Silver has been one of the most attractive commodities during 2021, especially as investors tried to corner the market collectively, but was the silver squeeze fake?

In this article, we will analyze if the silver squeeze was fake or not. We will include an overview of the market and what could happen in 2022.

How the silver squeeze started

At the beginning of 2021, silver prices skyrocketed to their highest level since 2013, in what seemed to be an attempt at a silver short squeeze. Regular retail investors fueled by what had happened to GameStop stock were pilling into silver. Buying up physical, ETFs, and even silver miners.

In a coordinated attempt to drive to corner the silver market, retail investors driven by this Reddit post started to collectively buy silver. Silver is a relatively small market, with large players that represent most of the traded volume. The Reddit buyers were able to move the price of silver. Spot silver climbed to $30.03 an ounce on Monday, up from $25 on Thursday morning, as shares of silver miners rose and merchants of bars and coins throughout the world strained to satisfy demand.

Is there actually a silver squeeze?

Currently, there is no silver squeeze going on. The attempted silver squeeze did not work exactly like investors were expecting. The reason is that silver is an incomparably larger market than a single stock like GameStop.

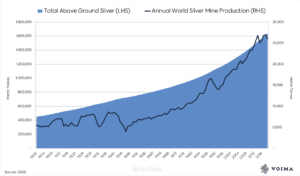

Silver miners continue to increase their production, in order to meet its industrial and investment demand. As a consequence, the amount of silver above ground also continues to increase.

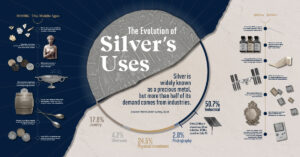

The demand for silver is continuously increasing, and it should continue over the coming decades. Silver is used mainly for industrial use. The auto industry, along with the renewables extensively use silver. Electrical and hybrid vehicles also require silver in order to be built. The demand for silver is expected to increase in the coming years, as the metal is crucial for the energy transition.

Although industrial use of silver represents over 50% of the demand, this should increase over the coming years. As demand for silver will likely continue. Here are some of the main uses of silver:

Source: VisualCapitalist

Is Reddit silver squeeze real?

The Reddit silver squeeze was a real attempt by retail investors to drive the price of the shiny metal. However, it did not work out like most investors were hoping. The reason is that the silver market is a very large market. Therefore, it is incredibly more difficult to create a short squeeze in this type of condition.

What is the silver squeeze?

The silver squeeze was an attempt by retail investors on Reddit’s WallStreetBets orchestrating a silver squeeze. The attempt followed the GameStop short squeeze and pushed silver to a 52-week high of over $30/oz. One of the main reasons behind the silver squeeze is that silver is highly shorted by most bullion banks.

Why the silver squeeze did not work?

Investors that engaged in the silver short squeeze underestimated the size of the silver market. The silver production in 2021 was close to 850M oz, at the current price of over $25/oz, the annual production is the equivalent of $21.250B. Additionally, there is silver that has not been used and is stored all over the world. Either for industrial or investment use.

Therefore a silver squeeze was something a lot more difficult to complete when compared with GameStop which had a market cap of just $1B.

Is silver really shorted?

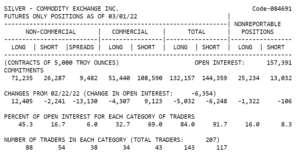

A small group of commercial COMEX traders has a significant short position that considerably outnumbers the amount of real silver they own. Since most of these traders settle their futures contract sales in cash they are never forced to deliver the metal.

Therefore, this creates a situation where most of the traders on COMEX are simply trading paper. This might give investors the idea that there is a lot of silver in the market when in reality, the supply is a lot more constrained.

As of January 2022, there is still a large short position in silver. According to the information disclosed by the CFTC. We can see that non-commercial traders are long the shinny metal, with most of the shorts being held by commercial traders (bullion banks).

Will there be a silver short squeeze in 2022?

It is still too soon to tell whether there will be a silver squeeze in 2022. With the current price increases in the commodities market, silver could go higher. The data shows that the net short position is still relatively high.

We can also see that COMEX silver reserves continue to decline consistently. This is an indicator that the demand continues to grow and that traders are taking delivery of their futures contracts.

COMEX UPDATE #silversqueeze

- #Silver vaults lost net 241,473 oz.

--- 1,737,586 oz. withdrawn from Eligible

--- 1,496,113 oz. deposited to Registered

- #Gold vaults gained net 19,015 oz.

--- 32,535 oz. deposited to Eligible

--- 13,521 oz. withdrawn from Registered pic.twitter.com/nqPnALSoPW— Michael 🏳️🌈 #silversqueeze (@mikesay98) March 3, 2022

How do you profit from silver short squeeze?

There are a few ways to profit from a possible silver short squeeze:

- Physical silver

- ETFs

- Silver miners

The main options are either to buy physical silver, ETFs holding physical silver or silver miners.

Physical silver

Physical silver is usually sold at a premium. This means that the price of physical silver will be higher than the spot price. Therefore, it is more expensive than buying ETFs. However, it has some advantages. The ETFs have annual costs of managing and storing the metal. Therefore if you buy physical, you will not have these costs.

ETFs

When it comes to silver ETFs there are two main choices:

- iShares Silver Trust (SLV)

- The Sprott Physical Silver Trust (PSLV)

Both these ETFs hold physical silver and make it effortless for investors to have exposure to silver. They are also easily traded.

Silver miners

Lastly, we have silver miners. Although most of them have recently become profitable they are still very volatile stocks. The attractiveness of silver miners is that they tend to rise a lot more than silver. If silver rises by 1%, you can expect miners to go up by 2% to 3%. This reflects the increase in profits they would be able to generate given that their margins are increasing.