- PAX Global Technology is an overlooked stock in the POS sector, with a focus on hardware and software.

- It has grown at a decent pace over the past 14 years, and management has been able to handsomely reward shareholders, with dividend increases and buybacks.

- Management estimated 10% top-line growth for this year, but profit for 1H21 is already up 30%YoY.

- Trading at an EV/Revenues under 1 and EV/EBITDA under 5, the stock is undervalued.

Given the recent decline across Chinese stocks, there are a few that stand out as possible buys, and Pax Global Technology is one of them. Some have recovered completely or partially, and some still remain highly undervalued and attractive.

This is the case of PAX Global Technology (HKSE:0327), a leading supplier of point-of-sale (POS) and payment software for businesses. PAX has sold over 60M units to more than 100 countries. Over the years its main commitment has been to invest in R&D, and continue to gain market share.

The results in 2020 were outstanding, and despite that, the stock is still undervalued. It currently trades at a price-to-earnings of 11, based on the expected earnings in FY21. This is still a conservative expectation, given that in the first 6 months of 2021, the company increased net income by not less than 30%.

We still have to wait for the 1H21 report, but so far profit is expected to be higher than ~HK$501.8M. If Pax is able to post the same results in the second half of 2021, we are looking at a price-to-earnings of ~9. With over ~HK$3.8B in cash and equivalents, very little debt, and a market cap of ~HK$9.22, it is one of the best opportunities out there.

Market overview

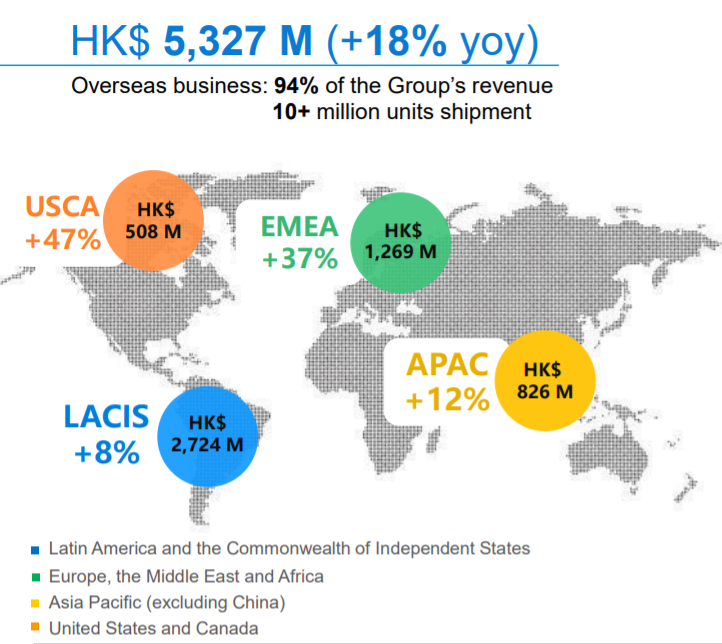

Although the company has grown at a fast pace, it is still the third-largest player in the POS industry. Ingenico, which was a publicly-traded company, was recently acquired by Worldline (PA: WLN) for $8.6B. Ingenico is by far the market leader, followed by Verifone, which is also a private company. Pax is based in China, but 94% of its revenues come from overseas, mainly South America, where the company has focused its attention.

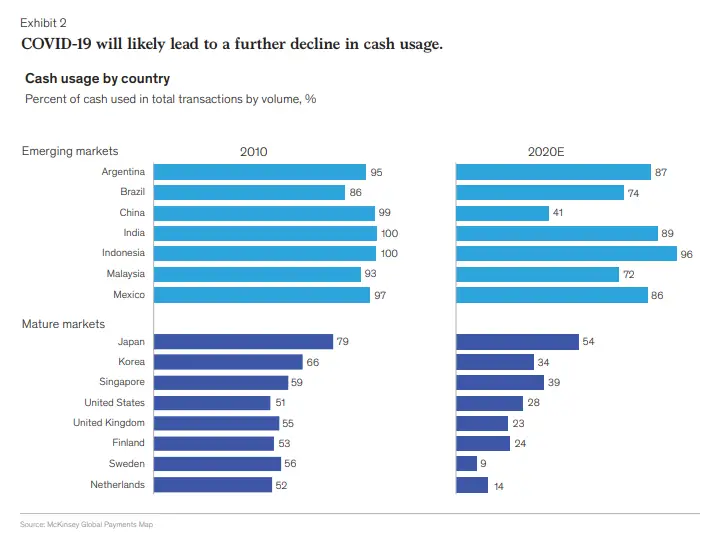

One of the reasons PAX has done so well in South America is the fact that most of the transactions in the region are made in cash. When the pandemic hit, with social distancing, and restrictive measures being implemented, many merchants had to offer their customers the possibility of paying with a POS.

Although Latin America remains the most important market for PAX, North America, as well as EMEA, have seen the largest growth in 2020.

Although Latin America remains the most important market for PAX, North America, as well as EMEA, have seen the largest growth in 2020.

Source: Investor Presentation

Source: Investor Presentation

Software segment

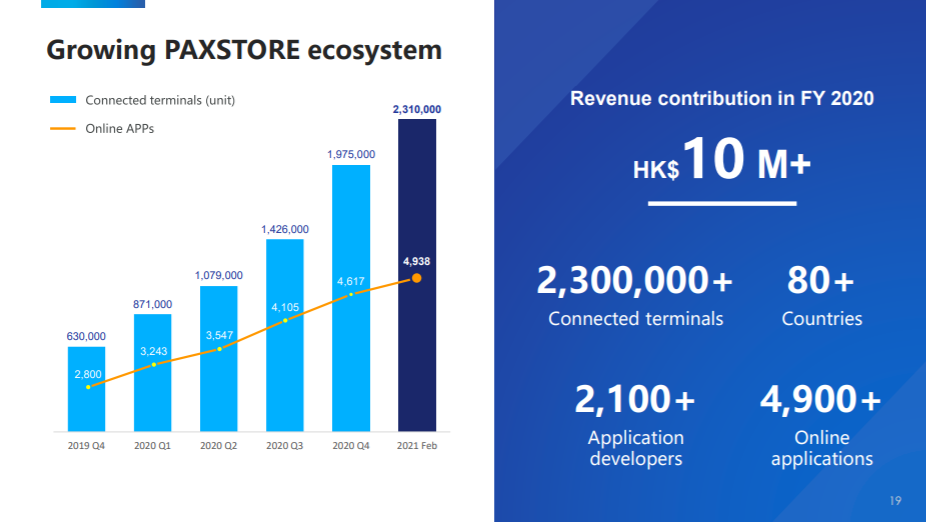

Revenues are mainly attributed to hardware sales, but PAX is also investing heavily in its software offerings. Their software solutions are not only targeting merchants, but also app developers and other partners. Pax has named this assortment of apps and features the PAXSTORE.

Although revenues from the PAXSTORE are still meaningless at ~HK$10M, the company has the ability to monetize these solutions as a SaaS. Due to its large presence among merchants, PAX has been able to grow its connected terminals and the number of apps over the years. It expects to generate HK$100M and have 10M connected terminals by 2023.

Results in 2020 and valuation

PAX Global Technology FY20 Results

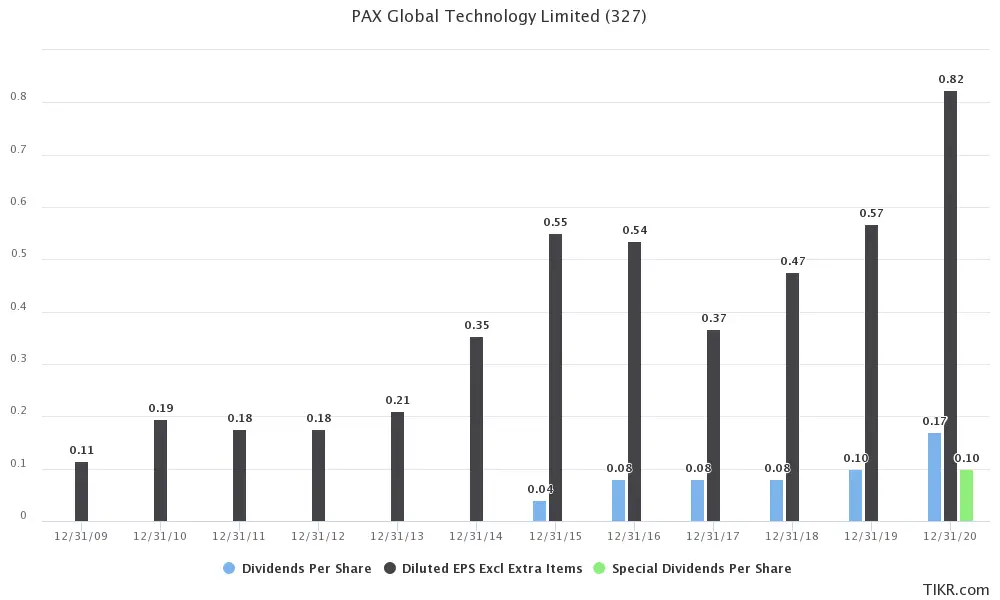

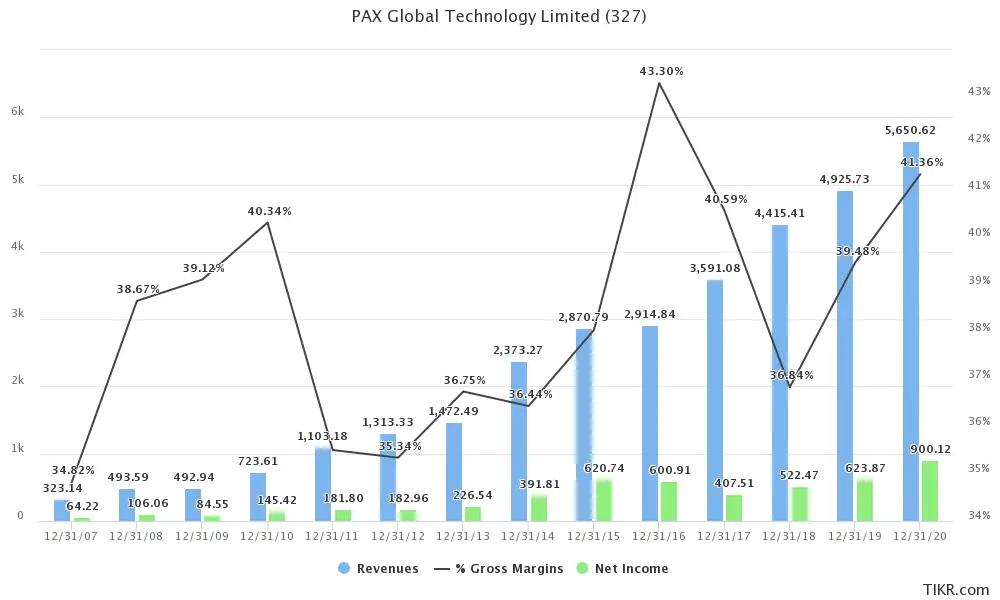

PAX’s had great results during 2020, reaching ~HK$5.651B in revenues and increasing its profit by over 40% YoY to ~HK$904M. Diluted EPS came in at ~HK$0.823. Although revenues increased organically, PAX was also able to improve its margins.

Management increased its final dividend by 67% to HK$0.1, and also gave out a special dividend of HK$0.1. Additionally, it also conducted a buyback program, buying back 20M shares, or 1.8% of the shares outstanding.

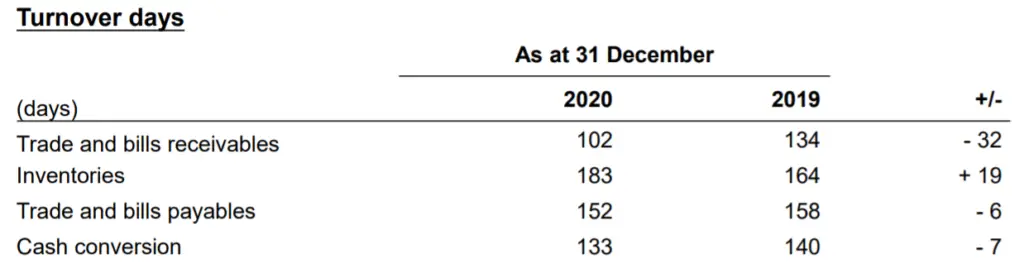

PAX ended the year with ~HK$3.8B in cash and cash equivalents, and some investors might question why management is not allocating this capital elsewhere. One of the key reasons is that turnover usually spans a long period of time. For this reason, the company needs to have cash at hand, to deal with any unexpected scenario.

For 2021, management was expecting revenues to increase by over 10%, and margins are expected to remain flat. So far earnings for the first half of the year have beaten management's expectations.

PAX Global Technology valuation

PAX Global Technology currently has a market cap of ~HK$9.22B, and an enterprise value of ~HK$5.45B. EV/Revenue is currently ~0.96, and EV/EBITDA is ~4.82, which signals how cheap the company is trading at.

If we consider diluted EPS in 2020, and the current market cap, it trades at a price-to-earnings of ~10.2. Free cash flow (FCF) in 2020, was ~HK$616.59M, which gives it an EV/FCF ratio of ~8.8. Taking into consideration that the company spent ~HK$461M in R&D. If PAX were to lower its R&D spending, free cash flow would be much higher.

Over the last 14 years, PAX has been able to consistently grow revenues and earnings, while maintaining stable gross margins.

Source: TIKR

Source: TIKR

During that time management has been able to increase the dividend, and reward shareholders.

Considering the growth ahead, and how the SaaS segment has also been growing and contributing to revenues. We think the company is trading at a very compelling valuation, with a significant margin of safety. It has a strong balance sheet, and some competitive advantages in the POS sector, that should reflect on its valuation in the coming years.

Management has been assertive and has constantly rewarded shareholders. The continued investment in R&D reduces free cash flow, it is important for the company to keep innovating and presenting its customers with new and updated products. This is a key aspect to gain market share, in some of the most competitive markets.

Bottom line

Considering the growth in the past few years, and how well management has been able to reward shareholders, PAX remains among the most attractive stocks in this market. Its strong liquidity and stellar performance over the last 14 years are signs of a high-quality company.

The expectations for the FY21 set out at the end of 2020, seem to be too conservative, as the profits for 1H21 seem to be already over 30% higher than in 2020. We think the stock is a buy under HK$10, which would give it a price-to-earnings of 9 based on expected diluted EPS in the 1H212.

We are long 0327. Read our disclosure.

Featured image source: cursos