When it comes to investing, there are a lot of different options to choose from. One of the most common choices is between stocks, mutual funds, and bonds. But which one should you invest in? What are the differences between bonds vs mutual funds vs stocks?

Each option has its own set of advantages and disadvantages, so it can be difficult to decide which is the best for you. In this blog post, we will take a look at each of these investment options and discuss the pros and cons of each one.

Advantages

First, let's explore the advantages. By evaluating which one has a stronger advantage, you can select the best method for you.

Advantages of Bonds

Bonds offer stability, and predictability and they remain one of the safest places for your money.

When you invest in a bond, you are lending money to a government, municipality, corporation, or other entity. In return, that organization promises to pay you back the principal plus interest.

The price of bonds fluctuates less than stocks, making them a good investment if you are risk-averse. This is because the payments on bonds are fixed, so you know exactly how much income you will receive.

Bonds are also a good diversification tool because they tend to move in the opposite direction of stocks. This means that when stock prices go down, bond prices usually go up.

If you are risk-averse, bonds might be for you, because the risk level is much lower.

Advantages of Mutual Funds

The main advantage of mutual funds is that they provide diversification. By investing in a mutual fund, you are investing in a basket of securities, which helps to spread out your risk.

Another advantage of mutual funds is that they are managed by professionals, which can save you time and effort. If you are not interested in researching and managing your own investments, mutual funds might be a good option for you.

Mutual funds can be found at most banks. The added support of speaking to a professional can be helpful if you are new to investing. Lastly, mutual funds are liquid investments, which means you can cash out your investment at any time. This is unlike some other investments, such as real estate, which can take longer to sell.

They are also less volatile than most other asset classes, making them an attractive investment if your risk tolerance is lower.

Advantages of Stocks

When you buy a stock, you become a partial owner of the company whose stock you purchased. This equity ownership grants you certain rights, including the right to vote on corporate matters and the right to attend shareholder meetings.

As the company grows and becomes more profitable, the value of your shares increases. This increase is called capital gain. They can also be a source of passive income if the company pays dividends.

Dividends are a portion of the company’s profits that are distributed to shareholders. The biggest advantage of stocks is that they have the potential to generate high returns.

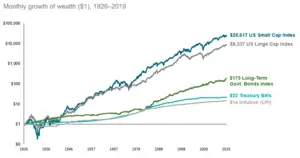

Over the long term, stocks have outperformed the other asset classes mentioned in this article.

Source: Darrow WM

Another advantage of stocks is that they are relatively easy to buy and sell. You can do this through a brokerage account. There are also plenty of simple-to-use apps that you can download on your phone.

This offers convenience and independence. The benefit of this is that you can place trades without having to speak to a human broker.

A final advantage of stocks is that they offer liquidity, which means you can convert your shares into cash relatively easily and quickly. Although there are some stocks that are illiquid, most stocks have plenty of trading volume every day.

This liquidity can be helpful if you change your mind about an investment. It can also be beneficial in the case of an emergency.

Disadvantages

Of course, there are some negatives when it comes to each investment vehicle as well. It’s important to be aware of the disadvantages before you make your final decision.

Disadvantages of Bonds

The main disadvantage of bonds is that they are subject to interest rate risk. This means that if interest rates go up, bond prices will go down. This is because when rates go up, new bonds are issued at a higher rate, making older bonds less attractive.

The governance risk is also a major drawback. This is the chance that the issuer of the bond will not be able to make the interest or principal payments. It may seem unlikely that this will happen, but it’s important to remember that it is a risk.

Lastly, bonds are also subject to inflation risk. This is the chance that the purchasing power of the bonds will go down over time. The reason for this is that as inflation goes up, the interest payments on bonds do not keep up with the rising cost of living.

Disadvantages of Mutual Funds

One disadvantage of mutual funds is that they have fees. These fees are called management expense ratios (MERs). They can range from 0.25% to over three percent. This may not seem like a lot, but it can add up over time.

Another disadvantage of mutual funds is that they are subject to market risk. The value of the fund can go up or down in value. This is because the fund is made up of several different securities, and the value of those securities can change.

Lastly, mutual funds are also invested in a diverse range of companies. This may seem like a benefit, but for socially conscious investors, it can be a negative. This is because you may not want to fund firms that are involved in certain industries.

Disadvantages of Stocks

The main disadvantages of stocks are market risk and liquidity risk. Market risk is the chance that the value of the stock will go down. This is because the stock market can be volatile, and the value of stocks can change quickly.

Liquidity risk is another disadvantage of stocks. This is the chance that you will not be able to sell your stock when you want to. This can happen if there are not enough buyers in the market.

Another disadvantage of stocks is that they are subject to dividend risk. There is a chance that the company will not pay a dividend, or that the dividend will be less than what you expect. Lastly, stocks are also subject to internal risks.

These are risks that are specific to the company, such as poor management or a decline in demand for the company's products. A company that seems like a great investment now may be obsolete in a few years.

When you invest in stocks, you are taking on these risks. However, you can also make a lot of money. Let's explore how stocks compare to bonds.

Bonds vs Stocks: Which is better?

The biggest disadvantage of bonds is that they are not as profitable as stocks. Over the long term, stocks have outperformed bonds by a wide margin. If you are searching for the best returns, stocks are better.

Liquidity

Bonds are also not as liquid as stocks. This means that it can take longer to sell your bonds and you may not be able to get the full value of your investment. This can be a problem if you need to sell your bonds quickly.

Returns

Production of products or services creates wealth. With bonds, you are lending money to a company or government and they will use that money to produce goods or services. The risk is that they may not be able to repay the loan. The same intention can be said for investing in companies.

The difference is that you receive equity ownership in the company, which can lead to a higher return on investment. You will also become empowered to vote on the companies' direction and have a say in other important decisions.

Even if you do not care to vote, participating in these meetings can increase your financial intelligence. With bonds, you have no say in how the company or government is run and you will not receive any additional income if the company does well.

This means you are depending on the abilities of the entity to repay the loan. You will not receive much else. Inflation is another big risk with bonds. When inflation goes up, the price of goods and services goes up as well.

This helps create value in companies because they can raise prices without losing customers. With bonds, you will receive a fixed interest payment that does not adjust for inflation. This means that the purchasing power of your investment will go down over time.

To summarize, stocks are better than bonds for various reasons. Bonds have been promoted as a safe investment, but they are not as safe as you may think. When you compare bonds to stocks, it is clear that stocks are the better investment.

Bonds vs Mutual funds: Which is better?

Now that we know that bonds aren't as good as stocks, let's see if they can at least be better than mutual funds. Generally, mutual funds beat bonds as well. This is because mutual funds are more diversified, which means that they are less risky. With bonds, you are investing in just one company or government.

This means that your investment is more likely to go down if there is a problem with the company or government. With mutual funds, you are investing in many different companies. This diversification helps to protect your investment. Another advantage of mutual funds is that they are not as affected by inflation.

This is because most mutual funds are invested in stocks, which go up when inflation goes up. Lastly, mutual funds offer more flexibility than bonds. With bond investing, you are stuck with the investment until it matures.

With mutual funds, you can sell your shares at any time. This can cause missed opportunities and loss of liquid cash. So, if you are looking for a safer and more flexible investment, mutual funds are the way to go.

Bonds may offer an income, but most of the time they do not keep up with inflation. And, if you are looking for more diversification, mutual funds are the winner once again.

Stocks vs Mutual Funds: Which is better?

We have identified bonds to be the worst out of the three investment options. By now you must be wondering which one is the best then?

The answer to this question is not as simple as it seems. On one hand, stocks offer the highest potential return on investment. If you choose the right stocks, you could make a lot of money.

On the other hand, mutual funds are more diversified and offer more flexibility. Stocks also require more research because you need to choose the right companies to invest in. With mutual funds, you can just pick a fund and let the professionals research for you. So, which one should you choose?

It depends on your goals and how much time you are willing to spend researching. If you are willing to do the research, stocks are the better investment.

But, if you want more hands-off and prefer to focus on other aspects of life, mutual funds are the way to go. In conclusion, there is no right or wrong answer when it comes to choosing between stocks and mutual funds. It all depends on your goals and preferences.

Conclusion

There are three schools of thought when it comes to deciding which one is better. One is to diversify and invest in all. The other is to focus on finding the best individual investment. The third would be to depend and trust that you will receive your end of the deal with no control. Each option has its own benefits.

However, we have discussed the pros and cons of each investment and have concluded that stocks are the better investment. There are many reasons, but the main one is that they offer the highest potential return on investment.

Of course, stocks are more volatile and risky. But, if you are willing to do the research and choose the right companies to invest in, the rewards can be great. The risk can also be lowered by investing intelligently.

In some scenarios, bonds are guaranteed to be a losing investment due to inflation. The next time someone tries to tell you that bonds are the safest investment, you can share this article with them.