There is no such thing as a free lunch in finance. At least that is what we are told. But the reality might be different for investors willing to put the time and effort, arbitrage situations can be found across multiple markets. One of these opportunities is CCRC (NASDAQ: CCRC). China Customer Relations Centers Inc. is a relatively unknown stock for most investors.

In fact, its institutional ownership of 0.22% makes it unknown to both retail and institutional investors. I have been following the stock since 2018, as call centers seem to be a simple, and defensive sector, but J Capital Research's short report on the company prevented me from investing.

At the time I was unsure whether the company numbers were actually accurate, or a misrepresentation of their actual operations. I decided to keep monitoring the stock and see what developments would come out of the whole situation.

CCRC Overview

Operating out of China, the stock has all of the signals that keep the most skeptical investors away from it.

- It is based in China, it went public around the same time many Chinese companies looking to defraud investors did.

- ViewTrade Securities, the only company responsible for taking CCRC public, was under investigation.

- The auditing firm responsible for auditing CCRC financials, MaloneBailey LLC. was heavily involved with many companies that turned out to have purposely inflated their numbers, in order to defraud investors, in what is now known as reverse merger fraud.

- MaloneBailey LLC has been under investigation by the SEC, and following the scandal, its reputation has been ruined.

- A shady company structure, where some of the companies owned by the parent company were not disclosed in the SEC filing according to J Capital.

Source: Seeking Alpha

Source: Seeking Alpha

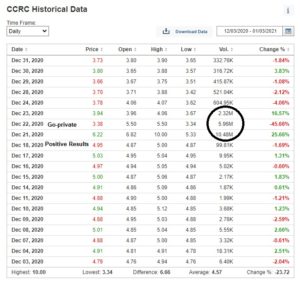

What Happened to CCRC in December?

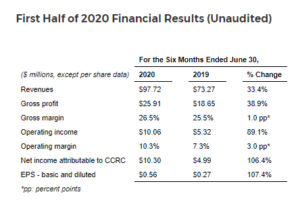

December was clearly a very intensive month for CCRC stock. The company released its results for the first half of 2020, on December 18th. Reported revenues increased 33.4% to $97.72 million, and gross profit also increased by 38.9% to $25.91 million. Gross margins also increased 1% YoY, with EPS growing over 107% YoY.

Source: PRNewswire

Source: PRNewswire

The excellent results for the first half of 2020, drew the attention of investors and traders. But what most people were not expecting was that on the 22nd of December CCRC received a Go-private preliminary non-binding offer led by the founder and chairman of the board Mr. Zhili Wang.

The offer presented $5.37/share in cash. This made the stock plunge nearly 46%, as investors who had bought the day before based on the good results, we're now afraid they would lose money if the offer was accepted.

Source: Investing

On December 21st after the release of the positive results, the stock rose in pre-market, opening at $6.82 reaching a high of $10, and closing at $6.22. The most impressive aspect was the fact that 10.48 million shares were traded that day, given that the float is 10.36 million and there are 18.33 million shares outstanding. The increase in volume was nearly 3075%, given that CCRC's average volume is around 330,000 shares.

Source: TradingView

Source: TradingView

When the market opened the next day, with the news of the go-private non-binding offer, the stock opened pre-market at $5.5 and continued to plunge. Closing at $3.38, losing 45.66% of its value. Investors who bid up the price of CCRC from $4.95 on the close of December 18th. To a high of $10 on the 21st of December were now rushing to sell.

2018 Offer

Back in 2018, CCRC had received a preliminary non-binding acquisition proposal to go private. At the time the price was $16 cash per share, and the report from J Capital on CCRC argued that the company entrusted to raise the money to conclude the offer, Guangzhou Cornerstone had no ability to attract the funding necessary to close the deal.

Today the offer is entirely different being less than 30% of the original $16/share proposed in 2018. Insiders hold 6.33 million shares out of the 18.33 million shares outstanding translating into 34.53% ownership of the company.

CCRC Fundamental Analysis

The stock is trading at an extremely low price given its balance sheet. As of June 30th, it held $28.67 million in cash. Given that the current market cap is $68.369 million, nearly 42% of the market cap is cash the company is holding. Working capital stands at $58.59 million, nearly 86% of the market cap.

| CCRC | |

| Price/Earnings | 3.73 |

| Forward Price/Earnings | N.A. |

| Price/Book | 0.92 |

| Price/Sales | 0.34 |

| Price/Cash Flow | 4.73 |

| Enterprise Value/EBITDA | 2.11 |

| Debt to Equity | 0.17 |

| Net Margin % | 9.28% |

| Return on Equity % | 27.87% |

| Dividend | N.A. |

| Payout Ratio | N.A. |

Source: Morningstar

With a Price/Cash Flow under 5 and trading under book value, the stock seems way undervalued. Earnings of $0.56 per share, assuming the earnings in the second half of 2020 will be in line with the first half, gives the stock a price-to-earnings ratio under 3.5.

Why CCRC Financials May Be Accurate

Even considering the risks, CCRC presents an opportunity for investors willing to do their due diligence. On one hand, the company can be defrauding investors and inflating their numbers. What leads me to think they might not actually be cooking the books, is the fact that there isn't a logical explanation for the following questions:

-

If the financial statements were purposely altered to give investors a different picture than what is going on in reality, why would insiders want to buy the whole business?

It does not seem to make much sense at this point. Of course, they could try to manipulate the stock price to go higher. But given the timing, why would they present the offer right after the positive results. My view is that, if they want the price action to move in a certain way, it is down. So that they can buy shares at a lower price. If that is the case, it is because the company’s financials are solid.

-

Why have insiders kept buying shares since 2018, if the stock price did not reflect the reality of their operations?

Another thing that does not make much sense is if the company was in fact a fraud, why did insiders buy shares in the past two years since the first go-private offer was presented. When the offer was presented in 2018. The aggregate ownership of the consortium trying to take CCRC private was roughly 21.6%. Today insiders have roughly 34.53% ownership of the company. Since the number of shares did not change since 2018, one can only conclude that the operational numbers are in fact accurate.

-

If the company’s operations are far smaller than what the financials make us believe, why would Huaxia Bank (SHA:600015), Ping'An Bank (SHE:000001), and Vipshop (NYSE: VIPS) use their services?

The companies mentioned have a considerable size and importance within the Chinese economy. They wouldn’t require services from a fraudulent or incapable company. On the other hand, CCRC wouldn’t disclose them as new customers if that was not the case. The backlash of potential lawsuits would deter them from misrepresenting the reality of their business.

Conclusion

There is a high level of risk when investing in obscure misunderstood securities - CCRC is one of them. Despite the risks, there seems to be a great deal of evidence that the financials are actually accurate. Otherwise, insiders would have sold their shares, a long time ago. At the same time, they wouldn’t try to take the company private.

If in fact, the financials are accurate, it seems there are two scenarios possible. Investors buying at the recent closing price of $3.73 can expect to make a roughly 42% return on their investment if the go-private deal closes. Or they can expect the offering price to be higher than the proposed $5.37 per share.

Even if there is no other offer, investors are getting a tremendous value for what they are paying, taking into account the financial statements. For $3.73 a share, investors are getting roughly $1.56 in cash, and they can also expect no less than $0.5 earnings per share for the second half of 2020. As the company is expected to maintain the earnings for the second half of the year, in line with the first.

We are long CCRC. Read our disclosure.

Featured image source: Twitter