Chart patterns are patterns rather than price chart movements that are often repeated in the market. Because this is often repeated, traders find it easy to recognize and take advantage of them. It also refers to the Dow Theory principle, where the price will continue to repeat itself. But how can you identify every charting pattern? Using trading patterns cheat sheet, you can keep track of different patterns and use it to identify them in stock charts.

In technical analysis related to chart patterns, traders categorize the 3 types of chart patterns most commonly found in the market. The three types of chart patterns are called reversal chart patterns, continuation chart patterns, and bilateral chart patterns.

What do these three types of chart patterns mean, and what kind of patterns can we find in them? In this article, you will find out the complete chart pattern.

Reversal Chart Pattern

What is a reversal chart pattern? A reversal Chart Pattern is a pattern that gives a signal to market participants that the trend will experience a reversal.

If this pattern appears in an uptrend or downtrend, there is a high possibility that the price will experience a reversal from the previous trend. Then what chart patterns are included in this reversal pattern.

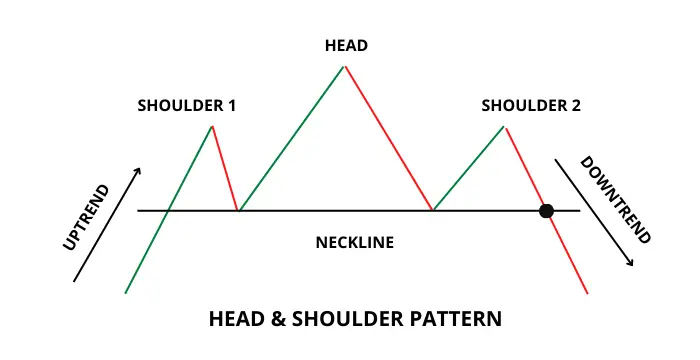

Head And Shoulder

The head and shoulder pattern is a pattern traders will find in a market experiencing a bullish trend. And usually, when this pattern appears, it is bullish at the end of the trend.

To recognize this one pattern, you need to remember that this pattern has a prominent first peak in height, with a third peak not always the same. No less important is knowing the neckline than this pattern because for early confirmation, this pattern is valid if the price breaks the neckline.

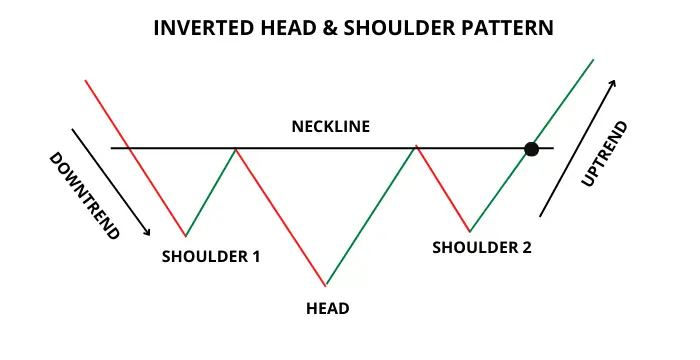

Inverted Head and Shoulders

Almost similar to the head and shoulder pattern, Inverted head and shoulders are a pattern where the price will experience a price reversal, at which time the price is experiencing a bearish trend. Like the head and shoulders, this pattern will usually be found at the end of the trend and will be confirmed as valid after the price manages to get out of its neckline.

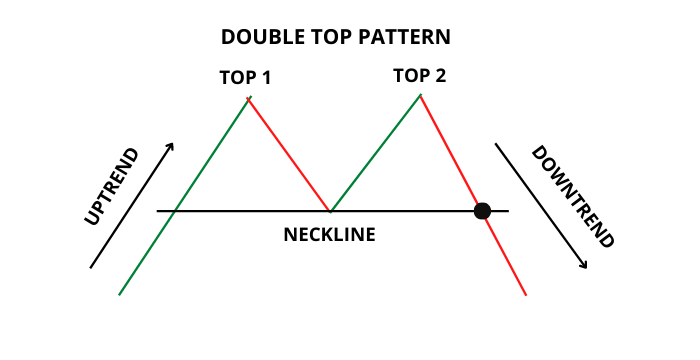

Double Top

The next pattern than the reversal pattern that a trader will most often find is the double top. The signal given by this chart pattern is a bearish reversal. This pattern occurs when the price experiences a retracement or pullback, and then it turns out that on the second attempt, it keeps going up. The cost can still not break through the existing resistance, so two peaks are created.

If the price continues to fall and passes through the valley, which became strong support, then the double top has been successfully confirmed.

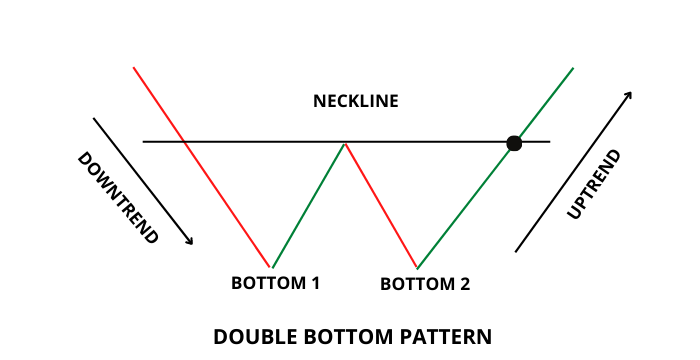

Double Bottom

The double bottom is the opposite chart pattern of the double top; if a double top can be found in a bullish trend, then a double bottom can be found in a bearish trend, which means this chart pattern gives a signal to market participants that there will be a potential bullish reversal if the price managed to break through its neckline.

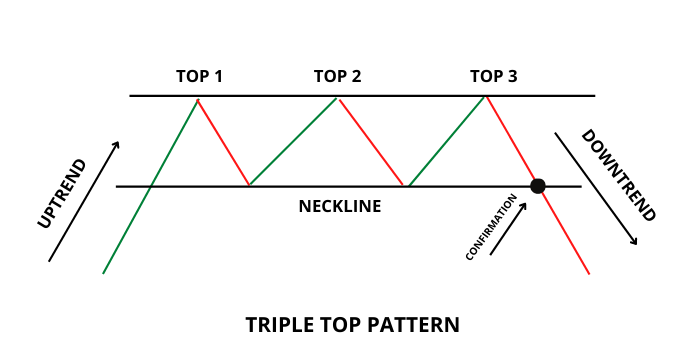

Triple Top

A triple top is a reversal chart pattern that signals that a bearish trend will occur after a prolonged price increase. This pattern is in the form of three peaks whose height is mostly the same because they continue to bounce in the resistance area, where the two valleys of the three peaks will be the pattern's neckline.

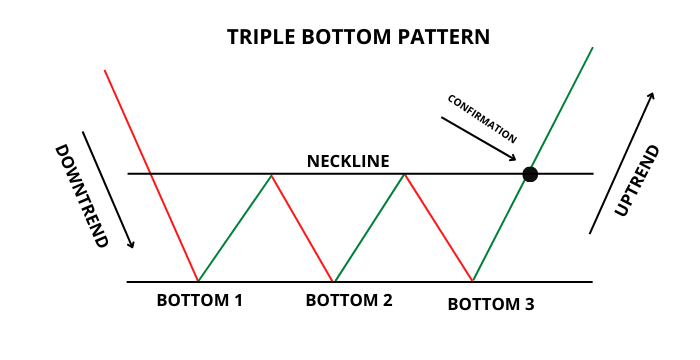

Triple Bottom

Unlike the triple top, this chart pattern did not form three peaks but began with three valleys of similar size because the price continued to bounce at the support area.

And if the price manages to break through the previous two peaks, which is the neckline, this pattern is confirmed, and the potential for a price reversal from bearish to bullish is huge.

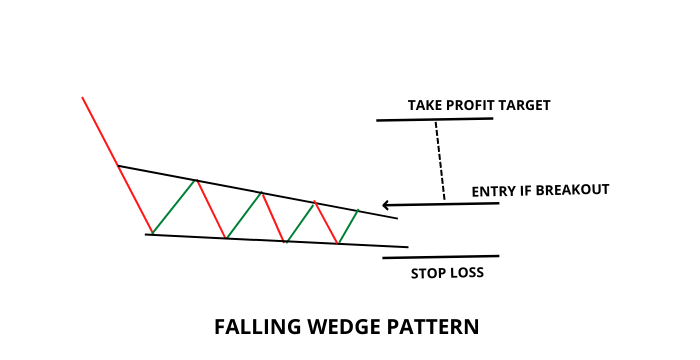

Falling Wedge

In addition to the previously mentioned chart patterns, the wedges pattern has been proven to provide signals with a high probability of actual occurrence. A falling wedge is a reversal pattern that signals that a bullish reversal will occur in the market.

If you see this pattern forming, then be prepared to take a long position, especially if it manages to break through to the top with high volume.

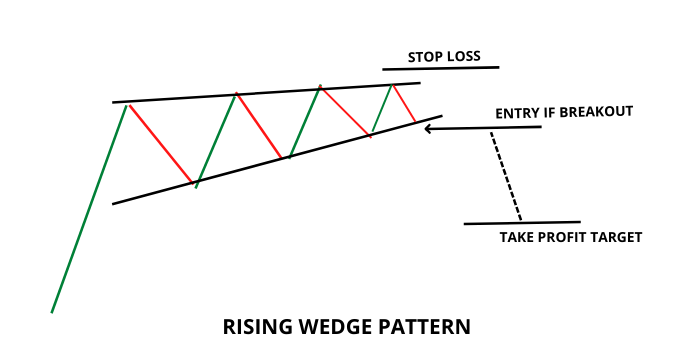

Rising Wedge

The rising Wedge gives a bearish reversal signal, and the rising wedge pattern is also the most common in the market. Just as the name suggests, you can find this pattern in a market experiencing a bullish trend.

At the end of the bullish trend, you will find a consolidation where the pattern looks like it is going up but cannot break through the resistance significantly. When the price manages to break through the support of this pattern, there will be an opportunity for a trader can take advantage of the entry position.

Continuation Chart Pattern

As the name implies, the continuation chart pattern is a collection of patterns which, if they appear, means that the current trend will continue, the initial bullish will remain bullish, and the bearish will continue. Although consolidation or retracement usually occurs in the price, the overall pattern will still indicate the price is continuing.

Here are some of the most common types of patterns to identify in the market:

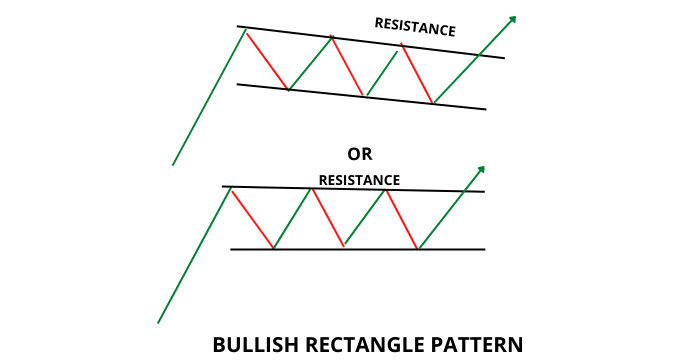

Bullish Rectangle

The bullish rectangle pattern is a pattern that indicates that the bullish trend will continue. You can identify this pattern in a trend that is moving up, then shows consolidation, and then continues its rise. You can open long positions when the price breaks through the

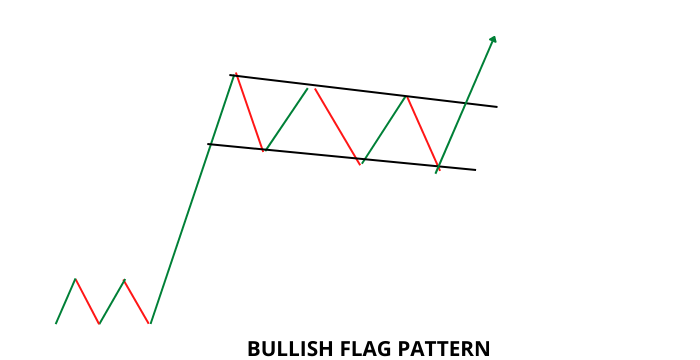

Bullish Flag

If we talk about patterns that are easy to identify, then the flag pattern will fall into that category. A bullish flag is a chart pattern that indicates that the price will continue because this bullish flag occurs in a bullish trend.

If seen from the picture above, this pattern occurs when the price experiences a significant increase (as a pole) and then experiences a retracement (decrease), where this decline will form a small pattern repeatedly and become like a flag, then continue its rise.

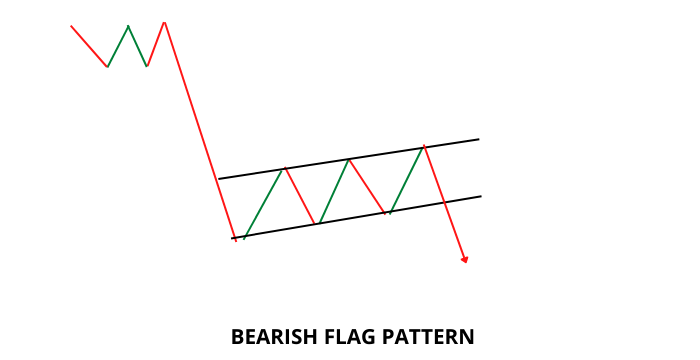

Bearish Flag

Not much different from the bullish flag; this bearish flag signals that the bearish trend will continue. If the bullish flag significantly increases as the pole, then there is usually a deep slump in the bearish flag. Then if we pull the trendline, a consolidation that resembles a flag is formed.

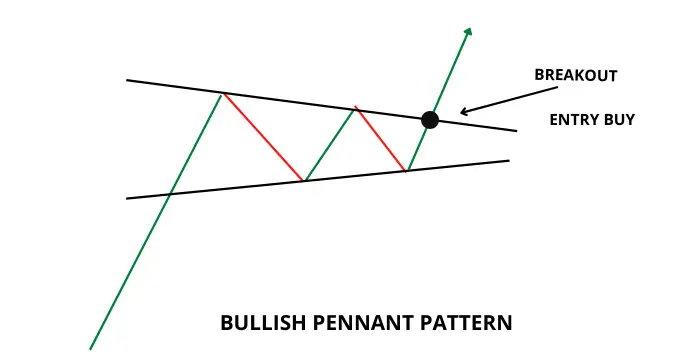

Bullish Pennant

This bullish pennant pattern combines the characteristics of the two previous patterns, namely the flag and triangle, where there is an increase that acts as a pole and then forms a high and low in the form of a triangle and tends to point up.

And of course, if you find this pattern, then be prepared because the probability of the trend continuing is huge. You can place a buy order after the price has broken through the trendline, which is the closest resistance.

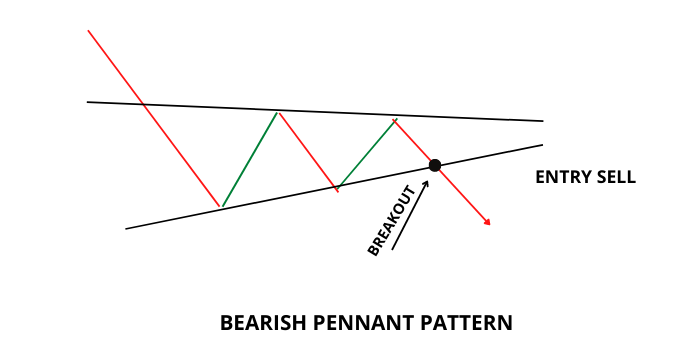

Bearish Pennant

The bearish pennant is quite similar to the bullish pennant, only that you will find it when a bearish trend occurs. The signal is also the same, and the probability is the same. You can consider opening a short position if the price breaks through the lower trendline, which is the strongest support.

Bilateral Chart Pattern

The bilateral chart pattern is a more complicated chart than the previous two types of chart patterns. This is not for no reason, but a bilateral chart pattern provides a two-way signal to traders. Therefore to take advantage of this type of pattern, you have to consider two probabilities that may occur, either an upside breakout or a downside breakout.

For this pattern, you must wait for the price to confirm the breakout first so you don't get stuck with fake signals from the chart pattern.

Then, what kinds of patterns can we find on Bilateral Chart Pattern? Here is the explanation:

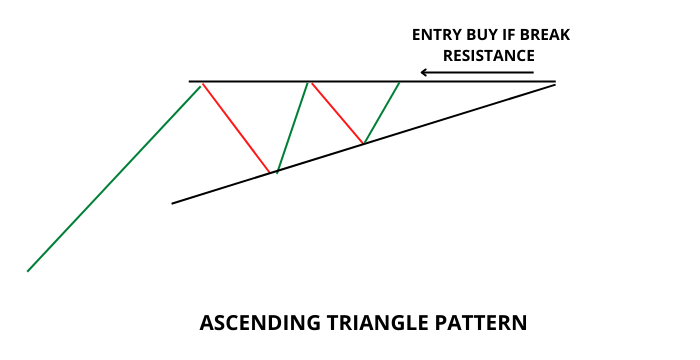

Ascending Triangle

An ascending triangle is marked when the low price decreases or continues to bounce at the trendline resistance, while the high price tends to be stable in the classic resistance area. This pattern will appear in an uptrend experiencing consolidation or sideways, which means that the appearance of this pattern means that two probabilities could occur, namely the trend experiencing a continuation of the trend experiencing a reversal.

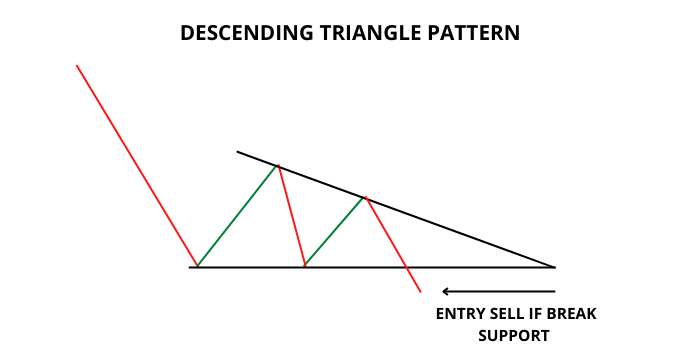

Descending Triangle

You can identify this ascending triangle pattern in a trend that is experiencing a decline. The opposite of the ascending triangle, this pattern has a high price that tends to continue to fall, but the low is more stable in the classic support area.

In a sideways condition like this, it indicates that the strength of the buyers and sellers is weakening, and if the price manages to break through the support, the price will continue its bearish trend. Meanwhile, if the price manages to break through its resistance, the price may change the direction of the trend to become bullish.

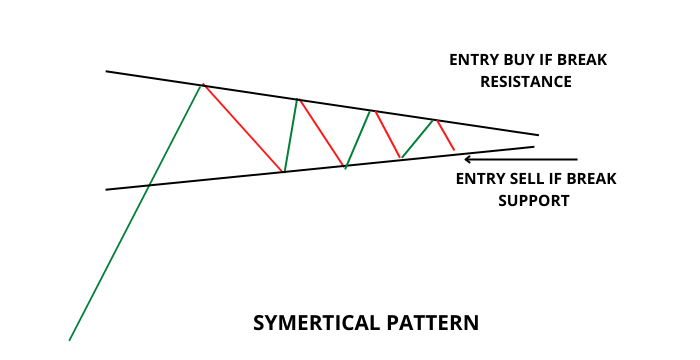

Symmetrical Chart Pattern

A symmetrical Triangle is a price pattern that, when formed from the previous long trend, is either bullish or bearish; you can find this pattern. This pattern is considered by traders as consolidation because, in this pattern, there can be two possibilities that occur. Either he continues the previous price trend or makes a new trend direction.

Because of its characteristic shape, which shows that the high price continues to decline while the low price continues to increase, this pattern will be very easy to identify if we can draw the trendline.

Frequently Asked Questions About Chart Pattern

What Are Trading Patterns?

A trading pattern is a combination of several candlesticks which form a price unit and can be seen on a chart. The combination of these candlesticks forms a pattern where when viewed historically; the price movement has always created a chart repeatedly.

However, even though they are repeated, the price charts provide different information because the price movements differ.

From there, a trader can identify these recurring patterns and profit from them.

Why do Trading Patterns Work?

By using Trading Patterns, you can get many benefits that can provide opportunities in the market, for example:

- After understanding chart patterns, you will not need many additional indicators, your screen will be much cleaner, and you will be trading like professionals.

- It is very easy to find on the charts of any instrument, especially in forex. You can use trendlines, horizontal lines, and similar tools to find chart patterns.

- Perform simple and practical analysis

- It can be used on all time frames

- Changes or forwarding of price direction will be easier to detect.

- Can determine the right time to enter the position so that you can determine the ideal stop loss and take profit.

- The effectiveness of your trading signals will be higher if you combine chart patterns with other indicators or technical analyses.

What Is The Best Pattern For Trading?

No pattern is better than one another. It's just that professional traders advise us to trade with a pattern that we are "confident and comfortable with" what does that mean?

So here you go; of the many patterns described in this article, you should do your research and try to trade using all of these patterns. By doing this, you can compare which patterns provide the highest profit opportunities and which do not, determining the best pattern for you to use.

In addition to the advice above, professional traders usually avoid bilateral patterns because they will usually make charts more difficult to analyze.

If you have found the pattern that you most believe in, even if it's only one, then it's okay. You just open a trading position when you find the pattern. If you have found a pattern that makes you comfortable, that is the best pattern for your version of trading.

What Patterns Should I Look For in Day Trading?

All patterns can be used in all types of trading styles, be it scalping, day trading, swing trading, or position trading. You need to pay attention to the pattern that you think is most likely to make a profit. But if you insist on being more specific, you can use these three patterns as your reference, including the bullish flag, ascending triangle, and other charts with a hammer candle with him.

How do you find trade patterns?

With repeated practice using trend lines, horizontal lines, and various other trading tools, you can find chart patterns very easily and quickly. Trust me; if you've done it often without even needing to draw a trendline or the like, you can identify a pattern.

Are trading patterns profitable?

In conducting technical analysis, from the past until now, two methods are most commonly used by traders, both beginners, and professionals. The first is to use a candlestick pattern to find complete price information, and the second is a chart pattern to identify price movements that keep repeating themselves. These two methods are used not without reason, but people use them because they provide a fairly high percentage of successful profits, especially when combined with other technical indicators.

One of the successful examples is a legendary trader named Jake Bernstein, a psychologist who switched professions to become a trader. When he does his analysis of the market, he usually uses chart patterns along with other techniques.