Insider trading is a line that any investor should not cross. In a system that relies so much on trust between companies and investors, using confidential information about businesses to one’s own advantage is illegal. Many have been convicted of cheating their way to the top throughout the years.

From notorious individuals such as Albert Wiggin and Martha Stewart, the financial world has seen its fair share of respectable personalities who wasted their legacies on an insatiable desire for more money. According to research, only 15% of insider traders are caught in the United States alone.

The problem of insider trading spreads across all levels, from the top brass down to average employees, taking advantage of sensitive knowledge in order to get ahead of the market is a sinister act that swindles fair-playing markets, and takes advantage of retail investors.

Top 20 Largest Insider Trading Scandals

20. Martha Stewart

In the year 2001, the hit television celebrity Martha Stewart was investigated for selling $228,000 worth of shares that she had invested in the biopharmaceutical company ImClone.

Stewart sold her shares a day after her friend Sam Waksal, the CEO of ImClone at the time, tipped her of an impending drop in value that ImClone was about to experience after its new drug Erbitux failed to pass the Food and Drug Administration's approval process.

Waksal had given the same advice to sell their stocks in the company to his family members as well in advance before the news was broken out to the public. Martha Stewart ended up spending five months in prison.

19. Art Samberg

Art Samberg, the former CEO of Pequot Capital, was caught red-handed in a thread of emails where he asked Microsoft employee David Zilkha for any insider information that he might have that could help Samberg in making the safe decisions in the stocks he had with the tech company — he earned a total of $2.1 million from engaging in unfair practices.

Besides Pequot permanently closing down in 2009, Samberg was also demanded to pay $28 million by the Securities and Exchange Commission for damages.

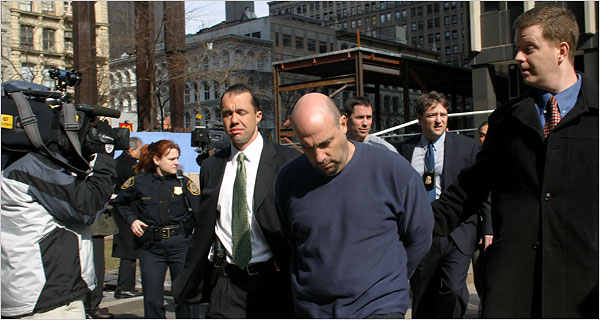

18. Joseph Nacchio

Joseph Nacchio, a former top executive of the telecom company Qwest Communications, was sued by the SEC for engaging in insider trading. During his time as the chief of the company, Nacchio had purposely deceived Wall Street traders by announcing that the company would be expecting huge profits — when in reality, it was not.

He had sold $50 million of his shares with Qwest after learning that the company’s value will soon drop based on insider knowledge that he acquired. Nacchio was charged with 42 counts of insider trading and was found guilty on 19.

17. Mitchel Guttenberg, Erik Franklin, David Tavdy Controversy

Amounting to around $15 million, the insider trading scheme that was concocted by Mitchel Guttenberg, Erik Franklin, and David Tavdy was one for the books. Gutenberg, who worked as a director in the Swiss bank UBS, had tipped hedge fund managers and traders of the rise and fall of stock values in companies such as CVS and Allstate even before knowledge behind it was made public.

Among these tipped entities, Erik Franklin and David Tavdy were known to be Guttenberg’s biggest partners — the two paid Guttenburg thousands of dollars for the information he had.

16. Raj Rajaratnam

Raj Rajaratnam’s success story began with his immigration to the United States from Sri Lanka and reached its peak when he became a billionaire from the success he had with the Galleon Group hedge fund that he founded.

However, his legacy would ultimately be destroyed after it was found that Rajaratnam had taken advantage of secret information he had on public companies to earn profits reaching up to $60 million. He was sentenced to 11 years in prison and was ordered a variety of penalties reaching up to $150 million.

15. James McDermott Jr.

James McDermott Jr., the former CEO of the investment firm Keefe, Bruyette & Woods, was found guilty of leaking insider information on at least five incoming mergers to his mistress, a Canadian adult film actress named Kathryn Gannon.

Using the tips to her advantage, Gannon had raked in a total of $80,000 from her investments. McDermott was eventually arrested and found guilty on a count of insider trading.

14. Steven A. Cohen

Steven Cohen had established one of the most successful firms on Wall Street, SAC Capital. However, as the company grew in size, controlling the entire operations of the business proved to be a more difficult task for Cohen than was expected.

Officials of SAC such as Michael Steinberg and Mathew Martoma were found guilty of engaging in insider trading after using secret information to guide their investments. Cohen was eventually charged with failing to supervise his officials and SAC was penalized with fines totaling up to $2 billion.

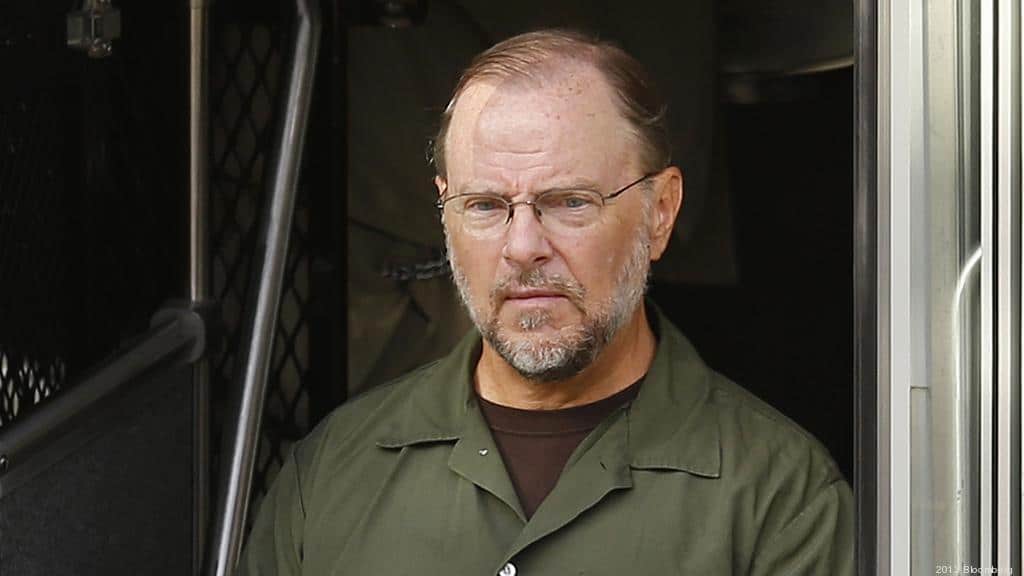

13. Chip Skowron

Yves Benhamou, a French doctor, was found guilty of tipping Chip Skowron — the CEO of hedge fund FrontPoint — about the failed trials of a hepatitis drug that the company Benhamou was working for.

The insider information provided by Benhamou allowed Skowron to save around $30 million in losses and gain $6 million in profits.

12. Wyly Brothers

The billionaire brothers Sam and Charles Wyly were investigated by the Securities and Exchange Commission after allegations had sprung up that the brothers gained over $31.7 million in profits after engaging in shady transactions involving Sterling Software — which they partially owned.

The bets that they had made against the company before deciding to sell it were described as being “massive and bullish” which indicated signs of insider trading occurring.

11. Scott London and Bryan Shaw

Scott London, who was known as a top executive in one of the biggest accounting firms, KPMG, had lived a relatively safe life. However, things would take a turn for the worse after he had provided insider information to his golfing friend Bryan Shaw to help him out with his financial struggles.

Shaw had gained a total of $1.27 million in profits while London received expensive gifts in return. London was sentenced to 14 months in prison and Shaw received a reduced sentence after cooperating with authorities.

10. Eugene Plotkin and David Pajcin

Eugene Plotkin and David Pajcin were involved in many cases of insider trading. But all of them were primarily conducted using the influence that Pajcin had as a major trader. Plotkin and Pajcin were both working for the banking firm Goldman Sachs.

The duo had attempted several insider trading schemes such as joining forces with an employee of the investment firm Merril Lynch and paying someone to work for BusinessWeek’s printing plants in order to snatch a copy of magazines before they were released.

Their biggest scheme involved the companies Adidas and Reebok where they gained huge profits from. Pajcin received the biggest penalty which was estimated up to $28 million.

9. Brian Callahan and William Jackson

William Jackson and Brian Callahan had used a more creative way of conducting their insider trading plans. Jackson, who worked for a printing company, had provided Callahan with copies of Business Week magazines that contained news on company stocks even before they hit the stores.

The duo earned around $19,000 each from their scheme. The scandal had brought to light a growing problem with business publications and the rising cases of insider trading.

8. Jeffrey Skilling

The Enron scandal was known to the world as one of the worst disasters to happen in the American business scene. Enron was previously one of the top energy companies, however, as time passed, the business soon experienced a slow decline.

Skilling, who was the company’s chief financial officer, misled the public by not disclosing the negative financials of Enron and instead reassured investors of the company’s “good” future. Knowing that the company will eventually crash, Skilling had sold off his Enron stocks beforehand.

7. Collotta Couple

Randi Collota, an officer for the investment company Morgan Stanley, had provided non-public information to her husband Christopher Colotta and a Florida-based trader who then shared the sensitive information to managers who worked for a Bear Stearns hedge fund.

The couple had earned around $9,000 for the tips they had provided — consequently, the companies that benefitted from the information they provided had gained around $600,000 in profits.

6. Yoshiaki Murakami

The Japanese investor Yoshiaki Murakami worked with a hedge fund that acquired stocks in the communications company Nippon Broadcasting that amounted to around 1.93 million worth of shares. He had initiated the move after learning from a tip that the financial services firm Livedoor was to acquire 5% of Nippon Broadcasting.

Murakami had earned $25.5 million from the non-public information he had. The scandal had shaved off 6% off of the Nikkei and Livedoor’s value dropped by 52% in just five days.

5. Rene Rivkin

Rene Rivkin was regarded as one of Australia’s most famous bankers. He had acquired secret information that Australia’s largest airline Qantas was to merge with Impulse Airlines.

Rivkin had only gained a measly $346 from the 50,000 shares he had invested on Qantas. He was permanently banned from the stock market and was sentenced to nine months in prison.

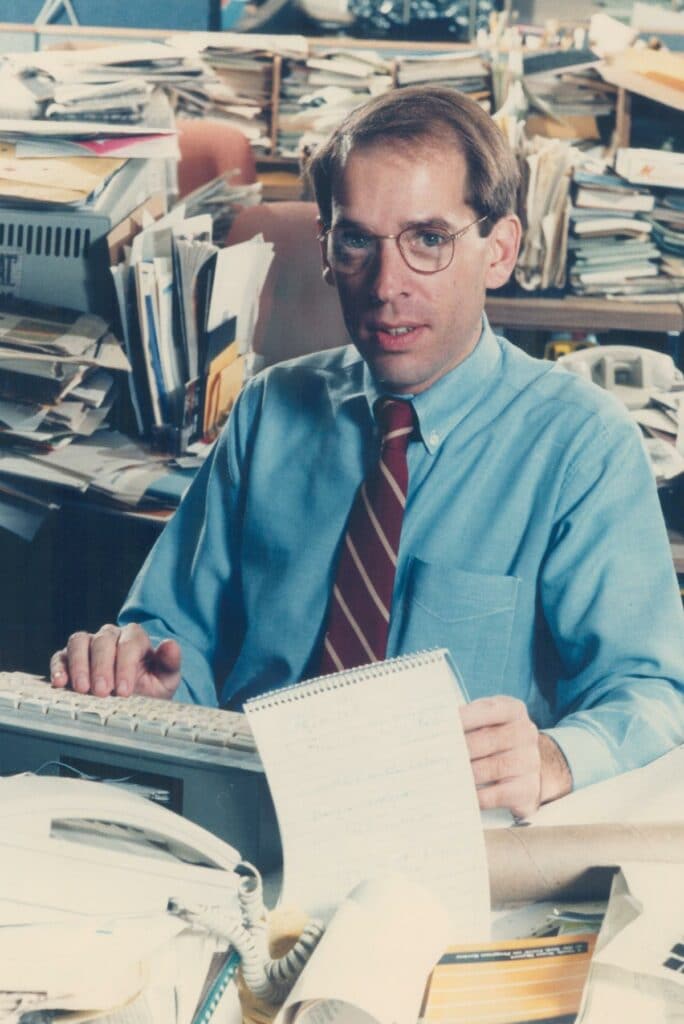

4. R. Foster Winans

R. Foster Winans worked as a columnist for The Wall Street Journal and he was known for his weekly release entitled “Heard on the Street”. As a financial writer, Winans had connections with people in the financial world and he himself held a certain authority as well as a financial columnist.

Winans had involved himself with a stockbroker who believed that he would gain an advantage from learning about Winans’ articles way before it is published. Winans had agreed to the partnership and he earned around $30,000 as his cut from the deal.

3. Phil Mickelson and Billy Walters

The professional golfer Phil Mickelson was no stranger to the dark world of insider trading. He had a golfing companion who went by the name Billy Walters.

Walters himself was a high earner after profiting from his involvement in the creation of a computer-based betting system. However, Walters was engaging in insider trading with his friend Tom Davis who was part of the board of the food company Dean Foods.

Davis had provided sensitive information to Walters who would then go on to make a profit — at the same time, Walters would also pass on this private information to Mickelson who would also gain huge profits from the scheme.

2. Ivan Boesky and Dennis Levine

Dennis Levine worked as a director for the investment firm Drexel Burnham Lambert which was respected as one of the most successful firms on Wall Street. However, as the company grew bigger, Levine also had a bigger network of connections.

One of these was with one of the biggest insider traders Ivan Boesky. Levine had gained around $2.69 million from the partnership while Boesky had earned a massive $50 million in profits from the insider tips.

1. Albert Wiggin

Albert Wiggin was known as one of the biggest banking personalities during his time in the 1920s. Since he thrived in his fortunes at a time when financial laws were still not fully defined, most of Wiggin’s insider trading activities were technically not punishable by the law.

As the head of the huge banking firm Chase National Bank, Wiggin had plenty of behind-the-scenes information about the company at his disposal. In the year 1929, Wiggin had begun short-selling his personal stocks with the company while at the same time he had moved Chase Bank to continue buying.

Manipulating the market for his own gain, Wiggin had earned around $4 million which translates to roughly around $54.7 million in today’s money. Soon after, the government drafted a law which was called the Wiggin Act which implemented stricter policies that prevented future traders from imitating Wiggins’ insider trading activities.

What is the punishment for insider trading?

When caught, the corresponding punishment for people found guilty of insider trading actually varies depending on the gravity of the situation and how many investors and businesses were affected.

However, according to US law, the maximum penalty that can be imposed on insider traders is a sentence of up to 20 years in a federal penitentiary. For convicted individuals, the maximum fine is $5,000,000 while entities such as businesses that have publicly listed shares that are found guilty will have a maximum penalty of $25,000,000. However, as can be seen in this article, the penalties can fluctuate at different rates.