Pyramid schemes are up there in the biggest scandals that can ever occur in the world of business. Much like the Ponzi scheme — which is its counterpart and what most people confuse it as — pyramid schemes operate in a slightly different way but nonetheless, its intention to defraud investors out of their hard-earned money through dubious tactics is one and the same. Today we will look at the most famous pyramid schemes in history, to try to understand how these schemes work.

Understanding what is a pyramid scheme

The clear difference between a Ponzi scheme and a pyramid scheme is that while the former simply asks for money from investors which can be used as funds for bogus ventures that promise little risk for high rewards, pyramid schemes also offer a whole cluster of rewards for its members if they actively recruit more people to join the organization.

Usually, these rewards come in the form of referral or singing bonuses that are given to recruiters who are able to invite a certain number of new members to also join their companies. The way these pyramid companies mainly generate profit is from their membership fees.

As the member pool continues to grow in size, the bigger the income is distributed starting from the higher-ups all the way down to the lower levels — thus forming the “pyramid”.

A pyramid scheme begins to show signs of slowing down when there are no more members left to recruit and the money that is being circulated begins to grow thin. Nonetheless, before major pyramid schemes crumble, a lot of money has already been pocketed.

Here are some of the other most famous pyramid schemes in history:

1. Mary Kay Consulting

The line between a multi-level marketing company and a pyramid scheme seems to be blurred especially in the case of several companies such as Mary Kay Consulting. Primarily selling cosmetics, the company has generated over $2.8 billion through a business model that uses a commission-based strategy.

There is no strict requirement for salespeople to buy products from Mary Kay, but doing so offers various incentives. To this day, the actual legality of the company’s practices which leaves a huge bulk of products left unsold and many salespeople in debt is still being questioned.

2. United Sciences of America

The United Sciences of America primarily dealt with nutritional supplements that promised protection against diseases such as AIDS and cancer. Some of their products include ‘Calorie Control Formula’ and ‘Fiber Energy Bar’ which were distributed by over 140,000 sellers.

Besides claims of the executive board receiving consultation fees and $100,000 research grants, the company was taken down after investigations revealed fraudulent claims and bogus scientific proof.

3. Business in Motion

Business in Motion was a pyramid scheme created by Alex Klippax that sold vacation club packages as its front. The venture promised Canadians a way to earn money by selling “dirt cheap” packages to customers for up to $100,000.

However, before selling, agents are requested to pay an entrance fee amounting to $3,200. The company promised profits of approximately $5,000 for every package that is sold. Obviously, the business model was not sustainable enough and some disgruntled representatives soon filed a $6.5 million lawsuit against the company which they won.

4. USANA Health Sciences

Usana Health Sciences is an active multi-level marketing company that sells dietary and nutrition products among many other offerings. USANA products cannot be found in any retail store and can be bought instead from its distributors and directly through the company.

For the many years that it has been in operation, USANA has been at the receiving end of many legal suits which range from artificial stock price inflation accused by anti-fraud figure Barry Minkow to a misleading business model. USANA is valued at $1.1 billion as of 2021.

5. Fortune Hi-Tech Marketing

Fortune Hi-Tech Marketing was a Kentucky-based company that sold health products and mobile phone services to name a few. Distributors were paid a meager 0.25% to 1% commission on sold products and were given a bonus for recruiting more representatives.

The sellers eventually discovered that they were making more money from recruiting than from selling actual products and the company was soon identified as a pyramid scheme. 350,000 members fell victim to the scheme, paying annual fees of up to $300. Fortune Hi-Tech Marketing was shut down in 2013.

6. Nu Skin Enterprises

Nu Skin Enterprises mainly sold personal care products which it sold via distributors that made people suspicious that the business model was a multi-level marketing ploy veiling a pyramid scheme in the works.

In the end, the doubters were right and Nu Skin Enterprises was investigated for false advertising and overstating the income of its distributors as a marketing tactic. After being flagged by the Federal Trade Commission, Nu Skin Enterprises settled all of its legal suits amounting to $2.5 million.

7. Vemma

Vemma Nutrition Company was an Arizona-based multi-level marketing organization that sold dietary supplements. However, as with any other pyramid scheme, most of the income earned by distributors was sourced from recruiting new members which comprised of young people and college students.

Vemma members had to pay $600 upfront for “starter packs” and additional fees for products to be sold. The company was shut down by the FTC for deceptive marketing and was ordered to pay a fine of $238 million.

8. BurnLounge Inc.

BurnLounge Inc. is a currently dormant company that was flagged by the FTC for operating a pyramid scheme that required new members to pay a subscription fee before being allowed to sell their songs through the website.

However, most of the income was generated from the cash incentives tied with recruiting new members.

Furthermore, members have the option of either redeeming their points (which they earn from sales) for BurnLounge products or having them converted to cash (minus additional fees). A lawsuit was filed by the FTC against the company with damages totaling up to $17 million.

9. WakeUpNow

WakeUpNow was a multi-level marketing company that was centered on selling health and financial management services. Founded in 2009 by Troy Muhlestein, the company’s offerings were investigated to be offered at either a cheaper price or for absolutely free on different platforms.

WakeUpNow was closed in 2015 after several complaints were filed with the FTC against the company.

10. Herbalife

Herbalife, an MLM company that sells dietary supplement products, has been under constant legal pressure from both clients and its distributors for suspicious activities that can be compared to that of a pyramid scheme in the works.

While the company had avoided further legal repercussions from the FTC, it was found that Herbalife paid its top sellers a measly $5 monthly salary which raised concerns that income was being generated elsewhere. Lawsuits were filed by distributors that complained about Herbalife’s deceptive business model.

11. AdvoCare

AdvoCare was yet another pyramid scheme that sold supplement products. Its business model aggressively focused on recruiting more than selling its offerings. On top of that, recruits were fooled with overestimated company earnings and inflated potential earnings with a shady list of registration fees. After investigations, AdvoCare was ordered to pay a $150 million fine for its fraudulent actions.

12. Neora

Neora was another supplement and skincare company that raised the suspicions of the FTC that directly promised its clients that they will “achieve financial independence” if they invested in Neora.

Former members have even called the company out for its special attention to recruitment as the topmost priority in its training videos as a part of the membership program. Neora was sued for $150 million in damages by the FTC.

13. LuLaRoe

LuLaRoe was a women’s clothing company that was built on an MLM model that went too far. The company had encouraged distributors to aggressively purchase LuLaRoe products to be sold to customers — even going as far as to advise members to “sell breast milk” in order to have enough money to buy products.

After a lawsuit was filed by customers in 2017 which was riddled with complaints of poor product quality and incorrect sales tax computations.

It did not help that the popular media company BuzzFeed published a 2019 report on LuLaRoe’s dismissal of all of its warehouse workers just five days before Christmas. Some of the lawsuits filed against the company amounted to $49 million.

14. Primerica

Primerica is a tough case since, on paper, the insurance and financial services company is identified as a legal institution and not as a pyramid scheme. However, as reports have alleged, the company operates under shady conditions especially as it focuses on hiring new recruits that have no deep knowledge of financial services and how they work.

Furthermore, these recruits are forced to recruit more members into the organization to recuperate their losses.

15. Beachbody

Beachbody is another legal business that explores a shady gray area to generate income. Focusing on selling workout programs, the company had aggressively invested its resources in marketing efforts and celebrity endorsements to entice new members.

Not long after, the customers themselves had begun selling the workout programs of Beachbody. Investigations by watchdogs had found out that Beachbody distributors have resorted to deceptive marketing tactics such as overestimating earnings to trick people into joining Beachbody.

According to the FTC, 99.6% of members have lost money and will lose it by hopping on to the scheme.

16. Younique

Younique is a beauty product company that operates under an MLM model which was investigated as a pyramid scheme. Distributors — called “presenters” — initially sign with the company and purchase products which will then be sold at a profit. In order to maintain presenter status, sellers have to regularly buy products (even if they are not sold).

As one’s status goes up, the higher the commission that is earned. Soon after, presenters realized that more money was coming out than what was being earned. A lawsuit was settled by Younique that amounted to $3.25 million.

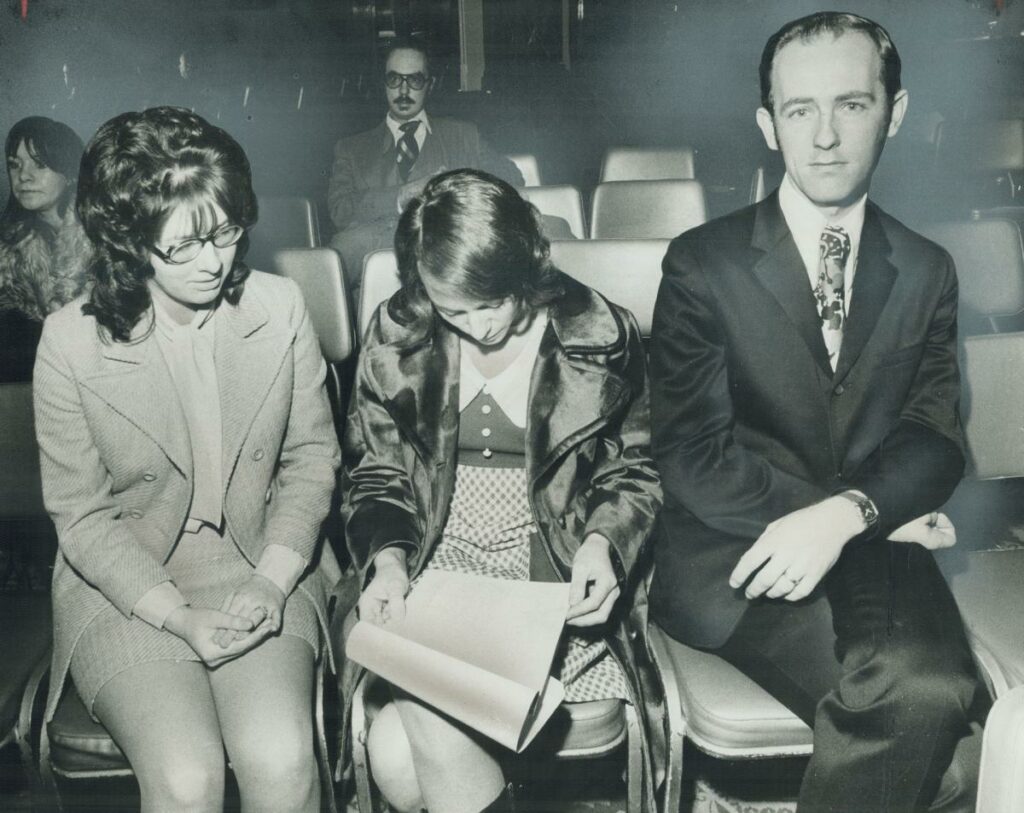

17. Koscot Interplanetary

Koscot Interplanetary was a multi-level marketing company that sold mink oil-based cosmetics in the 1970s. However, a bulk of the income was earned from recruiting more people. Distributors earn a commission from being able to attract new members.

Positions in the company range from becoming a supervisor ($2000 fee) or a director ($5400). Koscot Interplanetary eventually went out of business for its unsustainable model and its founder Glenn Turner was imprisoned in later years for being involved in another pyramid scheme.

18. MonaVie

MonaVie is an MLM-related company established in 2005 that both manufactured and sold health-related products created from natural ingredients such as concentrated fruit extracts.

One of the biggest issues surrounding the company revolved around fake scientific claims and misleading marketing strategies that only generate income for a small 1% of the entire MonaVie organization. The company closed its doors for good in 2015 after it was unable to pay off its $182 million loans.

19. Irish Liberty

Irish Liberty was a pyramid scheme organization established in the 2000s that lured investors to cash in around €10,000 into a Germany-based “headquarters” with the promise of low risk and very high returns due to the venture skipping over Irish tax laws at the time.

The members were advised to recruit members into the scheme after being ensured of incomes reaching up to €80,000 when they travel to Germany in order to collect their earnings on investments made.

The fraudster behind the scheme was able to run away with $28 million from the Irish Liberty scam — also known as the “Speedball scheme”.

20. Amway

Amway is considered to be one of the world’s largest pyramid schemes and with good reason. While the multi-level marketing company which sells health and beauty products has stood firm on its stance that it is not a pyramid scheme, many distributors of the organization — also called ‘independent business owners’ or IBO — beg to differ.

IBOs are rewarded for many activities such as recruitment bonuses, performance incentives based on total sales, and the markup on products sold.

The FTC itself has investigated Amway’s operations, and while the company was free from any direct accusations of being a pyramid scheme, reports have found that distributors of the company resort to making exaggerated income reports to fool customers.

Most lawsuits against the company have been settled by Amway throughout the years including a big-time legal case that amounted to $54 million in damages. As of 2019, Amway has been reported to generate total revenues of $8.4 billion.