To have a successful and profitable business you don't need a lot of different products and services you just have to be better than the rest in one thing. That is how Corticeira Amorim (LIS: COR) has been building a brand with worldwide recognition and became a market leader. Founded in 1870, Corticeira Amorim remains the oldest cork company in operation and the leader globally.

The reality is the cork business isn't the sexiest or the most technologically advanced. But at the end of the day, mastering this ancient technique has provided the company and its shareholders with consistent growth. Reflected in the stock price. The sector is defensive and allows the company to post consistent results that grant stockholders little volatility in the stock price. Picking cork is a technique in many ways similar to picking stocks. It requires patience skills and choosing the right timing.

Cork Market Overview

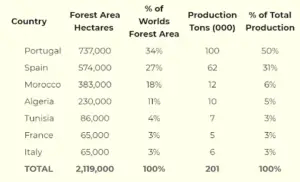

Usually, it takes a cork oak tree nearly 25 years to remove its first cork, the first harvest will not have the desired quality. It is estimated that only after 2 cycles are completed, high-quality cork can be harvested. With each cycle lasting at least 9 years, which means in essence it takes 43 years for a cork oak tree to produce high-quality cork. Harvesters usually write the number of years until the next cycle on the tree so they can manage their crops. Growing cork is in many ways similar to long-term investing. Portugal stands out as the biggest producer of cork worldwide, representing 50% of total global production.

Source: Corkqc

The company has multiple revenue segments, but cork stoppers are ultimately the most important, representing 70.3% of sales. With nearly 30% of the cork stopper market share internationally, Corticeira Amorim is the largest exporter of cork globally.

Source: Investor Presentation

The company’s client list includes names such as Siemens (ETR: SIE), Microsoft (NASDAQ: MSFT), Fiat-Chrysler (BIT: FCA), Airbus (EPA: AIR), Pernod Ricard (EPA: RI), and Francis Ford Coppola Winery. Despite the long list of notable clients, sales are dispersed throughout a high number of clients, with no client representing more than 3% of total sales. The know-how the company has in extracting and transforming cork products has allowed them to submit over forty patents during the years.

COVID-19

As with most companies, COVID-19 had an impact on the results for the first half of 2020. Sales for the period fell 5% YoY, and the second quarter registered a decrease of 10.5%. This in turn affected EBITDA which fell 3.4%. It reported earnings per share of €0.258 a decrease compared with the first half of 2019 in which it had earnings of €0.303.

Corticeira Amorim Fundamental Analysis

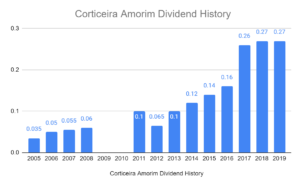

With the exception of 2009 and 2010 when the company suspended the dividend due to the economic crisis. Corticeira Amorim has been able to grow its dividend sustainably. Dividends have grown nearly 800% since 2005 and have been a handsome reward to long-term shareholders.

Source: Yahoo Finance

One of the reasons the company has been able to raise its dividend is the growth in earnings per share and operational results. The stock has also been a great performer in translating the company’s financial results.

Source: Morningstar

Source: Morningstar

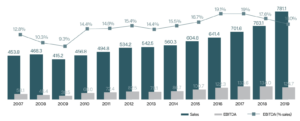

While looking at the operational results the consistency in growth and operational results is astonishing. The reality is Corticeira is not a stellar growth stock, but a long and well-established business in a sector that most would overlook. While growing revenues it has also been able to grow its gross margin and EBITDA.

Source: Investors Presentation

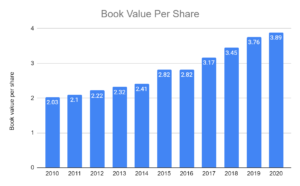

With growing revenues, EBITDA margin, earnings per share, and dividends the operational performance has been stellar. This has also translated into an increase in the book value per share.

Source: Morningstar

Source: Morningstar

Investing is all about consistency. Buying stocks in companies whose results are consistent, allows us to predict their long-term performance with more accuracy. While at the same time avoiding risks.

Corticeira Amorim Financial Ratios

If we look at the ratios, the stock seems fairly priced and supports a 3.5% dividend. Which will reward patient investors. With the payout ratio under 50%, the dividend is currently safe despite the negative effect of Corona. Not only that but the debt levels are relatively low, with currently a little over €143 million of interest-bearing debt. It has €211 million in unused credit lines available. The company has an interesting net margin and high return on equity.

| Price/Earnings | 20.16 |

| Forward Price/Earnings | N/A |

| Price/Book | 2.69 |

| Price/Sales | 1.83 |

| Price/Cash Flow | 12 |

| Enterprise Value/EBITDA | 12.44 |

| Debt to Equity | 0.38 |

| Net Margin % | 9.06% |

| Return on Equity % | 13.77% |

| Dividend | 3.54% |

| Payout Ratio | 49.10% |

Most of the analysts covering the stock are bullish. The price targets show the stock has some upside going forward. The most recent recommendation gives a price target of 13.

Conclusion

Corticeira Amorim is not a high-growth stock. It is a well-established company operating in an out of favor sector, that has total market dominance. As the world's largest exporter of cork not only does it have total market dominance. But it is well-diversified globally. By focusing on companies in sectors that are away from the Wall Street spotlight, investors may be able to find stocks such as Corticeira Amorim. In the words of Peter Lynch who once ran Magellan’s Fund:

The company not only has a wide moat but it's also a great compounder. It stands out as a stock operating in a defensive sector that should continue to consistently grow. While removing cork might be a simple endeavor, growing the trees takes time. The knowledge and expertise Corticeira Amorim has are difficult to replicate, especially to transform the raw material. The cork industry has a high barrier to entry, making Corticeira Amorim an extremely competitive business in the industry.

Taking into account the historical performance of the company and how consistent it has been over time, we think the stock might be a great addition to your portfolio. It is a low-volatility stock and stable dividend payer that offers investors a contrarian approach in an overlooked sector. At current prices around €10 a share, we think the stock is reasonably priced and would like to see it coming down to a level around €8 to €9 before starting a position. These lower levels will give investors a margin of safety and assure interesting returns over the long run.

We have no position in the stocks mentioned. Read our disclosure.

Featured image source: JornalEconómico