With the growing concerns over the sustainability of our planet, companies are increasingly changing the way they operate. This is reflected in the ESG trend which seems to be taking over financial markets. While companies implement changes to meet their ESG standards a new trend in the bond market has emerged - sustainability bonds.

What are sustainability bonds and how it works

Sustainability bonds are a type of fixed income instrument that is used by companies and public entities to raise capital in a sustainable way. Sustainability bonds signal to investors that the capital raised will be used in a sustainable way, by companies or entities that promote environmental and social causes, and that have an overall net positive impact on the world.

While social and green bonds have been popular over the last few years, sustainability bonds comprise both social and green goals. Sustainability bonds are also a way for companies to raise money for different sustainable projects. Allowing companies that promote environmental and social values easier access to financing.

What is the size of the sustainable bond market?

Although sustainability bonds are a relatively new debt instrument that aims to promote sustainability, these bonds were expected to reach $650B by 2021. The sustainable finance market increased by roughly 10 times in 2020, compared with 2019.

The trend should continue over the coming years, as more and more companies have more sustainable goals, and as investors decide to be increasingly more careful when picking which financial instruments to invest in. Since the first issuance of a green bond by the World Bank in 2008, investors and the fixed income market are increasingly more receptive to green, social and sustainable bonds.

Investors are also more concerned with how their capital impacts the world around them, and instead of focusing solely on the returns of their investments, they also look at the consequences of their investments.

Sustainability bond requirements

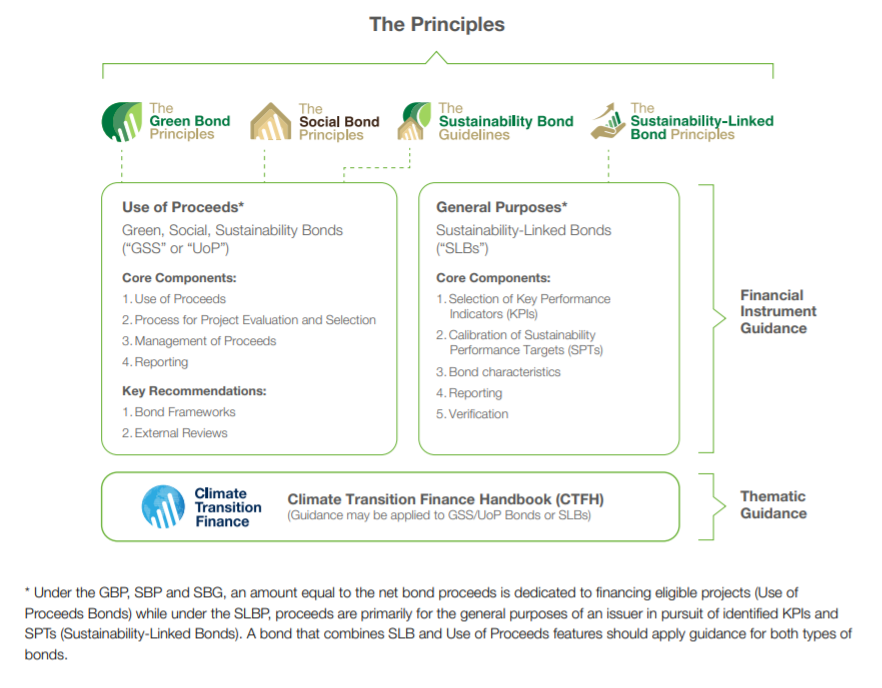

There are a few features that define whether a bond is eligible to be considered a sustainability bond. The International Capital Market Association (ICMA) determines the guidelines for sustainability bonds. The Social Bond Principles (SBP), as well as the Green Bond Principles (GBP), are divided into two components - the use of the proceeds, and general purposes.

Source: ICMA

Source: ICMA

Use of the proceeds

One of the most important requirements that sustainability and green bonds have to meet is how the capital is going to be used. There is a specific process in which each bond is analyzed based on how the proceeds will be used, and are selected based on that. ICMA also evaluates how the capital is managed and how it is reported.

General purposes

To be able to analyze whether the proceeds and the project are in line with expectations ICMA defines KPIs to track how the money is used. Companies will have to follow ICMA’s guidelines, in order to achieve the established KPIs. This is a way of controlling how companies are using the proceeds, and how efficient they are in their investments. Along with ICMA, companies set out sustainability performance targets that should be met.

There are also some more general aspects that are taken into consideration, like the bond characteristics. Reporting is also important so that ICMA could monitor whether companies report truthful metrics.

Projects funded by sustainability bonds

There are several projects or entities that are eligible to issue sustainability bonds. These projects might try to mitigate food insecurity or affordable housing for lower-income families. It can also be environment-friendly infrastructure, or research and development projects that have the goal of having a positive social and environmental impact.

How to invest in sustainability bonds

There are two main ways of investing in sustainability bonds - buying individual bonds or investing in a sustainable bond fund.

For most investors, the best option will be to invest in a fund that holds different sustainable bonds, or even social and green bonds. This allows your investment to be diversified and not be dependent on a single project or company.

Here are some of the most popular sustainable bond funds:

Keep in mind that some of these funds are not available for retail investors, and for that reason, you might have to invest in ESG bond funds, which are slightly different, and may comprise social, green, and sustainable bonds.

Sustainability bonds vs green bonds vs social bonds

Investors looking to add sustainable bonds to their portfolio should also consider the difference between sustainable, green, and social bonds.

Green bonds fund companies, entities, and projects that aim to make environmentally friendly investments.

Social bonds are fixed-income instruments with the goal of having a positive social impact.

Sustainability bonds combine both green and social bonds, in the sense that the capital is used for projects, companies, and entities that have a positive impact socially and on the environment.

Should you invest in sustainability bonds?

If you are an investor that is concerned with sustainability, and the future of the planet, as well as the positive impact of your investment portfolio, sustainability bonds are certainly an investment vehicle to consider. These bonds target conscious, and responsible investors who, above all are interested in having a positive impact on humanity. It allows you to combine both your investment goals, with your desire to help and improve life for all of us.

Conclusion

Financial markets are constantly changing, and the new generation of investors is increasingly more concerned about how their investments impact the real world. This shift towards environmental and sustainability-friendly investment vehicles is set to perdure for the years ahead. It will continue to change the way investors view both stocks and bonds.

Sustainability bonds allow you to invest with social responsibility and generate a return while having a positive environmental and social impact.