What is the Indonesian Stock Market Called?

The Indonesian stock market is commonly known as the Indonesian Stock Exchange or IDX. Similar to other stock exchanges, you can buy and sell securities on the IDX. There are currently over 778 companies listed on the IDX and traded every day, 40 indices, 47 ETF products traded, and 108 registered brokers.

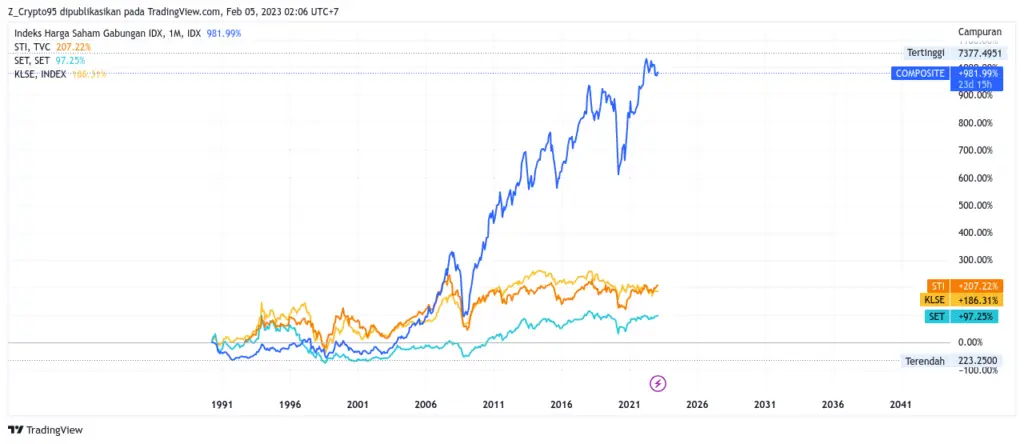

The Indonesian stock exchange has a long history, which is linked to the history of Indonesia's independence. The exchange was temporarily suspended during World War II but has now become one of the best-performing stock exchanges in Southeast Asia and is ranked fifth in the world.

How to invest in the Indonesian stock market

Indonesia is a relatively open country for investors from all over the world. As a result, to invest in the Indonesian stock market, local and foreign citizens only need to follow four important steps.

1. Opening a Trading Account with a Registered Broker

There are many registered brokers in Indonesia. You can do your research on the requirements and benefits of registering with a particular broker. But, it is important to choose a broker with a good track record. You can measure the quality of their customer service and the reliability of their online trading platform. Each broker has its own strengths, and it is up to you to find the one that best suits your needs. Make sure to prepare the necessary documents, especially your passport.

2. Understanding How Securities Transactions Work

Each broker generally has a slightly different online trading system, so you need to understand the facilities available with that broker after opening a securities account with a broker. At the very least, you should understand 4 important things such as how to buy, sell, cancel transactions, and how to withdraw or deposit.

3. Making an Initial Deposit

Once you understand how to make transactions, the next step is to deposit funds to buy your first stock on the Indonesian stock exchange. Each broker has different rules regarding this, and some brokers only require an initial deposit of IDR 100,000 or USD 6.62 based on the current exchange rate.

4. Making Your First Transaction

After successfully completing steps 1 to 3, the last thing you need to do is to start your first transaction by buying stocks or ETFs listed on the Indonesian Stock Exchange. Make sure always to keep updated on the regulations from the stock exchange, as it is important always to know if there are new regulations for foreign investors to invest in the Indonesian stock market.

Indonesian ETFs

In Indonesia, there are 40 officially registered ETFs, including:

- Mutual Fund Index Capital ETF IDX ESG Leaders

- FWD Asset IDX ESG Leaders Index Mutual Fund ETF

- BNP Paribas Index Mutual Fund IDX Growth30 ETF

- Premier ETF Index Mutual Fund FTSE Indonesia ESG

- RDI Danareksa ETF MSCI Indonesia ESG Screened

- MSCI Indonesia Index KISI Mutual Fund ETF

You can check on the official website of the Indonesian stock exchange by clicking here.

And did you know there are ETFs listed outside the Indonesian stock exchange, but their contents are still Indonesian companies? What ETF is it?

1. iShares MSCI Indonesia ETF (EIDO)

The most popular Indonesian ETF among global investors as an indicator of Indonesia's capital market performance is the iShares MSCI Indonesia ETF (EIDO). Since its launch on May 5, 2010, EIDO has been managed by Blackrock, the largest ETF provider in the world, and is listed on the NYSE Arca (United States). As of 2023, EIDO has a management fund of US$329 million. The ETF uses the MSCI Indonesia IMI 25/50 Index as its performance benchmark, with the top 5 holdings being BBCA, BBRI, TLKM, BMRI, and ASII out of a total of 75 stocks.

2. VanEck Vector Indonesia Index ETF (IDX)

The VanEck Vector Indonesia Index ETF (IDX) has been managed by investment manager VanEck since its launch on January 15, 2009, and is listed on the NYSE Arca (United States) with a management fund of US$33 million. IDX uses the MVIS Indonesia Index as its benchmark, with its top 5 holdings being BBCA, BBRI, TLKM, BMRI, and ASII out of a total of 41 stocks.

3. Lyxor MSCI Indonesia UCITS ETF (LYXI/INDO)

Lyxor MSCI Indonesia UCITS ETF (LYXI/INDO) has been managed by investment manager Lyxor since its launch on July 4, 2011, and is listed on Euronext (France), Borsa Italiana (Italy), and the Frankfurt Stock Exchange (Germany) with a management fund of EUR26 million. LYXI uses the MSCI Net Total Return Index as its benchmark, with its top 5 holdings being BBCA, BBRI, TLKM, BMRI, and ASII out of a total of 22 stocks.

4. HSBC MSCI Indonesia UCITS ETF (HIDR)

The HSBC MSCI Indonesia UCITS ETF (HIDR) has been managed by HSBC Investment Funds since its launch on March 30, 2011, and is listed on the London Stock Exchange (UK), Borsa Italiana (Italy), Frankfurt Stock Exchange (Germany), and SIX Swiss Exchange (Switzerland) with a management fund of US$41 million. HIDR uses the MSCI Indonesia Net USD Index as its benchmark, with its top 5 holdings being BBCA, BBRI, TLKM, BMRI, and ASII out of 22 stocks.

5. MSCI Indonesia Swap UCITS ETF (XMIN/XMID)

Unlike other ETFs that use full index replication methods, the MSCI Indonesia Swap UCITS ETF (XMIN/XMID) is a synthetic ETF that uses a swap mechanism to measure its performance.

XMIN is managed by investment manager DWS Investment Management and has been listed on the London Stock Exchange (UK), Borsa Italiana (Italy), Frankfurt Stock Exchange (Germany), and Singapore Exchange (Singapore) since its launch, with a management fund of US$89 million. XMIN uses the MSCI Indonesia Net USD Index as its benchmark, with its top 5 holdings being BBCA, BBRI, TLKM, BMRI, and ASII out of a total of 22 stocks.

Is investing in Indonesia a good idea?

Yes, investing in Indonesia is a good idea for several reasons.

1. Indonesia is a developing country with growing economic potential, which is expected to become the fourth largest economy in the world, according to the World Economic Forum. This indicates a promising future for the Indonesian stock market.

2. Stocks in Indonesia are relatively cheap, with many shares priced below USD 1 per share. This allows for more accessible investment opportunities.

3. Additionally, Indonesian companies have solid corporate fundamentals, including strong financial reports and business models.

4. Furthermore, Indonesia's stock market index has outperformed other Asian markets, and its share growth is ahead of neighboring countries such as Singapore, Malaysia, and Thailand, indicating a rapidly growing economy.

Compared to share growth in Singapore, Malaysia, and Thailand, Indonesia is very far ahead. It reflects the Indonesian economy, which continues to grow drastically yearly. Even today, Indonesia is one of the countries that are not in danger of recession; this has been stated by the IMF and the World Economic Forum.