Many terms are often used in technical analysis, in which traders will be required to understand these basic terms. It's, of course, because a trader must read the price movements that occur and recognize what is happening at a price at that time. When they can't recognize what happened to the current price, they usually won't be able to analyze it further to make a final decision.

On the other hand, if you know these terms, you can get a signal, either to open a trading position, a signal to refrain from opening a trading position or even to close a position.

Several terms are important to know, and we will discuss them in full in this article. Those terms are Pullback, Retracement, and Reversal.

What is Pullback?

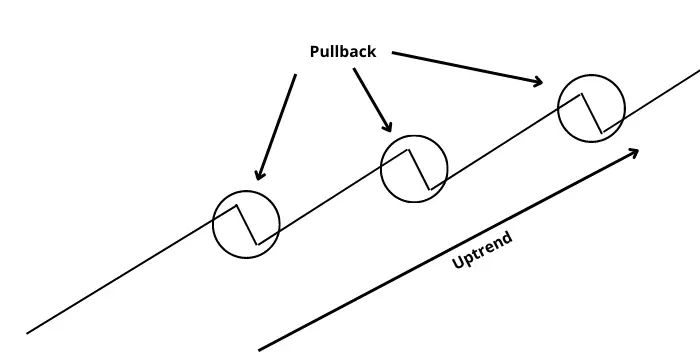

A pullback is a price action where the price will experience a temporary decrease when a fairly strong uptrend occurs.

Because there are slight differences for some people to interpret pullback, you can please consider the following example. Without people realizing it, pullbacks also occur in their daily lives.

For example, suppose a person is playing ping pong in the room, and he throws the ball on the floor so that the ball bounces on impact with the floor.

Then after bouncing, the ball continues to fly until it hits the roof and comes back down; this descending process is called a pullback. It's the same with rising prices but is pulled down again because they collide with resistance; how is the price like a ping pong ball, and resistance is the room's roof.

Keep in mind that there are two types of pullbacks, although the term is often synonymous with a momentary price decline in a bullish trend, a transient increase in a bearish trend can also be called a pullback. But because it is called "pullback," it is often used for movements against a bullish trend.

How To Identify Pullbacks

Then how does an investor identify a pullback? To identify a pullback we must know why the trend is changing. Here are several reasons that can explain why a pullback is happening:

- When the price is in the resistance area, during the bullish trend, the price will move up, and at some point, the price will not be able to break through the resistance and experience a decline to gather energy and try to break through the resistance.

- When there is a clash in the resistance, the resistance manages to hold back the price increase so that the price falls back to gather momentum.

- The supply is greater than the demand or bid; the volume of orders that occur in the pullback area also greatly influences why the pullback can occur and why the price is not able to break through the resistance at that time even though the trend was strong.

After knowing the three things above, you should be able to conclude that our reference in identifying pullbacks is the closest resistance point or area. So that you can understand better, please see the example image below:

In the picture above, META stock is experiencing a strong bullish trend on the daily timeframe. From the beginning of the increase in the $200 price area to the highest point in the $380 price area, the price did not continue to rise, but at some point, it experienced a pullback and then continued its increase.

Remember that a pullback is only a temporary decline in a bullish trend.

What is retracement?

A retracement is a temporary change in price direction that occurs in a much larger trend. The point here is "temporary price reversal"; therefore, a retracement is also called a "correction." and it is quite similar to a pullback.

In general, retracements can occur in a bullish or bearish trend. In a bullish trend, there will be a temporary decline; similarly, in a bearish trend, you will get a temporary increase from the strength of the current price decline, which is the retracement.

How To Identify a Retracement

Like a pullback, traders must know several things in advance to be able to identify a retracement.

- There was an action of profit taking or cut loss by traders, but those who did this were only part of it, aka a minority of traders. While the majority of traders usually still hold their positions, they usually consider that nothing is happening. This resulted in the price instead of experiencing a continuation of the reversal but continuing the trend at that time.

- The price is at its psychological level; this can also lead to a reversal. The decline will only be temporary if the psychological level is only an important resistance or support level.

- It is rare for a certain candle pattern to occur. Usually, there is, but it is a candle pattern that has no significant impact on trend changes.

- Don't have a price pattern. You won't find a price reversal pattern; usually, if the price pattern occurs, there will be a change in the direction of the trend.

The most common and popular method many traders use is the Fibonacci retracement alone. It can also be combined with other indicators such as the Relative Strength Index (RSI), Stochastic, or similar indicators that can help determine which retracements appear.

The following is an example of a picture of a retracement of a bullish trend on the Dow Jones chart:

As you can see, the Dow Jones does not immediately go up like that during a bull run. At one point, the price will reach a certain point and no longer be strong enough to go up. And at that time, there were two possibilities: whether it would happen or just a retracement.

Likewise for the downward trend on the same chart. Dow Jones:

Since January 5, 2022, the Dow Jones has started its bearish trend. And in the bearish trend that is still happening today, the trend doesn't just go down immediately. But at some point, he experienced a fairly short rise and continued declining.

What Is Reversal?

Reversal is a movement in the opposite direction of the price of the previous trend. This change in price direction can occur in an uptrend from a previous downtrend or a downward trend when previously up.

For example, if a stock is currently experiencing an up trend or a bullish trend, and then the price has decreased significantly after that, that is called a bearish reversal. And vice versa, if the stock is in a bearish trend, then there is a change in the direction of the trend to an up, and even then, it is called a bullish reversal.

This reversal can be categorized into two, namely bullish reversal and bearish reversal.

How To Identify a Reversal

Bullish Reversal

The bullish reversal occurs when the price declining (bearish) turns into an increase (bullish). This bullish reversal signals to traders that falling prices will soon rise. What are the characteristics of a bullish reversal?

- Prices experience a downtrend for a long period, usually several days.

- There are reinforcing data such as news that makes market psychology change.

- You can find price patterns and candlesticks as confirmation. Like double bottom, Inverse Head and Shoulder, and many other patterns.

So by looking for the three things above, you can identify the occurrence of a bullish reversal, which you can consider when buying an instrument, whether it's stocks, forex, or crypto.

This bullish reversal confirmation is used by traders as a reference so as not to mistakenly buy a stock or a commodity that is experiencing a decline because there are not a few of them out there who try to purchase at a lower price in the hope that the price will go up, but the price will continue to fall.

Example of a Bullish Reversal

As you can see, the EUR/USD pair above on the weakly timeframe is currently experiencing a downtrend. However, he did not continue the decline after that and instead moved sideways. During this sideways, there was a price reversal pattern that was successfully broken so that the pair experienced an increase.

Even if you look closely, you will find that there was also a candlestick pattern that was formed at that time:

Yes, it was a Hammer candlestick pattern, where after the appearance of the candlestick, the price movement immediately skyrocketed; even a few candlesticks after that were all green (bullish).

Bearish Reversal

The opposite bullish reversal, a bearish reversal, means that prices that previously experienced an increase turn into a decline. The bearish reversal also has characteristics similar to the bullish reversal:

- an uptrend is always the prelude to a bearish reversal.

- First sideways, be it long or short sideways.

- There is a candlestick pattern or price pattern that is formed.

By knowing this, a trader can determine the ideal take profit position. He also uses it if he wants to short positions in futures or the forex market.

Examples of Bearish Reversal

Examples of bearish reversals are still present in the following EUR/USD pair on the daily timeframe:

As you can see, after experiencing an increase, the trend cannot go higher and moves only in certain areas between support and resistance, which is called sideways.

When sideways, the price forms a pattern that indicates that there will be a change in the direction of the trend from the previous up to down. The pattern that appears is a ''double'' top as in the picture above; after the neckline, aka support rather than the double top, is broken, there is a bearish trend.

Conclusion

In closing this article, some questions are often asked by people in general regarding Pullback, Retracement, and Reversal.

Is Pullback Same as Retracement?

These two are like synonyms for a word. Because basically, both refer to the correction of the price direction of the trend that occurs. It's just that traders use these terms interchangeably. But sometimes, pullbacks are also used to describe the retracement of a price that has just broken out.

How do you tell if a pullback is a reversal?

It can be done in several ways if someone wants to distinguish between pullback and reversal. He can use indicators or only pay attention to the two characteristics.

The first to use an indicator, he can use the Fibonacci retracement as a reference. Fibonacci has several numbers called the golden area, which is between the numbers 0.382, 0.5, and 0.618. It would be best if you remembered that a pullback usually would only reach the Fibonacci area of 0.382 and 0.5. If there is a pullback that reaches 0.618, usually, the increase or decrease in the current trend will not last long.

The second way is to examine the characteristics. The characteristics that are the easiest to identify are two: the formation of sideways and the existence of a price pattern. Because these two things usually always go hand in hand before the reversal occurs. You will not find such things as price patterns or sideways movements in pullbacks.

How to Use Pullbacks and Reversals in Trading?

In dealing with pullback and reversal, each trader uses it in different ways. Some use pullbacks to enter so as not to miss the long rally from the current trend; some use pullbacks as a place to add positions to reap even more profits.

Reversals are also widely used to enter positions because this reversal is always synonymous with sideways and price patterns. Therefore many people use it to enter early and get the highest possible profit from the trend.

You must remember to use both in your trading and know in advance how to identify and distinguish them. Knowing all the terms in investing is one way to achieve even greater profits. Because if you understand the various terms that exist, then you can find opportunities in them