It is easy to get caught up in the mainstream media news, with so many things happening at the same time in financial markets it can be overwhelming for retail investors to pay attention to what really matters. One of the most important indicators investors can track is insider activity. One great signal sometimes ignored by mainstream media is insider activity.

What is insider activity?

Insider activity is an umbrella term used to describe when company insiders, officers, directors, or executives either buy or sell the stock. It is one of the most useful factors for investors to analyze how those with a lot of knowledge of a specific company are trading the stock.

Knowing insiders are buying can be a great bullish sign, and conversely, when insiders sell the stock it could be a bearish signal.

Who is considered an insider?

Any employee of the company that has a director, executive or officer role is considered an insider. Shareholders of the company that owns 10% or more of the outstanding shares are also considered insiders.

Why insider activity is important

Source: University of Cambridge

Source: University of Cambridge

One of the main reasons why insider activity is so important to monitor is that it could signal bearish and bullish reversals on stocks. Additionally, insiders tend to have a lot more information about what actually goes on inside the company than an outsider.

This makes it very compelling to track insider buying and selling, to try to understand how each one of these individuals is looking at the stock from an investment perspective.

Why do insiders have more information?

There is no doubt that nobody knows a company better than the people working there. Not only do they have first-hand experience but they also are familiar with the industry.

Usually, a stock with high insider ownership is an excellent sign. As insiders will strive to make the company succeed since they have skin in the game. They usually have a vested interest aligned with yours as a shareholder. Although it’s uncommon, some companies have insiders driven by a personal agenda. If that is the case you should consider avoiding that stock altogether.

Why insiders buying is much more important than selling

As Peter Lynch once said, “insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

This statement still holds true. Insiders might sell for some personal reason that is not directly related to the stock performance. But when insiders buy, their main goal is to make a profit. Therefore an insider buying could sometimes be a great predictor of a bullish reversal.

After all, what is a better sign than a worker trying to acquire shared ownership of the business he works for? Not only that but as an insider you have a deeper knowledge of the company and how it operates.

At the same time, you are much more knowledgeable about the industry and the competition. With this in mind, insiders are usually in a privileged position. Since they have more information available and knowledge, their decision to buy is a positive indicator for the stock.

How to analyze insider activity

There are a few different things you should analyze when insiders are buying:

- Volume traded

- Historical trades

- Number of insider buying

Volume traded

The first thing investors should do is analyze the volume of shares traded. It will be necessary to compare the amount of stock bought in nominal terms, but also compare it with the salary the insider is getting and any information on his net worth that you can get online. This should give you a good idea of whether an insider is just buying a few shares to diversify his portfolio, or he is actually committing a lot of money to the company he works for.

Historical trades

It is also important to get information on the number of trades an insider has made. Some insiders are known for buying and selling shares regularly. However, some do not trade very often, and if they are buying a lot of shares out of a sudden, it could mean that the stock is going higher.

Number of insider buying

Additionally, it is also crucial to identify exactly how many insiders are buying the stock. While one insider buying is definitely a bullish sign, if there are several insiders buying then there is definitely something going on.

Why do insiders sell?

Source: Fool

Source: Fool

When it comes to selling it can happen for a lot more reasons. It can be a personal decision, based on the worker’s personal life. Therefore, the decision to sell a stock might not always be an investment decision the insider is making or it may not signal that he does not think the stock is a good investment.

Insider buying is far more important than insider selling because it is a strong signal that an insider is bullish on the company. This is also attributed to the fact that it is much easier to know when to buy something, than when to sell. Buying securities has mainly to do with their value and determining if they are undervalued.

What does insider selling tell you?

Although insiders might sell because they no longer believe the stock is a good investment there are other reasons why it may happen. Here are some of the reasons why insiders might sell a stock:

- The stock is overvalued

- The company’s prospects are negative

- Personal reasons

- Stock options

- Lock-up period ended

The stock is overvalued

One of the possible reasons why insiders sell a stock is because it is overvalued. This is common, especially in tech stocks that tend to reach extremely high valuations. This can be easily spotted when you see several insiders selling at the same time.

The company’s prospects are negative

If the company’s prospects are negative, and the insider has a bearish on the business it will sell those shares. Although it may happen frequently it is difficult to tell exactly when this is happening, but if you look at several insiders selling it could signal that their views of the company have shifted.

Personal reasons

Some insiders sell their stocks due to personal reasons, and there is no way of telling exactly when this is happening.

Stock options

Another reason why insiders sell is that they may have exercised their stock options. Some companies award stock options, as a way to incentivize staff and an insider might exercise the option and sell those shares.

Lock-up period ended

The lock-up or lock-in period is a timeframe where shares of the company cannot be sold and it is common among insiders following an IPO. When the lock-up period expires it is common for some insiders to sell stock.

What drives insider activity?

There are many reasons that can drive investors to sell a security. It can be because your initial investment thesis was flawed, and the investment turned out to be a mistake that translated into a loss.

It could be driven by a recent spike in the price of that particular security. As we mentioned before it could also be influenced by a financial need of some sort. To sell securities, investors should do it on a valuation basis.

Meaning they have to value the company and determine if it is overpriced. If it is, you should sell your shares. For that reason, it is more difficult to make a selling decision than buying.

When you are working for a corporation and know its ins and outs, you have a much better understanding of how it is managed and its future prospects. This is why when someone working at the company buys the stock it is a very bullish signal. After all, insiders are in a privileged position to make those decisions.

No matter how much you research and analyze, an insider will always be more informed than you. That is not to say that all insiders know what they are doing. When considering insider purchases, you should understand how many insiders are buying and how many shares. This is a very important aspect.

If many insiders are buying a high number of shares that is a very bullish sign. On the other hand, only one insider buying a few shares is practically insignificant.

Historical data on insider activity

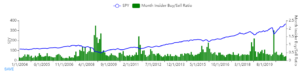

Looking back in time you can clearly see the insider buy/sell ratio compared with the fluctuation of the S&P 500. It is striking how good insiders are at market timing. In essence, they take advantage of crashes in the same way retail investors should.

Source: Gurufocus

Source: Gurufocus

While analyzing the data we can easily see that the buy/sell ratio increases exponentially when there is any correction. Following the advice of Warren Buffett, to be greedy when others are fearful and be fearful when others are greedy seems to be working so far for insiders.

Conclusion

The bottom line is that despite its relative unimportance, insider activity can send signals to investors. Although insiders buying is certainly more relevant than selling. Investors should be on the lookout for these signals and act accordingly. Insiders in a general sense have proven to be very successful at taking advantage of bear markets.