Passive portfolio management is one of the most common types of portfolio management approaches for retail investors. The reason it has become so popular is that it allows you to achieve great returns while ensuring that you do not have to spend countless hours researching stocks, and looking at charts.

How passive portfolio management became so popular

Passive portfolio management was one of the most innovative creations in the world of finance and investments. John C. Bogle’s innovation allowed millions of investors to build wealth over time with a simple yet extremely effective concept.

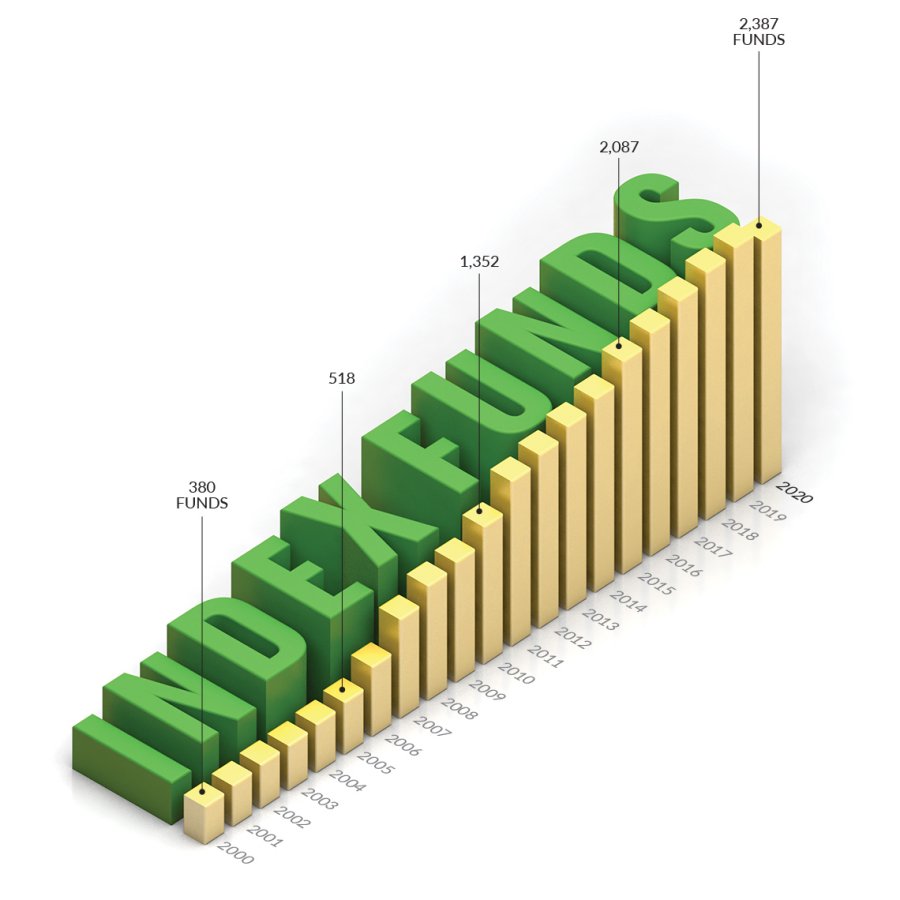

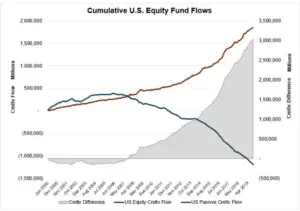

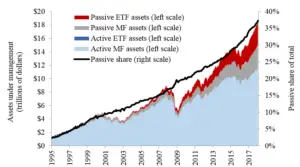

This is one of the reasons why passive fund inflows have continued to increase, and one of the reasons why actively managed funds are not attracting as much capital.

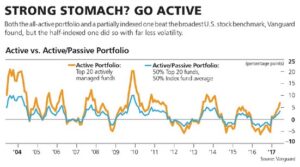

While there is a clear shift towards a passive portfolio management approach, active funds still hold the majority of the assets under management. The main reason is the possibility of outperforming the broader market. This remains one of the biggest advantages of active portfolio management.

What are the advantages of passive portfolio management?

Here are some of the main advantages of passive portfolio management:

- Requires less effort and knowledge

- It saves time

- Fewer costs and fees

- It does not require research

- Diversification

- Lower risk

- Tax benefits

- Ideal for most retail investors

Requires less effort and knowledge

Effort

One of the main reasons why passive portfolio management is so popular is that it does not require as much effort as active portfolio management. Most investors with a passive portfolio will select stocks or ETFs to hold for the long term, and they might even average down, or follow a dollar-cost averaging frequently.

As opposed to active portfolio managers which tend to rotate between stocks, and sectors. This is a constant effort for investors to keep up with the latest market news, and developments while actively managing a portfolio.

Knowledge

Passive investors also do not need to be very knowledgeable about stocks, financial markets, or even understand what is actually going on in the market. This is a great advantage and it is one of the reasons so many retail investors choose this type of portfolio management style.

It saves time

Since it requires less effort, it also takes less time to manage a passive portfolio than an active one. This is the perfect solution for investors who like to have a hands-off approach to investing.

Fewer costs and fees

Another advantage of a passive portfolio management approach is that it involves lower fees. According to Morningstar, the average fee for an index fund is close to 0.12%, and the fees of actively managed funds are on average 0.62%.

Actively managing a portfolio also means you need to buy and sell stocks frequently. Since you are not constantly rotating positions in your portfolio and your turnover is low, it saves you broker fees that active portfolio managers incur.

It does not require as much research

Passively managing an investment portfolio also does not require as much research. While active portfolio managers will spend countless hours screening and researching stocks, some passive investors don’t even research any stock at all.

They are happy with having the same performance as the index they are benchmarking.

Diversification

Another advantage of passively managing a portfolio is that it is usually a lot more diversified than an actively managed portfolio. This is a clear advantage for most investors because it mitigates volatility and risk.

Lower risk and volatility

Passively managed portfolios also tend to be less volatile and risky. By owning an index fund, or even sector-specific ETFs, you have a more diversified investment position. The increased diversification allows you to reduce the risk and volatility in your portfolio.

Some investors also hold multiple ETFs and index funds, which further lowers the risk and volatility the portfolio can be subject to.

Tax benefits

One of the best benefits of having a passive investment strategy is that there are clear tax benefits. While active portfolio managers will have a high turnover, meaning they sell several stocks and add new ones, this forces them to pay capital gains taxes.

Conversely, with a passive investment approach, you are not constantly selling stocks which saves you money on taxes.

Ideal for most retail investors

Due to the fact that it takes less time, and effort and doesn’t even require the same amount of knowledge, a passive portfolio approach is the best for retail investors. It makes investing simple and straightforward, and it is a great way to build wealth over time.

What are the disadvantages of passive portfolio management?

The main disadvantages of passive portfolio management include:

- Less efficient

- It does not allow investors to take short-term profits

- Hedging can be complicated

- It will never beat the market

- You will be limited to the stocks you will own

- It can be difficult to get the right exposure

- Can be too diversified

- There might be a passive investing bubble

It is less efficient

One of the main disadvantages of having a passive portfolio management approach is that it is far less efficient than its active counterpart. The reason is that when you invest in index funds, and ETFs you are not choosing each of the stocks. Therefore you cannot have complete control and oversight over each of the stocks in your portfolio. This is the main reason why index funds are inefficient.

It does not allow investors to take short-term profits

Another problem with passively managing a portfolio is that it does not allow you to take profits in the short term. While active portfolio managers are known for rotating between stocks and taking advantage of stock price increases in the short term to book profits, passive investing does not work like that.

It does not allow investors to hedge

It is also more difficult to hedge a portfolio that is so diversified, especially if you hold various ETFs and indexes. While it is easy to hedge a portfolio with a handful of stocks, hedging a portfolio with one index fund can be tricky. Additionally, shorting index futures, or even buying puts on the index can be expensive.

It will never beat the market

Something that is passive investors should also be aware of is that a passively managed portfolio will never allow you to beat the market. This is clearly one of the reasons why so many individual investors try to actively manage their own portfolios. A passive investment strategy will only guarantee that your returns will be the same as the broader market.

You will be limited to the stocks you will own

Something to keep in mind when investing passively is that you will be limited in the stocks you can own. Index funds and certain ETFs will completely disregard some small cap stocks, or even follow a strategy that might not be in line with your ethical beliefs.

It can be difficult to get the right exposure

If you are trying to get a specific exposure to some stocks, it can be difficult to do it with passive portfolio management. Unless you buy individual stocks you will not be able to select exactly what is your exposure to a certain industry, company, or even region.

Can be too diversified

Another disadvantage you should keep in mind is that a passive portfolio management approach tends to be too diversified. Sure, it can help you reduce the risk and volatility of the portfolio, but it can also hinder your returns. There are clear reasons why concentrated portfolios are more likely to beat the market and achieve better returns.

There might be a passive investing bubble

Something to also keep in mind is that there are certain investors that have called out a passive investing bubble forming in the market. Their rationale behind this claim is that index funds invest in stocks without any discrepancy. If their assets under management increase, they buy the stocks in the indexes.

This complete disregard for stock fundamentals and valuations helps to form a bubble in stocks. As long as a company is in the index, index funds will always buy it. Research conducted by Vladyslav Sushko has found that these passive investment vehicles can contribute to pricing and valuation discrepancies in the market.

Conclusion

While there are clear disadvantages of passive portfolio management, this investing approach has become one of the most popular. It allows every retail investor to invest their savings without having the knowledge to analyze and research stocks.

Not only does it help to democratize investing, but it also helps individuals invest their savings for retirement.