Coca-Cola (KO) is one of the more popular stocks for small investors. The stock is on the Dividend Kings list having raised the dividend for 58 years. Coca-Cola is also on the Dogs of the Dow in 2021 after a relatively poor year in 2020. COVID-19 affected some end markets for Coca-Cola as stadiums, arenas, bars, and restaurants closed or limited operations. The stock is yielding about 3.3% making it one of the 10 highest yielding Dow Jones 30 stocks. The stock price is facing downward pressure in early 2021 due to some recent downgrades. In fact, the stock is down about -9% year-to-date. That said, I like Coca-Cola. The company has been a proven performer over time. Despite the near-term challenges, I view Coca-Cola as a long-term buy.

Overview of Coca-Cola

Coca-Cola was founded in 1886. Today, it is the largest non-alcoholic beverage company as well as one of the largest packaged food and drink companies in the world. Coca-Cola has operations in over 200 countries. The company makes and sells almost every type of non-alcoholic drink included carbonated soft drinks, water, enhanced water, sports drinks, dairy, juices, teas, coffees, and energy drinks. Coca-Cola’s brands are extremely well-known. The leading brands include Coke, Diet Coke, Sprite, Minute Maid, Fanta, PowerAde, Schweppes, Dasani, Gold Peak, Honest Tea, Topo Chico, FUZE Tea, and many others. Interbrand ranked Coca-Cola as the No. 6 global brand in 2020. The company sells its beverages through a network of company-owned, company-controlled, affiliated, or independent bottlers, distributors, wholesalers, and retailers worldwide. Companywide sales were $37,266 million in 2019 and $33,471 million in the LTM.

Coca-Cola Revenue and Earnings Growth

Coca-Cola has the No. 1 or No. 2 market position in most of the categories that it competes in. This leads to consistent sales each year. Even if one category experiences slowing sales, Coca-Cola probably has brands in growing categories that offset the decline. However, Coca-Cola is the dominant company in carbonated soft drinks owning five of the top 10 brands. This means that the company may have a harder time generating growth in this category. Furthermore, it also means that Coca-Cola can experience shocks such as from the adverse effects of COVID-19.

Source: Coca-Cola Investor Briefing Q3 2020

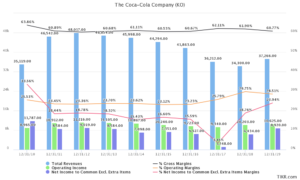

Revenue has also declined since Coca-Cola is refranchising its bottling operations. However, the effect was to increase operating margins as bottling operations have high costs. Despite the decline in revenue, Coca-Cola has able to generate similar operating income. COVID-19 has negatively impacted volumes and sales in 2020 due to government restrictions on sports stadiums arenas, bars, restaurants, and the like. Volumes and sales will also be affected in 2021. Gross margins are remarkably flat over the past decade though they ticked down in 2019. This indicates that the cost of sales as a percentage of total sales is relatively constant.

Source: TIKR.com

Today, Coca-Cola is trying to grow in the coffee sector. It completed the acquisition of Costa Coffee in 2019 and is now leveraging the brand to grow in coffee shops, at home coffee, coffee on the go, packaged coffee, and ready-to-drink markets. Along these lines, Coca-Cola has created a new operating segment called Global Ventures to house Costa Coffee and also Monster (distrbution agreement), Innocent (juices and smoothies), and Dagodan (tea).

Coca-Cola is also trying to grow revenue by entering the alcoholic drink market. The company announced that it would release a hard seltzer under the Topo Chico brand in Latin America and then the U.S. in 2021. This is a change for Coca-Cola. It also makes it a competitor to alcoholic beverage companies. Coca-Cola partnered with Molson Coors (TAP) for distribution.

Coca-Cola’s Dividend Growth and Safety

Coca-Cola’s divided has grown at nearly 4.5% annually over the past 5-years and 6.4% annually over the past decade. Recently, dividend growth has been slowing due to the high payout ratio, but the rate of growth is still decent. It is difficult for a company with over $35 billion in revenue and leading global market share to raise both earnings per share and the dividend at a high rate. Coca-Cola’s forward payout ratio is approximately 87% although based on depressed earnings suggesting that future increases will be modest for the next few years.

Source: Portfolio Insight

From the perspective of earnings, free cash flow, and debt Coca-Cola’s dividend safety is not great at the moment due to the effects of COVID-19. The current forward dividend is $1.64 per share giving a yield of about 3.3%. The payout ratio is about 87% based on consensus earnings of $1.90 per share in 2020. This is a not a great value and above my threshold of 65%. However, revenue and earnings are depressed in 2020 due to the impact of COVID-19. If earnings per share were the same as in 2019 at $2.11 per share the payout ratio would be better at about 75%.

The dividend is also reasonably safe on a cash flow basis. Operating cash flow in the TTM was $8,920 million. Capital expenditures were $1,607 million giving free cash flow of $7,313 million. The dividend required $6,948 million giving a dividend-to-FCF ratio of roughly 95%. This is a high value and above my criterion of 70%. However, note that operating cash flow was almost $10.5 billion in 2019. This higher value in normal operating conditions would result in a better ratio.

The balance sheet is in acceptable shape but can be more conservative, and the company has an A+ corporate credit rating. At end of Q3 2020, Coca-Cola had $11,385 million in cash and cash equivalents and $9,743 million in short-term investments on hand offsetting $5,857 million in short-term debt and $7,508 million in current long-term debt and $39,502 million in long-term debt. Interest coverage was about 4.5X at end of the quarter. The leverage ratio was 2.6X. I would like to see a higher interest coverage and a lower leverage ratio. However, the dividend is not currently at risk.

Coca-Cola’s Valuation

Coca-Cola is currently overvalued based on earnings multiple. In the past 5-years the average price-to-earnings ratio was nearly 23.4X. The stock is currently trading at about 26.5X. If we assume a fair value multiple of 22X this gives a fair value estimate of ~$42. However, this is based on depressed earnings during the COVID-19 pandemic.

A second valuation model, the Gordon Growth Model, gives a fair value estimate of $47 assuming a desired return of 8% and dividend growth rate of 4.5%.

Final Thoughts on Coca-Cola

Coca-Cola is a stock many investors like to hold because of its yield, consistent dividend growth, and the fact that Warren Buffett owns a large number of shares. The current yield is about 3.3% and the dividend is growing albeit at a slow and steady rate. Dividend safety is also acceptable but has declined recently due to the adverse effects of the COVID-19 pandemic. Coca-Cola is slightly overvalued at the moment, but I would consider Coca-Cola at the right price despite the near-term challenges. Small investors may want to keep this stock on their watchlist.

Disclosure: Long KO

Author bio: Dividend Power is a self-taught investor and blogger on dividend growth stocks and financial independence. Some of his writings can be found on Seeking Alpha, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial blogs. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. He was recently in the top 10% out of over 7,853 financial bloggers as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.