We have a tendency to look for value, and more often than I would like to admit, end up trying to catch falling knives, and Telecom Argentina seems like one. Argentina has been one of the countries where some stocks are incredibly cheap.

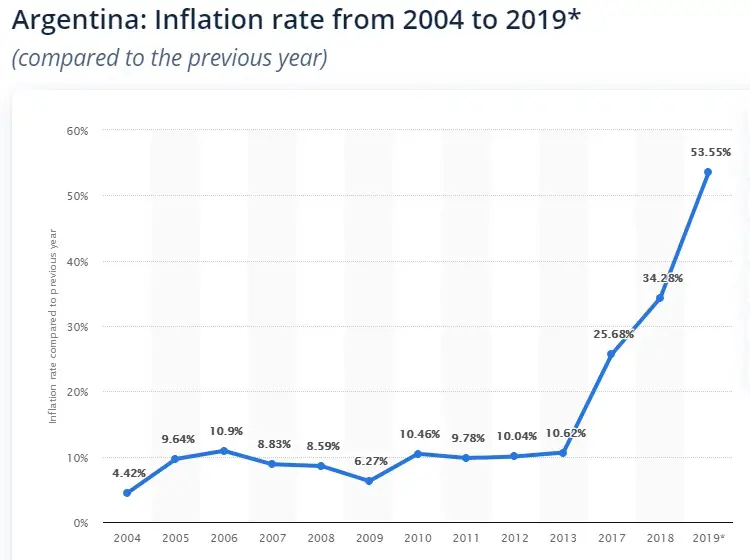

Ever since Alberto Fernández, the left-leaning leader took over the outlook has only worsened. Argentina nearly defaulted on its sovereign debt, and the IMF stepped in. All of those daunting news coupled with the double-digit inflation that has progressively increased since 2014. Argentina will continue to face high inflation in the short to medium-term.

The negative outlook on the country does not deter me from trying to find underpriced stocks. There are several interesting businesses in Argentina whose stocks have plummeted and offer both value and growth. What is important to address here is the fact that the challenging economic situation the country faces, makes it difficult to invest in some industries.

Telecom Argentina Overview

Telecom Argentina S.A. (NYSE: TEO), is the largest telecommunication provider in Argentina, with a market share of mobile and broadband estimated at over 50%.

Gross Margins have remained above 50%, and although the operating margin has decreased in the last few years, it still remains above 10%. The decline in margins can be partially attributed to the high inflation rate that forces Telecom Argentina to constantly increase its prices. This also makes it look as though the company is experiencing high growth.

Working capital has been negative for the past 6 years. As of 3Q20 working capital was ARS-29.42B. One of the reasons is the fact that currency devaluation forces TEO’s management to deploy its capital fast.

So that it doesn’t lose value to inflation. It wouldn’t be a good option for the company to hold a lot of cash denominated in ARS, and the CAPEX requirements to prepare the 5G infrastructure force the management to deploy funds very fast. As of this writing, Telecom Argentina has an operational 5G network in Buenos Aires and Rosario.

Telecom Argentina Valuation

Shares are trading at ~$5.5, the book value of each share is ~$9.55, meaning a price-to-book of 0.6. Current price-to-earnings seems high at over 18, although forward price-to-earnings is considerably lower.

With a market cap of ~$2.4B, the stock has a price-to-sales of 0.95. If the margins stabilize at over 10%, it should be able to provide investors with a +10% return over the long term.

Free cash flow generation may also improve, given that CAPEX has been high in the recent past attributed to 5G. Once the infrastructure is in place it will dramatically be reduced. It trades at a P/CF of 2.78x. EV/EBITDA is currently under 4, which signals an undervaluation. For 2020 free cash flow is expected around $410M. Given the current valuation, the P/FCF is ~5.8x.

Tailwinds

Pricing Power

Given that Telecom Argentina is the largest telecommunication service provider in Argentina. It has considerable pricing power that can help the company raise prices as it deals with inflation.

Economic Situation

Once the economic situation in Argentina returns to normal. The shares should see a considerable appreciation in price. Bear in mind that the telecommunication industry is in itself defensive. No matter how bad the situation looks - Argentinians will need to make calls and use the internet.

5G

One of the few reasons that could drive growth is the 5G network. As soon as the infrastructure is in place, TEO will be able to charge a small percentage of its consumers a higher price for the 5G service. Currently, it does not cover the whole country, but eventually, 5G will spread.

Telecom Argentina Risks

Inflation

If inflation continues at the rate previously seen, Telecom Argentina will continue to face challenges. Mainly because their pricing needs to be adjusted frequently. So that the company is able to retain its margins. Failing to do so, can make the company be unprofitable in the short term.

Source: Statista

Debt denominated in foreign currency

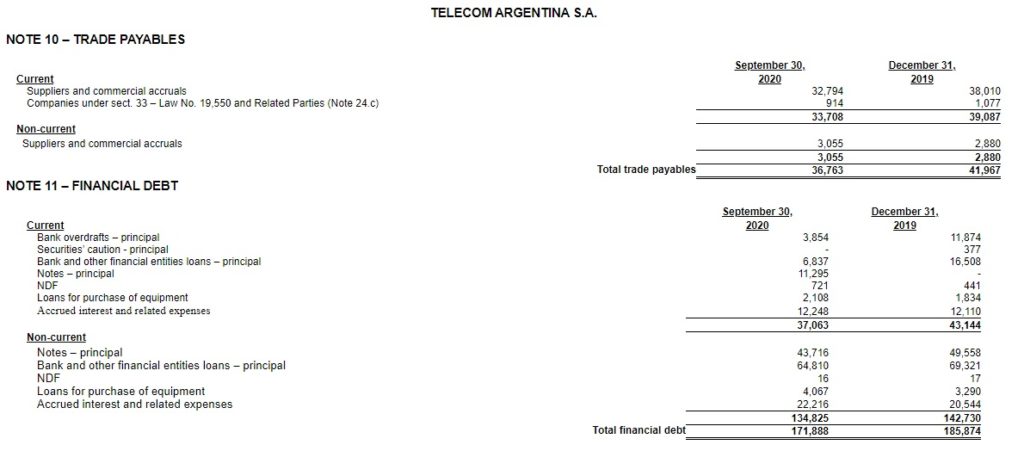

Given the high level of inflation and the fact that revenues are booked in ARS. One of the major reasons for concern when investing in a high inflation scenario is to analyze the debt denominated in different currencies. As inflation may make it more difficult for the company to service its debt. Hedges are probably in place, but as inflation rises it becomes increasingly costly to hedge debt in another currency.

Payout Ratio

The payout ratio has been over 100% in the last two years. This is also something to take into consideration, as it does not help the company in the short term given its negative working capital. Also, it impairs the growth prospects.

Nationalization

Increasing fears of the nationalization of the company are also something investors should keep in mind. Although there isn't any indication at this point that this scenario could play out in the foreseeable future.

There is a possibility that it could happen. In 2020, the Argentinian government decided to nationalize the largest soy producer in the country, and one of the largest worldwide, Vicentin SAIC. The decision was not well received by the public, raising tensions and fueling protests.

Dilution

Over the recent years, we have witnessed the number of shares outstanding grow from 237M to 431M.

Conclusion

Telecom Argentina remains a contrarian investment, that despite the challenges should prove to be a great long-term option. Even if the economic situation in Argentina does not improve, the company will continue to operate and generate profits. The stock price might remain around these levels for quite some time.

Competitors in Argentina face some of the same challenges, which limits the competitive environment. In the past, I have invested in a few Argentinian stocks and managed to reek up some profits.

There are good businesses with competitive advantages in the country, and despite the challenging environment, some Argentinian stocks will surge once the situation is under control. As of now, I wait patiently and monitor the stock price, as I think it could drop further. The FY20 results could also shed some light on the 5G segment of the business, and that is key to being able to predict the growth ahead.

The stock is attractively priced, and there is some upside potential. Bear in mind that it is a risky and highly contrarian investment. It might take years before the stock sees a meaningful price appreciation. I will wait and see if the stock price finds some support before jumping on it.