Value investors have not had the best returns over the last few years, which leads investors to question whether value investing is outdated or even dead. Is value investing still relevant and is it still a viable investment strategy? Yes, and there are several reasons why!

Is value investing outdated or dead?

No, value investing is not outdated or dead and there are plenty of investors and capital allocators still investing in value stocks. What happened to value stocks?

Similarly to what happened in the dot-com bubble of the early 2000s. Many investors are asking themselves the same question – Is value investing outdated or dead?

The recent performance of tech and growth stocks has completely overshadowed value stocks. It’s interesting to analyze how Warren Buffett’s ability was questioned with such persistency during a similar period of outperformance by growth stocks.

In the 2000s Berkshire Hathaway’s relative underperformance led many to question if the legendary investor was out of touch.

The same also happened in 2008. Today the same headlines are coming out. From Morningstar to Financial Times, many seem to doubt Warren Buffett’s ability yet once again.

In hindsight, this type of headline could be a signal that a crash is impending. But why are some of the major financial publications in the world questioning the ability of the most successful investor ever?

Why does value investing seem outdated or dead?

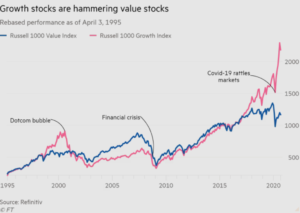

The main reason why value investing has been questioned so fiercely is due to the underperformance of value stocks relative to growth stocks during the last few years.

This has happened before in the past, especially during the dot-com bubble. As growth stocks made new highs investors also thought that value investing was not relevant anymore, but it turns out that they were wrong.

Why are value stocks underperforming?

There are a few reasons that explain why value stocks are underperforming:

- Low-interest rates

- High valuations and speculation

- Economic growth

- Bull market

Low-interest rates

Historically low interest rates have been one of the biggest drivers not only of valuations across growth stocks but also economic growth. The low-interest-rate environment in which we find ourselves has been the single biggest contributor to this. With unlimited liquidity in the market, it becomes fairly easy for unprofitable companies to finance and refinance.

Since instead of servicing the debt, companies can easily issue more bonds or ask for cheap credit. They can go on losing money for a long time, without the consequences being felt on their financials.

Source: PIMCO

Higher valuations and speculation

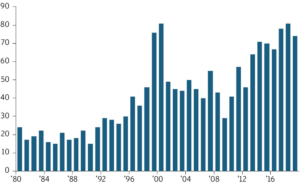

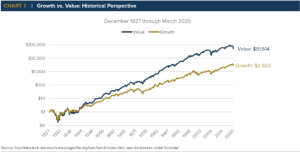

According to the Bank of America, since 1926 value investing has returned 1,344,600%. During the same time growth investing has only returned a meager 626,600%, roughly half of the returns. Investors are more enticed to invest in growth stocks with virtually no earnings. Similarly to what happened in the dot-com bubble. Many unicorn companies without any earnings and a clear path to profitability are going public.

US initial public offerings with negative earnings

Source: Pitchbook, Jay Ritter, University of Florida, J.P. Morgan Asset Management

Since the cost of borrowing money is so low, companies are able to borrow a lot of capital to fuel their growth.

In turn, it leads companies to increase revenues, and grow which drives valuations even higher. As more investors see growth stocks continuing to outperform they continue to invest in them.

Economic growth

Low-interest rates indirectly affect economic growth. Since there is more capital in the economy, it fuels sending, which also helps companies to grow revenues and profits.

Bull market

All this capital in the economy has created economic growth and led to one of the longest bull markets in history. Just like it happened during the dot-com bubble, growth stocks, and especially high-growth stocks tend to perform extremely well during periods of irrational exuberance.

Is value investing still relevant?

Yes, value investing is still relevant and it will always be. Buying stocks for a lower price than their intrinsic value will always be a great investment strategy. Value investing has evolved over the years, from Ben Graham's cigar butts to growth stocks, that trade at attractive valuations.

Why value investing is still relevant

Value stocks have outperformed growth stocks over the course of nearly 100 years. Even if we account for the relative underperformance of value investing over the last few years, value stocks are still outperforming growth investing strategies.

In fact, value investing seems to be making a comeback. As value stocks are expected to perform better than growth stocks, not only in the long run but especially in an inflationary environment with rising interest rates.

Do value stocks do better in a recession?

Yes, according to research conducted by Vitali Kalesnik, and Ari Polychronopoulos the historical data shows that value stocks tend to perform better than growth stocks during recessions, and recoveries.

Is value investing making a comeback?

There are clear signs that value investing could be making a comeback and there are several signs that point to this:

- Inflation

Inflation has been rising constantly over the last year, and value stocks tend to perform better during inflationary periods.

- Higher interest rates

Higher interest rates are also expected going forward which will put additional pressure on growth stocks’ valuations. As the cost of capital increases, some growth stocks with unprofitable business models are expected to decline. Higher interest rates will favor mature companies that are well established and are not dependent on borrowing cheap capital to grow and justify their valuation.

- Valuations of growth stocks declining

Investors will most likely balance their portfolios accordingly, and value stocks will benefit from this rotation.

So is value investing outdated or dead?

No, value investing is not outdated or dead, but it might seem like it is dying. Investors tend to focus on short-term performance and for that reason, value stocks are being overlooked right now.

Investors should not focus just on growth vs value stocks. Instead, they should focus on the business behind the stock and how well it is doing. This will ensure that they buy the stock based solely on the business performance and not on its price action.

When the price of your stocks goes down, it is important to know the narrative that justifies your purchase. This way you will avoid selling in a panic because you know the underlying business is doing just fine.

Investors focused on short-term price action, are the first ones to feel the pressure and give into selling. Focus on what you know, and analyze companies and you should do just fine in the stock market. Don’t follow the crowd and do your due diligence.