Index funds are by far one of the most important financial creations of the 20th century, and Jack Bogle’s legacy is unmatched. His life’s work allowed millions of people to invest in stocks in an almost riskless way. It helped many investors retire early. However, index funds have slowly become one of the most common investment vehicles, and it leads many of us to wonder what are the main disadvantages of index funds.

Are index funds a good investment?

The truth is indexing is probably the best and safest option for most investors out there. It allows them to invest and diversify their portfolios with minimal effort. Today index funds come in many shapes and forms and are one of the most common investment vehicles for investors looking to get exposure to the markets.

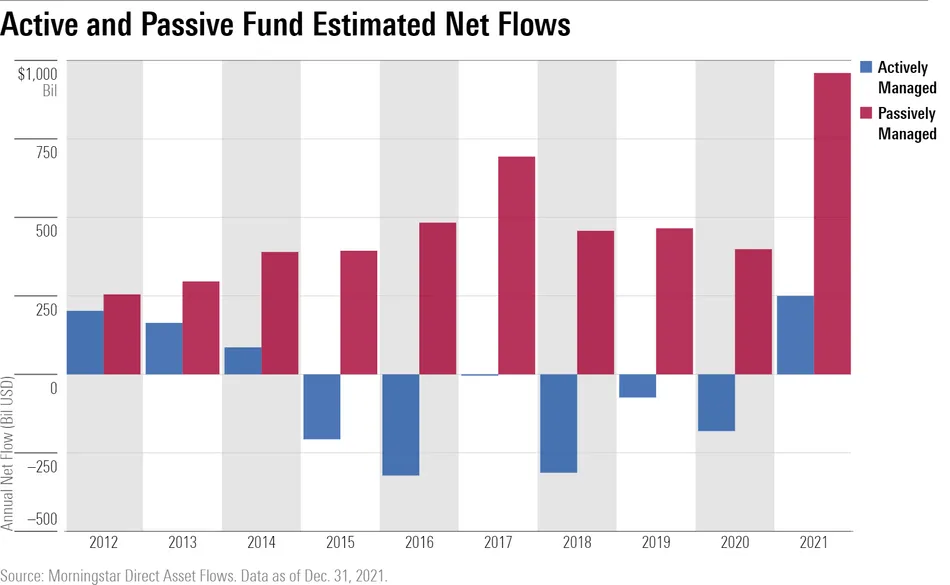

This has been a prevalent theme in financial markets, and the data shows the increased inflow into passively managed funds, while actively managed funds seem to be losing investors’ interest.

Source: Morningstar

Despite the clear advantages, and the popularity of index funds, they have one big disadvantage - inefficiency.

The Restaurant Buffet Analogy: What is the problem with index funds?

Let’s put it this way. You are having a meal, so you go to the supermarket and look for some ingredients, that you can use to make your own meal. You start picking up some of your favorite ingredients, along with some that might be on sale for a reason.

What this shows is that when you are the one choosing all of the ingredients you are picking everything yourself, and you make sure you make the best meal. This is the equivalent of actively managing your portfolio. You research your own stocks and pick the ones you like the most and even some that might be on sale like value stocks.

Index funds would be the equivalent of eating at a buffet restaurant. The kind of package that includes a variety of different meals all packed into one. From rotten food to some high-quality meat, fish, or even vegetables.

But the reality is that a few good bites of something wonderful won’t make up for the rotten pieces that also come in this already prepared meal. If you are a highly demanding food critic, you wouldn't settle for an average meal.

By contrast, value stock pickers are essentially walking through the supermarket aisles looking for quality ingredients at a discount.

https://www.youtube.com/watch?v=huQmAOqxwDc&ab_channel=Billionaire%27sInsightRow

Why investors choose index funds

It is understandable that some retail investors or even sometimes hedge funds, use ETFs and index funds to get a certain specific exposure. As the work and time necessary to research every company individually would take a lot of time.

This in turn is actually the key to outperformance. Analyzing stocks individually might take time, but allows you to find opportunities across countries and sectors, and craft a unique portfolio according to your investment profile.

The disadvantages of index funds

Here are some of the main disadvantages of index funds:

- Fees

- Investing in stocks you wouldn’t invest in

- Passive investing bubble

Fees

Source: Majlaw

One of the advantages of index funds is their low fees and compared with most actively managed funds they are lower. However, if we compare that with the cost of holding a portfolio of stocks over the long term, the fees are still high, and not every index fund charges low fees.

Funds inevitably have expense fees. These expenses are usually supported by investors, who sometimes are charged an upfront fee. Additionally, an ongoing expense fee is added on top and charged yearly so that the fund can pay for expenses.

According to Barron’s. The average index fund expense ratio is around 0.09%. Despite this, there are billions invested in index mutual funds that charge over 1% in yearly fees.

Fidelity was one of the first to offer zero minimum investment and zero expense ratio mutual funds. Although they are not widely used, these funds actually tackle the problem of yearly fees.

Investing in stocks you wouldn’t invest in

Another consequence of index funds is the fact that it is impossible to satisfy all investors. In essence as an investor in index funds, you have to compromise. Meaning that despite not agreeing with some of the fund's holdings, you are still invested in them.

You have no other option but to accept it. Investors in funds, end up owning pieces of businesses they wouldn't normally invest in if they were to pick their own stocks.

Passive investing bubble

Source: Mac.Else

Given the fact that most individual investors use index funds as their primary investment vehicle, the ownership of most companies around the world is now dominated by asset management companies.

Companies like Vanguard and BlackRock, end up having majority stakes in some of the largest publicly traded companies in the world. This wouldn’t be a problem if they weren’t completely passive about what goes on in the company.

Since their ownership represents millions of investors interest’s in those businesses they do not have any influence on how the company is managed. They usually take a passive stand on many of the key issues going on inside the business.

Before the boom of passive investing, active investors would dictate market prices, and passive investors would go along for the ride. Today the scenario has completely changed. Active investors have moved from a major influence to having relatively meaningless impacts across markets.

Michael Burry correctly predicted the housing bubble in 2008. Since 2019 he has repeatedly warned against what he describes as an index fund bubble. In essence, his theory may be right, and it might take a while until it actually unfolds. Perhaps when all the boomers retire, we will start to see the bubble collapsing.

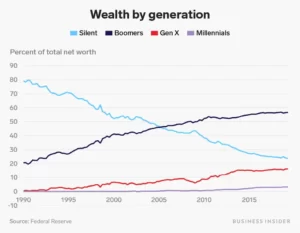

Source: Business Insider

This is because boomers own most of the wealth, roughly over 50% of total US wealth. When all of them retire and convert their investments into cash and more secure investment vehicles like bonds. We could finally see funds pressured to sell securities, as their assets under management shrink.

It is still too early to understand how this passive investing bubble could affect markets and stock prices.

Can index funds make you rich?

While index funds can certainly help you to build wealth, it is unlikely that you are going to become rich just by owning index funds, unless you invest a lot of money. Index funds have a return that mimics the performance of the major indexes, and this is about 10% a year over the long run. v

This is clearly an attractive return, but it might not be enough to make you rich unless you invest a lot of money upfront, and keep adding constantly.

Conclusion

While index funds have been one of the most revolutionary financial creations of the 20th century, having most investors' funds in passively managed funds poses a risk. Capital allocation is essential for an economy to grow, and it is the only way to reward the most capital-efficient companies.

If we are not able to put our own capital into the hands of the most efficient capital allocators, this could have economic consequences.