Investing in instruments with high volatility levels, such as stocks, forex, and commodities, comes with risks and difficulties. Some traders suffer losses due to market volatility, and some have managed to survive and mitigate these risks with the various tools they have. One of the tools that are very popular in dealing with market volatility is Stop-loss. So, what is it, and how do you use a good stop loss in each of your trades? This article will discuss everything in detail.

What is Stop-Loss?

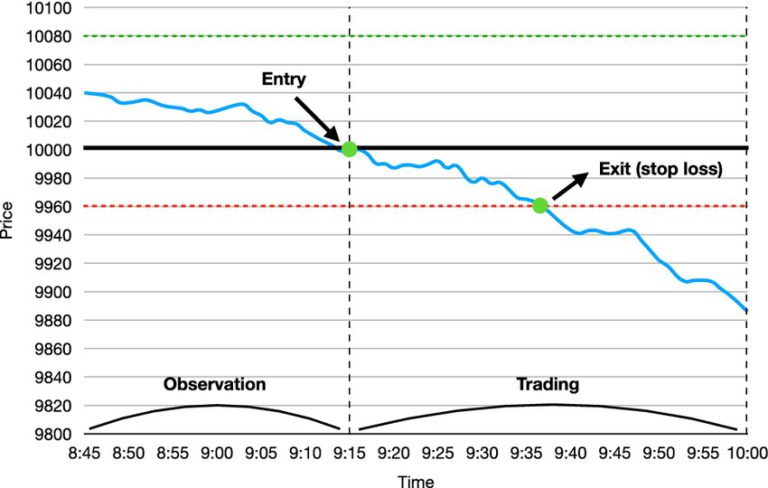

A stop-loss order is an order made by a broker to buy or sell an investment instrument (both in the form of crypto assets and stocks) when the price has reached a certain limit. These orders are designed to limit a trader's losses.

For example, a trader purchases Amazon stock and sets a stop-loss order 15% below his purchase price. So, when the value of Amazon shares falls, the order will be active, and his shares will be automatically sold as a market order.

How to Set A good Stop loss?

After knowing the meaning and use of it, you must know how to apply a good stop loss. Keep in mind that you can avoid placing a stop loss with your current purchase price because if you do, you can get caught up in market fluctuations.

There are several ways to determine a good stop loss:

Trailing Stop-Loss

Also known as a protect stop, a trailing stop loss moves in the direction of the trend. When the price reverses from the trend, the trailing will not move. The result of this technique is the highest profit, not from the entry price.

You can use this method even though you didn't make a profit before. This method is quite effective in trending markets because the movement will be in line with market prices and will automatically stop when the trend changes direction.

Using Risk Management

Risk management is a way that can help traders to trade with discipline. When you trade diligently, the possibility of making a profit will certainly be even greater.

Some of the risk management steps you can take include:

- Do not use all available funds. Use only a small portion first for each trading position, no matter how much money you have. Don't Stay out of one particular instrument. Always remember only to risk 2-3% of the funds you have for one open trading position.

- Take into account the beliefs and opportunities that you have.

Whatever asset you buy or sell, the risk will still be there. However, a stop loss can be powerful enough to prevent losses.

What Happens if The Market Opens Below my Stop-Loss?

When the value of an asset falls below a certain predetermined level (the stop loss), a sell-stop order is automatically activated. This causes a market order to sell the asset to be executed at the next available price, effectively closing out the trader's position in the asset.

Do Stop Losses Work After Hours?

Stop-loss orders are typically only executed during the regular trading sessions, which run between 9:30 am to 4:00 pm Eastern Time (ET). These orders do not take effect during pre-market or after-hours sessions.

Additionally, stop-loss orders do not execute on weekends or market holidays when the stock or the instrument is not trading. At the end of the trading day, any stop-loss order is placed outside of regular trading hours; it will be carried forward to the next trading session. There is also a stop-loss order called a GTC order, which remains active for a maximum of 60 days and will carry forward to future market sessions until it is either triggered or canceled by the trader himself.

So far, no stockbrokers have allowed triggering stop losses during pre-market or after-hours sessions. This is not because of broker regulations or the like but because that's how the market works.