United Natural Foods (NYSE: UNFI) shares are trading at a deep discount compared with the market's price-to-earnings ratio of 35. Despite being a low-margin food distributor, it trades at a price-to-sales of 0.03, and a forward price-to-earnings ratio under 5. It is also trading under book value making it one of the most attractive value stocks in the market right now.

UNFI's SuperValu Acquisition

Since the SuperValu acquisition, the company has been struggling, mainly because of the amount of debt resulting from the acquisition. The stock price has been badly affected and UNFI lost most of its value since the acquisition was announced, the stock was trading at a low of $5 during March Sell off.

Source: TradingView

Source: TradingView

Not only did UNFI lose most of its market cap, but the deal was also wrapped in controversy. Goldman Sachs (NYSE: GS) was responsible for advising UNFI during the deal, and according to UNFI, Goldman Sachs had improper conduct, generating ill-gotten gains from the situation. In May a judge dismissed the case against Goldman.

Latest Earnings Report

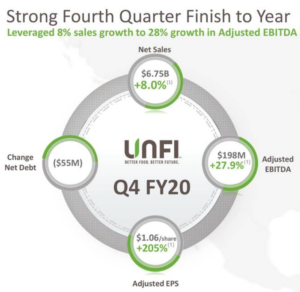

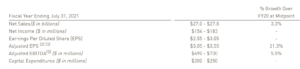

UNFI’s fiscal year ended last quarter, the company posted a record full-year Adjusted EBITDA of $673 million and reduced its net debt by $388 million. By the end of the fourth fiscal quarter, UNFI delivered impressive growth and excellent operational results, posting Adjusted EPS of $2.72/share for the year.

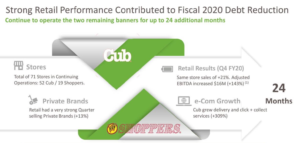

The retail segment represented only 13% of the Adjusted EBITDA, but it has shown that it can grow at an incredible pace. UNFI operates a total of 71 stores that were acquired through SuperValu. As it was noted in the latest earnings call by the CEO Steven Spinner:

"For the full year, we generated $284 million of free cash flow and reduced our net debt outstanding by nearly $390 million, exceeding our full-year debt reduction expectations."

Same-store sales have increased over 21%, with Adjusted EBITDA of the retail segment increasing 143%, driven by a growth of 309% in online purchases. It also increased its gross margin by nearly 3%.

Source: UNFI Presentation

UNFI’s CEO Steve Spinner is retiring, and despite the great results, the stock has trended downwards after announcing the results. Management has also revised upward the estimates for the next fiscal year.

Source: Press Release

UNFI Investment Thesis

Given the size of the company’s operations, it is essential for retail partners to keep working with UNFI given its distribution centers located all around the country and its vast product offerings. This has led UNFI to recently strike an agreement with Key Food Stores, guaranteeing supply to the retail chain for a period of 10 years valued at $10 Billion. UNFI has also signed a recent deal with San Diego Farmers Outlet. Both agreements show that the company is moving in the right direction and should continue to grow revenues going forward.

On another hand with the objective of reducing its interest expenses the company is planning to issue bonds due in 2028 totaling $500 million. This will ease the debt burden and help the company manage its debt more efficiently allowing them to roll over the debt and benefit shareholders.

The stock is so cheap it is difficult to ignore! Last quarter’s Non-GAAP EPS of $1.06, an increase of 300% YoY shows that the stock is immensely undervalued. It trades at a market cap of under $900M and had sales of over $26.5B, generating $284M of free cash flow. That translates into a price-to-free cash flow of nearly 3, which could translate to above-average returns over the next few years. Despite beating Revenue and EPS estimates, and improving the outlook for the next year, the stock has been hit hard by many shorts, with nearly 22% short of float. It seems to be a lot of negative pressure on the stock price, and a short squeeze could become.

Competition

According to IBISWorld, the grocery wholesale market in the U.S. has a size of over $218 Billion and should continue to grow. Some of the companies in the space supply products to the hospitality sector and that can bring higher margins. UNFI focuses on supplying retail, and given the size of its operation, it still holds a good chunk of the market share. If we compare with competitors such as Spartan Nash (NASDAQ: SPTN), U.S. Foods (NYSE: USFD), Sysco (NYSE: SYY), and Performance Food Group (NYSE: PFGC). UNFI stock seems to be the cheapest among the group of stocks analyzed below.

| UNFI | U.S. Foods | Sysco | Spartan Nash | Performance Food Group | |

| Price/Earnings | - | - | - | 13.61 | - |

| Forward Price/Earnings | 4.64 | 12.39 | 29.5 | 8.47 | 32.57 |

| Price/Book | 0.74 | 1.46 | 23.83 | 0.91 | 2.48 |

| Price/Sales | 0.03 | 0.22 | 0.63 | 0.07 | 0.17 |

| Price/Cash Flow | 1.83 | 7 | 13.11 | 2.37 | 11.04 |

| Enterprise Value/EBITDA | 38.66 | 20.88 | 29.2 | 8.88 | 43.22 |

| Debt to Equity | 3.2 | 1.69 | 11.08 | 1.22 | 1.66 |

| Net Margin % | -1.03% | -0.59% | -0.04% | 0.53% | -0.58% |

| Return on Equity % | -20.62% | -3.93% | -1.14% | 6.84% | -9.00% |

| Dividend | - | - | 2.96% | 4.17% | - |

| Payout Ratio | - | - | 63.40% | 56.30% | - |

Source: Morningstar

The stock presents the lowest price-to-book and the lowest forward-price-to-earnings under 5. Not only that but the price-to-cash-flow is under 2. At this level, the stock is deeply undervalued, a contrarian value investment opportunity that will produce market-beating returns. As the company reduces the debt and improves its earnings and revenues the stock has tremendous upside.

UNFI Risks

- Despite being able to reduce the debt at a fast pace the company still has nearly 2,66B in long-term debt and has nearly $50M in interest payments every quarter and an EBITDA leverage ratio of 4. One of management's objectives is to reduce debt fast, with a $390M debt reduction last year the company should be able to continue to repay debt and strengthen its balance sheet.

- Whole foods represent a big percentage of sales and the contract will expire in 2025 which can bring some pressure to the company. A potential end to that contract would have a big negative impact on the company going forward and affect the stock price.

- While trading at such a low valuation the opportunity of being acquired is something to keep in mind. As the main distributor of Whole Foods, there is the possibility of being acquired by Whole Foods/Amazon. On the other hand, some private equity firms may be interested in the company and could take it private.

- Given a large number of employees UNFI has and its intricate operations, its workers in cooperation with syndicates often do strikes. This can negatively impact the operations and affect the business going forward.

- Being a low-margin business, a slight change in the profit margin can greatly affect the company’s results and affect the stock price.

Conclusion

Although UNFI operates in the low-margin food distribution sector, the results show that the company is growing at a decent pace, while increasing margins. The natural foods space has seen great growth in the last few years and should continue to drive sales. Corona has positively impacted UNFI's prospects, accelerating the synergies created with the SuperValu acquisition. While paying down the hefty $2.66B in long-term debt will be a challenge, the balance sheet should improve as the debt is reduced and the stock value should rise as it continues to grow revenue and EPS.

The stock under $20 is a total bargain offering growth and a big margin of safety. The natural groceries market is going to continue growing and UNFI distribution capacity makes it a great player in the sector. A possible extension of the Whole Foods Agreement can also send the stock soaring.

We are long UNFI. Read our disclosure.

Featured image source: CDN