Whenever you look online for crypto advice, you’ll have people babbling on and on about their personal biases and then swiftly disregard their own points with the expression DYOR crypto. While doing your own research (DYOR) is extremely crucial when investing money, heading into the unknown yourself could be the very thing that gets you in trouble. Here’s how to approach it.

Why even do your own research?

There are many reasons as to why and why not do it. One can make the argument that you should always listen to more experienced people but at the end of the day, you’re the only person responsible for your own investment decisions. Keeping an open mind is always a good thing when dealing with crypto but there’s a fine line that is hard to separate.

Research is extremely important when it comes to anything blockchain-related. If you were to come short of an investment or in the worst case, fall for a scam like a rug pull, you are the only person you can hold accountable. Because at the end of the day you’re the one who made the final decision, and you are responsible for DYOR crypto. Not doing your own crypto research can lead you to be an NGMI.

Step 1: Initial analysis

Throughout your crypto journey, you’ll encounter countless potential investments that look extremely promising at least on paper. No matter how exciting, this is the time to put biases aside and look at the project objectively.

One of the first things you should do is to critically evaluate their information based on their public website. Not only to understand the project further but also what the organizers want general users to see and their approach and what the organizers want general users to see.

The crypto sphere is rampant with scams that try to lure in the unassuming public. They often use buzzwords that sound cool but you really know they mean nothing concrete.

Terms like “Web 4.0” or “revolutionary blockchain technology!” are nonsensical jargon that is targeted at newcomers. Thus, you need to be aware of such a suspicious approach. Instead of jargon, their website should feature the team’s background, the roadmap, and their history.

Then search them up on social media or even LinkedIn and confirm if their vision matches. Any discrepancy is a red flag and a genuine company would not have those.

Read through the business development plan and make sure you completely understand its crypto functions and how it plans to create value. Use the blockchain explorer to understand their distribution and how legitimate they are.

Step 2: Build your investment checklist

The project you’re looking into always needs to tick all the boxes on your specific investment checklist. Simply having a list of convenient and relevant questions already set up will make all the difference. You need to know what you’re looking for, what your standards are, and your limits. Imagine the dev team sitting right in front of you, what would you ask them?

- To what purpose is the coin designed? What problem or inefficiency is the coin seeking to resolve?

- Who consists of the developer team? How are they funded and have they done in past projects?

- How large is their target market and who are their competitors?

- Are there any current products?

- From where does the token/coin derive its value? Does it have a staking mechanism or is it transactional?

- What are the general problems and weaknesses of this cryptocurrency?

Ask yourself these kinds of questions and look for an answer. Of course, these are general ideas that should be answered easily. And if you can’t find the answer or you’re generally dissatisfied, the project is either not transparent with the community or just not the investment for you.

Step 3: Create a simple DYOR crypto evaluation model

When evaluating a project you have to keep in mind that you’ll most likely have numerous other coins you’re interested in. Unless you have infinite money, the ‘hierarchy’ in your own watchlist will play a part in the likelihood of investing. For this, you’ll need an evaluation model for the projects that do pass the initial two steps.

You can use any metric that suits you really. For example, you can apply Metcalfe's Law to compare cryptocurrencies based on their market cap and number of active users or traffic.

Alternatively, if it will be used just as a currency, check the circulating supply and the amounts that are in cold storage or about to be released/burned. Since most cryptos are deflationary, consider how the float schedule will change over time and how this will influence the price.

Diversification of your crypto portfolio

Anyone getting into crypto needs to seriously consider their portfolio and its diversification. This is an age-old practice in investing and translates well to crypto. Create at least two categories for your investments. These separate categories are quote-unquote ‘safe’ and ‘speculative’. For most investors, it is better to keep the larger of their portion in these so-called ‘safe’ coins such as Bitcoin or Ethereum. A general rule of thumb is anywhere from 50-80%.

The rest of your money can be used to speculate on the near future. Diversifying your investment is a great risk measure that could potentially help you with unexpected market volatility and prevent huge losses.

Match your circle of competence with DYOR crypto

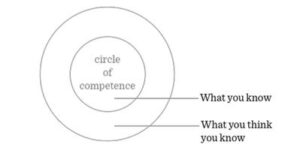

What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. - Warren Buffet

Everybody has strengths and weaknesses, interests and disinterests. In crypto investing simply, no one can accurately assess every category and type of coin. You need to understand where you stand and match your research intensity to your circle of competence. As an example, without knowing anything about how supply chains work, is it possible for you to assess whether VeChain will achieve adoption?

In this case, even if you’re unsure, you need to DYOR crypto until you become an expert. Only then it is a sensible idea to invest in that project. However, if you still can’t grasp it, you should stick to whatever your circle of competence is. In order to improve your DYOR crypto, you can start by reading crypto books to help you understand better how blockchain can be used in different applications.