With Brexit deal fears looming, and as we approach the critical phase of the negotiations, there are several UK stocks that are worth considering. The FTSE might present some opportunities, and value investors should research some UK stocks. Here are some of our favorite stocks to watch in the UK during the last month of the year.

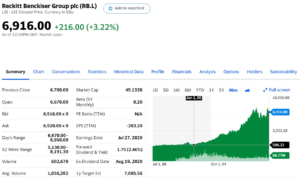

Reckitt Benckiser (LSE:RB)

With an incredible portfolio of strong brands, this stock has been a great performer in the last 20 years. The company makes everything from cleaning products to condoms and cough drops. Its presence worldwide is well revered and it shows some resemblance to Procter & Gamble (NYSE: PG) and Unilever (NYSE: UN). Not only in the vast offering of branded products but also in the strong brand presence it has worldwide.

Source: YahooFinance

Source: YahooFinance

A compounding machine

If you had invested in the stock at the turn of the century, your initial investment would have grown over 11-fold. Not only that but the hefty dividend payments have been increasing over the same period of time. In 2003 the dividend payments amounted to £0.268 per share. Last year the company paid a total of £1.73. This means that the dividend increased nearly 6.5x during the last 20 years.

This means an initial investment at the price on January 1st of 2000 would yield nearly 30% just on dividends. This is exactly the kind of stock we look for and we want to own! RB stands out as a company with a wide moat, that compounds your initial investment at an amazing pace. The company has been operating for over 200 years and its vast product offerings show just that. It is without a doubt one of the best long-term UK stocks available.

Today, it has a strong online presence, and the groups' online revenues represent over 10% of total sales. The company has been experiencing the biggest increase in sales in all of its history. This is mainly attributed to the pandemic, and how consumers went into a buying frenzy for essential products.

Pandemic improved results

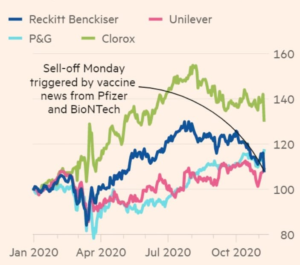

Lysol and Dettol, two of Reckitt’s brands in the hygiene space have seen sales skyrocket boosting the company’s revenues. Once an overlooked part of the brand portfolio, the two brands have gained increasing importance over 2020. So much so that the stock price was negatively influenced by the announcement of the vaccine by Pfizer (NYSE: PFE) and BioNTech (NASDAQ: BNTX).

Source: FT

Source: FT

Despite the price action of the stocks being similar. Out of the group, Reckitt saw the biggest growth in revenues. Reckitt saw its revenues grow by 13.3% in the third quarter. As for Unilever and Procter & Gamble, their sales increased 4.4% and 9% respectively. This is in part due to the health segment of Reckitt which includes brands like Strepsils and Nurofen. Both brands were acquired back in 2005. Boots OTC unit was sold at the time for $1.9 billion, which has proven to be a terrific deal.

Rolls Royce (LSE: RR)

Source: FT

Source: FT

Rolls Royce (LSE: RR) is an iconic brand and one of the most coveted UK stocks, that has tremendous recognition worldwide. Although cars are not their main focus anymore, the company produces extremely high-quality engines for aircraft. Over the last century the company has changed its attention from the low margin and highly competitive car market to using its expertise in engine manufacturing and today it supplies 50% of the engines sold for Wide Body planes.

Rolls Royce margins

While selling engines have a low-profit margin, maintenance and repairs are also conducted by Rolls Royce and offer higher margins, the civil aerospace segment represents 51% of sales. It also supplies industrial engines and that accounts for 22% of revenue. It is also involved in the defense sector, and it is unclear exactly what the company's products or services are in that segment, which represents 20% of revenue.

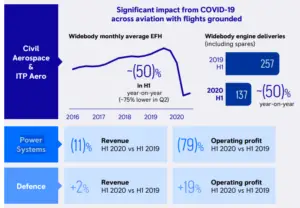

The company was hit hard by the pandemic with struggling airlines, plane producers are also going through a tough period. Naturally, Rolls Royce as one of their suppliers is also in a tough situation. Due to the over-exposure to the civil aviation sector, the company's future results are heavily dependent on the recovery of the traveling industry.

Since the high in February of £6.97, the stock has lost over 86% of its market cap, and it trades today at the levels unseen since 2003. Revenues for the aerospace segment plummeted 50% for the first two quarters. The impact on the second quarter was such that sales collapsed nearly 75%.

Source: Investor Presentation

Results

The results show that Rolls Royce had a negative free cash flow of £2.8 billion pounds in the first half of the year. Despite having over £8 billion pounds in liquidity. With the intention of raising new capital £2 billion. Management has announced on the 1st of October that 10 new shares will be made available. Selling at 32p each for every 3 shares.

As an investor, you should always avoid situations where your holdings can be diluted. But in this case, the company is valued at £2.6 billion. Taking into account that in 2019 the company delivered nearly £900 million pounds in free cash flow, the stock seems to be undervalued. Taking into account that the recovery in civil aviation and travel will take some time to materialize, the time horizon in this specific investment should be at least 5 years.

Rolls Royce presents itself as a turnaround investment that might take some years to produce the results investors expect. Keep in mind that this kind of investment in a cyclical company that needs an improvement in the aviation sector to deliver double-digit returns to investors - Presents some risk. This kind of position should be taken with careful consideration and should be considered in terms of your own portfolio allocation. Investors should be aware that the stock performance will only improve when the aviation industry makes a comeback.

Churchill China (LSE: CHH)

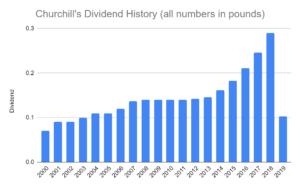

Lastly, we have a smaller but very interesting stock. Churchill China (LSE: CHH), has been operating since the late 18th century. The ceramics business is not by any means the most attractive. But well established brands like Churchill have been able to maintain a moat in the sector. Management has been able to reward long-term shareholders. As we can see by the dividend history the company has been delivering exceptional growth since the early 2000s.

Source: Author

The increase in the dividend has been reflected in the share price. Which has seen tremendous appreciation since the early 2000’s. But recently due to the pandemic, the company has taken a hit. Although ceramics is a relatively stable business. Churchill relies deeply on the hospitality industry, where most of its revenue comes from. With the limitations surrounding travel and being indoors.

Results

The results for the first half of the year have been nothing short of disappointing. The results show a loss of £0.029 per share. The year started incredibly well for Churchill, as it saw its revenues increase 33% in the first two months. But overall revenues dropped 41% for the first six months of the year, comparing YoY. This has led management to halt the dividend, and postponed the decision to the end of the year.

Despite the sudden decrease in revenues sparked by the pandemic. The balance sheet remains strong, with very little debt. Churchill will most definitely be able to overcome the situation. During the March sell-off, the stock reached a low of £6.05, and it is now trading at £13. Which we consider a fair value, given the past performance. Taking into account the earnings in 2019, during normal circumstances, it would translate into a P/E of 15. Churchill’s products differentiate themselves from the competition in terms of design and durability. The company also has a very strong geographical reach.

Reopening stocks

We believe that Churchill's situation is comparable to Rolls Royce's. Their future is dependent on the success of the industry that represents the most share of its revenues. The fact is Churchill needs an improvement in the outlook of the hospitality business to improve its results. Although Churchill is a much smaller company and has a stronger balance sheet. It is one of the most interesting UK stocks, in a very specific niche.

However, both companies share some of the struggles created by covid-19. Ultimately we believe that Churchill offers less upside than Rolls Royce, but at the same time, it comes with less risk associated. Given the current market valuations, we think Churchill is trading at a fair value and would start a position under £10. In order to have a margin of safety.

We have no position in the stocks mentioned. Read our disclosure.

Featured image source: Metro