Diversification plays a key part in the complex dance of wealth management, directing investors away from potential traps and toward a balanced growth trajectory. While many methods emphasize capital growth, 'investing for income' is becoming increasingly popular, reflecting the desire of many to tap into reliable and diverse revenue sources.

In addition to examining how to disperse your investments across different assets, we'll highlight the importance of investing for income as we delve into these seven crucial ideas.

This guarantees capital development and a regular stream of returns, laying the groundwork for a secure financial future. Diversifying with an eye on income can completely change your financial journey, regardless of your experience level.

Assess Your Risk Tolerance

Assessing your risk tolerance is crucial in determining the level of investment risk you are comfortable with, as it allows you to make informed decisions when diversifying your portfolio. Risk tolerance refers to an individual's willingness and ability to take on financial risk. It is influenced by financial goals, time horizon, and personal circumstances.

To assess risk appetite, investors can consider various factors, including their financial stability, investment knowledge, and previous experiences with risk. Risk tolerance assessment tools, such as questionnaires, can also gauge an individual's risk tolerance level.

Understand Different Asset Classes

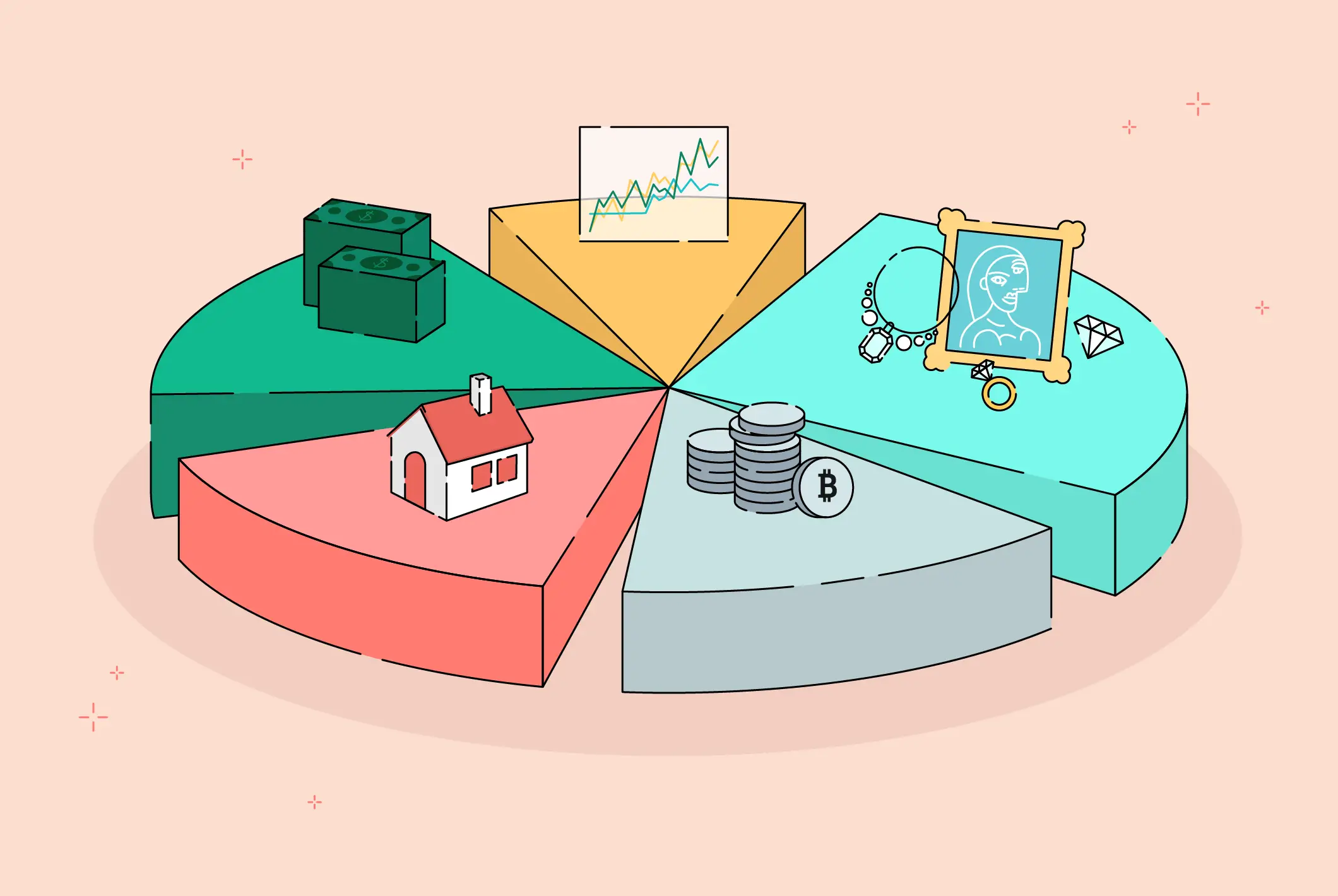

Investors should thoroughly research and consider the benefits and risks of different asset classes before making investment decisions. Diversifying investments across various asset classes can mitigate risks and increase returns. Here are three key asset classes to consider:

- Stocks: Investing in stocks offers ownership in a company and the potential for capital appreciation. However, stock values can be volatile and subject to market fluctuations.

- Bonds: Bonds are debt securities issued by corporations or governments. They provide fixed interest payments and return of principal at maturity. Bonds are less risky than stocks but offer lower potential returns.

- Real Estate: Investing in real estate involves purchasing properties or real estate investment trusts (REITs). Real estate can provide regular income through rental payments and potential appreciation.

Allocate Your Investments Strategically

When it comes to investing, strategic allocation of your investments is crucial. Properly allocating your investments across different asset classes can help mitigate risk and potentially enhance returns.

Asset Allocation Importance

With proper asset allocation, individuals can effectively balance their investments and optimize their portfolio's performance. Asset allocation strategies are crucial in achieving financial goals and managing risk.

To understand the importance of diversification, consider the following sub-lists:

Risk Management:

- Allocating investments across different asset classes helps mitigate the impact of market volatility.

- Diversification reduces the risk of significant losses by spreading investments across various sectors or industries.

- Combining assets with low correlation can reduce the overall risk of the portfolio.

Return Maximization:

- Asset allocation allows for potential higher returns by investing in a mix of assets with different growth rates.

- By diversifying across various asset classes, individuals can capture the benefits of different market cycles.

- Balancing risk and return through asset allocation can optimize portfolio performance.

Long-term Investing:

- Asset allocation strategies focus on long-term goals, helping individuals stay disciplined and avoid making impulsive investment decisions.

- Diversification ensures that the portfolio is not overly exposed to any single asset class, reducing the impact of market downturns.

- Regularly reviewing and rebalancing the portfolio maintains the desired asset allocation over time.

Diversify Risk Exposure

Diversification is a technique that involves spreading investments across various asset classes such as stocks, bonds, real estate, and commodities. This helps to reduce the impact of any single investment on the overall portfolio.

By diversifying, investors can minimize the risk of losing a significant portion of their investment if one asset class underperforms. It is important to note that diversification does not guarantee profits or protect against all losses, but it can help to mitigate risk.

Long-Term Investment Benefits

One of the key benefits of long-term investment is the potential for significant returns over time. By committing to a long-term investment strategy, investors can ride out short-term market fluctuations and capitalize on the power of compounding.

Here are some important considerations for risk management and investment planning in the context of long-term investing:

- Diversification: Spreading investments across different asset classes, industries, and regions can help mitigate risk and enhance potential returns.

- Asset allocation: Determining the optimal mix of stocks, bonds, and other asset classes based on individual risk tolerance and investment goals is crucial for long-term success.

- Regular review: Periodically reassessing investment portfolios and adjusting the allocation as needed helps ensure alignment with changing market conditions and personal circumstances.

Consider Geographic Diversification

Geographic diversification should be carefully considered when constructing an investment portfolio in order to mitigate risks associated with specific regions or countries. By allocating investments across different geographic locations, investors can potentially benefit from reduced exposure to the risks inherent in any single country or region.

Diversification allows investors to take advantage of global investment opportunities and spread their risk across a broader range of economies and markets. This strategy can help safeguard against localized economic downturns, political instability, or regulatory changes that could negatively impact a specific region or country.

Invest in a Mix of Industries

Investing in a mix of industries can provide numerous benefits.

Sector diversification helps reduce investment risk by spreading out exposure across different sectors, reducing the impact of any sector's performance on the overall portfolio.

Additionally, investing in a mix of industries provides the opportunity for growth as different sectors may perform well at different times, allowing investors to capitalize on those trends.

Sector Diversification Benefits

Investors can reap the sector diversification benefits by allocating their funds strategically across various industries. Diversification helps reduce risk by spreading investments across different sectors, thereby minimizing the impact of any single industry's performance on the overall portfolio.

Here are three sub-topics to consider when discussing sector diversification benefits:

- Market Timing: Diversifying investments across sectors mitigates the risks associated with market timing. Predicting which sector will outperform or underperform in any given period is challenging. Investing in various sectors can benefit from overall market growth, regardless of the timing.

- Investment Performance: Sector diversification allows investors to participate in the growth potential of different industries. While some sectors may experience temporary setbacks, others may flourish. By diversifying, investors can capture positive investment performance across sectors, helping to balance out any underperforming investments.

- Risk Management: Diversifying across sectors helps manage risk by ensuring that a single industry's poor performance does not significantly impact the overall portfolio. This approach helps protect against industry-specific risks, such as regulatory changes, technological disruptions, or economic downturns.

Reduce Investment Risk

To mitigate investment risk, it is essential to diversify one's portfolio by allocating funds across a diverse range of industries. Investment diversification strategies play a crucial role in risk management techniques. By spreading investments across different industries, investors can reduce the impact of potential losses from a single sector.

Opportunity for Growth

By exploring a wide range of industries and identifying high-potential sectors, individuals can uncover numerous opportunities for growth within their investment portfolios. Diversifying investments across various industries can mitigate risk and exploit growth potential.

Some of the key sectors that offer opportunities for diversification and growth potential include:

- Technology: Investing in technology companies can provide exposure to innovative and disruptive technologies that have the potential to drive significant growth.

- Healthcare: The healthcare industry is constantly evolving, with advancements in medical research and technology creating opportunities for investment in pharmaceuticals, biotechnology, and healthcare services.

- Renewable Energy: With the increasing focus on sustainability, investing in renewable energy companies can offer long-term growth potential as the world transitions to cleaner sources of energy.

Don't Forget About Alternative Investments

What are the potential benefits of considering alternative investments in order to diversify one's investment portfolio?

Diversifying one's investment portfolio is a key strategy to manage risk and potentially enhance returns. While traditional investments such as stocks and bonds are commonly used, alternative investment strategies offer unique advantages.

Alternative investments, such as real estate, commodities, private equity, and hedge funds, have the potential to provide uncorrelated returns, which means they may perform differently than traditional investments during market fluctuations. This can reduce the overall volatility of a portfolio.

Regularly Review and Rebalance Your Portfolio

Regularly reviewing and rebalancing your portfolio is crucial for maintaining an optimal asset allocation and ensuring alignment with your investment goals. By regularly reviewing your portfolio, you can assess its performance and make necessary adjustments to keep it on track.

Here are some key tips to consider:

- Review frequency: It is recommended to review your portfolio at least once a year. However, it may be beneficial to review it more frequently, especially during periods of market volatility or significant life events.

- Portfolio performance: Analyze how your portfolio performs compared to your investment goals. Assess whether certain investments are underperforming or if any sectors are overexposed. This evaluation will help you make informed decisions about rebalancing.

- A rebalancing strategy involves selling overperforming assets and investing in underperforming ones to maintain your desired asset allocation. Develop a rebalancing strategy that aligns with your risk tolerance and long-term goals.

Conclusion

Diversifying investments is a crucial strategy for managing risk and maximizing returns. Individuals can mitigate potential losses and achieve long-term financial goals by assessing risk tolerance, understanding different asset classes, and strategically allocating investments.

In addition, considering geographic diversification, investing in a mix of industries, and exploring alternative investments further enhance portfolio diversity. Regularly reviewing and rebalancing the portfolio ensures it remains aligned with financial objectives.

Interesting statistic: Studies have shown that a well-diversified portfolio can reduce the risk of loss by up to 80%.