A lot of investors do not want to pick stocks at all, they prefer to invest in index funds and consider stock-picking a waste of time. Is it true that stock picking is a complete waste of time?

In this article, we will analyze whether stock picking is worth your time and if you are better off actively picking stocks, or delegating this responsibility to someone else.

Can stock picking really work?

Yes, picking the right stocks can help you to achieve a higher return than the broader market. However, you need to be very knowledgeable about the market, and make investments within your circle of competence.

Not everyone can do it, and that is one of the reasons why picking stocks might be a waste of time for some investors.

Why do some people consider picking stocks a waste of time?

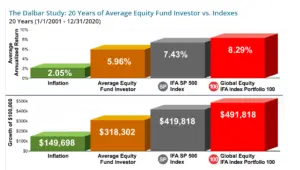

According to the SPIVA report, only 10% of active fund managers beat the market. This means that roughly 90% of those managers are underperforming their benchmarks or the broader market. Investors in these underperforming funds are paying fees to get lower returns than investing in index funds.

Source: IFA

This is why some investors consider stock picking a waste of time and effort.

Is individual stock picking worth it?

Stock picking is worth it for seasoned investors, that are willing to put in the time and effort that equity research requires. If you are not an experienced investor you can still pick stocks, and use that as a way to learn more about the market and fundamental analysis.

Why do investors try to pick stocks?

While there are several reasons why investors pick stocks, the main one is that they are trying to beat the market. In their quest to get above-average returns, they have to select individual stocks carefully.

This is a crucial part of any winning market strategy over the past. There are several reasons why stock picking is appealing to some investors, as it has several advantages that include:

- Enjoyment

- Learning

- Scrutiny

- Creating a personal investment portfolio

- Index funds are inefficient

- Higher control

- Avoid unethical stocks

Enjoyment

Believe it or not, some investors actually enjoy picking their own stocks. One of the reasons is that it is extremely complicated, and doing so can be exciting. If you think about it, the stock market is the most complex game anyone can play, and that excites investors who take great joy in building and carefully selecting individual stocks.

For some, it is also a great opportunity to learn about new industries, economics, and finance.

Learning

One of the reasons why so many investors pick their own stocks is that they end up learning a lot about companies, markets, and businesses. The stock market can be an invaluable source of knowledge, that you can apply in other industries.

What can you learn while stock picking?

Stock picking forces you to research a company, and its industry. It also requires you to understand the competitor's business models, and how it relates to the stocks you own. Here are some of the major topics you can learn while stock picking:

- Accounting

- Finance

- Economics

- Business

- Management

It also allows you to get insights into:

- Industries

- Companies

- Countries

- Management approaches

- Marketing

- Risk management

Scrutiny

Another important reason why investors like to pick individual stocks is that they can have a higher degree of scrutiny. Not only in picking the stocks but also in how they build their own portfolios. If you invest in a fund, that has a certain theme you are dependent on the portfolio manager's decisions on which stocks to buy or sell.

Picking stocks allows you to set your own standards, on why some stocks should or should not be included in your portfolio. This allows investors to build more personal portfolios.

Personal investment portfolio

If you have a portfolio manager dictating which stocks should be bought or sold, you depend solely on their decisions. You can also monitor those trades, and how the portfolio changes over time. But if you truly want full control over your investments you need to pick stocks.

This is one of the greatest advantages for stock pickers because they can build an investment portfolio exactly according to their beliefs, views, analysis, and financial goals.

Index funds are inefficient

Some of the biggest advocates of index funds point out that it is nearly impossible to beat the market by picking individual stocks. They are right. However, it is hardly mentioned how index funds are inefficient.

Index funds buy stocks indiscriminately, solely because they are included in an index and have a certain weight on that index. This forces index fund managers to buy stocks that may not be attractive. Their portfolio construction and trades are all automated, and this is not the best solution for some investors.

Higher control

Picking stocks allows you to scrutinize every stock individually, and it also gives investors higher control over their portfolios. This way you can structure your portfolio at a personal level, according to your situation and long-term goals.

You can also avoid certain stocks that do not fit your criteria, and that you would otherwise be forced to own if you invest in a fund. Picking stocks allows an investor to define a much more strict investment strategy that matches their investment profile and their risk tolerance.

Avoid unethical stocks

Stock picking also allows investors to avoid stocks they deem unethical. Some investors are uncomfortable investing in industries that go against their beliefs. If you pick your own stocks, you can easily avoid companies that you think are unethical.

If you are invested in a fund, you are not directly making the investment decisions. You can monitor but ultimately, you are delegating that responsibility to a portfolio manager.

Should you pick your own stocks?

If you like to do it, and you can dedicate time and effort to it you should pick your own stocks. Additionally, if you want your portfolio managed in a certain way, stock picking is also a good solution.

Conversely, if you do not want to invest that much time into it, or you are inexperienced, and unsure how to pick stocks, the best option is to invest in an index fund or a high-quality actively managed fund.

Conclusion

It is clear that stock picking is not for everyone. Not everyone likes it, and the amount of time and effort you need to dedicate can be overwhelming. However, for a select number of investors, stock picking is one of the most challenging and exciting activities.

It requires not only a special skillset but also a lot of knowledge and experience to be a successful stock picker.