The stock market has always been unpredictable. Depending on the economic status of a country backed up by the wisdom and effectiveness of the strategies placed by lawmakers in order to sustain it, the financial markets can either work in the favor of a nation or against it. In some cases, the panic caused by the biggest stock market crashes ever led many investors to lose money.

Throughout the years, the volatility of the financial market has been on full display as history has been a witness to several stock market crashes that can only be described as being the most disastrous and chaotic times in a country’s economy as well as the global economy.

However, the final nail in the coffin in most crashes is the inevitable investor panic that would follow the dramatic price drops. As more people pull their money out of their investments, the entire market drops significantly as well.

This irregularity has many consequences such as an increase in poverty rates and an overall economic crisis that may be felt for decades if left unchecked and unsolved. Here are some of history’s biggest stock market crashes.

20. Subprime Mortgage Crisis

The 2008 Subprime Mortgage Crisis was a result of the unregulated lending policies that banks had put up for mortgages in the United States.

As the debts kept on piling up, the succeeding home foreclosures also accelerated the economic decline experienced in employment rates.

The combination of negative economic impacts had resulted in the S&P 500 dropping by over 57% and the nation recovering for as long as 17 months after.

19. Dotcom Bubble

The Dotcom Bubble is one of the biggest economic bubbles to ever happen in the United States.

After tech companies had been overvalued despite lacking any actual earnings to match said high values attached to their organizations during the latter part of the 1990s, a bubble had formed in some of the major tech businesses in the United States which finally led to a crash in 2000.

The Nasdaq dropped by 77% and economic recovery was estimated to be around 15 years.

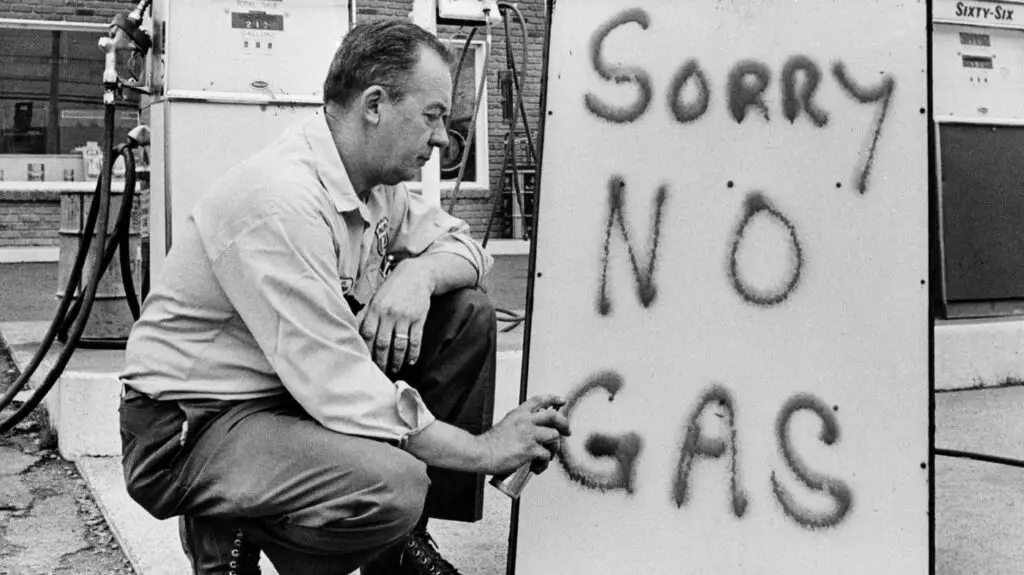

18. Oil Crisis and Recession of 1973

The 1973 Oil Crisis and Economic Recession started after a series of economic events had clumped up together to initiate a crash that would be remembered as one of the biggest to occur in the American market.

Such events that contributed to the crash include the detachment of gold from the dollar and a skyrocket in oil prices which all worked together to speed up inflation in the country.

The result was a market crash at an estimated 48% and a full recovery that took place only after 21 months.

17. COVID-19 Crash

One of the more recent economic crashes is the COVID-19 pandemic economic crisis which has seen many businesses forced to close down their doors in compliance with health and safety protocols placed to curb the spread of the coronavirus.

While the crash lasted for only 33 days, the sudden drop in stock prices still came as a relative surprise for investors with the market dropping by over 34%.

The American government had acted fast in preventing the crash from persisting by increasing cash circulation in the country.

16. Black Monday Crash

The Black Monday Crash occurred on October 19, 1987, and was felt in many countries all over the world. The United States in particular had experienced one of its biggest percentage drops during this day.

Several factors have been pointed out to have caused the crash such as a persisting bull market, unrefined computer programs (which were new at the time), and portfolio insurance systems that accelerated the price drops.

The Dow Jones Industrial Average had dropped by 22% and the S&P 500 had fallen by 20.4%.

15. Crash of 1937

The Crash of 1937 was an economic recession period that occurred during the Great Depression era in the United States.

While the nation had slowly recovered from the initial impact of the depression, a rapid decline occurred once again in 1937 which led to unemployment rates jumping from 14% to 19% and manufacturing output falling by 37%.

The source of the crash was primarily pointed toward poor money circulation policies executed by the government.

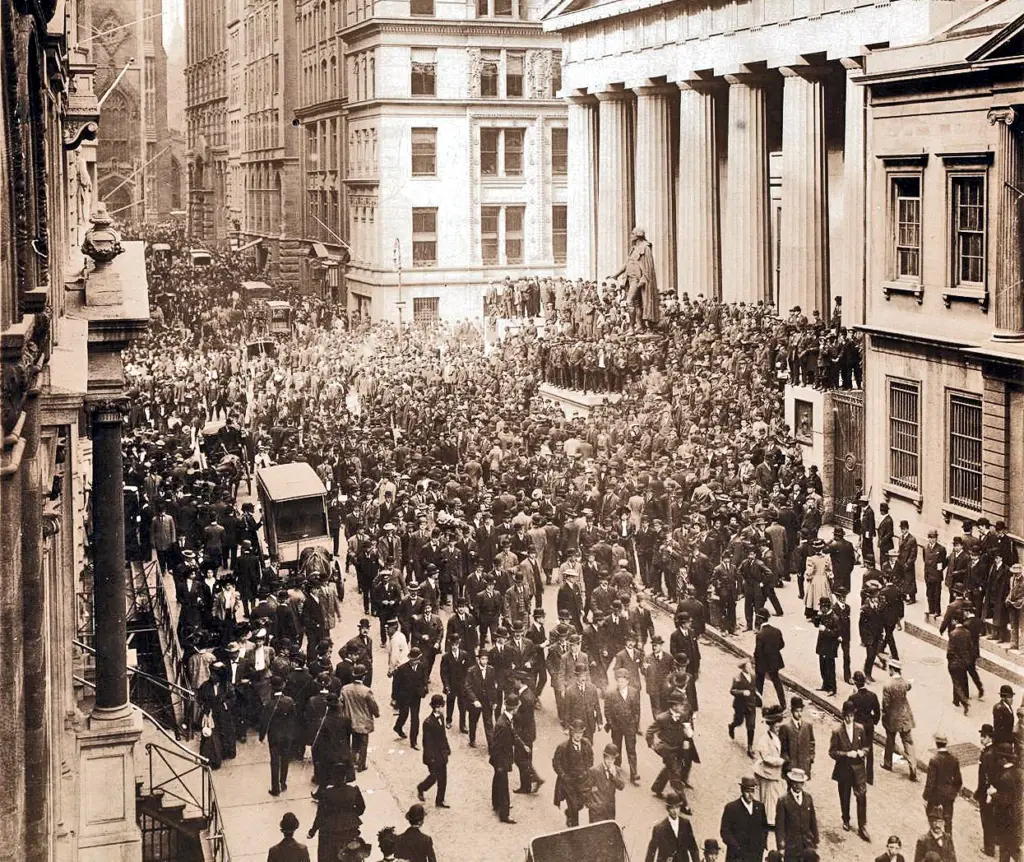

14. Panic of 1907

The Panic of 1907 was a prime example of the snowball effect that can occur with poor financial decisions by authorities.

During this particular crash, people had grown weary of the current banking policies and proceeded to withdraw their savings from multiple banks — causing the bankruptcy of several companies and the stock market to fall by around 50% from its peak the previous year.

Companies such as J.P. Morgan had injected funds into the market to restabilize the economy.

13. The Crash of 1932

The crash of 1932 was triggered by an initial crash that took place three years prior in 1929 — which would then go on to be dubbed as one of the worst market crashes in the world’s history which we will discuss later in this article.

However, the American market had reached its rock bottom in the crash of 1932 with the market losing a value of around 80% at this point in time.

Many lives were affected by the disastrous unemployment rates and overall harsh living conditions.

12. World War II Crash

The event occurred from October 1939, all the way up to April 1942, hence its name being the “World War II Crash”.

The decline of the market first began when Germany initiated its invasion of Poland which led to the Dow Jones Industrial Advantage dropping from its peak of 152 to around 95 in the latter part of the crash.

With the panic and unpredictable costs incurred during major wartime periods, the economic crash did not surprise many traders.

11. 2015 Chinese Market Crash

The Chinese stock market had been going on a hot streak during the 21st century. However, things took a turn for the worse when the economy of the country burst its bubble in June 2015 with A-shares losing around 30% of their value on the Shanghai Stock Exchange in just a month’s time.

A primary cause of the crash is pointed towards the rapid buying frenzy in China which would — as most analysts expect — subsequently lead to panic selling that can lead to a crash.

10. The Panic of 1873

The Panic of 1873 was an economic crisis that primarily occurred in the regions of Europe and North America. The market crash at the time was known to have kickstarted the period known as the “Long Depression” in Britain.

Factors such as inflation and an increase in speculative investments in the railroad industry had all come crashing down — leading to many factories going out of business and consequently, workers being laid off and the national debt rising gradually.

9. Black Wednesday

Also known as the Sterling Crisis of 1992, Black Wednesday was the result of a failed attempt by the United Kingdom government at the time to keep the pound sterling included in the European Exchange Rate Mechanism to prepare the country for the transition to the euro currency.

With speculators betting against the pound and the administration publicly speaking about the failures of the currency, a crash was inevitable. In the process, the United Kingdom lost £3.3 billion.

8. Great Crypto Crash

The Great Crypto Crash was a more recent event — occurring in January 2018, many investors had begun selling their cryptocurrency assets despite the boom of crypto during the year 2017.

From January to February 2018, Bitcoin — one of the leading digital currencies — had sharply dropped by 65%.

And as of September 2018, Bitcoin had crashed by over 80% in losses from its initial drop period in January of the same year. It did not help that companies such as BitConnect which hopped on the bandwagon were investigated for fraud during this tumultuous period.

7. Eurozone Debt Crisis

The Eurozone Debt Crisis first started with the failure of the banking system in Iceland in 2008. Other countries in Europe such as Greece, Portugal, Italy, Ireland, and Spain soon followed.

Most allegations that caused the crisis come from mistakes on the government’s side such as misleading reports of debt which caused confusion during the transition of power from the previous administration to its successor and rising bond yields in government securities.

The result of the crash was a loss of confidence in most businesses in the European countries affected.

6. 9/11 Crash

Known as one of the most shocking events to happen in world history, the September 11 attacks in the United States which occurred in 2001 caused stock markets all over the world to rapidly drop.

Due to the plane attacks, stock markets such as the New York Stock Exchange were closed for days in fear of follow-up terrorist events happening all over the world.

The U.S. dollar did not fare well against other currencies and stock prices in markets specifically in the Latin American region had also crashed. 430,000 jobs worth around $2.8 billion in wages were lost in the months after 9/11 had occurred.

5. Kennedy Slide of 1962

Also known as the ‘Flash Crash of 1962’, the Kennedy Slide was a period in American history where the market crashed under the term of President John F. Kennedy.

The S&P had fallen by 22.5% and the Dow Jones Industrial Average experienced a 5.7% decline — the second-lowest drop recorded back then.

there was no specific reason for the crash, some believe that the drop occurred due to ever-changing investor behaviors in the market which caused fluctuations in stock prices.

4. 1997 Asian Financial Crisis

The Asian Financial Crisis was the product of unstable currency exchange rates in the Southeast Asian Region which began with the country of Thailand that soon spread across neighboring countries.

With the Thai government running out of foreign currency supply, the country was forced to float the Thai baht which then contributed to its collapse.

During the process, other nations such as the Philippines and Indonesia were also significantly affected. Stock markets plummeted and currencies among the affected regions were at an all-time low.

3. 2007 Chinese Stock Bubble

The 2007 Chinese Stock Bubble occurred when the Shanghai Stock Exchange had dropped by over 9% — the largest decline it had experienced in over a decade. The fall of the market value had spread over other stock markets such as Wall Street and the event had been dubbed the “Shanghai Sneeze”.

The market crash was due to rumors that the Chinese government was planning on increasing interest rates to slow down inflation and introducing stricter policies toward speculative trading with borrowed money.

The Dow Jones had dropped by 3.29%, the largest drop since 9/11.

2. 1998 Russian Financial Crisis

Also known as the ‘Ruble Crisis’ or the ‘Russian flu’, the 1998 Russian Financial Crisis was a result of the government devaluing the ruble currency and unmaintained debt defaults.

Rising wartime costs and poor economic policies paired with rampant corruption had driven the Russian economy to the ground.

Banks suffered losses, inflation was at an all-time high, and a political crisis was on the verge of melting down due to the financial crash.

1. The 1929 Crash

Infamously referred to as the “Worst Crash in History”, the 1929 Crash had put a resounding conclusion to the Roaring 20s and was the first sign of the beginning of a long economic crash in the United States also known as the Great Depression.

Industries all over the world experienced negative effects for over a decade. People had gone to great measures to invest in the stock market such as mortgaging their own homes for cash.

Eventually, the buying frenzy was paired with panic selling that led to disastrous results. The Dow Jones had dropped by 89% and hundreds of businesses had permanently closed down their doors during this period in American history.

When was the Largest Stock Market Crash?

The largest stock market crash took place during the 1920s in the United States when the Wall Street Crash occurred. The event was nicknamed “The Great Crash” and the downfall of the economy which was initiated by The Great Crash became a warning sign for worse events to come in the country — infamously called “The Great Depression” which was a time when unemployment rates skyrocketed and industries such as agriculture greatly suffered.

What was the Biggest Fall in the Stock Market?

The Great Crash, as expected, also brought about the biggest fall that the stock market has ever experienced up to date. With a whopping 89% drop in the value of the market, investors were in a financial panic that was considered the worst and biggest of its time. And up to today, there has never been a more disastrous event to ever plague a country’s economy even outside of the United States.

What Year was the Worst Stock Market Crash?

The Great Crash was also called the Wall Street Crash of 1929 — or simply, the Crash of 1929. The event occurred shortly after the downfall of the London Stock Exchange and came after a period of relative economic success and prosperity in the United States. The era that came before the crash is affectionately called the “Roaring Twenties”.