As markets reach new all-time highs, boosted by the rise of the retail investor and meme stocks. Valuations are extremely high and markets display a great deal of foolish behavior. High valuations imply an extremely good outlook on the economy and future business prospects. The reality is far from it. Investors caught up in this frenzy of speculation, may soon discover that valuations are extremely important. That is why dividend growth investing is such an interesting investment approach.

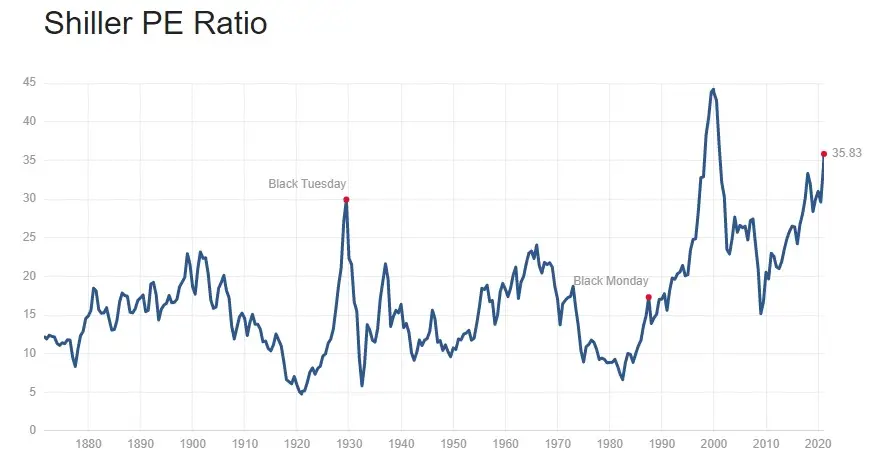

The Shiller price-to-earnings ratio is one of the best indicators to assess market valuations. It takes into consideration the earnings in the past 10 years and gives a better perspective than the current price-to-earnings ratio of the market. Only during the dot-com bubble were valuations at such high levels.

The rise of the retail investor

Everyone is a day trader now. The ease with which unsophisticated investors can get permission to trade incredibly speculative instruments such as options. Without understanding them clearly is a sign that we are near a market top. Investors should consider a multitude of things before investing. Unfortunately, most retail investors are jumping on the bandwagon without the necessary due diligence.

The carnage is going to be brutal, once the market starts crumbling down. Greed takes some time to spread, among individuals. Fear and panic spread a lot faster. Not only that but most of these investors are holding stocks, for a short period of time. This leads me to believe that when the market starts selling off, most people will run to the exit - clogging it.

There are many young people starting investing during this speculative period. It is extremely unfortunate, mostly because if things turn sour they might develop a complete aversion to markets altogether. Most of these investors will associate markets and investing with this speculative experience they have had. They are not prepared to deal with a bear market and to see their holdings' prices collapsing. They might be deterred from investing in the future, which is a shame. The markets are a great way for everyone to invest and compound their money.

Emphasis on short-term performance

This over importance that the short-term performance of a given stock might have is clouding the notion of what investing is all about - Slowly compounding your money. Which is reinforced by the noteworthy returns some investors are able to achieve in the short-term, taking extreme amounts of risk. It should be noted that returns should not be measured and compared in a simple way. Returns are always subject to the amount of risk required to achieve them.

There is no point in arguing with these extremely confident retail investors. The way most of them think and share their ideas is as if the market can only go up. Which could not be further away from the truth. This self-perceived confidence aids them in taking increasingly more risks and speculative bets. Which may ultimately cause a lot of pain, and force them to lose their capital. It is of the utmost importance that investors try to avoid these common mistakes.

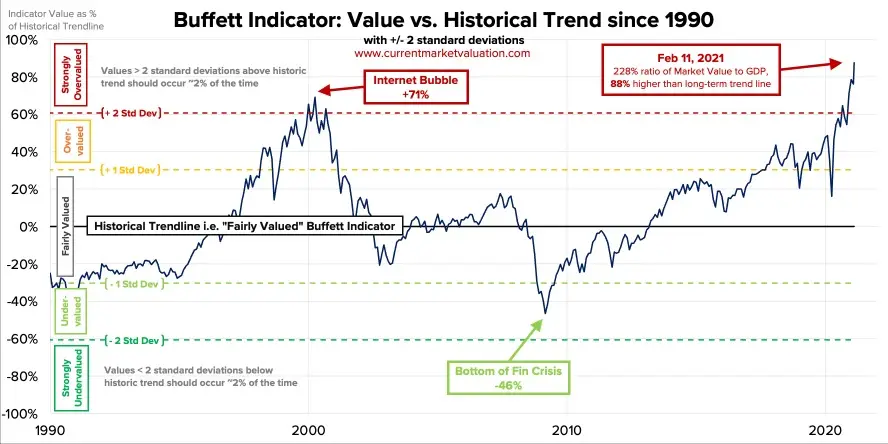

The famous Buffet indicator which is nothing more than a ratio between the total US stock market valuation to GDP is also signaling trouble ahead. Given the decrease in GDP, a consequence of the forced lockdowns, it is wise to invest carefully during this extreme period.

Dividend growth investing for the long-term

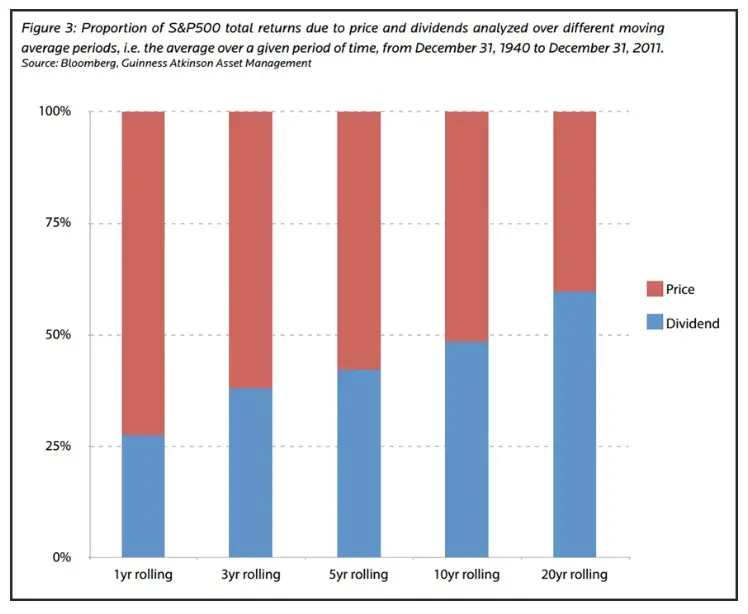

Investing is not about what will happen tomorrow or a week from now. It is about what will happen years from now. Underestimating how difficult it is to guess what will happen in a day or weeks could be a costly mistake. It is fairly more accessible to envision what will happen within a few years. Another fact most investors are unaware of is the fact that most of the returns the market provides in the long-term are in the form of dividends.

If you start investing today, you are probably going to do it for a long span of time. Perhaps for over 20 years. Over 50% of the returns over such a long time frame come in the form of dividends. This is why it is crucial to focus on dividend growth stocks, rather than the hottest stock around.

Dividend Growth Investing

Dividend growth investing offers a very compelling value proposition. Mainly because the income generated from your initial investment is always growing. Some stocks manage to increase their dividend for decades. This ensures that over the long term your portfolio will both increase in value and the income it generates. It also relieves you from the stress induced by price fluctuations. Choose a portfolio of outstanding businesses with competitive advantages. This will allow you to sleep much better knowing your dividends are increasing, and your money is slowly compounding.

There are a few investors that manage to achieve outstanding returns in the short term. This is not the norm, for most investors a well-diversified portfolio of dividend aristocrats is a much better option. It offers great upside and very limited downside over a long period of time.

Image source: Fool