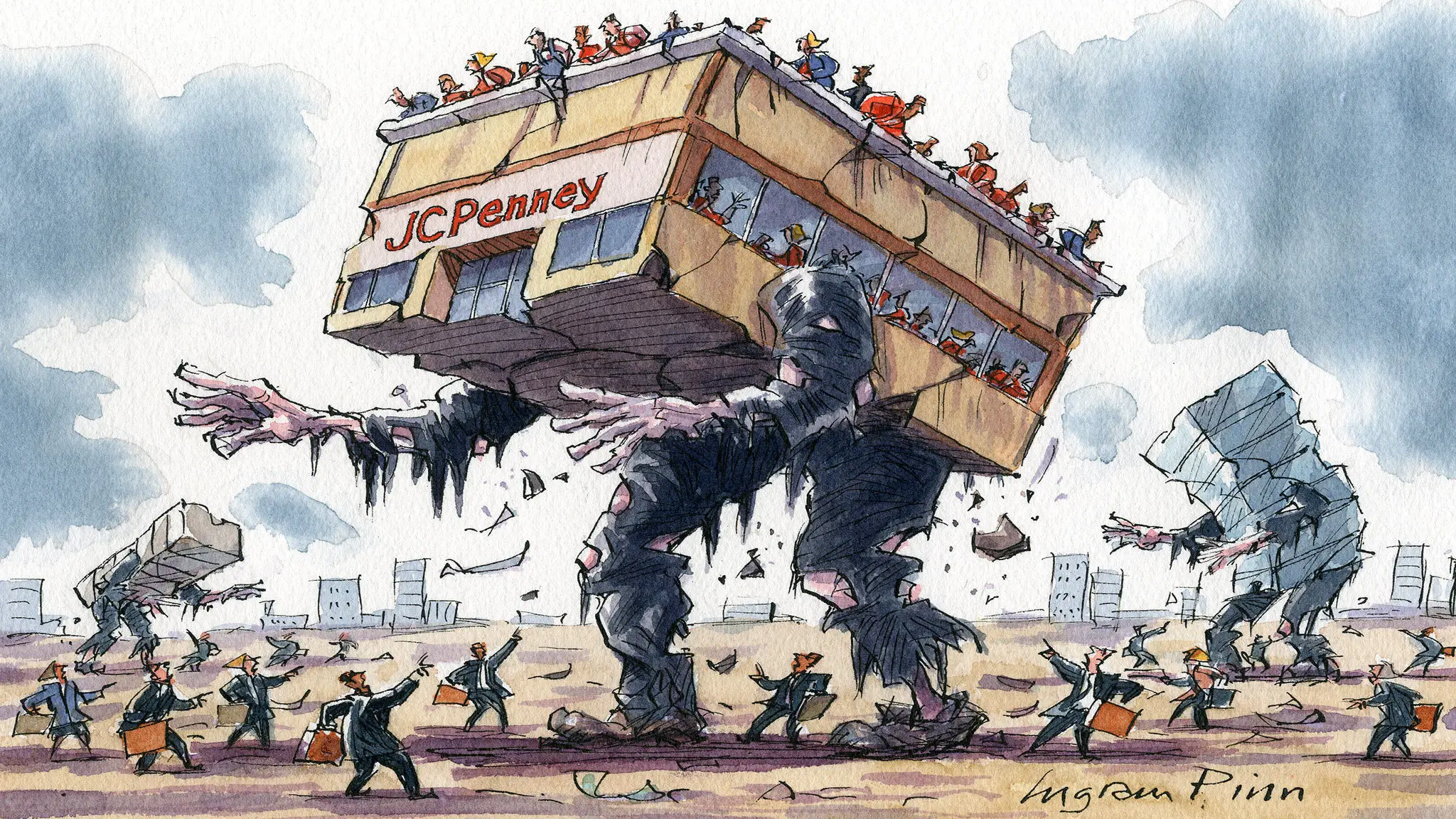

Zombies are a work of fiction. They are living corpses. You may have seen them on popular tv shows or movies, but what you don’t know is that they can be real, well figuratively. So what are zombie companies after all? A zombie company is a company with a large debt pile, that is only able to pay the interest on the debt, and sometimes not even that.

Just in the US, it is estimated that zombie companies have $2.6 trillion in debt. There are over 600 US companies that are in fact zombie companies. These entities are barely surviving, and are a dead weight on the economy. Slowing down GDP growth, and negatively impacting the economic system. The fact that interest rates in many countries across the world have been at historic low levels has fostered some of these companies.

A little bite of history

The term “zombie company” has been widely used ever since it emerged in Japan in 1990. It happened during the time when Japanese firms supported by Japanese banks stopped profiting because they had to pay interest from bank loans. This time was also known as the “Lost Decade” after the collapse of the Japanese asset price bubble. The bubble was caused by the fast rise of asset prices and stock markets.

What turns a company into a zombie?

A company becomes a zombie when it is weighed down with immense debts. It is only able to generate enough money to pay interest on its debts, and sometimes it is not even able to pay the interest. Therefore, it is incapable of expanding, has no capital growth. This makes it vulnerable to market changes such as sudden changes in business and economic dynamics. These entities are unable to invest and grow, eventually leading to insolvency and bankruptcy.

Why do zombie companies exist?

There are a few reasons that explain the existence of zombie companies, and it is important to understand the macroeconomic scenario we are living in. One of the factors that have most contributed to the proliferation of zombie companies, not only in the US but around the globe is low-interest rates.

Low cost of capital

The low-interest-rate environment has lowered the cost of capital for most companies around the world. This helps zombie companies to lower their interest payments, and extend the maturity on their debts. It has also allowed these companies to refinance their debts, sometimes at even lower rates.

Low rates have been the main driver behind the surge in the number of companies that are deemed as zombies. It has also greatly influenced the pile of debt these entities have accumulated over the years. Some lenders may also be forced to loan more money to zombie companies, fearing their initial loans might not be repaid in the future.

Conversely, the greatest risk surrounding zombie companies is high-interest rates. As higher interest rates will increase the amount of interest the company has to pay. Putting it at risk of default.

Other factors that explain the existence of zombie companies

Although low-interest rates are the main reason why these entities have been able to survive over the past. There are a number of reasons that explain how these entities reached this point. These may include:

- Inadequate accounting or human resource management.

- Increase of expenses without substantial profit.

- Increasing prices of goods and services.

- Lack of innovation and market study.

- Poor business strategy and inefficient management.

- Incapability to assess a situation and act quickly to resolve an issue.

- Depleting economy due to unforeseen events like the coronavirus pandemic.

Problems zombie companies face

High-interest rates

One of the major concerns of a zombie company is high-interest rates. As long as their debts have a variable interest. If interest rates reach a certain point, they might push the company into bankruptcy. They also squeeze the company out of their profits.

Increasing expenses

Another critical problem for these zombie companies is when expenses start rising. The increasing prices of goods, services, and expenses make it harder for zombies to maintain their profit margins. Thus diminishing their profits, and putting additional pressure on the company’s financials. Because they are not profiting, they cannot afford these increased prices and expenses, especially if it keeps getting more and more expensive.

A few goods, services, and expenses that make zombie companies incapable of profiting are:

- Raw materials

- Fuel

- Employees

- Maintenance

- Rent

The prices of these expenses are always fluctuating, so it is much more difficult for zombie companies to adapt, and regain profitability.

Bad management and zombie companies

Another reason why companies become zombies is because of bad management. This is when the company does not know how to innovate its business model. While incapable of offering new products and services, the business slowly enters into decay. Management plays a vital role in determining the future outlook of every company. Inefficient management will turn every great business into a zombie company.

There are a few key areas where management might be negatively influencing operations. Areas like business strategy or marketing and advertising, are of the utmost importance to the company’s success. Keeping up with consumer preferences, and being able to offer products and services demanded by their target audience is also crucial.

Coronavirus pandemic and zombie companies

The Coronavirus pandemic had an immensely huge impact on the economy. The global economy has drastically slowed down and sales decreased across most industries. This situation has put additional pressure on multiple companies across several industries. It has been particularly felt in the companies’ ability to generate profits and reduced productivity across the board. In turn, this has increased the number of zombie companies significantly.

What keeps zombie companies operating?

As we have seen, interest rates are the determining factor of survival for these zombie companies. To some extent, some economists, and experts attribute the existence of zombie companies to the Federal Reserve. During the coronavirus outbreak, the FED took an accommodative stance. Lowering interest rates and buying securities. This has extended the life support of some of these zombie entities into perpetuity.

Why are zombie companies an issue?

Although this is a highly debatable topic, some economists view this as a never-ending situation. Some of these companies will never be able to turn around their financial situation. They end up dragging along, and ultimately hurt the economy. An often disregarded quote that explains this situation in a succinct manner is attributed to Frank Borman. Frank Borman is known for being the CEO of Eastern Airlines, aiding the company to avoid bankruptcy.

"Capitalism without bankruptcy is like Christianity without hell" - Frank Borman

Zombie companies also prevent new companies from being created. This with the help of the government sustaining these entities could be a combination of deadly factors with a deeply adverse effect on the economy. At the same time capital is not used efficiently in the hands of these corporations. Creating inefficiency across several economies worldwide.

Prevent your company from turning into a zombie company

Although there are a few ways you can turn around a zombie company, the best solution is always prevention. Being able to avoid the factors that can lead to your company becoming a zombie company is the best approach. However, if your organization is now a zombie it is not too late. Here are a few methods to help prevent your company from turning into a zombie.

Invoice financing

Invoice financing allows a company to borrow money even if their customers have not yet paid in full. This increases liquidity and might improve the cash flow generation. The company will also be able to pay for expenses and reinvest its capital even before it gets paid. This is a fairly simple solution that might help to improve the financial situation of your company tremendously.

Debt refinance and asset refinance

Another way of improving the financial well-being of your company is to refinance your outstanding debt. This could lower your interest payments and extend the maturity of the loans.

You may also want to consider asset refinance. Asset refinance is a secured loan using your business’s assets. These assets are used as a kind of collateral, and ease the process of raising capital, since the lender has guaranteed collateral in case of default.

Crowdfunding and peer to peer lending

As your company’s financials deteriorate your cost of capital will increase, to a point where banks and traditional lenders do not want to deal with you. However, there are still alternative ways of financing your business.

Crowdfunding is a good way to raise money from a group of people who want to sustain your company and provide financial aid. They might serve as a last resort in case your company is struggling to raise capital. Another solution you may want to consider is peer-to-peer lending. Instead of borrowing money from an institution sometimes it is fairly easier to raise it from certain individuals. There are a number of online platforms for crowdfunding and peer-to-peer lending services.

Other things to consider

To prevent your company from becoming a zombie corporation you should always focus on decreasing the debt. At the same time focusing on improving cash flow. Lastly, asset sales should also be considered. The capital can be used to lower the debt and improve cash flow generation. It is always wise to try and prevent this situation from happening than to actually correct it.

Image source: FT