Stocks are by far the best performing asset over the last 20 years, and investors of all ages look at the stock market as a way to build wealth and prepare for their retirement. But what are the advantages and disadvantages of investing in stocks? Is it worth it?

There are clearly risks involved when it comes to investing in stocks, but that should not deter you from doing it. In fact, stocks have historically outperformed, bonds, treasuries, and just about any asset class.

Advantages of investing in stocks

Here are some of the main benefits of investing in stocks:

1. Potential for higher returns

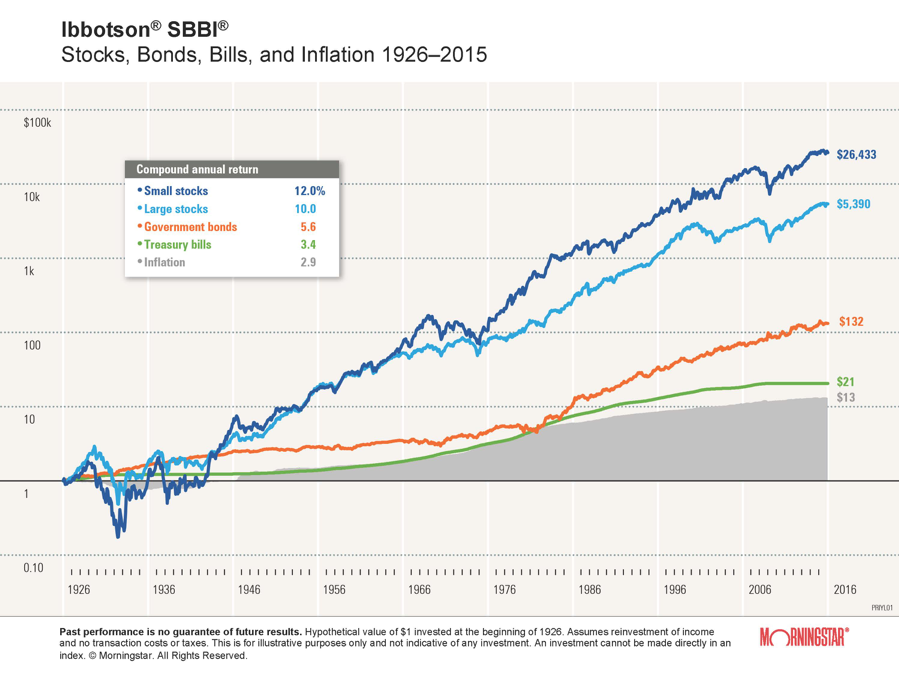

Historically speaking stocks have produced the best returns, beating every other asset class available to retail investors.

Since 1926, the average yearly return of the stock market is 10.49% including dividends. Far higher than any other asset, which remains one of the main pros of investing in stocks. This historical outperformance remains the main reason why stocks remain the most attractive investment.

2. Stocks allow investors to get exposure to several assets

Even if stocks or equities are in themselves an asset class, they allow investors to get exposure to other asset classes. For example, if you want to invest in nickel, which is a commodity, you can do so by investing in nickel mining stocks.

The same applies to other commodities and precious metals, real estate which you can invest through a REIT (Real Estate Investment Trust), and even alternative investments like cryptocurrencies, to which you can get exposure by investing in stocks of crypto miners.

This is one of the great benefits of investing in stocks because it allows investors to diversify their portfolios according to their risk and investment profile.

3. Low transaction costs

Investing in stocks is always extremely low cost. While decades ago, the fees and commission charged by brokers were far too high, and only wealthy individuals could access public markets and invest in stocks that are not the case today. There are plenty of brokers that offer commission-free trading.

4. Easy to invest passively

Investing in stocks also allows you to have a completely passive approach to the way you manage your investments. While investing in a private company, requires a hands-on approach, or investing in a certain requires you to keep an eye on its price, stocks can be a completely passive investment. All you have to do is to invest in a passive index fund, and you can just forget about it.

5. Everyone can invest in stocks

Today with the creation of fractional shares, which allow you to buy a fraction of a whole share, everyone can invest in the stock market no matter how much money they have. This makes it extremely easy to invest in stocks, and if you factor in the fact that some brokers do not even charge commission on fractional shares the barrier to entry is non-existent.

6. Ability to diversify

Stocks also have a clear advantage when it comes to diversifying your investments. Since you are able to get exposure to different assets through stocks, that makes it easy to diversify your portfolio.

With the creation of exchange-traded funds (ETFs) that can be easily transacted, diversification has never been so easy. Fractional shares can also help investors with small portfolios to diversify their holdings.

7. Voting rights

When you own a stock, you own equity in a business, and this allows you to have a saying in how the company is run. Compared with other assets, for example, treasuries, you can’t really have any impact on how a certain government acts. Therefore, as a shareholder, you have voting rights, and this is one of the major benefits of investing in stocks.

8. Thousands of stocks to choose from

There are thousands of stocks, in different sectors, industries, and locations, which makes it extremely easy to choose the right stock for each investor. This allows you to build a portfolio that accurately represents your investment and risk profile.

In some asset classes, you do not have as much choice, and the only options available are scarce.

9. Beat inflation

With the exception of a few historical periods, stocks have always outperformed inflation. This guarantees that if you invest in stocks you will not lose purchasing power due to inflation. With the current high inflation expectations, this is yet another reason why it is beneficial to invest in stocks.

10. Liquidity

Liquidity is often a misunderstood and underappreciated characteristic of stocks, which tend to be extremely liquid. Being able to buy and sell an asset whenever you want, and have a completely functioning market at all times, is a tremendous advantage.

For instance, if you invest in real estate, it might take some time before you are able to buy or sell a house. With stocks, you just need to press a few buttons, and you can buy or sell any stock you would like.

While there are some illiquid stocks available, most stocks will be far more liquid than real estate.

11. Generate income

Stocks also allow you to generate additional income, which some assets like commodities do not. You may even choose to only invest in income stocks, which guarantee that you will receive the cash flow, that you can use.

12. Tax benefits

Finally, there are also tax advantages of investing in stocks, especially through retirement plans such as an IRA, or 401k. This makes it extremely enticing to invest your retirement fund in stocks to take advantage of the tax benefits retirement plans have.

Disadvantages of investing in stocks

While investing in stocks is extremely beneficial there are still some risks, and disadvantages you should be aware of:

1. It’s easy to mix trading and investing

One of the main disadvantages of investing in stocks it is easy for first-time investors to mix trading and investing, which could be a huge risk. It is far too common for someone who starts investing, to find themselves day trading or investing in high-risk stocks such as penny stocks.

This could not only lead to losses but also give a very bad first impression of what investing actually is. When you invest in a stock, you are buying part of a business, and you should see it as a long-term investment. Choose your stocks carefully, and avoid buying random stocks just because someone recommended them.

2. Researching individual stocks is not for everyone

While investing passively in index funds is easy, some investors try to have a superior performance by picking individual stocks. While it can be done successfully, you need to have a keen interest in understanding and researching companies, and you also need the right skill set and knowledge.

Additionally, researching companies requires a lot of time and effort to be able to understand if they are worth investing in or not.

3. Some investing styles are difficult to master

Even if you are interested in researching and picking individual stocks, some investing styles can be difficult to apply correctly. For example, value investing which Warren Buffett used to become a billionaire and one of the most successful investors ever is extremely difficult to learn and apply.

4. Diversification is not as easy as it looks

While diversification remains one of the main pros of investing in stocks, it is difficult to do it right. The main reason for this is that although you may be buying different stocks, that does not mean that you are actually diversifying your portfolio.

For example, if you own Costco stock and you buy Walmart stock, this is related diversification, and it does not reduce the overall risk of your portfolio. Since both companies are in the same sector and are prone to the same risks.

Additionally, if add a stock to your portfolio of a company that is worst than the ones you already have, that is not diversification, it is diworsification.

5. It is difficult to control your emotions

Investing requires you to have extreme control over your emotions all the time. Whether you need to control your anxiety because the market is crashing and you are panicking and want to sell your stocks at a loss, or even when you feel the urge to buy a stock out of FOMO. Not everyone is able to completely control their emotions, especially when you are managing large sums of money.

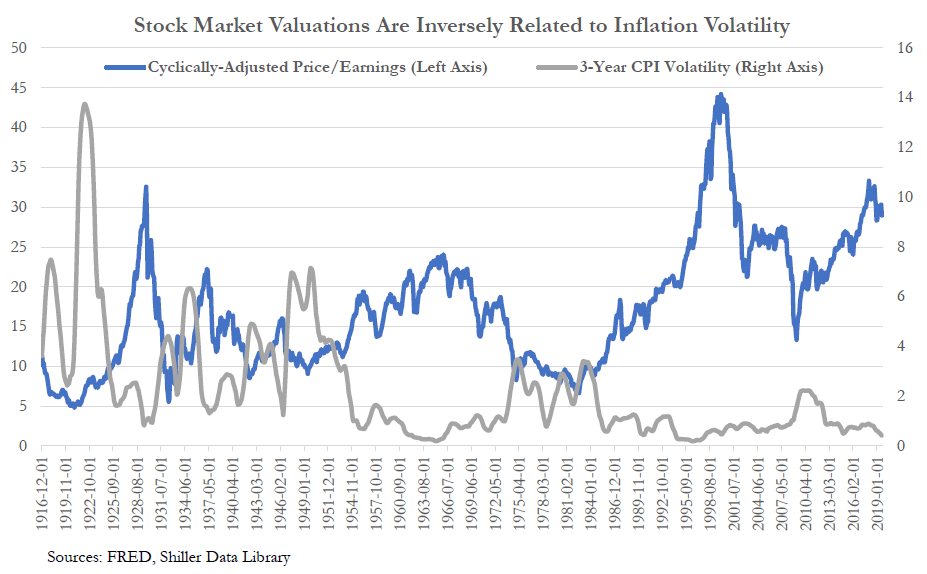

6. Volatility can be brutal

One of the main reasons why controlling your emotions is such an important step into a successful investing journey is because of volatility. Volatility in stocks tends to be a lot higher than in bonds for example. Sudden large changes in stock prices can trigger your emotions and not every investor is able to deal with them.

Moreover, if your investment horizon is short, you should not be investing in stocks at all. Due to the high volatility, it is nearly impossible to predict the performance over the short term. For this reason, if you are looking to invest over short periods of time, or you are a risk-averse investor, consider investing in safer options.

7. Taxes on dividends and capital gains can affect your returns

Although there are tax benefits of investing in stocks through retirement plans, if you do not use them your taxes could eat your profits away. Whether you are receiving dividends, or you are selling stocks for a higher price than what you paid, taxes will eventually take a toll on your portfolio.

8. Investing in stocks requires patience

Perhaps one of the simplest, and yet one of the most complicated things to understand about investing in stocks is that it requires a lot of patience. Not only do you need to be able to control your emotions like fear and greed, but you also need to be calm, focused, and wait patiently.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Paul Samuelson

Should you invest in stocks despite the risks?

If you are a first-time investor, you may be wondering if it is even worth it to invest in stocks, because it can be risky and confusing. The reality is that despite the potential risks, investing in stocks is by far one of the best decisions you can make. Whether you are just putting some money on the side every month, or you are planning to retire, stocks are the best investments.

It is important to understand that for most investors a simple index fund tracking the S&P 500 will be the best option. You will be guaranteed the market return, and you do not have to worry about researching stocks.