The 2010 flash crash is one of the most memorable events to happen in the stock market in the 21st century. In the span of just under an hour, the entire United States trading floor fell to the mercy of Navinder Sarao, a tech-savvy trader who had successfully accomplished one of the biggest market manipulation strategies the country and its economy had seen.

To this day, many theories and speculations have been running around as to the actual gravity of Navinder’s actions and if there were other forces at play. But setting that aside, let us take a look at how the 2010 flash crash actually played out back then.

What was the 2010 Flash Crash?

To provide a little bit of context, a flash crash occurs when there is a very sudden and quick fall in security prices in the stock market — only for it to recover after a certain period of time.

Usually, a flash crash happens when an automated program is involved in the trading process which encourages high-frequency trading or trading activities that happen at very fast speeds and at huge ratios.

Obviously, the robotic speed of placing buy and sell orders in the market repeatedly fluctuates the billions of dollars that have been moving — due to the large number of transactions happening in a very short period of time. And eventually, the volatile movement results in a flash crash.

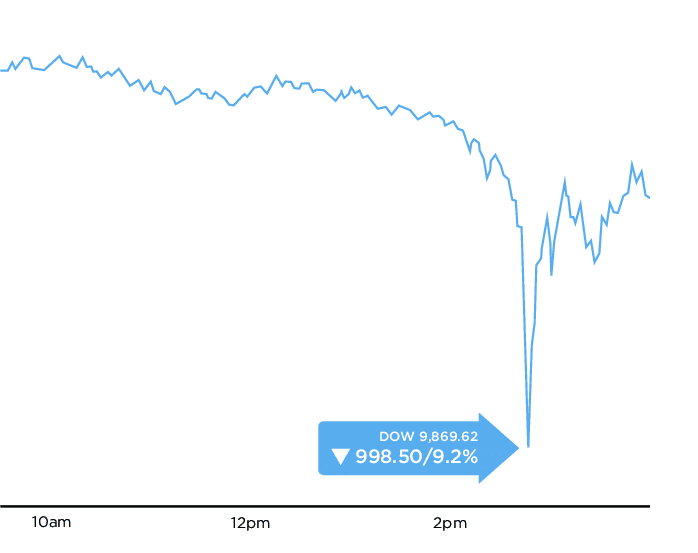

This is exactly what played out on May 6, 2010. The 2010 flash crash was also referred to as “the crash of 2:45”, and the event happened at around 2:32 PM (Eastern Time Zone), lasting around 36 minutes.

During the intense minutes that had passed while the flash crash occurred, the recorded financial loss of the market was estimated to reach a value of almost a trillion dollars. After the dust had settled and traders were able to stabilize their investments after the chaos that had ensued, a wide-scale investigation was launched in order to find the cause of the notorious 2010 flash crash.

It did not take long for authorities to dig up enough evidence into the matter and identify a single personality who was responsible for the entire fiasco. The suspect was none other than a trader by the name of Navinder Sarao.

But how is it that a single person can stimulate the market enough for it to endanger the entire economy of the country even just for a few minutes? How is it possible for a trader to single-handedly threaten the United States market with losses reaching up to a trillion dollars and a panic that could have gotten worse? Just who is this man called Navinder Sarao?

Who is Navinder Sarao?

Well, Navinder Sarao looks as average as any other person you might come across on the street. His average appearance did not fit the sinister reputation he had gained as a manipulator of the American stock market.

Currently 42 years old as of this article’s writing, Navinder Singh Sarao was an ordinary trader who learned the tricks of the market by himself. Nicknamed by the media as the “Hound of Haslow” for his notorious deeds — perhaps as a joke referencing the “Wolf of Wall Street” persona of convicted Wall Street trader Jordan Belfort — Navinder had thoroughly analyzed the software programs that were used by traders in the stock market to his advantage.

According to his lawyers, Navinder referred to his market manipulation tactics as similar to that of “winning a video game”. A person identified by many to have a very high IQ, Navinder is on the autism spectrum, having been diagnosed with Asperger’s syndrome (which also had a part to play during the deliberation procedures in court).

What Caused The 2010 Flash Crash?

Well now that we have a background of Navinder Sarao, what exactly did he do to cause the flash crash of 2010? Navinder actually used his extensive knowledge of technology to his advantage when scouring through the markets.

Navinder focused on trading the S&P 500, through the use of futures contracts. He then created an algorithm-based software to buy trade contracts. After the value of the contracts he bought reached a certain threshold, Navinder sold off his assets at a large profit.

In the index that he preferred, high-frequency traders made their own trading activities whenever a buy or sell order is made in the market. These high-frequency traders were actually bots controlled by high-frequency trading firms.

Milliseconds before an order can be executed, the digital traders would place their own orders so they can get ahead and earn an even larger profit with every movement of the market.

However, Navinder found out that these high-frequency traders actually ran with a similar executing program. And so, he created a customized software that took advantage of the herd mentality-like behavior of these bots by acquiring a huge amount of orders in order to generate artificial demand for a particular asset.

Only to cancel or modify the orders at the last minute in order to bank on the additional profit brought about by the meteoric rise in value. This strategy used by Navinder is popularly referred to as “spoofing”, and it is illegal.

Playing with the price as it rose up and down in the market, he was able to successfully manipulate demand and gain as much profit as he can gain from exploiting the algorithm.

The flash crash finally reached its breaking point when the trades Navinder orchestrated which were estimated to be around $4.1 billion on the New York Stock Exchange led to the Dow Jones Industrial Average dropping by at least 1,000 points, only for it to rise up to its original value in the span of just fifteen minutes.

Theories About The Crash

While the scandal of the flash crash and Navinder’s role in the possible disaster that could have struck the entire economy of the country continues to be speculated on up to today.

There have been many theories that have sprung up to possibly explain the entire scenario and if Navinder was the only party responsible for the fluctuating market prices.

Here are a few theories that have sprung up shortly after the flash crash took place and even throughout the years that have passed since the incident occurred.

Fat-Finger Theory

One of the common beliefs back then was that the flash crash was caused by a ‘fat-finger’ trade. Basically, a fat-finger trade happens because of a miss click on a market trade which results in a far larger amount than what was initially intended.

As for the flash crash, rumors spread that an accidental huge sell order placed on stocks of the multinational company Procter & Gamble led to an aggressive stock dumping effort by high-frequency traders.

However, this theory was quickly disproved as well after findings show that Procter & Gamble’s stock decline was caused by other factors.

Huge Directional Trading

Another popular theory suggests that the flash crash was the result of the huge trading movements of several firms in the market. Some theorists have pointed out that an E-Mini S&P 500 firm kickstarted the flash crash.

Others have argued that hedge fund firm Universa Investments caused the crash after purchasing a vast amount of put options. Another speculation under the directional trading theory is the fluctuations that occurred between the US Dollar and the Japanese Yen.

Technical Difficulty Theory

This theory suggests that the 2010 flash crash was caused by rampant technical glitches that have been occurring with the New York Stock Exchange as well as several other alternative trading systems.

It was reported that the NYSE experienced delays reaching up to five minutes in posting up quotes. This led to mass confusion and fears among traders who consequently pulled out their stocks to avoid any unwanted risk.

Triggering a domino effect, the software-run high-frequency traders also moved to pull out of the market as soon as possible. With these two scenarios happening simultaneously, the massive plunge in market prices finalized the infamous flash crash.

2010 Flash Crash Aftermath

While there were many scenarios that tried to fully explain and understand the reasons behind the flash crash of 2010, it was Navinder’s involvement in manipulating the market for his own benefit that was eventually believed as the most likely origin of an event that would trigger a panic in the market which led to a trillion-dollar loss in the stock exchange.

The flash crash caused a market anomaly which led to indexes dropping by 9%. The infamous $1 trillion value of the market was also temporarily removed during the minutes that have passed since the crash, only to bounce back and recover.

This was an unusual event in the stock market that signaled traders that a flash crash had just occurred. Several major companies listed in the stock market also had their market cap decline considerably during the 2010 flash crash.

As expected, investigations on the matter were intensified. Hearings were declared by the U.S. Congressional House Subcommittee on Capital Markets and Government-Sponsored Enterprises to produce a timeline of events that occurred during the 2010 flash crash.

Market authorities have also announced a trial run of trading curbs or circuit breakers which were set in place to prevent stock market crashes from occurring as frequently as they did during the flash crash.

The trading curbs were set to trigger if a stock rises or falls in value by more than 10% in the span of a ten-minute period. The first event which triggered the trading curbs was a jump in the shares of the Washington Post Company that was caused by an error in NYSE trades.

Where Is Navinder Sarao Now?

After thorough investigations on the 2010 flash crash concluded, charges were officially filed against Navinder Sarao in 2015. Some of the crimes pinned against the flash crash trader include one count of wire fraud, ten counts of commodities manipulation, and another count of spoofing.

In official statements of the United States Department of Justice, Navinder was responsible for manipulating the market through the use of software programs in order to generate massive uncontrolled profits.

Reports have stated that Navinder and his company Nav Sarao Futures Limited were able to accumulate a massive $40 million profit from trading activities alone, from the year 2009 all the way up to 2015.

As of 2017, Naviner’s attorneys have claimed that most of his assets were stolen or depleted due to multiple bad investments. While he was released on bail, Navinder was ordered to be supervised by his father and is permanently banned from trading.

A few years later in January 2020, Navinder was officially sentenced to one year of home confinement without serving any jail time. Besides citing his mental disability as a factor in the reduced penalty, prosecutors have also highlighted Navinder’s contribution to catching other market manipulators and that most of the profits he earned were not spent on any luxuries and other suspicious purchases.

Afterword

While most countries including Navinder’s home country, the United Kingdom do not identify spoofing as a legal crime, the practice was made illegal in the United States as of 2010.

The first documented case of a spoofing conviction in America was in the case of Michael Coscia in 2013. He was sentenced to three years in prison for using software programs to manipulate the market.

Trading using set algorithms, in general, is also not viewed as a crime in many areas, which has sparked heated debates with regard to the ethical grounds of the stock market and which trading practices can be classified as illegal. And which ones are just the product of pure human intelligence and craftiness.

At the end of the day, Navinder Sarao’s case is an interesting look at the risks posed by trading in the stock market and why it is important to always practice due diligence every step of the way — especially in an environment where huge amounts of money and investments flow in and out constantly.