Stock market trading is one of the most defining advancements in human history. The world of trading and investing has long been considered a mecca for wealth and a place where dreams are made. In the hustle and bustle of this world, a few personalities have forever etched their names in the golden halls of the best traders that the world has ever known.

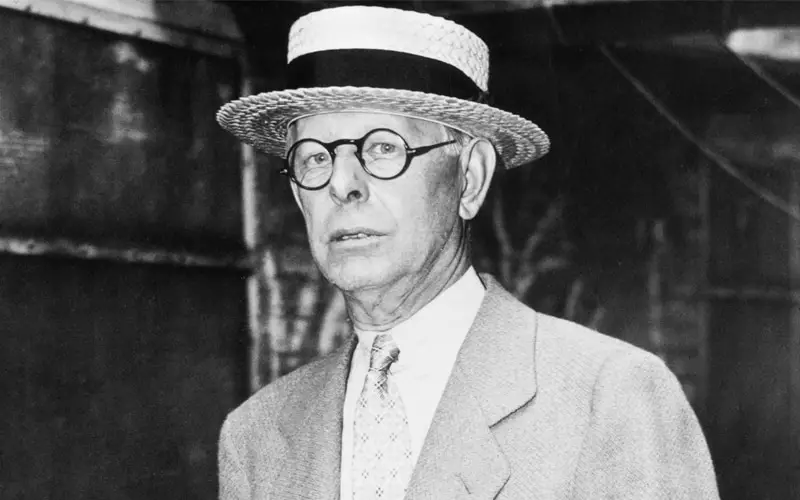

Among these prominent names that have always resounded in the mind of traders both young and old, Jesse Livermore is a name that has always been part of the list. While his legacy continues to be remembered as being one of the best to this day — just how did Jesse Livermore become a trading legend.

Let us take a look at the life of one of the world’s most renowned traders — Jesse L. Livermore.

Early Years

Jesse has always been remembered for the rollercoaster life he lived while enjoying the benefits of the world of fame and fortune. But things did not seem as hectic for him as many people assume them to be.

In the early years of Jesse’s life, everything was more simple and easy to understand. Nonetheless, the experiences he had growing up have also played a part in building the man who will be remembered for the years that followed.

Everything started out from his first days, from his entire persona all the way to his knack for the art of trading.

Growing Up

Born in the town of Shrewsbury in Massachusetts on July 26, 1877, Jesse’s parents had a simple living that one would not expect from someone who would become one of the world’s richest businessmen.

Living a life of poverty as he grew up, Jesse’s father worked as a farmer while his mother tended to the home. But, ever the exceptional child who expectedly had a greater destiny ahead of him, Jesse was able to read and write at the young age of 3.

At the ripe age of five, Jesse was reaching even more unexpected heights by being able to read financial newspapers that their family had around their home. Continuing his kid-genius hot streak in his education, Jesse was the cream of the crop in the classes he attended in grammar school for his exceptional ability in mathematics especially in the realm of mental arithmetic.

While the statements have come from his own mouth, Jesse believes that he was able to accomplish several courses in arithmetic that were worth over three years of studying in the short span of a year. But, good things had to come to an end and Jesse had to face the harsh realities of a life of poverty.

His father had persuaded him to leave school for good and help out with the family by working — effectively ending his education. This decision by Jesse’s father ultimately came from his own experiences while growing up when he also stopped going to school at the age of 14 to become a farmer.

Of course, this was a life that did not suit the prodigy that was Jesse Livermore. And so, Jesse was desperate to get out of the labor-filled life that he was about to live under the guidance of his father.

He had a love for numbers and he was not about to let go of this passion anytime soon. With the help of his mother, Jesse ran away from home with only $5 that his mother had left him. Today, those $5 would be the equivalent of $100.

Taking Up Jobs

However, Jesse knew better than to only rely on the money that he was left with on his journey to set out a path that would suit him the best. And so Jesse started to look for jobs to sustain his everyday needs.

His first job was as a chalk boy with the brokerage firm that went by the name Paine, Webber, & Co. even when he was at the young age of 14 years old. In today’s time, working at that age would have been a very unusual (and in some countries, illegal) thing to occur.

Jesse got his first job with the firm in a rather unceremonial and unexpected fashion. While he was just looking around the business premises, one of the boys who was on duty at the time had to call in sick — and fortunately enough for Jesse, he was just around at the right time to fill in for the vacancy.

For Jesse Livermore, this was the perfect job that suited his love for numbers that motivated him to leave the “comforts” of his home in the first place. As the numbers were called out on the ticker tape, Jesse would write them down on the chalkboard consistently so that the firm’s customers could be updated.

During this job, Jesse was amazed at how the numbers moved from time to time that he even kept a little notebook to himself where he would write down notes on how the numbers and prices moved for the day — since he was in charge of writing all of it down, he had mastered the numbers down to the finest details.

Eventually, these notes would serve him well as he started to recognize familiar patterns in how the numbers moved. Jesse’s pastime hobby while working as a chalk boy would soon change the direction of his life for the better.

Jesse Livermore’s First Trade

After studying the price patterns he had learned during his time with the firm he worked for, Jesse soon had an interest in trading and the stock market. But he always had reservations about jumping into the world of investments at first, since Jesse believed that one had to have a lot of money to trade.

But, during his time as a chalk boy, he was able to learn about bucket shops. Basically speaking, bucket shops were betting areas where people could technically bet on a specific stock in the market and whether or not that said stock would go up or down at a given time period.

There were no huge investments needed to bet on bucket shops and one could easily get into it with just a few dollars. Seeing this as an opportunity to test the theories he had formulated by crunching the numbers in his notebook, Jesse started betting.

Jesse used the patterns he had written in his notebook as a reference when choosing a stock to bet on. Using the system he had developed, he was able to earn his first profits on an investment that amounted to a total of $3.

However, this streak of small profits would not last long for a numbers genius such as Jesse Livermore. Soon enough, he was already earning more from the bucket shops as compared to his salary as a chalk boy.

He was making big enough money that at just the age of 15 years old, Jesse was able to earn a grand total of $1,000 from his trading in the bucket shops which amounts to $25,000 in today’s money.

Amusingly enough, because Jesse was able to earn tons of money from using the system he had perfected, he was banned one by one in the bucket shops that he frequented because of the money he was able to get from them.

Going as far as to wear a disguise just so he could bet at the bucket shops, Jesse was eventually banned from almost all the betting locations in the area.

Jesse Livermore’s Trading Career

At the prime age of 20 years old, Jesse was beginning to earn so much that he was able to make his first $10,000 from the get-go. But, as they all say, good things don’t last forever. The following year, Jesse notice a sharp drop in his earnings — from the $10,000 amount he was able to collect, he was only able to earn $2,500 at the age of 21 which when compared to his previous earning power, was not a good sign.

He began to notice a pattern between his gains and losses — when following the system that he had developed, he was able to earn profits on his bets, but if he did not stick with the system, he would lose money.

Cashing in the $2,500 he had left, Jesse moved on from the bucket shops gig in his area (which had already banned him completely) and traveled to the New York Stock Exchange to officially begin his trading career.

Arriving in New York

Expectedly enough, Jesse was beginning to make his presence known in the stock market for his wit and knack for choosing the right investments to bet his money on. But it was not always sunshine and rainbows for Jesse since he also did lose out on his earnings every now and then.

Jesse’s trading activities were easily described as an up and down venture. From the initial $2,500 he had coming into the market, he was able to grow the amount to $10,000 and then to $50,000 in the span of just five days after trading his Harris, Hutton, & Company shares.

However, Jesse went all-in after anticipating a correction in the market but was unable to successfully earn from the move because the ticker tapes were not updated fast enough to reflect his trading choices.

Seeing that he was bound to lose more money if things did not change for him in the stock market, Jesse went to St. Louis with $2,000 in his pocket which he borrowed from a friend to once again take a chance with bucket shops.

Pseudonyms and Nicknames

Jesse went by several nicknames and pseudonyms during his storied career that continues to be revered by financial hobbyists to this day. One of his most famous aliases is ‘Lawrence Livingstone’, a disguised name which he had used for his interviews in connection with the writing of Reminiscences of A Stock Operator that would eventually launch his name into legendary status.

Due to his reputation that began in the bucket shops and onto the trading world where he went on to earn even bigger money, Jesse was first given the nickname ‘The Boy Plunger’ for his skill of earning big on stock prices that were otherwise falling.

Jesse was also called ‘The Bear of Wall Street’ during the peak of his career in the stock market for his talent in predicting when the market would drop — consequently turning the tides in his favor with every trading decision that he would make.

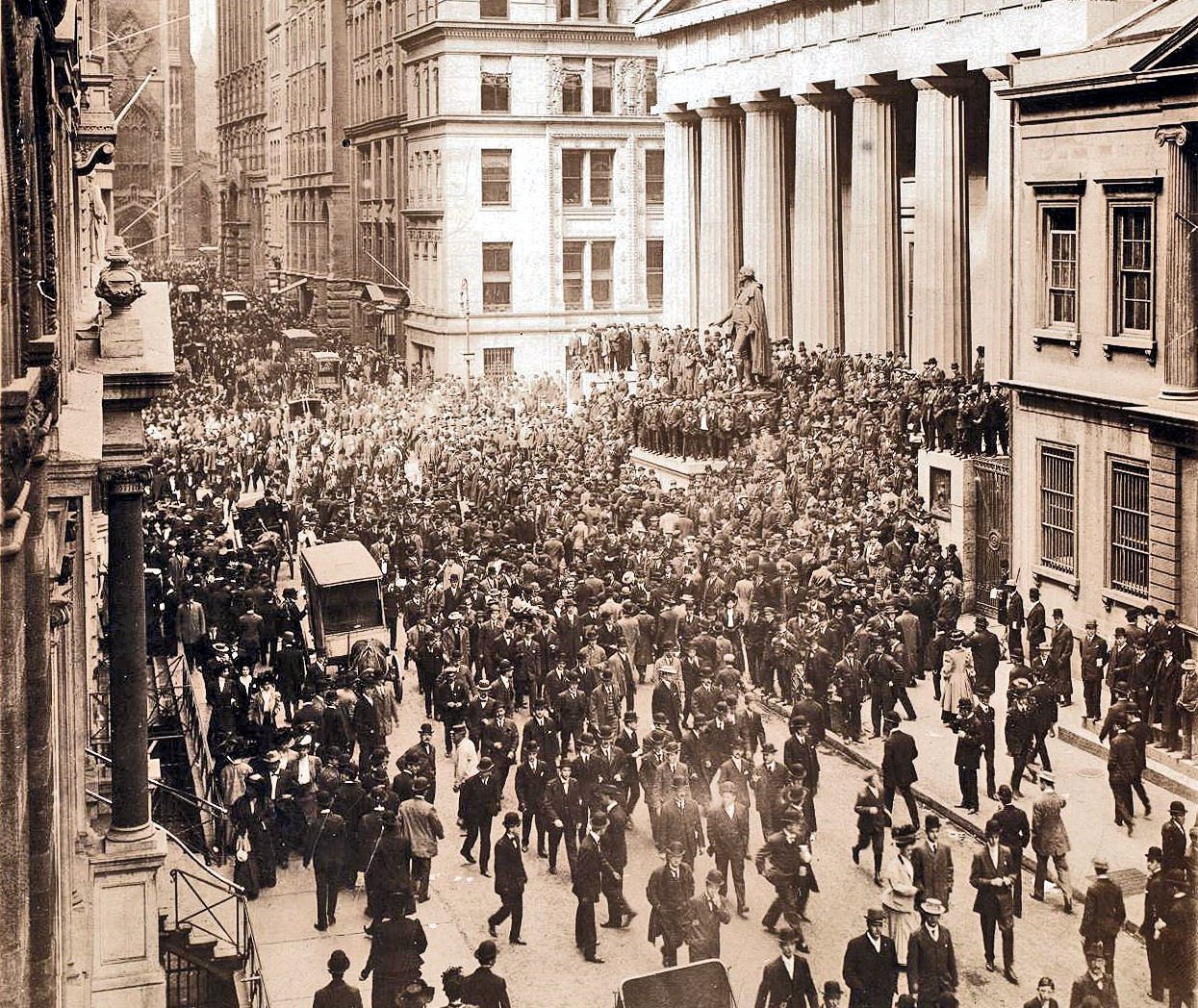

The Panic of 1907

The Panic of 1907 would be remembered as one of the most defining moments of Jesse’s career as a trader. It was during this time that his net worth had exceeded the expectations of people by a huge margin — Jesse was earning so much that he was able to cash in a grand total of $1 million in just a single day of trading. Now the question that is begging to be asked is:

How was Jesse able to earn this much money anyway?

Well, a primary strategy he incorporated was shorting the market while it was experiencing a crash. After calculating every trading decision to his advantage, Jesse was able to accumulate a massive $3 million after the crash had begun to subside and the market was beginning to recover once again.

Observing that even though the market was able to bounce back from the crash, it was obvious that the negative projections would still persist. And so, Jesse had begun to formulate a plan in order to protect his finances from the impending doom that the market would be facing in the near future.

Following Events

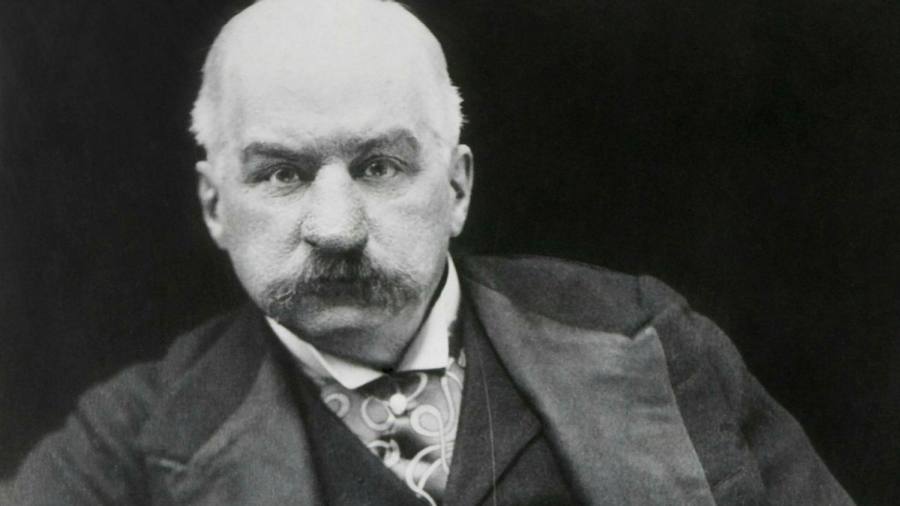

However, as if decided by fate, the legendary investment banker J.P. Morgan reached out to Jesse to ask for his assistance in launching a wide-scale plan that would help the market stand up on its own two feet again.

Seeing Morgan as an inspiration, Jesse did not hesitate to comply with the financier’s requests and soon after, he began to purchase stocks in the market to the best of his abilities. This move inclined other people to then invest in the stock market as well with the boosted morale that Jesse brought to the table.

Expectedly, the stock market began to recover gradually with the confidence of investors being regained. And those that first followed in Jesse’s footsteps evidently won big on their investments as well.

Perfectly living up to his name as the Bear of Wall Street, Jesse had accomplished many feats during this time — besides accumulating enough wealth to elevate his fortune to new heights, he was also referred to as a ‘hero’ in some circles for his efforts to rejuvenate the ailing market.

At the peak of his trading career, Jesse reached a net worth of a whopping $100 million which roughly translates to $1.5 billion in today’s money values.

Why Did Jesse Livermore Fail?

Living at the top of the world and being on his A-Game, Jesse had successfully entered a life of luxury that would allow him to enjoy the finer things in life. Being officially a part of the elite group in the country, Jesse lavished in fortunes such as buying yachts, rail cars, and even an apartment on the exclusive Upper West Side of New York City — he also enjoyed the bachelor’s life having accommodated many mistresses during the peak of his career as well.

But things would not always be so good for Jesse since tough times were just on the horizon.

How Did Jesse Livermore Lose His Fortune?

With the massive success that Jesse experienced as a trader, many people who were inspired by his feats tracked his actions and strategies down to the smallest details in the hopes of acquiring the level of financial freedom that he was able to attain. And one of the most notable habits that Jesse had was his inclination to work solo.

This was a rule that he had always kept to heart for a long time, and obviously, keeping true to this personal mantra that he had established as a guide for his trading activities has served him well given the financial success he enjoyed.

But he ultimately gave in and broke his own rule of following his own advice — a move that has always been taboo among traders. Perhaps blinded by the flashiness of the life of wealth and being surrounded by similarly successful personalities in the market, Jesse opened himself up to financial advice that would eventually bite him back hard.

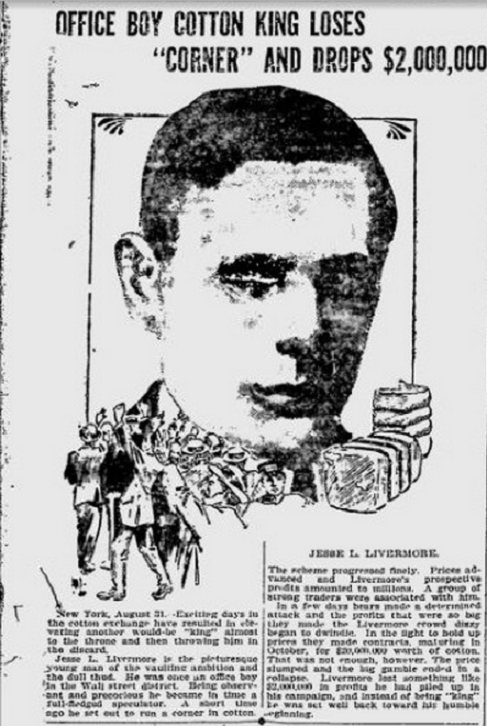

There are several documented events that pinpoint exactly when Jesse had taken bad advice. One of the more known events was when Jesse heeded the advice of a cotton trader to keep on buying cotton in the market — even when it was against his intuition and gut feel.

Unsurprisingly enough, the same cotton trader who convinced Jesse to buy huge on the cotton market was actually colluding with other traders to sell — this move cost Livermore greatly as the cotton market began to move against him.

Jesse lost an astounding 90% of the entire earnings he had saved up during his profitable run during the 1907 crash.

Taking More Bad Advice

Jesse was on a one-way ticket to financial doom. Having been surrounded by self-serving people who wished to get a piece of Jesse’s massive fortune, he had no one to reach out to who would give him sound advice on reestablishing himself in the market and recovering the financial losses he had endured in the cotton industry.

When he was at one of his lowest points, Jesse accumulated an outstanding debt of $1 million which forced him to file for bankruptcy on the year 1915. Without any money to help him get back into trading, Jesse was desperate for any form of assistance.

Eventually, he ended up with a trading facility that amounted to 500 shares when it was under his ownership. Realizing that it was a do-or-die situation, Jesse was intensely focused on making sure that he played his cards right this time around in order to win back the fortunes that he had lost just a while back.

In fact, Jesse was so consumed with paying attention to how the markets moved during this time that he spent almost six weeks just reading the tape in order to make the right trading decisions.

Relying on the trading instincts that had given him the peak moments of his career, Jesse was able to bounce back from his slump and he was able to recover financially enough in order to pay back the debts that had piled up.

By this time, Jesse made the rounds in public newspapers for his feats in the stock market which one could easily compare to that of an epic or a heroic tale of redemption. From being a prodigy in the market who then lost his fortune massively, Jesse had launched a successful comeback in his career that would propel him and his finances to a higher level of respect and admiration.

Reminiscences Of A Stock Operator

One of the biggest reasons why people still remember Jesse’s life today is because of the many Jesse Livermore books detailing his story. But one book, in particular, has stood out from the rest - Reminiscences of a Stock Operator which recorded the events of his trading career and how he was able to cement his legacy as one of the most successful investors that the world has ever seen even in today’s standards in the stock market.

The book has survived to this day and is still in publication. During the period it was first published and up to the current times, the book has experienced many updates such as an annotated edition released in 2009 and a foreword added in by billionaire hedge fund manager Paul Tudor Jones.

Background

In the year 1922, Jesse agreed to participate in a set of interviews conducted by Edwin Lefèvre who was an American writer that was known to many for his write-ups that were related to Wall Street and the activities and personalities that were involved in its day to day operations.

The interviews that Edwin was able to gather from Jesse were eventually turned into a book that would soon be called the iconic Reminiscences of a Stock Operator which has immortalized the persona of Jesse as a legendary trader in the market.

Not only that but the book would also be regarded by many people in the industry as being one of the best trading books to be published of all time. While the interviews were personally conducted with Jesse who went by the alias Lawrence Livingstone (as mentioned earlier in this article), the book perfectly blended the world of fiction and reality to depict his life in a manner that would be easy to understand among readers.

Narrating the ups and downs that had occurred in Jesse’s career, the book is an indirect retelling of his entire life and the experiences he had in the stock market. Because of the fictitious nature of the book, some have speculated as to how much of the book actually happened in Jesse’s life and how much of it was made up in order to gain more publicity.

Jesse Livermore Legacy

With the success of the book, the myth that surrounded Jesse Livermore's feats was becoming even stronger. And the legacy he would leave behind as one of the world’s most renowned traders would continue on to this day.

While he decided to distance himself from Wall Street shortly after Reminiscences of a Stock Operator came out, Jesse still had some fight left in him when it came to his passion for trading.

The Market Crash of 1929

Noticing that the market was beginning to follow a pattern that was very similar to the crash of 1907, Jesse had the desire to relive the glory days of his career and began making big moves in the market by opening short trades that would anticipate the impending crash that was bound to happen.

Obsessed with the movement of the market which foretold that a crash was about to happen, Jesse doubled down on his efforts to open trades. Thanks to his excellent prediction skills, the crash did actually happen and Jesse had successfully skyrocketed his already legendary status into the most profitable point in his career.

It was during this time that Jesse was able to earn his historical $100 million net worth. But other people were not as fortunate as him, having suffered huge losses during this crash. However, Jesse’s winnings during this time quickly withered away into thin air.

How Did Jesse Livermore Pass Away?

While people could only speculate on what actually caused Jesse’s massive earnings to sharply drop once again, many people have believed it due to the many difficulties he had with his private life.

Going through a divorce with his second wife who shot his son (non-fatally), Jesse found another romance with Harriet Metz from Vienna who would then become his third wife. Jesse’s children did not take a liking to Harriet who they believed was shrouded by a “darkness” around her.

During this turbulent period in his life, Jesse had to file for another bankruptcy which at this point was to his third time doing so in his entire life. But with the piling amounts of pressure he had faced from all sides — personal and work-life combined — the heaviness of it all was too much for Jesse to handle.

Jesse had once again brushed rock bottom and he lost the fire he once had as a blazing hero who rescued Wall Street from its doom. He was starting to get comfortable with the money that his wife had earned and his mental health was beginning to deteriorate at the same time.

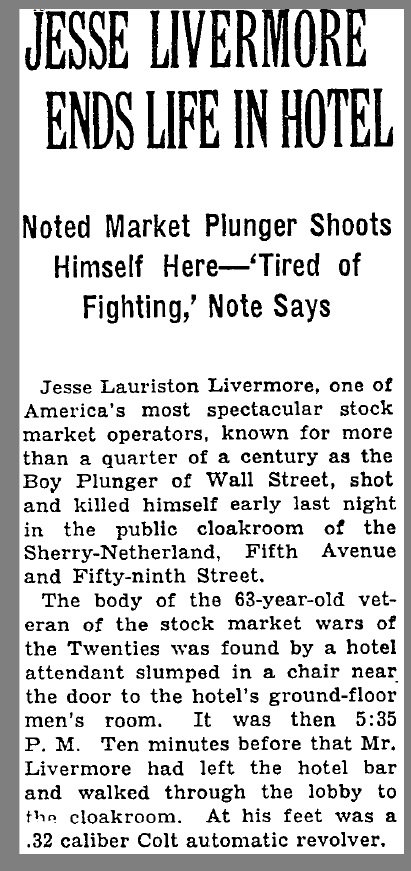

On November 28, 1940, Jesse was found dead in a room of the Sherry Netherland hotel located in New York. His death was ruled as a suicide inflicted by a gunshot wound. And thus, the day marked the end of the life of Wall Street’s most iconic traders and one who would be remembered for the decades that followed.

Jesse Livermore Strategies and Rules

Thanks to the book which followed his life and the reputation he had built over the years — Jesse’s memory lived on Wall Street as a stark reminder of the uncertainty that the stock market always posed even to the most talented of people who dared enter its walls.

Respected as a master investor who possessed techniques and strategies that would still be applicable in the market up to today, Jesse’s movements have been taken note of word for word — inspiring future investors that followed to adapt his strategies and improve on them as needed.

Some of the strategies and techniques that he had been known for in his trading career followed several rules such as, “there was nothing new about speculating or investing in commodities and securities”, “do not trade every day or every year”, and “only invest in a trade when the market acts in a way that confirms your opinion, only then can you enter a trade”.

Furthermore, Jesse also kept even more rules that if he followed, would have certainly protected him and his assets from taking a downward spiral into financial ruin. These other rules include, “end trades when it is clear that the trend you are profiting or gaining money from is already over for good”, “go long when stocks reach a new high and sell short when they reach a new low”, and perhaps the most important rule, “markets are never wrong — opinions often are.”

Afterword

It is clear as day that Jesse Livermore and his success and failure in the stock market is a lesson that all aspiring investors should take into heart. While the ups in his career can be properly emulated in order to incorporate the strategies and rules he once followed, people who are looking to enter the stock market should also be wary of the downfalls he has experienced in order to not repeat the same mistakes he had encountered.

Jesse Livermore’s life is one that remains untarnished even by his untimely end. His rags-to-riches story is one that is marked by virtues of discipline, patience, hard work, and confidence in one’s self.

The success that Jesse Livermore experienced in the stock market is a true-to-life example of how anyone can achieve anything in life. All it takes is a strong belief and confidence in one’s self and a dedication to putting in the work in order to make his or her dreams possible — similar to how Jesse Livermore manifested his own aspirations and goals in life into reality.