If you are planning to invest in a stock that is about to IPO, you are probably wondering what performance you can expect. So, do stocks always go up after IPO?

While stocks tend to have a positive performance on the IPO day, and post-IPO that does not mean that they always go up.

In this article, we will go over some of the facts about IPOs, and the performance you can expect both on the first day of trading, and in the following months.

What is the average first-day return on IPOs?

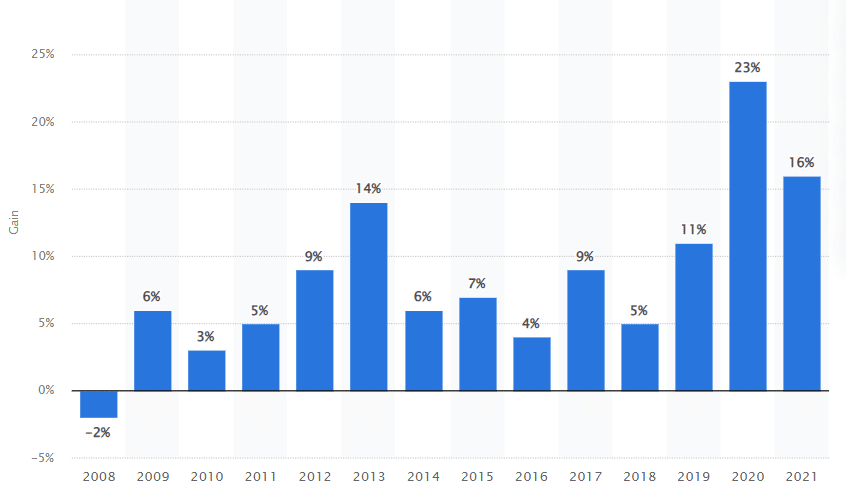

According to Statista, over the last 14 years, the average first-day return for IPOs in the US markets was ~8.3%.

Source: Statista

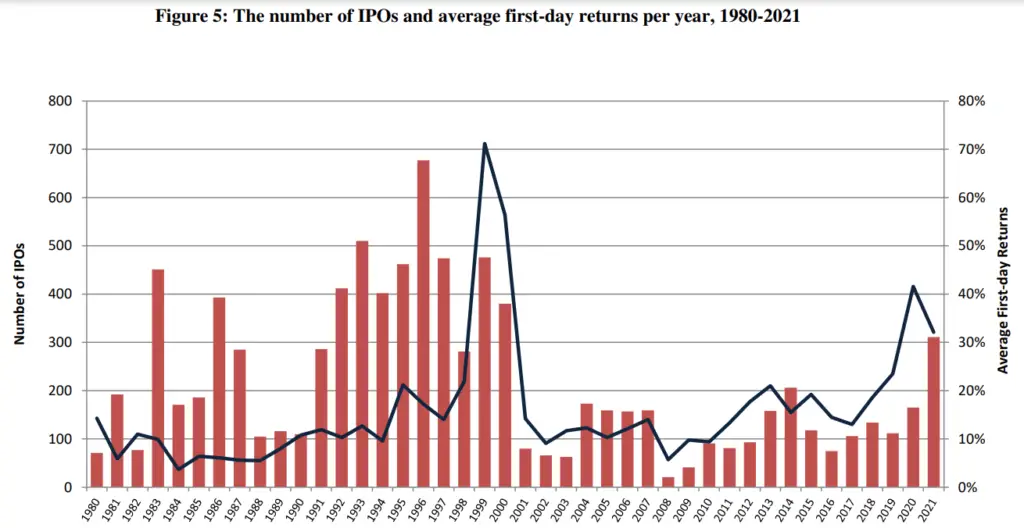

When we compare the data available since 1980, according to research conducted by the University of Florida the average first-day IPO return was 18.4%. One of the main reasons, that explains the difference between the returns over the past 14 years, and since 1980 is the period of the dot-com bubble.

During this time, there was a large number of tech IPOs as well as a lot of interest from investors to take part in the internet trend.

Source: University of Florida

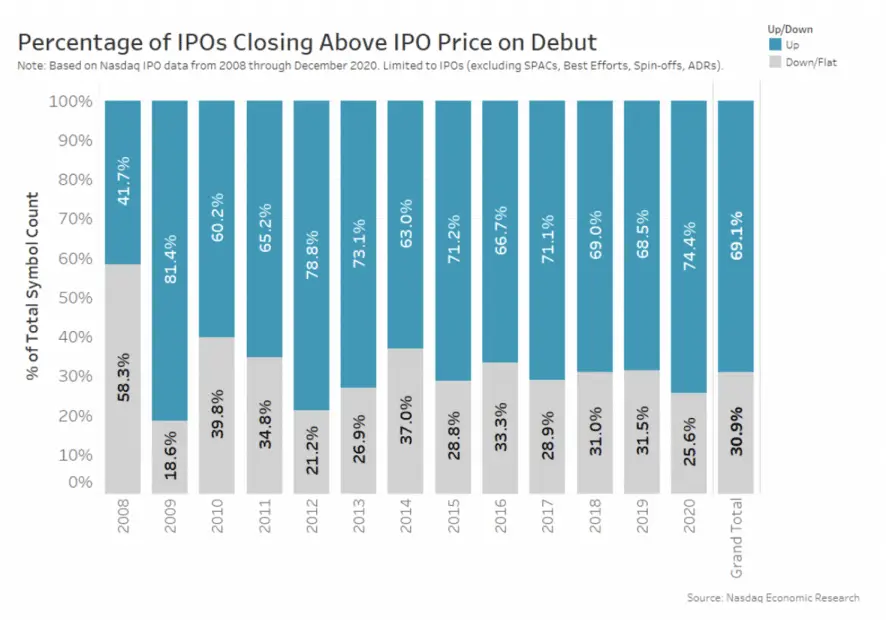

It is important for investors to understand that although the average first-day return of stocks is on average positive that does not mean that every stock goes up on IPO day. In fact, in some years the median first-day IPO performance was negative, according to the Nasdaq Economic Research.

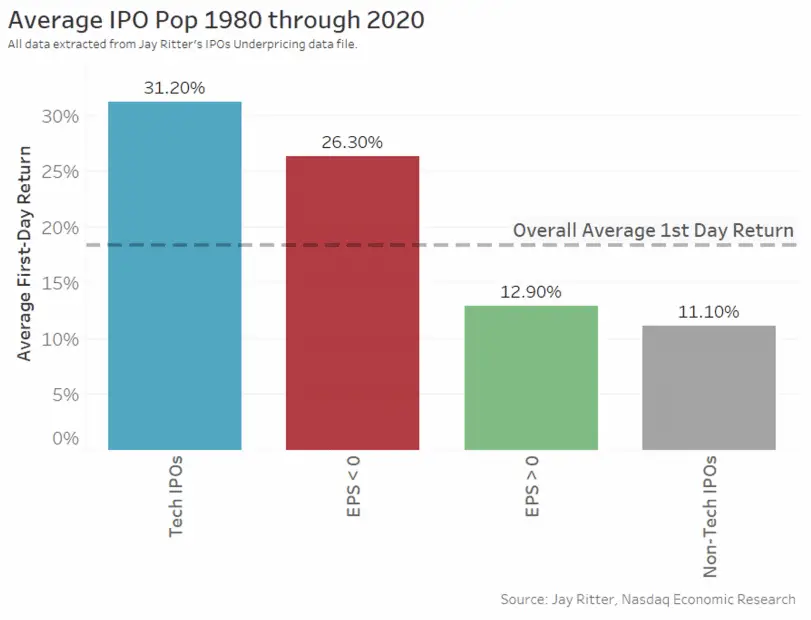

Additionally, the first-day IPO returns are also dependent on the company’s valuation, the industry, and investors’ interest in the company itself. For example, from 1980 to 2020, the tech industry IPOs had a much higher first-day return than the other industries.

Does stock usually go up or down after IPO?

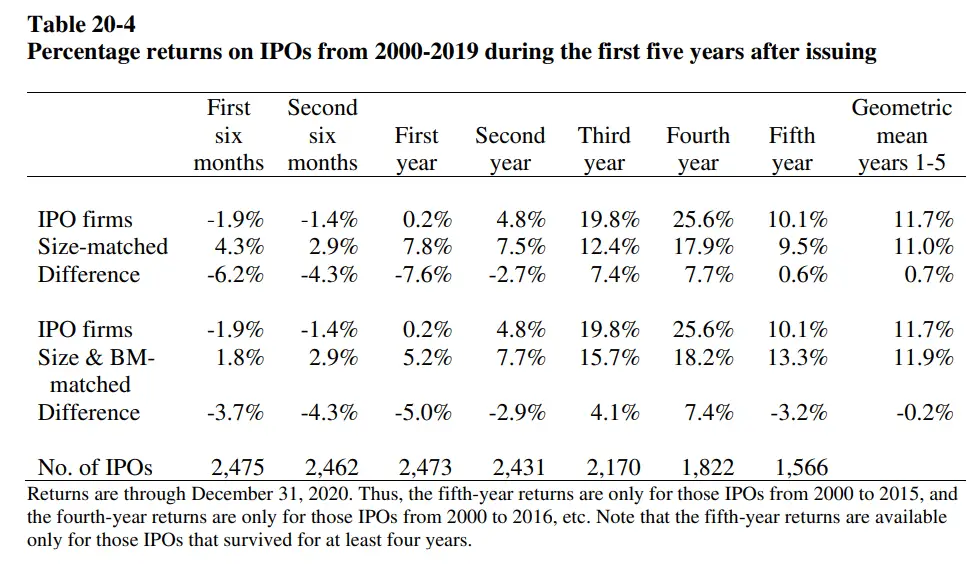

Stocks tend to go up not only on the first day of trading and the following days but the first-year performance of IPOs is on average just 0.2%.

When compared with other similar stocks that are already public, companies that have IPOs tend to underperform them by 7.6% in the first year.

This underperformance on average continues throughout the second year, and only in the third year, the research shows that IPO stocks tend to outperform similar stocks.

Average IPO performance

Source: University of Florida

Is it always good to buy an IPO?

Since stocks tend to go up on average over 16% on the first day of trading it is a good idea to buy stocks on IPO. However, you would need to sell them because the returns of IPOs in the first year are on average just 0.2%.

How to trade an IPO

According to the research, if most IPOs go up by 16% to 18% on the first day, and tend to finish the year just with 0.2%, that means that on average the best way to profit from IPOs is to subscribe to them and sell in the first weeks of trading. As IPOs are expected to perform very well during the first weeks of trading, but the stock price tends to be lower as we approach the end of the first trading year.

When should I sell a stock after IPO?

If you are able to subscribe to an IPO, you should sell a stock either during the first day of trading or in the following weeks. The reason is that most IPO stocks tend to return just 0.2% at the end of the year. Additionally, IPO stocks also tend to have a negative return of -1.9% in the first 6 months of trading.

Therefore if you subscribe to an IPO, or you bought the stock during the first day of trading, you may want to sell it right after because based on historical data, on average the stock is expected to decline.

This will not be the case for every stock, as some stocks actually outperform during the first trading year. However, for most IPOs, this is the best trading and investing approach.

Why do stock prices increase after IPO?

One of the main reasons why stock prices increase after the IPO is that most inventors finally have a chance to invest in the company. If the company has a lot of interest from investors you should expect the stock to rise significantly.

Additionally, fund managers are also looking at IPOs. There are several IPO ETFs, which are exchange-traded funds that buy stocks in recent IPOs. These funds will buy the stock independently of the company, its industry, or the valuation. This also pushes the stock price up.

Other fund managers that run industry-focused ETFs will also look to add certain stocks to their funds, and this also drives demand.

Another reason why stocks go up after IPOs is the lock-up period, which is a period of 90 to 180 days, where insiders such as founders, the CEO, and other owners or employees of the company are not able to trade the stock. These stockholders in some cases have large equity stakes in the companies and they are not able to trade or sell the stock.

For that reason, the float is significantly smaller, which makes the stock more volatile, and with all the interest from investors and fund managers, IPO stocks tend to rise a lot during the first weeks of trading.

Why do IPO stocks go down after a few months?

The main reason why stocks go down after the first couple of months of trading is the lock-up period expiring. When insiders are finally able to sell their shares, the stock tends to go down significantly. This obviously depends on how the company is doing financially, the valuation, and the number of shares insiders control.

Typical IPO stock chart

Here are some IPO stock charts that show the performance of the average IPO stock:

Beyond Meat

Conclusion

While IPO is expected to have a positive first-day return of over 16%, that does not mean that every IPO stock goes up on the first day. If you are looking for a way to invest in IPOs, or to trade IPO stocks, you should be aware that although the average IPO return is positive that is not always the case.

The company and its valuation tend to dictate the returns over the first year. Additionally, you should also analyze how many shares insiders own and how the lock-up expiration can push insiders to sell a lot of their shares.