yield of ~5%, according to estimates for 2021.

With €876.3M in cash, and long-term debt of ~€152.6M, it looks like a strong balance sheet.

At 22.41x EV/EBITDA it seems fairly priced overall. The key point to justify the higher valuation will be its ability to retain customers and continue to grow. This is perhaps the biggest challenge HelloFresh faces and the discerning factor between novelty and a long-lasting product.

HelloFresh seems to be dependent on marketing expenses to drive revenue, and acquire new customers. Gross margins going forward will be mostly dependent on marketing expenses and inflation in food prices. If HelloFresh is able to reduce its CAC, margins may improve. Lower marketing expenses could also boost margins and propel HelloFresh to an even higher valuation.

HelloFresh Risks

Although Covid-19 was a tailwind for the company, it is still imperceptible if the trend will continue in the future. The US seems to have the highest average order value, at €53.1. HelloFresh also seems to be acquiring more customers outside the US, with its international average order value being lower around €45.2.

Inflation

With food prices rising, along with other widely used commodities. Margins might be affected, and it is possible that HelloFresh might have to adjust prices accordingly.

Novelty

This is certainly dependent on your personal view. Perhaps HelloFresh’s growth can be a short-term trend boosted by its novelty status. Once it wears off, it is difficult to say how loyal their customers are. Obviously, HelloFresh’s customers seem to be choosing other ways of sourcing their meals. Unless the average number of orders or the value per order increases, it will be difficult to tell if it is just a novelty or a product that consumers love and cannot live without.

Lacks a Clear Competitive Advantage

HelloFresh seems to lack a clear competitive advantage. Not only among its peers but also because it competes directly with the foodservice industry and grocers. Although there seem to be some advantages to using the products since every recipe is tailored according to the customer's needs. It seems to be far more costly than visiting the supermarket or buying food online. At the same time, ordering meals from restaurants seems to be far more practical and time-saving.

Inability to Expand to Countries with Lower Disposable Income

Given that the average customer spends €200 for 13,33% of their meals in a quarter. We can assume an average food spending per month of €500, totaling €1,500 per quarter. Although reasonable it seems that countries with lower wages might be difficult to expand to. This could limit the total addressable market.

Although there are some ways around this, like choosing cheaper recipes and products to offer in these countries. It could put a stop to HelloFresh’s growth. Assuming there are customers using HelloFresh for all of their meals. An average cost annually of €6,000 is expected. It seems far too expensive, accounting for the average per capita expenditure on food, even in the countries that spend the most.

Final Take

I have a certain biased view towards HelloFresh. On one hand, I don’t see the advantage of ordering their product when you can just order the same thing from a food retailer and get better value for your money. On the other hand, I do not see how it can compete with restaurants since it still requires you to cook the meal. Perhaps for someone that is not so accustomed to cooking, or does not like to prepare food, it might seem like the ideal product. Although in this case there are cooking robots that will basically do the same thing, all you need to do is buy the products.

Due to the fact that there is not a single distinguishing aspect of the product, the investment thesis behind HelloFresh would require a considerably lower price point. Although HelloFresh’s total addressable market is vast, it does not seem to be the main choice for consumers. It competes directly with restaurants and food retailers.

It has a clean balance sheet, with very little debt. Enough cash to deploy to expand into new countries. For a high-growth company, it seems fairly priced. I do have mixed feelings about the company, especially on its ability to make recurring sales, and its dependence on marketing to further fuel its growth. Perhaps under €50 a share, I might consider the stock again. It will be crucial to understand to which extent pandemic-driven sales continue through 2021 and into 2022.

We have no position in any of the stocks mentioned. Read our disclosure.

Featured image source: CNET