Supermarkets are far from being a high-growth business, and most of the time are disregarded by some investors but Ingles Markets should be on your watch list. Up until March of 2020, most supermarket stocks were trading at very low valuations. The pandemic and lockdowns have prompted investors to look at this once despised industry. Propelling its stock prices higher. Supermarkets are an incredibly safe industry, with relatively low growth expectations, and low margins.

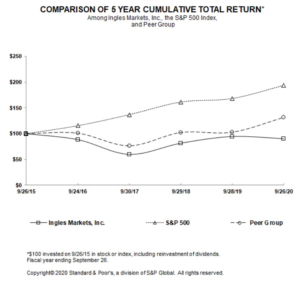

Supermarkets are one of the few retailers that are definitely not going out of business anytime soon. One of the most interesting stocks in the industry is Ingles Markets (NASDAQ: IMKTA). This relatively unknown supermarket chain mainly operating in North Carolina, Georgia, and South Carolina has nearly 200 locations. The stock has underperformed the S&P 500 and most of its peers in the past 5 years.

Source: 10-K

Operational Overview

The company is well organized. It has a main warehouse that supplies most of the stock needed for its locations. Given the close proximity of most of their stores, the company efficiently moves stock around. This is extremely important. Retail and particularly the supermarket industry relies on large amounts of stock. A discerning factor when analyzing this kind of company is to see how they handle the stock. Since some of the products they sell are perishables, stock control and management are of the utmost importance.

Ingles Markets Financials

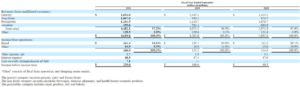

The pandemic allowed the company to increase its margins. Record earnings of $8.82 per share in 2020 were mostly prompted by the pandemic. Generating nearly the same amount of free cash flow per share.

Source: Morningstar

Given the current price of $47.5 per share, and the earnings in 2020 the stock is trading at a price-to-earnings and price-to-free cash flow of 5.4. Which is extremely low when compared to its peers and the general market. Book value per share has also seen a steady increase over the years. The price-to-book currently stands under 1.2.

Ingles Markets had a solid operational performance in the past five years. Average sales per store have grown at a CAGR of 4.17%. Average sales per square foot have also grown at a CAGR of 3.8%.

Source: 10-K

Ingles MarketsTailwinds

Debt Reduction

The company has shown its operational excellence in the past. Which allowed for increased revenues, earnings, and free cash flow. Management has been able to reduce its debt over the past and should continue to do so. Thus, at the end of 2019, Ingles Markets had roughly $840 million in long-term debt. It currently stands at roughly $586.2 million, a reduction of roughly 31% or nearly $253.6 million. If management continues to reduce the debt at this pace we can expect an upward movement on the stock, as its balance sheet strengthens.

Source: 10-K

Management decided to take advantage of the stellar performance in 2020 to reduce and restructure debt. Eliminating fixed interest debt, for which the interest was 4.29%, and getting a much more favorable rate on its variable interest debt. Reducing it from 3.79% to 1.75%.

Source: 10-K

Essentially reducing its average interest rate from 3.42% to 1.64% - the expected interest expense for 2021 should be 48% lower to account for the rate reduction. Interest Expense for 2020 was $40.53 million and we should see that amount decline in 2021 for a little over $20 million which can help boost earnings by no less than 10%. If revenue and margins stay the same.

Gasoline Segment Will Grow

Source: 10-K

Revenue from the gasoline segment has been decreasing in the past three years. In 2020 the segment decreased by 21% YoY. Which can easily be attributed to the lockdowns. Obviously as many people end up staying at home, explaining the reduced consumption. Relative lower revenue in the gasoline segment was offset by increased revenues in the main segments. A positive catalyst for the company is the future growth in gasoline sales. As the vaccines roll out and economic activity returns, the segment should see an improvement.

Ingles Markets Increases Its Dividend

Ingles Markets has been paying a dividend since 1995. Although the increases haven’t been consistent and drastic, with sporadic special dividends. The company has a lot of liquidity. Given the relatively low payout ratio of 9.4%, it is expected that management will reward shareholders by increasing the dividend. This could also help push the stock price up. The company could easily double or triple its dividend.

Ingles Markets Risks

Reduced Margins

Supermarkets have enjoyed a particularly favorable business environment. Which may not continue in the future. Margins might be affected, and once things get completely back to normal, revenues and profits can also be impaired.

Regional Exposure

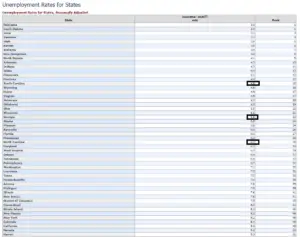

Roughly 90% of its locations are in North Carolina, South Carolina, and Georgia. The economic conditions in the regions are highly correlated with future results. With 39% of its operations located in North Carolina.

Source: 10-K

As of the 26th of January, 2021 South Carolina, Georgia and North Carolina had unemployment rates of 4.6%, 5.6%, and 6.2% respectively. All of which is below the national average of 6.7%, which is a positive indicator.

Source: BLS

Bottom line

The prospects for the supermarket industry as a whole are fairly positive. The pandemic has boosted both the top line and bottom line. Ingles Markets is a solid player in the industry. Despite its small size, the company is well set up and prepared to reap the rewards. 2020 was a great year for the sector, and Ingles Markets has some positive catalysts going into 2021. Even if the company doesn't grow at these prices it is clearly undervalued enough to offer a reasonable margin of safety. At under $50 per share, it sounds like a reasonable defensive investment, that offers a modest upside.

We are long IMKTA. Read our disclosure.

Featured image source: Glassdoor