- Strong firearm demand in 2020 and continuing into 2021.

- A strong balance sheet with virtually no debt.

- Great market position to benefit from the increased demand for firearms.

- Cheap when compared with the broader market.

Smith & Wesson Overview

Smith & Wesson Brands (NasdaqGS: SWBI), is one of the most important firearms brands. The company manufactures firearms and ammunition, and it was established in 1856. Although the number of mass shootings in 2020 was considerably smaller than in 2019 due to the pandemic. Gun violence became increasingly more common. 2020 had an estimated increase of 4,000 murders when compared with 2019. Just the last month alone there were at least 45 mass shootings in the US. The number of homicides has also increased.

This is one of the reasons that explain the high demand for firearms in 2020, with over 23M guns sold across the country. The trend seems to continue in 2021, with people lining up to purchase guns. Over 2M guns were sold in January, marking the third-highest monthly record. An increase of 80% in volume when compared with January 2020.

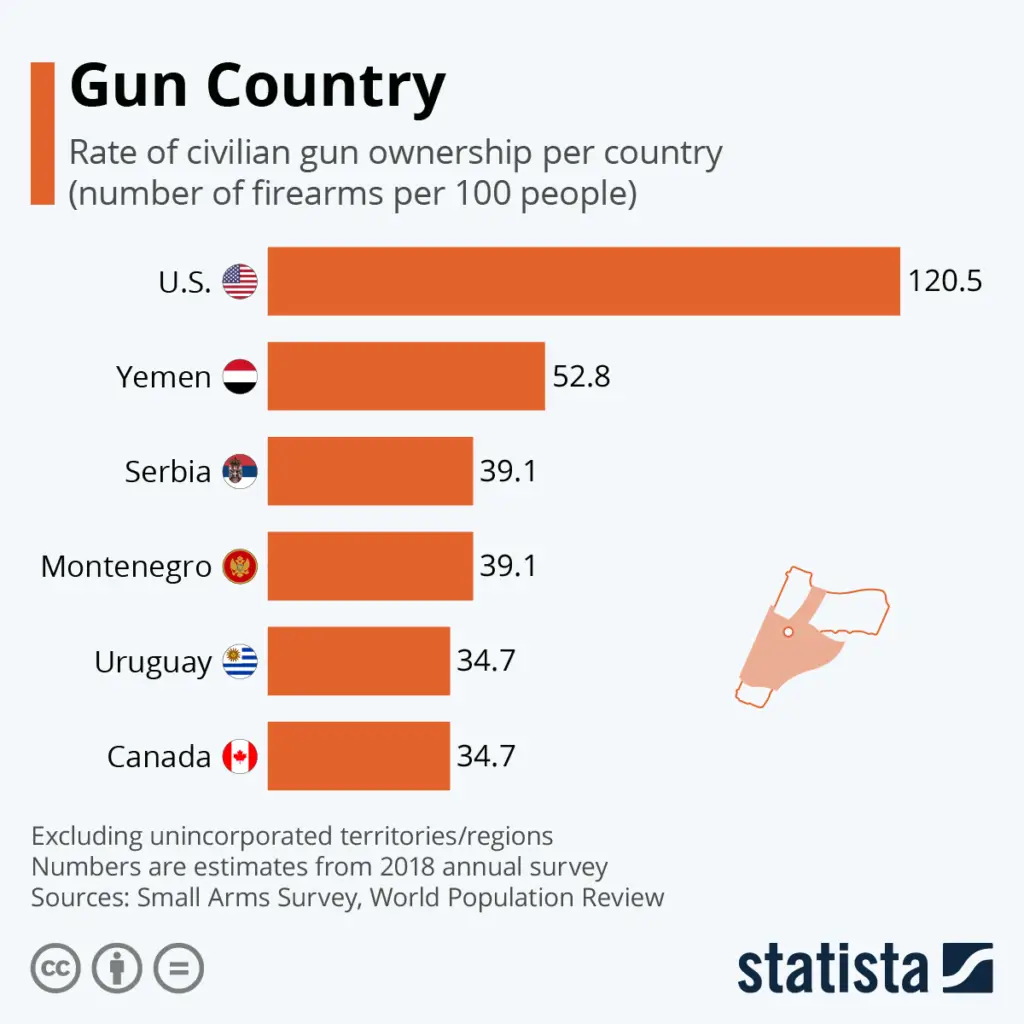

Since the US is the country with the highest gun ownership among civilians, with over 120 guns per 100 people. However given that 42% of US households own guns, there is still a demand for new gun owners.

One of the reasons behind that is the stance of the Biden administration on gun policies, which has pushed Americans to purchase more guns. Fearing that potential restrictions will limit the amount and type of guns they are allowed to own.

American Outdoor Brands Spin-off

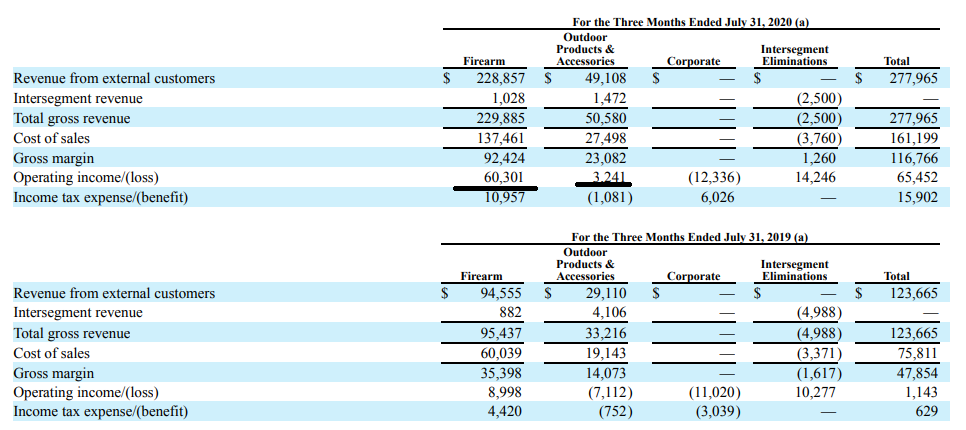

SWBI recently spinning-off its segment focused on outdoor products and accessories, American Outdoor Brands (NasdaqGS: AOUT). SWBI is now solely focused on firearms. Despite contributing significantly to revenues, the net income of the segment is quite low when compared with its main firearms segment. It should not materially impact earnings going forward.

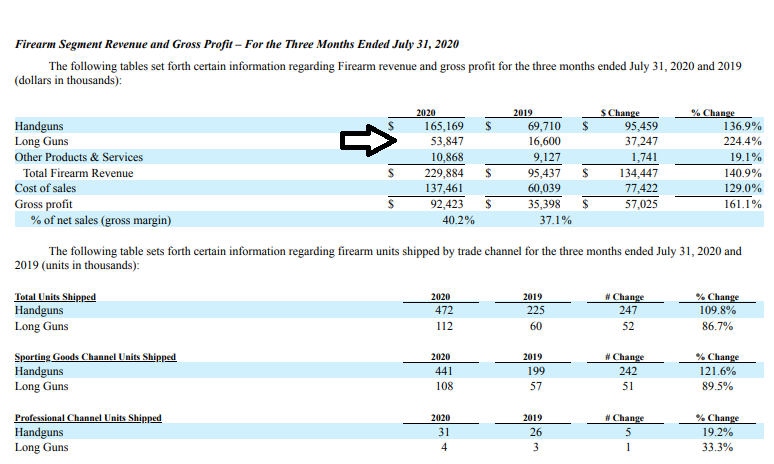

Source: 10-Q

Smith & Wesson Results

SWBI had a great quarter, reaching net sales of $278M, a 124.8% increase when compared to 20Q1. It also managed to increase its gross margin by 3.3% to 42%, achieving diluted EPS of $0.86.

Over the last four quarters, Smith & Wesson has managed to impress analysts. Beating their earnings estimates by a considerable amount. What was once perceived as a relatively slow growth company, is impressing Wall Street. Even taking into account the loss in revenue and net income due to the spin-off, we can expect net income to remain ~$50M per quarter. If the demand for firearms remains stable. In 2021 SWBI should easily achieve a net income of ~$200M. Given the market cap of ~$1.04B gives the stock is a price-to-earnings around 5.

SWBI pays a $0.20 dividend per share, and we can expect it to increase in the following quarters if it manages to grow its bottom line. Adding to that the fact that the company has zero net debt, gives it a very stable outlook.

Capex over the last decade has remained fairly low, which allows the company to return more value to shareholders. Over the first three quarters of 2020, SWBI had an average of ~$59M of free cash flow per quarter. Assuming it will continue in the near future, it is trading at ~5x free cash flow, clearly undervalued.

Smith & Wesson Risks

With the Biden administration planning to enact some changes restricting the access to firearms, this can pose a potential risk to the whole industry, and ultimately affect Smith & Wesson. Gun violence is often attributed to firearms legislation that easily allows Americans to purchase guns and ammunition.

A reversal of the Protection of Lawful Commerce in Arms Act could potentially be the most damaging piece of legislation to affect gun manufacturers. Passed in 2005, the law protects gun manufacturers from being held civilly liable for their products, Biden voted against at the time. Other restrictive laws could also deter Americans from acquiring guns. Potential restrictions include banning the manufacture and sale of assault weapons, regulating possession of existing assault weapons, and eventually requiring mandatory background checks on all gun sales.

Handguns seem to be out of reach for most of the legislation, and eventually, only the background checks can affect its sales. Assault weapons represented ~23.4% of total sales in the last quarter

Key Takeaways

Despite the potential political challenges that might impact SWBI. The uncertainty about the possible gun controls imposed by the Biden administration has driven demand for firearms. It is still unclear how long demand will stay at these levels. Given the controversy surrounding the firearms industry, as an investor, you should require a higher margin of safety. The stock is not for everyone, and some investors do not want anything to do with the firearms industry.

SWBI is a wonderful business, with relatively low CAPEX and high margins. R&D in the industry seems to be fairly low across the board. SWBI benefits from its strong brand presence with consumers to make recurring sales. Although it is highly dependent on the demand for firearms its stock performance is highly correlated with it.

We believe the company has some competitive advantages in the sector and should continue to benefit going forward. At under $20 it seems like a good investment in the short term. If you decide to invest in the stock, I would keep an eye out on NICS firearms background checks. As it gives a good perspective on how firearms sales are doing overall.

We have no position in any of the stocks mentioned. Read our disclosure.

Featured image source: Centralguide