The short US dollar trade can be not only a way of speculating on the value of the dollar declining but also a way to hedge your portfolio. What are the reasons to short the US dollar? Why should you consider it? And how do you go about shorting the US dollar?

Well, there are plenty of different options to choose from, depending on your goals, and the investment horizon for this trade.

In this article, we will go over the different reasons why investors might consider shorting the dollar, and the ways to do it. We will also analyze the best ways to short the dollar, and which one is best depending on your situation.

Can you short the US dollar?

Yes, every trader and investor can short the US dollar. However, the key point is to decide whether this trade actually makes sense, and if it will benefit you. Apart from that you need to also find the best way of shorting the dollar. Since there are several ways of doing it that are more geared towards the short-term, if you want to get long-term short exposure to the US dollar, you might have to skip those leveraged short dollar ETFs.

Reasons to short the dollar

There are a few reasons why you would want to have a short position on the dollar, and here are some of the main ones:

- Hedging your investment portfolio or your savings

- Increasing inflation

- Current interest rates are still lower than the inflation rate

- Purchasing power continues to decline

- Losing reserve currency status

- Speculating

Hedging your investment portfolio and your savings

Investment portfolio

If your portfolio is mainly comprised of US stocks, their value is in US dollars. If for some of the reasons mentioned above you think the value of the dollar will decline, that means that the value of your US stocks will decline relative to other currencies or other assets.

This could mean having less purchasing power while having the same amount of dollars as before. In order to hedge the risk of the US dollar declining relative to other currencies and assets, you might want to short the dollar.

If you are heavily invested in treasuries or CDs or other debt instruments that tend to be considered safe, you might be worried that if the rate of inflation keeps rising you will end up losing purchasing power even if you are fully invested. A solution to this problem could be shorting the US dollar.

Savings

If you have savings that are US dollar-denominated, shorting the dollar could be a way of protecting your savings. In theory, you would make money on the short position to cover the potential decline in value relative to other assets and currencies the dollar might experience.

Increasing inflation

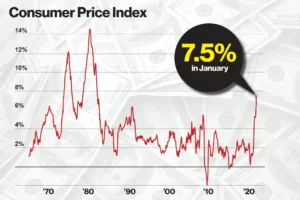

With inflation continuing to rise across the Western countries, it has never been a better time to be short a currency, that keeps losing its value relative to goods and services. In fact, inflation is slowly approaching its highest level since the 1970s and 1980s, when measured based on the CPI. Since then the way the CPI is calculated has also changed, and if it was calculated like in the 70s and 80s we would have a double-digit CPI.

Source: NY Post

This is an important difference that should be outlined. So far, the dollar has not lost its value relative to other currencies and assets, and in fact, the stock market keeps rising. However, the dollar is in fact losing value against the goods and services we buy every day.

Interest rates and inflation

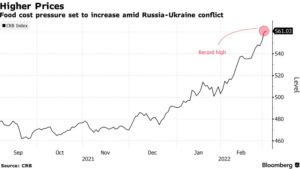

Even with the current increase of 25 basis points by the Fed, inflation is running a lot higher than interest rates. This will certainly pose a challenge to most central banks that will have to meaningfully raise rates in order to control inflation. In a similar way to what Paul Volker did during the late 70s and early 80s.

Source: Fred

Purchasing power continues to decline

With inflation continuing to rise, purchasing power continues to significantly decline. This also leads investors to seriously consider shorting the dollar. As the purchasing power, and the value of the US dollar continues to erode unless you have investments that are hedged against inflation it could be a significant risk of losing the value of your savings. Some investments like treasuries, and corporate debt may not even keep up with inflation unless you are investing in TIPS (Treasury Inflation-Protected Securities)

Losing reserve currency status

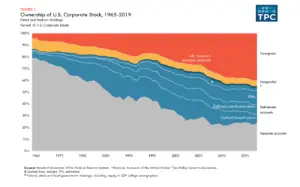

There has also been a lot of o debate surrounding the US dollar losing reserve currency status. Although it is possible that something like this could happen, its likelihood still remains low. However, some recent news continue to push this narrative, and the probability of happening is slowly increasing although it is still very unlikely that the US dollar could lose its reserve currency status.

India seems to be reinstating the rubble to rupee exchange in order to trade commodities with Russia, and Saudi Arabia is even considering accepting yuan instead of dollars when trading directly with China. Although these recent developments do not prove anything, they are signs that some countries are moving away from the dollar which might put more pressure on its value, since the demand for it will be lower.

However, the US dollar remains a safe haven during times of uncertainty. When the market crashes, investors tend to flee to the dollar and hold it until the volatility declines.

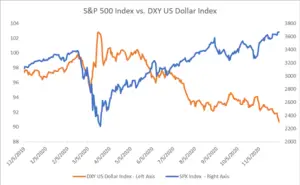

There is also a negative correlation between the US dollar and the S&P500. This means that when the value of the US dollar against other currencies declines, the S&P500 tends to edge higher.

This reflects the lower cost for foreign investors to exchange their currency and invest in the market since foreigners own about 40% of the US-listed stocks.

Speculating

Finally shorting the dollar could simply be speculation. Speculating, especially on the value of currencies can be risky, and it is important to draw the line between outright speculation and hedging. Given the macro environment, where inflation keeps rising and the value of the US dollar relative to goods and services keeps declining, it could be a trade that makes sense. You know what they say, “the trend is your friend”.

8 Ways of shorting the US dollar

There are plenty of ways to short the dollar, and each one has its own advantages and disadvantages. It is also important to consider that most of them are not even right for you. Every investor must consider which of these works best for them. Here are the 8 ways to short the US dollar:

- Take debt and buy assets

- ETFs

- Shorting

- Options

- Exchange US dollars for other currencies

- Buy assets

- Currency futures options

- Currency forward

Take debt and buy assets

For those investors worried about inflation, and how it can affect the value of their investments and savings there is a simple solution to shorting the US dollar - take debt and buy assets. If the value of the US dollar declines in the future, you can take debt today at a fixed rate, and buy cash-flowing assets that are hedged against inflation. This means that if the US dollar declines in value, the value of the assets you bought with the debt will increase in dollar terms, while also generating income, or increasing in value.

Although this is more of a hedging strategy, it can actually work extremely well if you know what you are doing. Make sure you get fixed-rate debt, to make sure the payments are fixed, and they will not increase in case interest rates rise. Depending on the investment portfolio you have and your financial goals this might be a good strategy.

ETFs

There are a number of ETFs that can be used to speculate on the value of the US dollar. You can either go long with these short US dollar ETFs like the Invesco DB US Dollar Index Bearish Fund (UDN), or short one of the long ETFs like the Invesco DB US Dollar Index Bullish Fund (UUP) and WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU).

Shorting

As we have mentioned you can short one of the long US dollar ETFs to get short exposure to the dollar. Additionally, you can rely on historical correlations of assets to try to profit from a dollar decline.

Options

Another common way of speculating on the decline of the US dollar is by using options. This falls upon the shorter-term time horizon, and it involves risk. Since most of the options tend to expire worthless, it might not be worth speculating a lot with them. However, options can be used as a great hedging strategy.

The most common way of speculating on the US dollar value with options is by trading the US dollar index. This is a simple way of getting short exposure to a possible decline of the dollar against other currencies.

You can also trade options on some of the short US dollar ETFs, which will increase the risk and give you more leverage. You can use Invesco’s short US dollar ETF - Invesco DB US Dollar Index Bearish Fund (UDN).

Another option is to buy puts on the long US dollar ETFs. Here are two long US dollar ETFs:

- Invesco DB US Dollar Index Bullish Fund (UUP)

- WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU)

There are also other options that involve more risk and depend on historical correlations. Namely, the fact that the S&P500 tends to have a negative correlation with the US dollar value, so you could theoretically go long the S&P500 as a way of getting short exposure to the dollar. You could also do the same with the MSCI World for example. There is also the possibility of trading the US dollar against another currency that might benefit from its decline, such as the yuan.

Be aware that involves a lot of risks and it is highly speculative.

Exchange US dollars for other currencies

Perhaps the most simple and less time-consuming way of getting short exposure to the dollar is by exchanging it for other currencies. You will end up owning different currencies, and in case the US dollar declines their value should increase relative to US dollars. If you need dollars for some reason, you can always exchange the currency you have chosen for US dollars.

Buy assets

Although this is not directly benefiting from a dollar decline, by investing in assets you protect yourself against a decline in the value of the dollar. The assets you buy will hedge your portfolio if the dollar loses value. As we explained, you might even consider getting into debt to do so, but that involves more risk.

Currency futures options

This type of financial derivative is only available to seasoned investors, but it can be used to short the dollar. Having a long position on a US dollar future put gives you the right to sell dollars at a determined price, and until the option expires.

If the value of the dollar declines in the meantime you will end up making the difference. You can also short a currency future option, but that involves even more risk.

If you are not familiar with options, and especially currency future options it is better to look for short dollar exposure elsewhere. This type of derivative is aimed at experienced traders.

Currency forward

Finally, we have another way of shorting the dollar, by using a currency forward contract. If you think the US dollar will decline in price, you can agree to exchange dollars at the current exchange rate in the future, against another currency.

This is one of the most straightforward derivatives where you just agree to a price today and complete the trade in the future. Although you can use this as a hedge, you can also speculate using currency forward contracts, just be aware of the risks.

Other ways of shorting the dollar

For the time being, we will avoid mentioning Forex CFDs, and binary options due to the risks involved, and to the nature of these financial products. Although you can get some short dollar exposure trading these financial products in the short term.

Additionally, we also did not mention currency swaps, since they are not even available to most investors but this type of derivative can also be used to short the dollar.

What is the best way to short the dollar?

There is no single best way to short the US dollar, as it depends entirely on your investor profile and your risk tolerance and capacity. Once you have defined how much risk you want to take you might want to consider an option that better suits your risk appetite, your current investment portfolio, and your financial goals.

It is also important to understand that some of these ways of shorting the US dollar are required a lot of financial knowledge that you may not have. Do not risk your money trading financial products you know nothing about. Avoid that at all costs.

Conclusion

With the continued decline of the purchasing power of the US dollar and increased inflation, there continues to be mounting pressure on its value. Investors are now looking for ways not only to hedge against inflation but to also profit in case the dollar declines. Although there are many ways of shorting the US dollar, you should consider what the best way is for you.