Cash cow is a common term used to describe a company that is consistently profitable and delivers strong and recurring earnings.

What is the meaning of a cash cow?

Cash cow is often to describe consistently profitable businesses, assets, or products that deliver strong and steady income, without growing, and they can even be in an industry that is in decline.

A business that delivers stable cash flows over the course of its life and requires low CAPEX to maintain is essentially a cash cow. The term can also be used to describe certain stocks of companies that are mature and well-established, and continuously deliver earnings to their shareholders.

Cash cow companies are also able to consistently retain market share and are usually market leaders, and they also tend to be large corporations. Cash cows are some of the most sought-after businesses, because they require low ongoing investment, and consistently deliver high returns.

Why is it called a cash cow?

The analogy also originates from farming, and the idea that a female even after giving birth will continue to produce milk, essentially being a cash cow for the farmer. Additionally, cows do not require a lot of maintenance to continue to produce milk.

What is the origin of the term cash cow?

The term cash cow is attributed to Peter Drucker who used it to describe well-established companies with a strong historical performance who are to maintain their share of the market in their industry.

Cash cow example

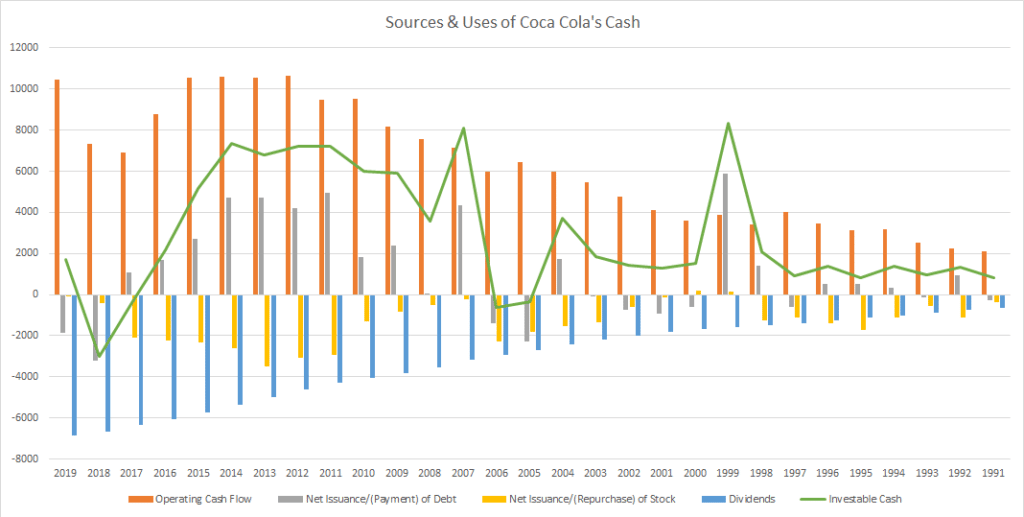

A good example of a cash cow is Coca-Cola, which has been in business for centuries and continues to deliver revenues, and strong earnings. Despite the low growth, the company has maintained its market-leading position and remains the most popular soft drink in the world.

Despite the low growth over the last 10 years, Coca-Cola has continuously maintained its revenues, and earnings, while increasing its dividends and rewarding shareholders.

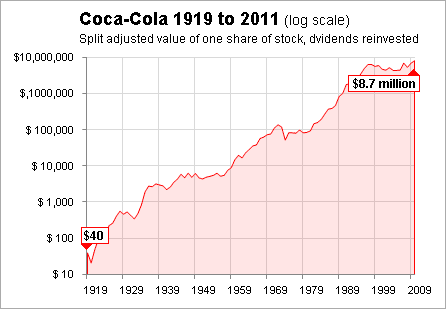

This consistent financial performance can also be seen in the stock performance, which continuously has beaten the market.

Features of a cash cow business

There are a few key features that define a cash cow:

- Maintains market share

- Stable revenues and cash flow

- Slow growth

- Continuously profitable

- Well-established company

- Stable or declining industry

- Doesn’t require a lot of CAPEX

Maintains market share

One of the main features of a cash cow is that despite its relatively low investment, or CAPEX, the company is still able to retain its market share. An example of this is Coca-Cola, which does not require a large investment every year, but it is still able to retain its customers.

Stable revenues and cash flow

Steady revenue and cash flows are other common features of cash cow companies, who despite the low investment are still able to generate consistent revenues and cash flow.

Slow growth

Cash cows are also known for being stable and solid companies in mature industries, which tend to have low growth.

Continuously profitable

Cash cow companies are also consistently profitable, and continuously deliver returns to their shareholders, or owners.

Well-established company

Another common feature is that they are mature businesses that have been operating for several years, and are usually recognizable brands, that everyone knows and uses.

Stable or declining industry

The industry in which they operate tends to also be a mature industry, and it might be slow growth or even a declining sector.

Doesn’t require a lot of CAPEX

Finally, cash cows are also known to require very little continuous investment in the business, which helps the companies to be consistently profitable and deliver high returns to shareholders.

Cash cows as a segment of a company

Although some companies are standalone cash cows, in some cases the segment of a company is the cash cow itself. Some companies actually have certain segments that can be considered a cash cow, and end up financing or generating the required cash flow to expand other segments. Essentially acting as the driving force behind the company’s growth, while management will try to take advantage of the cash flow generated to grow other areas of the business.

Cash cow segment example

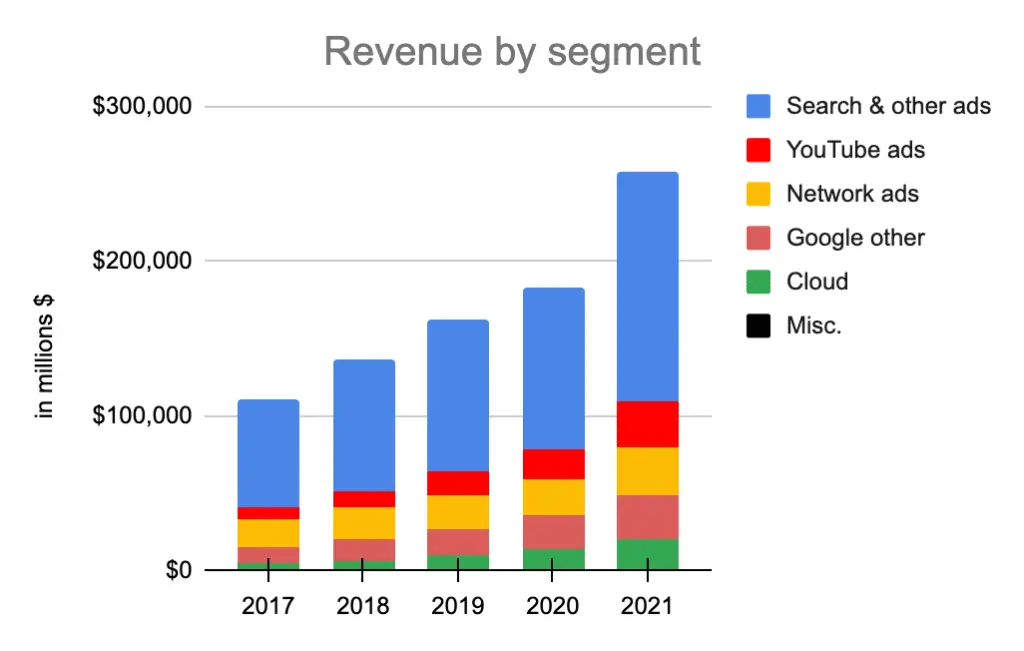

A good example of this is Google, which has been using the cash flow generated by its advertising revenues to grow other segments of the business.

This type of company also tends to reward its shareholders, either by distributing profits or by a great stock performance reflecting the quality of the business. While some of these companies such as Coca-Cola grow their dividends over time, others such as Google might not pay any dividends but they beat the market.

What should a company do with the cash that is generated by cash cows?

When it comes to using the cash flow generated by a cash cow, there are two main uses: distributing profits through dividends or investing that capital back into the business. Although dividend investors love to get dividends every quarter, and sometimes even special dividends, actually the best use of the cash is to invest back in the business.

The reason has to do with taxation, and the fact that every time a company pays its shareholders a dividend, investors are forced to pay taxes on that income.

Warren Buffett has remained one of the biggest proponents of this type of approach, and this is the reason why Berkshire Hathaway does not pay dividends. Instead, they focus on using the capital to reinvest in the business or acquire other businesses.

This benefits shareholders because they can sell the stock when they need additional income, and optimize the taxation of their investments. It allows the cash in the business to compound without having to pay taxes every quarter when you receive a dividend.

Risks of cash cows

Despite all of the benefits of cash cow businesses, there are still some risks that investors should be aware of:

- Lack of investment in the company

- Low returns on the investments made with the cash generated

- Declining industry

Lack of investment in the company

If the company is continuously distributing profits, it may lack the required investment in the business to keep it competitive. There is always disruption across sectors, and even in mature industries. By not investing enough in the business some companies face the risk of disruption.

Lack of innovation could pose a threat to a company’s profitability and its market-leading position.

Low returns on the investments made with the cash generated

Another risk that cash cows face is if the company chooses to use the cash flow to invest in the business and earns a low return, it could destroy shareholder value. This is also something that investors should consider.

Declining industry

Lastly, if the company operates in a declining industry, its profitability, and earnings could decrease over time. This is why it is so important to either use the cash to reinvest in new segments so it can capture different sources of revenue.