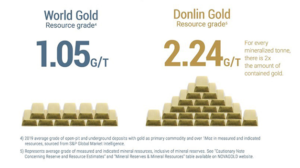

Barrick Gold, Inc (NYSE: GOLD) owns a 50% stake of the Donlin Gold LLC, and NOVAGOLD (NYSE American: NG) owns the remaining 50%. The Donlin Gold Project stands as one of the highest-grade open-pit gold deposits in the world. Not only is it located in a stable Jurisdiction in Alaska, but it also contains very large reserves, estimated at around 39 million ounces. With a resource grade much higher than that of its peers. Federal and State permits have been granted. With the drilling program in the course, construction is expected to start in 2022.

Source: NovaGold

Source: NovaGold

Overview of Donlin Gold

The project is expected to process around 59,000 short tons a day, once it's fully operating. Given the high resource grade the mine has. It is expected to produce an average of 1.3 million Oz over the course of 27 years. Over 1.5 million ounces are expected to be mined in the first five years.

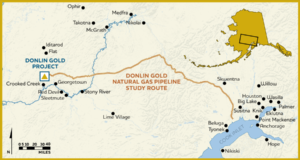

The remote location of the operations and the infrastructure it will need to operate the mine come at a high cost. It is estimated that the mine would require an average load of 157 megawatts to operate. In order to supply that, a natural gas pipeline will be built, providing energy to conduct the operations, being over 312 miles long.

Source: Project Summary

Source: Project Summary

Feasibility Study of Donlin Gold

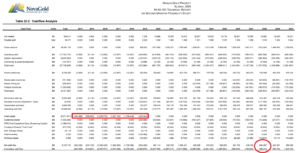

A feasibility study conducted in 2011 concluded that the Project will require a huge initial investment. Estimated at nearly $6.7 billion. The level of accuracy ranges between -15% to +30% of the final costs. Thus, the initial investment could reach $8.71 billion. Given the fact that nearly 10 years have passed since the study was initially published. It is likely that there is a discrepancy between the estimated costs then and today.

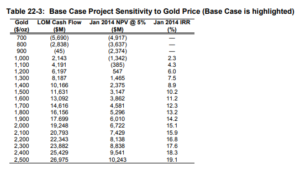

This price was calculated based on the 27 years of life the mine is expected to have. The economic analysis at the time concluded that a gold price of nearly $907/oz would be required in order to break even. Even taking into account the variation of the estimated costs between the 2011 feasibility study and today. The mine is expected to be an extremely profitable operation, considering the current gold prices.

The economic analysis presented in the feasibility study was based on a gold price of $1,200/oz. It is estimated that the Project will only be able to generate a positive cumulative cash flow in the 14th year of operations after construction starts. That coupled with the initial capital required to construct the mine and to start the operations.

This shows that the project can only be completed by a company with a strong financial position. Despite the fact that the current gold price is much higher, and that it positively impacts the estimates for cash flow generation. The mine will take at least 6 years to be net cash flow positive. The feasibility study was conducted roughly 10 years ago and it is expected that the operating costs should be higher today.

Why NovaGold Won’t Benefit as Much as Barrick

NovaGold has not booked any revenues in the last decade, having been able to survive by diluting its shares and promoting its stock price. Except for 2011, the company has been constantly losing money and value for its shareholders. The Donlin Project will be a very capital-intensive endeavor and should take 6 years for the construction to be completed. NovaGold simply does not have the capital or financing ability to commit to it.

Meanwhile, the company currently holds nearly $135 million in cash and has $100 million in receivables, from the sale of the Galore Creek Project to Newmont Mining Corporation (NEM). With the sale, an additional $75 million are contingent upon approval of a plan to construct the mine. Even with the additional $75 million, the company barely has enough cash to get through the second year of construction.

The potential $310 million in cash only represents 65.3% of the required investment in the first 2 years, especially when considering that the capital required in the first 2 years is substantially lower than the remaining 4 years.

Source: Feasibility Study

Source: Feasibility Study

How Barrick Will Increase Its Stake in Donlin Gold

At some point in the future, Barrick will increase its stake in the Project. In order for NovaGold to be able to finance its part of the construction costs. This should be the only way the company will still manage to keep a minority interest while backing the project. Another feasible option would be for Barrick to acquire NovaGold outright. Given the Cash Flow Analysis conducted. It leads us to conclude that NovaGold won’t be in a position where it can keep its 50% interest in the project and still be able to fund it.

According to the Feasibility Study published in 2011, the project reveals an NPV of nearly $7 billion, given the $2000/oz price. This points to nearly 7% of Barrick’s Market Cap, which needs to be taken into account when valuing the company. Since the mine has a life expectancy of 27 years. This represents a very valuable long-term asset that should provide investors with long-term returns. If we take into account Bank of America’s gold price forecast of $3,000/oz, Barrick's 50% stake in Donlin becomes even more attractive.

Source: Feasibility Study

Source: Feasibility Study

Bearish Case For NovaGold

In late May of this year, J Capital released a report titled “The Deposit that will never be mined”, with its bearish thesis on NovaGold. J Capital argued that the high construction costs are underestimated. And how NovaGold’s management has used the deposit to promote its stock price and enrich itself.

The company’s CEO has awarded himself $8.3 million over the course of the last five years. The report also points to the recent insider selling, driven by the stock surge. This has prompted NovaGold to sue J Capital Research. Even if the construction costs are underestimated, J Capital's research makes bogus claims. It claims that the Donlin deposit is not feasible to put into production at any gold price. Which is an exaggeration.

Conclusion on Donlin Gold

Despite being a very attractive asset, especially now that gold prices are surging. The Donlin Project will only unlock value for shareholders of both companies in the medium term. The Drilling process is running, but it was delayed due to COVID-19, and construction is only projected to start in 2022. This means that the production would be expected to start in 2028.

For the long-term investors in Barrick, an asset of this quality is something to keep in mind while valuing the company. As for NovaGold investors, the current financial position of the company will not allow for it to keep its 50% interest in the project. Only through dilution or by overleveraging the balance sheet will the company be able to keep its stake. As well as fund the project, in cooperation with Barrick.

HERE are 8 ways of finding undervalued stocks

We are long GOLD. Read our disclosure.