There is a lot of debate surrounding the topic of active vs passive portfolio management. Both have their pros and cons, and it can be difficult to decide which type of investment strategy is right for you.

In this article, we will discuss the difference between these two types of portfolio management, and help you decide which one is best for you.

What is the difference between active and passive portfolio management?

Passive portfolio management is when you invest in a predetermined mix of assets and then hold that investment mix over time. Active portfolio management is when you make ongoing decisions to buy or sell assets in an attempt to beat the market.

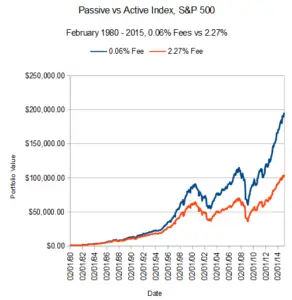

Another difference is that passive portfolio managers tend to have lower fees than active portfolio managers. This is because passive managers don't have to spend time and money researching investments, and they don't have to buy and sell assets as often.

An example of a passive management portfolio would be an index fund that tracks the S&P 500. An example of an active management portfolio would be a mutual fund run by a manager who is trying to beat the S&P 500.

Active managers may also take on more risk than passive managers. This is because they are constantly buying and selling assets, which can lead to higher transaction costs and taxes. They may also make bad investment decisions that lose money.

Passive investors may change assets within their portfolio but not as frequently as active investors. Typically, they do not worry about market timing and instead, try to “buy low and hold.”

The goal of passive investing is to match the market return, while the goal of active investing is to outperform the market. The market return can be defined as the return of a specific index, such as the S&P 500.

On average, the target to match (passive investing) and the target to beat (active investing) is the same at around 10.5%, which is the approx. rate of growth of the S&P 500.

Is active or passive portfolio management better?

Which approach is better depends on your investment goals and risk tolerance? If you're looking for stability and don't mind matching the market's returns, then passive management may be a good option for you.

However, if you're looking to outperform the market, then active management may be a better choice. Just keep in mind that active management comes with higher fees and more risk.

There are pros and cons to both active and passive portfolio management. Some investors prefer passive management because it is less expensive and easier to implement than active management. Other investors prefer active management because they believe it will lead to better returns.

Why passive investing might be better

Warren Buffett bet against the top hedge funds. The bet was that a low-cost S&P 500 index fund would outperform a portfolio of hedge funds over the long term. Warren Buffet isn't known to be a betting man, but in this case, he won. He recommends that the average person should stick with passively managed portfolios.

The reason is that passive funds have outperformed the majority of active managers.

Why active investing might be better

While Warren Buffett recommends that most retail investors should invest in an index fund, he actively manages his portfolio. He is one of the most successful investors of all time.

Peter Lynch is also an example of an active investor who outperformed the market. However, these two are exceptional cases. Not everyone who actively manages will have the skill and temperament to match their success.

Active vs passive portfolio management

The truth is, there is no right or wrong answer when it comes to choosing between active and passive portfolio management. The important thing is that you understand the difference between the two approaches and how each one can impact your overall investment strategy.

With this knowledge, you can make an informed decision about which type of management is right for you.

Which type of investor should invest in actively managed portfolios

The type of investors that would benefit from an actively managed portfolio are those that are willing to take on more risk and have a higher tolerance for volatility. If you don't want to deal with the stock market entirely but want to put some money into it, an actively managed portfolio may be a good option.

If you are not comfortable with your own emotional temperament, paying a manager to actively monitor your investments may be beneficial. This is because an actively managed portfolio can help prevent you from panic selling and making hasty decisions during a market crash.

However, if you are actively managing your own portfolio by picking stocks yourself, you need to have the knowledge and experience to make sound investment decisions. This is not a decision to be taken lightly, as it can have a significant impact on your financial future.

The type of person that would have a good experience actively managing their own portfolio should be passionate about researching stocks, have a strong understanding of the market, and be comfortable with taking on more risk.

If you are not comfortable with any of these things but still want active management, you can hire an investment company.

If you answer "Yes" to the following questions, you might be the type of investor that should invest in active portfolios managed by someone else:

- Are you okay with paying someone else to manage your money?

- Do you want to invest in the stock market but don't feel comfortable picking stocks yourself?

- Do you have a high tolerance for risk and volatility?

- Are you trying to beat the market?

If you answer "Yes" to the following questions, actively managing your own portfolio might be right for you:

- Do you enjoy researching stocks?

- Do you have a strong understanding of the market?

- Are you comfortable with taking on more risk?

If you do decide to go the route of active management, it is important to make sure that the manager of your account is a good investor.

Which type of investor should invest in passive portfolios

The type of investor that would benefit from investing in passive portfolios is someone who wants to match the market. This could be because they don't want to take on more risk, or they don't have the knowledge or experience to actively manage their own portfolio. A passively managed portfolio will track an index, such as the S&P 500, and attempt to replicate its performance.

This means that you will automatically be diversified across a range of different investments, which can help reduce risk. One downside of passive investing is that you will not outperform the market if it goes up, but you also won't underperform if it goes down. This makes passive investing a good option for investors who are happy to accept average returns. If you want to save money on fees, a passive portfolio may also be a good choice.

This is because there is no need to pay a manager to actively trade your investments, As an investor that is trying to save money on taxes, a passive portfolio may also be a good choice. This is because there is no need to actively trade your investments, which can trigger capital gains taxes.

If you answer "Yes" to the following questions, passive portfolios might be right for you:

- Do you want to match the market?

- Do you want to reduce risk?

- Are you happy to accept average returns?

- Do you want to save money on fees?

- Do you want to save money on taxes?

Active vs Passive Portfolio Management

Before making any decisions about which type of portfolio management is right for you, it's important to speak to a financial advisor. They will be able to help you understand the pros and cons of each approach and make a recommendation based on your individual circumstances. With their guidance, you can make an informed decision that is right for you and your financial goals!