Compañía de Distribución Integral Logista Holdings (BME: LOG) is a Spanish company that operates as a distributor across southern European countries. Imperial Brands (LSE: IMB) owns a majority stake, 50.2% to be more precise.

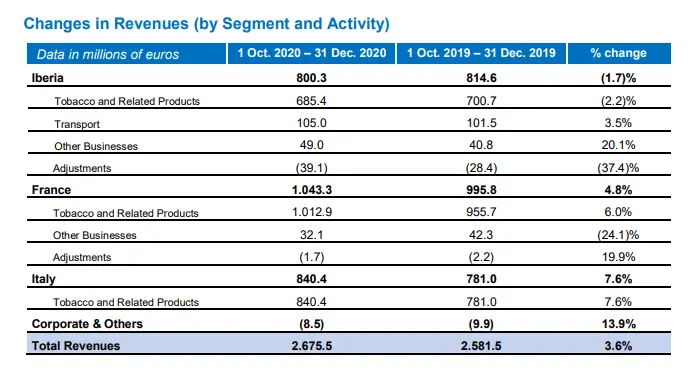

Logista distributes mainly tobacco products, along with convenience, pharmaceuticals, and books. Although it focuses on business logistics, its subsidiary Nacex caters to individual consumers. Logista’s operations are spread across Portugal, Spain, France, and Italy. All of these countries still have a high smoking prevalence among individuals.

Share of individuals who smoke

Source: Statista

Source: Statista

Revenue Distribution

FY 2020 Results

Despite the challenging year of 2020, Logista’s financial performance was strong. Revenues increased by 4%. EBITDA increased by ~10% to €340M. Despise that earnings per share in 2020 declined 4% to €1.19 when compared with 2019 when it had EPS of €1.24. It maintained the dividend at €1.18 per share, which has been paid consistently since 2015. The payout ratio for the FY 2020 was ~99.7%, which seems to be very high. But management’s dividend policy has been to consistently have a payout ratio above 90%.

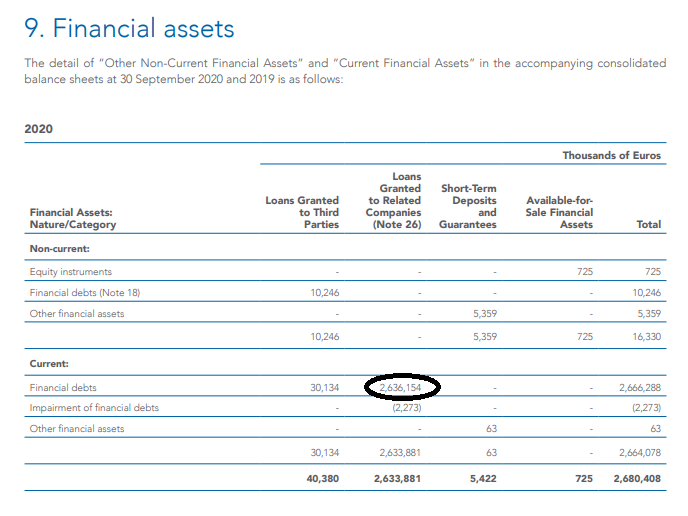

Bear in mind that Logista’s fiscal year starts on the 1st of October. For Q1 2021, comprising the period between 1st of October and 31st of December Logista had some impressive results.

Revenues were up 3.6%, along with margins increased by 1.5%. EBITDA increased 4.7% to ~€86.3M. This in turn allowed the company to increase net profit by 21.7% to €45.3M. Resulting in an EPS of ~€0.34. Given the stellar results, guidance has been revised, FY2021 adjusted operating profit is expected to be higher than in 2020.

You can read the annual report here, and the quarterly results here.

Logista Valuation

Logista currently has a market cap of ~€2.26B. With an average cash position for the first quarter of 2021 of ~€2.563B, greater than its market cap. Expected profits for FY 2021 to be higher. If we assume a net profit of ~€45M per quarter. Logista can expect profits of €180M. Earnings per share would be ~€1.36. Which would give the company some margin to increase its dividend. EBITDA is expected to be over €340M, representing 6.6x the market cap.

Logista has no long-term debt and has under €100M of short-term debt.

Logista Catalysts

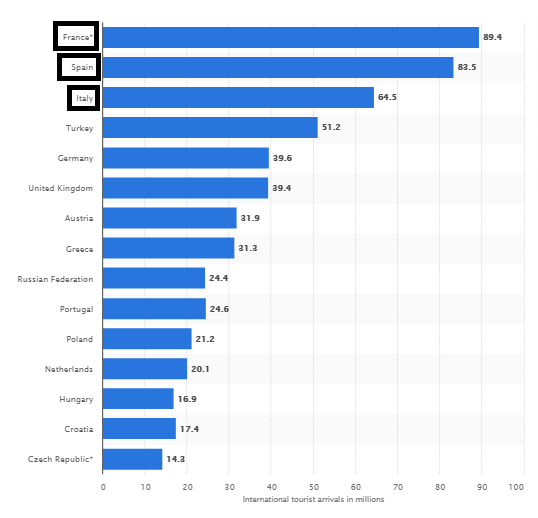

Assuming the results of the last quarter will continue through 2021. One of the catalysts is the fact that Logista operates in countries that are a huge tourist attraction, especially during summer. With travel restrictions being lifted around that time, we can expect the final year results to be very positive.

Number of international tourist arrivals

Source: Statista

Source: Statista

Logista has sales of over €10.5B, if it continues to improve its margins as it did in the last quarter, earnings could be significantly higher.

Logista Risks

Despite the obvious risk of declining tobacco sales, which the company has been addressing trying to diversify its revenue segments. And the fact that Logista operates on very thin margins, and any decrease might greatly impact its earnings.

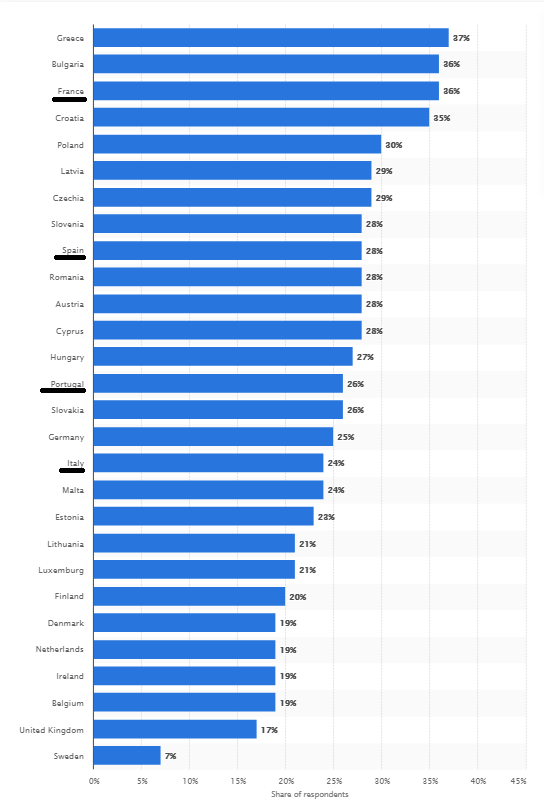

Majority Shareholder

Logista is in a rather complex situation, because of its majority shareholder. Imperial Brands has been struggling with large amounts of debt on its balance sheet for some years. After acquiring Logista back in 2008, Imperial Brands has been selling some of its stake in order to reduce its debt. Initially, it cut its stake to ~60% in 2017, and in 2018 it reduced it further until the +50% it holds now.

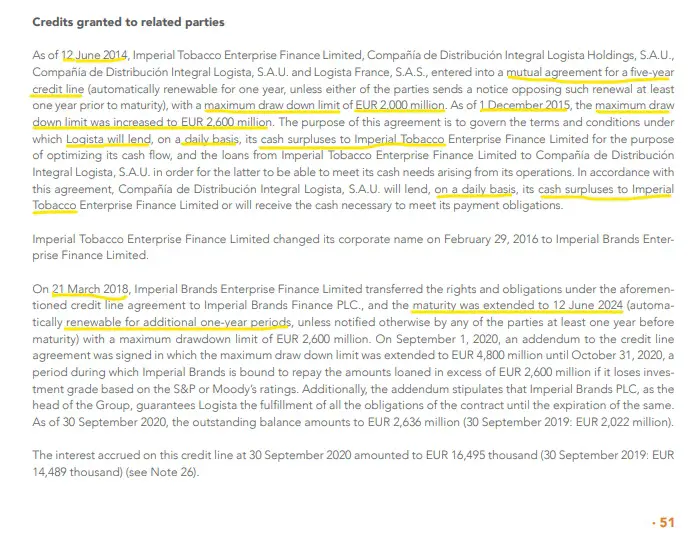

In 2014 Logista and Imperial Brands agreed on a credit line. In which Logista would provide its cash surpluses to Imperial Brands on a daily basis.

This explains why management has maintained its dividend policy, with a payout ratio above 90%. All things considered, Logista seems to be getting a low return for its capital. This in turn affects the company’s ability to grow and expand its operations. Imperial Brands has been taking advantage of minority shareholders, by draining all the liquidity it can from Logista. There are countless opportunities to grow in the logistics business around southern Europe. By failing to invest in CAPEX and expanding, Logista might soon fall into decline.

Final View

Given the rich valuations found across markets, Logista seems to be trading at a cheap price. There is some upside to the stock, and we think under €20 per share seems to be a fair price. The potential upside will depend mainly on the financial results for 2021. Given the lift in travel restrictions, we can expect the results to improve and the stock price to appreciate during 2021 and into 2022.

We are long LOG. Read our disclosure.

Featured image source: Foodretail