- The stock is trading below working capital.

- Rakuten’s mobile segment will boost revenue growth and could easily double its revenue.

- By offering multiple services, it is able to retain consumers within the ecosystem.

Rakuten Inc. (OTC: RKUNY) is a very diversified conglomerate and its operations range from Banking to Travel Services. In the past, it has been able to create an ecosystem for its customers that benefits the company’s operations. Through a loyalty program, through which customers earn loyalty points that can be exchanged for products and services. The company can easily retain its customers and is able to offer them multiple services.

Rakuten is one of the leading e-commerce platforms, and the Japanese e-commerce market is set to continue to rise at 6% until 2022. Rakuten is also the leading credit card provider in Japan, has recently focused on telecommunication services, and is set to shake the Japanese Telecommunication Market.

Source: Investor Presentation

Strategy

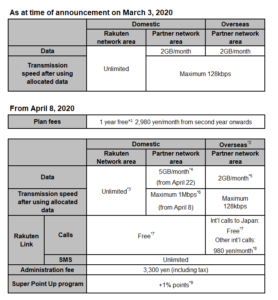

The Launch of Rakuten Mobile was a success, the company’s 4G mobile plan UN-LIMIT plan will provide great value for its customers. During the first 3 months after the launch, there were over 1 million applicants.

The Rakuten UN-LIMIT plan offers unlimited data and voice at half of the competitor’s price. But for the first 3 million customers, the first year is free of charge. Not only is the company pressuring its competitors by offering a cheaper price, but it is also exempting its customers from paying a cancellation fee. For now, only Tokyo, Osaka, and Nagoya regions have unlimited data usage. The company partnered with KDDI Corp. (KDDIF) to offer the service outside of these regions with a 2 GB limit. Rakuten is targeting 70% population coverage by March 2021. Rakuten was the first company to create a virtualized network. Innovation usually comes with a high cost, but Rakuten’s solution was cost-saving. This will allow the company to launch 5G by March of next year, a delay attributed to COVID-19.

Source: Rakuten

Source: Rakuten

A year from now, out of the 1 million new customers, Rakuten Mobile can expect monthly revenues of ¥2,980,000,000. This represents roughly 3% of 2019’s yearly revenues. According to the World Bank, Japan has nearly 180 million mobile subscriptions. For Rakuten to double the revenues it had in 2019, it would require around 35.5 million new mobile subscribers. This is approximately 19.6% of the total addressable market. We can conclude that if Rakuten Mobile manages to capture nearly 20% of the addressable market. If so the company will be able to increase its revenues by at least 100%.

Japanese Consumer

In January 2019, the Consumer Affairs Agency surveyed Japanese mobile users, and 83% would want their mobile prices to be reduced. As a result, Japan's House of Councillors passed a bill in May 2019, to improve the telecommunications business law. Aimed at reducing the mobile phone fees. The amended law enforces carriers to offer pricing structures that separate handsets from monthly fees.

The main carriers in Japan will have to change their plan structure. The cancellation fees and pricing will be subjected to revision. Especially taking into account that Japan is planning to ban the carrier change charge, which is currently ¥3,000. This should positively impact Rakuten’s Mobile business going forward, as it becomes easier to acquire new clients and grow its market share.

Fundamental Analysis

In terms of valuation with a price to book under 2 and a Price to Sales of 1, the company is undervalued. The unrealized loss from the Lyft (NASDAQ: LYFT) investment has led to a lack of earnings in 2019, which has been extended until the first half of 2020. This is mainly attributed to the Capex requirement to set its mobile segment ready to start operating. And these are the main reasons why the stock has gone sideways since late 2019.

The company has managed to increase revenues and cash flows from operations at a fast pace and since the announcement in 2017, has been deploying capital to expand into mobile. Once the infrastructure is in place, Rakuten will become a more attractive company. By producing much more free cash flow, there is upside potential in the stock price. The balance sheet currently holds over ¥2,296 Billion in cash and should provide enough safety in the short term until the company completes its mobile infrastructure and unlocks a new revenue stream. Meanwhile, the stock offers a small dividend of ¥4.5, roughly 0.46% of the current price.

Risks

The main concern with Rakuten has been the debt it has accumulated over the recent years. At the end of the second quarter, the total long-term debt amounted to slightly over ¥2,069 Billion. This puts some pressure on the company, as it expands operations. Given the fact that, in the past, the company has been rolling over debt. A potential shortage of liquidity in the market could affect Rakuten’s financing ability. In response to the pandemic, the Bank of Japan has been making an effort to support stocks and bond prices across the Japanese market, and the policy is expected to ease from March to April of 2021.

The company has exceeded the expectations deploying 4,738 of the 4,400 initially planned base stations but had to delay its 5G launch due to COVID-19. It is still unclear what kind of margins Rakuten Mobile will be able to achieve, given that further CAPEX will be needed to complete the network’s infrastructure. It is also dependent on future customer acquisition costs. Adding to that competitors will eventually change the pricing structure for their plans. In order to be more competitive, and prevent Rakuten from gaining any market share.

Conclusion

With the launch of the Mobile segment, the company is expected to grow revenues at a fast pace. Given the growth prospects, it seems undervalued. Despite the lack of earnings in the past year and a half. Thus, the stock offers a compelling growth story at an attractive price for the patient investor. The ecosystem it has created is able to easily retain customers, offering them multiple services. Reducing customer acquisition costs, as it is emphasized by its loyalty program.

It is expected that once the company is able to fully put in place its mobile segment. It will be able to generate a lot more free cash flow and be able to reduce debt, which should benefit long-term investors. At the current price, the stock offers enough long-term upside to initiate a position.

We are long Rakuten. Read our disclosure.

Featured image source: FT