While everyone is preaching investment, some of us do not have that much money to invest, which leads us to think of investing is really worth it. So should you invest even small sums of money, or should you focus on saving?

In this article, we will analyze the importance of investing even very small sums of money, and how it is a better strategy than saving. Keep in mind that each individual is different, and although these concepts can be applied by most of us, it really depends on your personal financial situation.

Is it really worth investing money?

Yes, even if you invest small sums it is worth investing some of your savings. The reason is that by investing you can generate returns on your capital, which would otherwise be impossible if you just save money. Additionally, when compared with savings accounts, investments offer far better returns, which in the long term it allows you to compound your money.

Compounding happens when you have assets that produce income or earnings that are then reinvested. By compounding your money, you're constantly increasing your annual returns, since your capital and yearly returns are reinvested.

To take advantage of compounding, you should start investing as soon as possible. The longer your investment horizon is, the more you will be able to compound your money, which increases your returns tremendously.

Einstein has a wonderful quote on compounding that truly shows what you can achieve by investing over the long term:

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn't … pays it.” - Albert Einstein

Is it better to save money or invest?

Although saving is important, it won’t have much impact unless you put that capital to work. Remember that :

- “Nobody ever got rich by saving”

- “Nobody ever got rich with his saving account”

This shows you that in order to build wealth over time you need to invest your money. Whether it is investing in yourself by improving your skillset or investing in a business or even real estate.

Saving also has an enormous disadvantage - inflation. Currently, the rate of inflation is approaching dangerously high levels, never seen before in the last 40 years. which in turn eats up your savings. You still have the same amount of savings, but the purchasing power slowly diminishes. This also shows you how investing is an important step to preserving wealth.

Should I save or invest?

It is important to have some money saved, in what is commonly called an emergency fund. Depending on your goals you should have at least 3 to 6 months of living expenses in your emergency fund. This makes sure that whatever happens in your personal or professional life, you always have some funds to get you by.

While an emergency fund is important, it is also crucial to invest frequently. One of the best long-term investing approaches is to do a dollar-cost averaging. This allows you to make frequent contributions to your investment portfolio, either weekly or monthly.

Is it worth it investing in stocks?

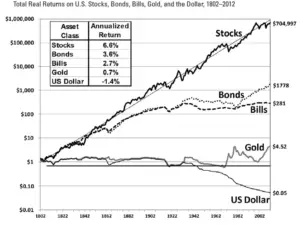

Yes, it is definitely worth it to invest in stocks. Stocks have historically been the best performing asset class, which means that they generate the highest returns when compared with other asset classes such as bonds, cash, and even gold.

Over the long term, you are expected to generate the highest returns by investing in stocks, therefore they are the best asset class to focus on.

Do you lose money if you invest?

Yes, you may lose money. However, if you invest in a stock and its price declines you only lose money when you sell. Your loss is what is commonly called a paper loss, meaning that on paper you are losing money, but only when you actually sell your stocks will you really lose money.

How much can you lose if you invest?

It’s important to understand that if you just invest in stocks, the most you can lose is your initial investment. Unless you use a margin account, which can put you in debt. When investing you want to take a cautionary approach, and make decisions that you are comfortable with.

Unless you are a seasoned investor you should avoid trading, especially on margin, and engaging in speculation. Remember that what you are trying to do is to generate returns on your savings. You do not want to risk losing what you have saved to chase money you might not earn.

Is small time investing worth it?

Yes. Even if you do not have a lot of money to commit to investing, it is still worth it. Additionally, if you are not that experienced in the markets the best way to start is with small sums. Today there are fractional shares, which allows investors with small portfolios to still invest in every stock.

There are also plenty of discount brokers who charge very small fees for trading stocks or do not even charge any fees. So, even if you do not have that much money to invest, it is still worth it, and today there are tools that allow everyone to have access to financial markets.

Not everyone is able to commit thousands of dollars to invest, some of us actually are not able to save, or earn that much. However, this should not stop anyone from trying to create their own investment portfolio and compound their investments. Remember that even a small monthly contribution to your portfolio could be extremely important over the long term.

Conclusion

We have seen the importance of investing even if you do not have that much money. Even if you invest just $100 every month, you will still be able to generate additional income through your investments, and it will also allow you to protect the purchasing power of your savings from inflation.