Saas companies have been one of the biggest trends over the last few years, but what is driving SaaS valuations so high? Will it continue going forward?

In this article, we will analyze the main reasons why SaaS valuations have been so high, and how that might change going forward.

What are the reasons for SaaS valuations to be so high?

There are several reasons that explain why SaaS valuations multiples have been very high lately, such as:

- Low-interest rates

- Low inflation

- SaaS market growth

- Advantages over traditional software

- High LTV, and low CAC over the long-term

- Difficult to disrupt

- Investors' interest is high

Low-interest rates

One of the main reasons why SaaS companies have such a high valuation is that interest rates are at historically low levels. This means that the cost of capital is extremely low. Therefore, unprofitable companies, in this case, early-stage SaaS businesses are able to borrow at an extremely low cost.

They can use this capital to further grow and expand their businesses. This has been one of the main drivers of the valuations, not directly but indirectly. Since SaaS companies are able to borrow at a low cost, they grow even more which contributes to higher valuations.

There is a clear correlation between low rates and the multiple expansion across tech businesses.

Low inflation

The low inflation has also been one of the drivers of the SaaS business model growth, which directly leads to higher SaaS valuations. This benefits SaaS companies who are able to maintain prices, and take advantage of long-term contracts with some of their customers. They are also able to sell subscriptions over a significant period of time and take the whole payment right away. If inflation is too high, or difficult to predict this approach would not work out.

There is also evidence that the valuation of tech companies is affected by inflation. Historically, tech stocks tend to underperform during periods of rising inflation. We have already seen how an increase in the PMI seems to be correlated with a decrease in tech valuations.

SaaS market growth

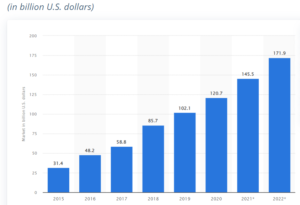

Another reason why SaaS valuations have been so high is that the global SaaS market has continued to grow at an astonishing pace. In 7 years it grew by over 550%, making it one of the most attractive spaces to invest. This pushes valuations higher, as investors expect the growth to continue and it further attracts more investment into the space.

Public cloud application services/software as a service (SaaS) end-user spending worldwide from 2015 to 2022

Source: Statista

Advantages over traditional software

One of the reasons that explain the continued growth of SaaS businesses is that the business model is in part superior to traditional software companies. The ability to generate recurring revenue, and retain customers easily ultimately reduces the customer acquisition cost (CAC) and improves the customer lifetime value (LTV).

On one hand, this pushes SaaS valuations higher than its non-SaaS counterparts, and it drives even more attention from investors.

High LTV, and low CAC over the long-term

Since SaaS businesses are able to retain customers easily and are more difficult to disrupt due to the subscription model, they tend to have higher LTV, which in turn means they can have an even higher CAC.

SaaS businesses are then compelled to get as much capital as possible and to grow their customer base as fast as they can. This fuels the growth, and it also contributes to higher valuations.

Difficult to disrupt

Some of the most notable SaaS businesses are incredibly difficult to disrupt. They know this, and users are well aware of this also. In turn, this means that some of these companies have very wide moats that are not easily replicated.

Investors' interest is high

Due to all of these reasons, investors' interest in SaaS is incredibly high, which in turn directly drives valuations upwards. Not only in public markets but also when it comes to private companies, which drives the interest of angel investors, private equity firms, and venture capitalists.

This creates a positive feedback loop that pushes valuations extremely high. Continued growth, creates higher valuations that attract investors, and the cycle keeps going.

Why SaaS valuations and multiples may decline

Despite SaaS valuations and multiples being high, there are reasons that lead us to believe they could decline even further. The macroeconomic scenario seems to be shifting incredibly fast, and it is going to impact SaaS valuations. Here are the main reasons why SaaS valuations can decline:

- Rising rates

- Rising inflation

- Lower SaaS market growth

Rising rates

With the current level of inflation, it seems likely that rates will eventually rise, and that might happen very soon. A rising rate environment will increase the cost of capital of SaaS businesses, which rely heavily on low-interest rates to implement their hyper-growth business models. The growth going forward is expected to be lower, as the cost of servicing the debt will increase.

Additionally, as rates rise, investors might find other investments to focus on, and with the lower expected growth, SaaS businesses will not be as attractive.

Rising inflation

Inflation also has a great influence on SaaS businesses. Some of these businesses depend on lower inflation to sell their services during a long time frame and customers make a one-time payment.

However, if we approach double-digit inflation, some of these businesses will be selling services for a lower cost now than they will cost in the future due to inflation.

Since they are receiving a one-time payment in exchange for providing a service in the future where their costs might rise significantly. This could hurt margins, and unless they are able to put that capital to work fast, they could actually lose money in the long term.

Lower SaaS market growth

All of these factors could influence the growth of the SaaS market worldwide. A lower growth would push SaaS valuations down. However, it is too soon to tell exactly what will happen going forward, but rising inflation and interest rates will certainly take their toll on SaaS valuations.

Lower investor interest

With lower growth and rising rates, investors will certainly look for other investments. Lower valuations can even have an effect on how the overall market perceives SaaS businesses.

Conclusion

It is clear that there are a number of factors that combined pushed SaaS valuations extremely high. It is too early to tell exactly what will happen in the coming years, but it seems that growth going forward might be lower than expected, and SaaS valuations will not be as high.