Billboards are one of the most interesting businesses around, because they require very little capital to keep the business running, and at the same time provide a steady stream of cash flow. But how to invest in billboards? Do you have to start a billboard advertising company to be able to invest in billboards?

If you are thinking of investing in billboards there are a few different ways you can do so, and today we’ll look at each one as well as the pros and cons of doing so.

Are billboards a good investment in 2022?

Consumer behavior is constantly changing, and advertisers have to constantly adapt in order to acquire customers. While billboards may seem like a fad that has passed, the data shows a growing opportunity with fewer and fewer investors interested in investing in it.

Sure, online advertising has been constantly growing, and it will continue to do so, even using some of the most advanced technologies. Virtual reality advertising is expected to boom over this decade. But until then, outdoor advertising still has a role to play, and marketers are still allocating a good percentage of their budget to outdoor billboards.

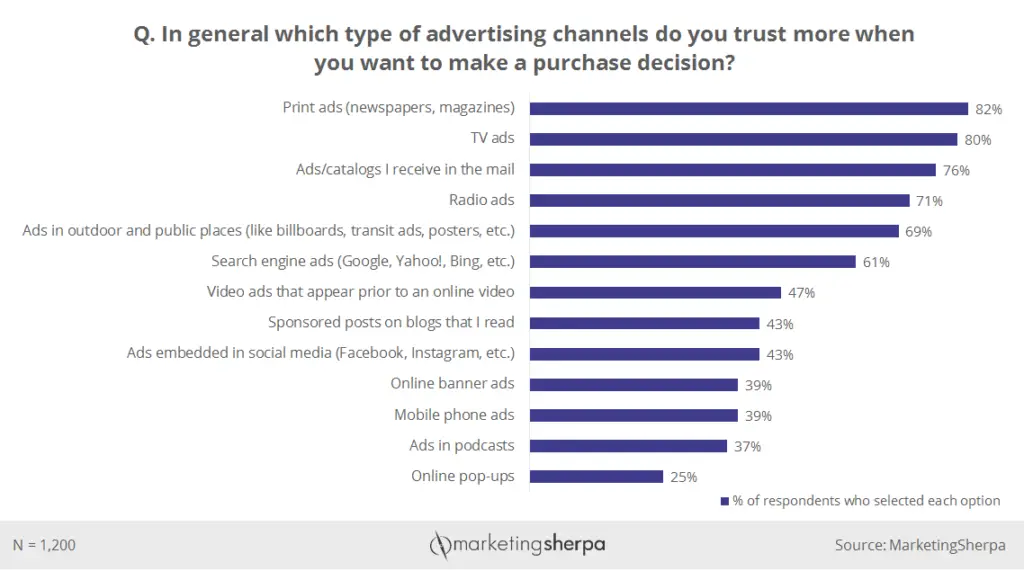

The reason is that even if you cannot track certain consumer metrics with traditional advertising channels, marketers know that consumers still attribute a lot more trust to traditional advertising. In this case, billboard advertising is even seen as more trustworthy than online banner ads.

For that reason, it is important for brands to have an online presence while keeping their offline presence. Companies are also aware of the importance of billboards to build brand awareness and recognition.

Source: Marketing Sherpa

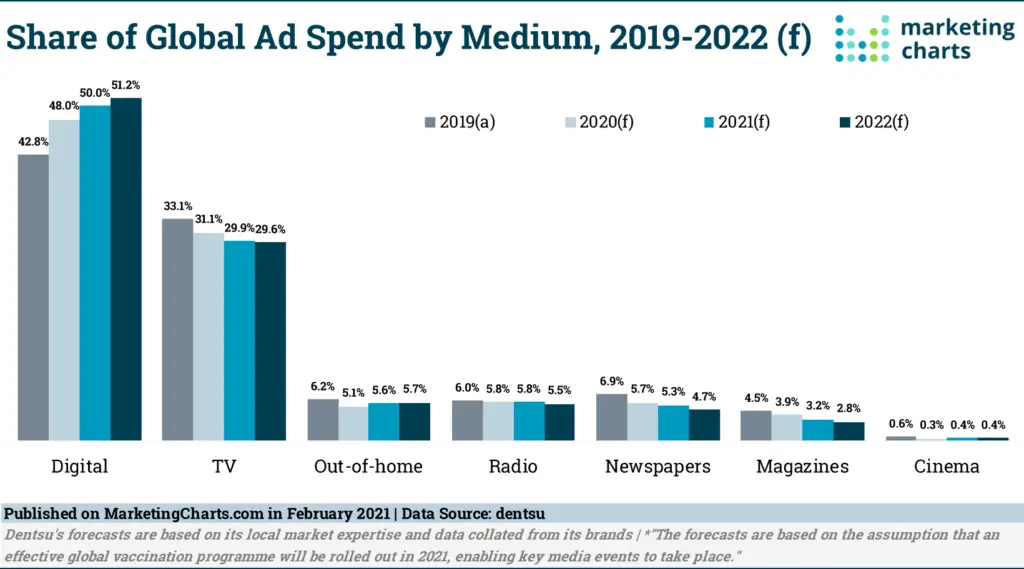

Out-of-home ad spending has been relatively stable, while some of the traditional marketing channels such as magazines, newspapers, and radio have kept declining.

Source: Marketing Charts

Size of the billboard market

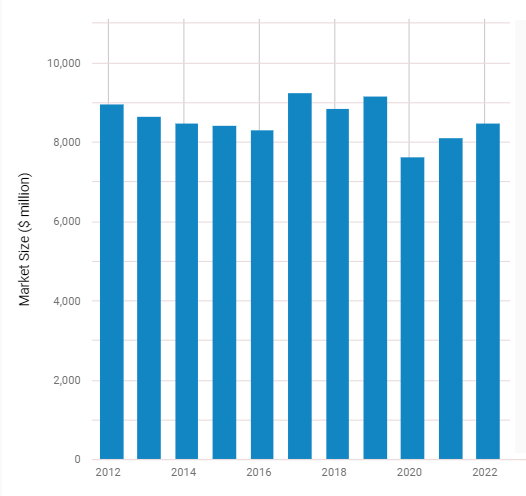

While it may seem like the billboard market has stabilized or it might even decline, that is not right. In most of the developed world, billboards and outdoor advertising have clearly matured. For example, in the US, the billboard contracted by 1.7% since 2017. However, it still has a significant size at $8.5 billion.

US Billboard & Outdoor Advertising Market Size

Source: IBIS World

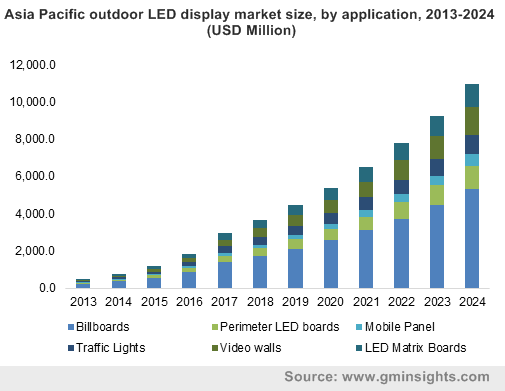

On a global scale, the billboard and outdoor advertising market is actually set to grow from $66.8 billion in 2022 to $87.7 billion in 2026. Most of this growth is expected to come not only from developing countries but also from digital outdoor advertising solutions.

In fact, the Asia Pacific region will be responsible for most of the growth as the market is expected to increase by roughly 50%.

Why billboards are a great investment

There are a few reasons that make billboards such an attractive investment, such as:

- Steady cash flows

- Minimal CAPEX required

- Large gross margins

Steady cash flows

One of the main advantages of investing in billboards is that they generate steady cash flows. Companies will make regular payments in order to keep advertising, and this reduces the need to have a strong sales team.

Minimal CAPEX required

The capital required to keep the business is very low because once you lease the land, or buy it, and place the billboard all you need to do is to replace it or renovate it. This means that the business does not require constant investment, and the cash flow can be used to acquire or lease more land and growth the company.

Large gross margins

Gross margins in the billboard business are also extremely attractive, with some of the most coveted locations earning 50% to 60%. This makes it an extremely attractive business to own, because not only does it have great margins but also does not require a lot of spending.

3 Ways to invest in billboards

Here are the 3 main ways you can invest in billboards:

- Start your own billboard advertising company

- Invest or acquire a private billboard company

- Invest in billboard stocks

1. Start your own billboard advertising company

One of the simplest ways to invest in billboards is to start your own billboard advertising company. You’ll have to go out and find locations that you can either lease or buy and set up the billboard structure, and approach companies to advertise. You may also approach other companies to buy or lease billboards from them, and then rent them to companies that want to advertise.

Starting your own company is always challenging, especially in this highly competitive area. Obviously, the potential profits are too good to pass, but it will be difficult to get the best locations that have already been bought, and you will also need to have some capital and a few employees.

2. Invest or acquire a private billboard company

Another option that does not involve creating a company from scratch is to acquire a stake or buy a billboard business. If you are looking to invest in private billboard companies, you may approach them, and ask if they would be interested in investment.

You can also look for companies in the sector that are distressed, or whose owners may be interested in selling. The key step when investing or buying private companies is to make sure you follow a strict due diligence process, to avoid making any mistakes.

3. Invest in billboard stocks

For investors that are not willing to put that much time and effort into starting a company or investing in a private one, you can simply invest in billboard stocks. There are plenty of publicly-traded billboard companies that you can invest in.

Here are some of the best billboard stocks you can consider investing in:

| North American billboard stocks: |

| Lamar Advertising (NASDAQ: LAMR) |

| Outfront Media (NYSE: OUT) |

| Clear Channel Outdoor (NYSE: CCO) |

| Boston Omaha (NYSE: BOC) |

| European billboard stocks: |

| JCDecaux SA (OTC: JCDXF) |

| Ströer (XETRA: SAX) |

| APG SGA SA (SW: APGN) |

| Asia Pacific billboard stocks: |

| Asiaray Media Group(HKG: 1993) |

| Focus Media (SHE: 002027) |

| oOh!Media Ltd (ASX: OML) |

Conclusion

Considering all the options, the best solution for most investors is to choose a publicly-traded company and invest in it. Some of the companies available on the list are very large and dominate their local markets. Some of them like Boston Omaha, which is run by Warren Buffett’s nephew and is a holding company with investments in different sectors. It is a way to get some exposure to the billboard business while management looks for ways to allocate capital.

Some of the Asian billboard stocks on the list are also extremely attractive due to the expected growth over the coming decade.