Hedge fund manager Michael Burry believes he has identified the next market bubble - the passive investing bubble. Perhaps one of the largest trends over the last 20 years in financial markets is how investors are moving away from active management into passive investing. The concept first introduced by John C. Bogle has been adopted by millions and millions of investors. However, this overdependence on passive investments and index funds certainly has some advantages. We have previously pointed out the risks associated with index funds, and why we think passive investment vehicles are inefficient.

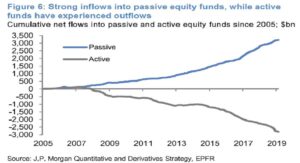

However, for most investors who are not even remotely interested in studying businesses and following the market on a daily basis, it is understandable that they choose index funds as their main investment. The funds moving into index funds have been growing considerably over the last decade, and active management is now something that is frowned upon by most investors.

In fact, investors have been consistently pulling funds out of actively managed funds to invest in index funds.

What are the risks associated with index funds and the passive investing bubble?

There are several risks associated with index funds that are often overlooked by most investors. Firstly there is the indiscriminate buying of securities. This is a feature of every index fund, but it is a considerable risk that should be considered. By buying securities indiscriminately, investors end up owning businesses without any rational reasoning behind each purchase. Every stock is purchased based on its weight in the index.

No longer are companies valued based on their intrinsic value, instead, their market cap is influenced by the inflows into index funds.

Tesla as an example

Not too long ago, Tesla was added to the S&P 500. Since then its market cap has hit over $1 trillion, and it currently stands at $1.142T. By comparison, the total market cap of the S&P 500 is ~$39T. When we compare Tesla’s weight on the S&P 500 is currently 2.9%. This means that every investment in an S&P 500 index fund will give the investor a 3% of exposure to Tesla. Considering the overvaluation of the stock, investors stand to lose a great percentage of their initial investment if these types of stocks are bought without any active consideration.

Inflows can have a deep impact

Another risk to consider about index funds is how they can impact market volatility. Index funds are dependent on inflows to buy stocks, therefore any sizable inflows or outflows can impact the market volatility. This leads us to question what could happen if many investors decide to pull funds all at the same time?

The way ETFs are now structured, investors can easily move funds in and out of index funds with a few clicks. If everyone decides to throw the towel at the same time, we can witness extreme index volatility, and the individual stocks that make up the index could also see very large price fluctuations.

Lack of governance and board presence

Some of these asset management companies that hold some of the largest index funds globally tend to have large stakes in several companies. However, due to their passive investment philosophy, they do not seem to have any impact on the company’s governance. This is because they represent so many investors. Thus, it would be impossible to make corporate decisions based on all of their intentions. This leaves some of these companies to do as they please. Although these asset management firms are able to elect board members, they have little to no impact on how the company performs.

Index funds can impact price discovery in the market

Index funds have become the most attractive investment vehicle and will continue to be. However, let’s consider a situation where all investors are solely invested in index funds. This would essentially kill the market. As more inflows would only be used to buy the companies that were already in the index. This creates a situation where price discovery for a particular asset or stock is not dependent on any rational reasoning. Instead, it is mandated by the number of inflows or outflows index funds have.

Passive investing bubble disproportionately affect valuations

We have seen that index funds can also impact the valuations of companies. Solely based on their inclusion or exclusion in a determined index. When a company is included in a particular index, index funds tracking that index are forced to buy that particular stock. This creates a situation where stocks are no longer valued based on their fundamentals. Instead, their valuations are influenced by being in a certain index fund. This also leads us to question if the market value of certain stocks has not been influenced by this more than their business fundamentals.

Dr. Michael Burry has warned about the passive investing bubble

"The bubble in passive investments via ETFs, as well as the trend among asset managers to make very large investments, is orphaning smaller, value-oriented securities around the world," he wrote Bloomberg in an email.

Michael Burry became famous for recognizing the housing bubble in 2008. He also said he is interested in smaller-cap stocks because there is not a "critical mass of active managers looking for small-cap stocks, like me."

Burry became famous for recognizing the housing bubble before the 2008 financial crisis and betting against mortgage-backed securities. The unconventional trade made Burry millions. It was later documented in Michael Lewis’s best-selling book, "The Big Short." The book was later adapted into the 2015 feature film of the same name. In which Christian Bale played Michael Burry. It is among the best stock market and Wall Street movies of all time.

He was one of the first and few to predict the onset of the financial crisis more than a decade ago. Now he believes he has once again identified a market bubble. This time, the passive investing bubble. Just as collateralized debt obligations (CDOs), a financial instrument consisting of safe and risky mortgages, were underestimated ten years ago, so are the huge investments in index funds today.

How can investors and traders take advantage of the passive investing bubble?

There are some ways to take advantage of this passive investing bubble. On one hand, there are already systems in place that consistently take advantage of these extreme index fund inflows. There are high-frequency trading strategies that take into account the balancing of different index funds. By knowing exactly how stock price movements could affect the rebalancing of index funds. Algos are able to buy and sell securities in a consistent and profitable manner.

For investors, this overreliance on index funds presents other opportunities. If you are willing to look beyond the traditional large caps, there are several small-cap stocks that are extremely interesting. These stocks also tend to have very attractive valuations. Since active funds have seen outflows over the last decade, the number of fund managers looking for these particular stocks has decreased. This creates an opportunity for investors willing to research and analyze these companies.

Image source: Chase