Value investing still remains a viable investment strategy used by investors, but over the years its relevancy has been questioned, especially during the last few years. The historical performance of value stocks has proven time and time again, that value investing outperforms growth investing. Value investing is difficult, but why is that? And why is it considered outdated?

In this article we will look at 16 reasons why value investing is so difficult.

Why is value investing difficult?

There are several reasons that explain why value investing is difficult, but the main one has to do with going against the market consensus. Value investors are known for picking out favor stocks when their price is lower than their intrinsic value. When you buy a value stock you are essentially betting that the market is incorrect in its assessment of the value of the business.

This differs from growth stocks, whose performance is more dependent on the company maintaining its growth trajectory.

16 Reasons why value investing is difficult

Besides going against the market consensus view, there are also other reasons that make value investing difficult:

- It is difficult to accurately value a stock

- Value investing is always evolving

- You can’t rely on low P/E and P/B anymore

- There are a lot of investors and funds looking for value stocks

- There are a lot of value traps

- Identifying Value traps is not always easy

- Value is an abstract concept

- Going against the consensus

- Value investors fight the market sentiment

- Value stocks need a catalyst to rise

- Value investing takes patience

- Value investing requires conviction and confidence

- Difficult to manage emotions

- Catching falling knives

- Value investors tend to have a bottom-up approach

- Going against the trend

1. It is difficult to accurately value a stock

One of the main reasons why value investing is difficult is that it relies on valuing businesses in order to determine their intrinsic value. Valuation is an extremely complex subject, that can be very subjective, depending on who you ask. There are different valuation methods that can be used, and every analyst or value investor will come up with a slightly different valuation figure.

At the end of the process, the valuation is just a rough estimate of what the business is worth, and it can change overnight. We have seen this repeatedly in the market, where one event can completely disrupt an industry and affect the valuation of thousands of stocks.

Why is it hard to value a stock?

Valuing a stock is hard because any valuation method relies on assumptions about the business’ future ability to generate cash flow. Different people will make different assumptions regarding the company’s ability to generate earnings, and at the end of the day, all of these assumptions are subject to change.

Valuation is both an art and a science, and it requires an extreme ability to foresee events and to understand the business competitive landscape upon which those assumptions rely on. Stock valuation is also dependent on a multitude of factors that are everchanging, which means that valuations need to be constantly adjusted to reflect that.

Finally, you also need to thoroughly understand the business behind the stock, to be able to accurately value it.

2. Value investing is always evolving

Over the years value investing has completely changed. From its early innings when buying net net stocks, was all it took to outperform as a value investor until its more modern form, where you might even consider growth stocks as value stocks.

Over the years these changes have made it more difficult not only to find but also to value these stocks. Additionally, as the universe of what is considered a value stock expands, value investors have to consider and research a lot more stocks. This makes it more time-consuming.

3. You can’t rely on low P/E and P/B anymore

While you could rely solely on low price-to-earnings and price-to-book that method of finding value stocks does not apply anymore in today’s markets. It takes a lot more than just looking at the company’s earnings and trying to pick stocks that have a low price-to-earnings. The same can be said for price-to-book. Low price-to-book stocks are usually priced that way due to the inherent risks related to the company.

4. There are a lot of investors and funds looking for value stocks

As value investing became more popular there are plenty of funds and investors out there looking for value stocks. This has made it difficult not only to find value stocks but also to invest in them. The increased competition means that valuations of good companies do not stay low for a long time.

5. There are a lot of value traps

Most of the stocks that appear cheap have a low valuation for a reason, and with the increased number of value investors looking for the same stocks, all there is left out is a lot of value traps. These stocks can seem like value stocks but are in fact declining companies that are not worth the investment.

With more value traps, value investors need to go through more stocks to find the ones that are worth investing in.

6. Identifying value traps is not always easy

Identifying value traps is never an easy task, and it is one of the major challenges value investors have to face. While it is easy for companies to appear undervalued when in fact they will continue to decline in price indefinitely.

Forcing value investors to look for new ways to find undervalued stocks, that will perform as expected.

7. Value is an abstract concept

The value of a business is defined by quantitative aspects, like financial results, but it is also influenced by qualitative factors. There will always be a discrepancy between how one investor looks at the company’s financials and how another investor actually perceives them.

Additionally, the qualitative factors like the competitive landscape of the business, and its competitive advantages can be very subjective depending on who you ask.

This makes it even more difficult to be a value investor, and it is one of the reasons this investment strategy is both an art and a science.

8. Going against the consensus

Value investors are essentially going against the market consensus and this will always be challenging. When you are betting that the market is wrong you can obviously be right, but you will never be right all the time.

This is one of the main reasons why value investing is difficult. Therefore it is important to understand exactly why a stock is priced the way it is.

9. Value investors fight the market sentiment

Since you are going against the market consensus you are effectively fighting against the market sentiment towards a certain stock. This will always be something difficult to do because you think a stock will go up when the market is valuing it low because it thinks it will go down.

This is the main reason why value stocks are considered riskier by some investors because to generate a good return the market needs to change its views on the company from negative to at least neutral.

10. Value stocks need a catalyst to rise

Most of the time value stocks also need some sort of catalyst to rise in price considerably. Without any positive development, or even the stock price can stay depressed for a number of years.

It is also common for value investors to identify potential catalysts that never come to fruition, that take too long or never really happen the way they envisioned.

11. Value investing takes patience

Patience is a virtue, and when it comes to value investing it is a crucial quality that value investors need to have. One of the most outstanding value investing quotes is by Joel Greenblatt:

“If you do good valuation work, the market will eventually agree with you.” - Joel Greenblatt

What is important to understand is that the market might take years to agree with you, and this is why value investing requires a great deal of patience.

12. Value investing requires conviction and confidence

To be able to be patient value investors also need conviction and confidence. Without them, you will not be able to keep holding to your value stocks while the market continues to disagree with you. It might take years before a value stock reaches its fair valuation, and it might continue to drop in price during that time.

This is why it is important to do your research and be sure of the business you are investing in. While the stock keeps dropping it is also wise to average down.

13. Difficult to manage emotions

Having most of the market participants disagree with you while keeping your conviction and confidence can be very challenging. This is why it is sometimes difficult for value investors to deal with emotions when using this investment strategy.

14. Catching falling knives

Value investors also find themselves catching too many falling knives, and it can be extremely difficult to get the timing right. This means that a position can lose a large percentage of its value, and even decline abruptly.

15. Value investors tend to have a bottom-up approach

A bottom-up investing approach requires investors to commit a lot of time and effort researching individual stocks. This due diligence process can be not time-consuming but also requires a lot of knowledge of accounting, and a good ability to project how companies will do financial.

Whether a value investor uses financial models or rough estimates, it takes a lot of time to go through each stock, and analyze it carefully. This is another reason why value investing is difficult.

16. Going against the trend

Finally, value investing most of the time requires you to go against the trend, and you know what they say - the trend is your friend. This requires a lot of conviction and confidence as we have mentioned, but for a value stock like this to be profitable it needs to reverse the trend, and move in the opposite direction. This can take time, and it might not even happen.

Does value investing still work?

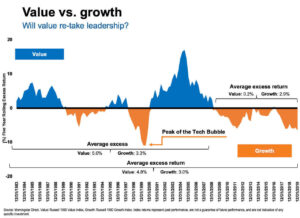

Yes, despite being one of the most difficult and challenging investment strategies it has been proven to work. Historically, value stocks have continued to outperform growth stocks over long periods of time. Even if during the short-term value stocks underperform the broader market or growth stocks, historical data tells us the opposite.

Source: Seeking Alpha

Conclusion

Value investing is one of the most simple investing strategies out there, at least in theory. The idea of buying something for less than it is worth may sound simple, but you need to be able to accurately know how much it is worth.

While value investing may be less popular now, it is an investment approach that has worked very well for many, and it will continue to do so.