You may have heard the term "bullish reversal" before but what does it actually mean? A bullish reversal is when the price of an asset starts to increase after a period of decline. This can happen for several reasons but usually indicates that the market is starting to become more optimistic about the asset's future prospects.

In this article, we will discuss 13 different candlestick patterns that indicate a bullish reversal.

We will describe each pattern, as well as how to spot it on your charts

What is a bullish reversal?

A bullish reversal is a term used in technical analysis to describe a change in the market trend from down to up. This can be spotted with candlestick patterns, which are graphical representations of price movements over time.

A bullish reversal means that the market has changed its sentiment from bearish to bullish. The market sentiment is the overall feeling or tone of the market. It is important to remember that the market sentiment can change quickly, and it is not always easy to spot a reversal. However, it is typically seen as a sign to buy a signal.

How does a bullish reversal work?

A bullish reversal is a technical analysis term used to describe a situation in which a stock or other security that has been trending downward reverses course and starts heading upwards. They work by identifying key levels of support and resistance in a security's price chart, which can give traders clues as to where the stock is likely to head next.

How to identify a bullish reversal

If you're watching for bullish reversals, there are a few things to look for on a chart.

First, you'll want to see a clear downtrend that suddenly changes direction. This may happen over several days or weeks.

Second, volume usually increases as the stock starts to move back up - this indicates that there's buying interest from investors.

Finally, the moving averages (a technical indicator that smooths out price data) may start to turn up as well. There are a few specific candlestick patterns that can indicate a bullish reversal underway.

One is the "bullish engulfing pattern," which happens when a small black candlestick is followed by a large white one. This suggests that the bears are losing control of the stock and the bulls are taking over.

Another pattern to look for is the "hammer." This happens when the stock trades lower than its opening price but rallies to close near the high of the day. The long lower shadow indicates that there was significant selling pressure, but the bulls were able to push the stock back up by the end of the day.

The "inverted hammer" is similar to the hammer, but it happens at the end of a downtrend. This suggests that the bears are losing steam and the bulls may be ready to take control.

The "morning star" is another three-candlestick pattern that can indicate a bullish reversal. It happens after a long black candlestick and is made up of a small white candlestick in the middle, followed by a large white candlestick.

To spot a bullish reversal, keep an eye out for these three things:

- A sharp drop in price followed by a period of consolidation

- A break above a key level of resistance

- An increase in buying volume

If you see these signs on a chart, it could be an indication that a bullish reversal is underway. If you see a stock that you think is about to experience a bullish reversal, it's important to do your own research before making any investment decisions.

Combining it with fundamental analysis

You'll want to look at the company's fundamentals and make sure there's a reason for the sudden change in direction. Once you've done your due diligence, then you can decide whether or not to buy shares.

Bullish reversals can be great opportunities for investors, but it's important to approach them with caution. By doing your research and understanding the underlying reasons for the reversal, you can increase your chances of success.

Some investors believe that spotting a potential bullish reversal is more art than science. While there are some clear signs to look for, ultimately it's up to the investor to decide whether or not to act on them. If you're new to technical analysis, it may be a good idea to wait for a few confirmations before buying shares, or even try paper trading.

However, if you're experienced and comfortable with making decisions quickly, then you may be able to take advantage of the reversal sooner. No matter what your approach is, always remember to do your own research before making any investment decisions. And never forget that past performance is no guarantee of future results.

13 Candlestick patterns that indicate a bullish reversal

Many different candlestick patterns can indicate a bullish reversal, but we will focus on 13 of the most common ones. Each pattern has a specific name and is made up of one or more candlesticks.

The patterns vary in terms of their complexity, but all can be spotted on your charts if you know what to look for.

We've already mentioned a few candlestick patterns that can indicate a bullish reversal, but there are many more.

Here's a list of 13 candlestick patterns that technical analysts look for to spot potential reversals:

1. Three White Soldiers

2. Hammer

3. Inverted Hammer

4. Morning Star

5. Piercing Pattern

6. Bullish Engulfing

7. Three Inside Up

8. Tweezer Bottom

9. White Marubozu

10. Bullish Counterattack

11. Three Outside Up

12. Bullish Harami

13. On-Neck Pattern

1. Three White Soldiers

This bullish reversal can be spotted by looking for three consecutive white candlesticks that have progressively higher closes. Each candle should close near the high of the day, and there should be very little overlap between each candlestick.

The Three White Soldiers is a bullish reversal that can indicate the end of a downtrend and the beginning of an uptrend. This pattern is most effective when it occurs after a prolonged decline.

The key to trading this pattern is to wait for the breakout and then enter the trade. The stop loss should be placed below the lows of the three candlesticks. The target price can be set at the next resistance level.

2. Hammer

A hammer candlestick forms when the price of an asset drops significantly lower than its opening, but then rallies back to close near its original price. The long wick on the bottom of the candle indicates that sellers tried to push prices lower, but buyers eventually stepped in and pushed prices back up.

This shows that there is significant buying pressure even when prices are falling. The hammer candlestick is a bullish reversal pattern that can indicate the end of a downtrend.

3. Inverted Hammer

This bullish reversal is characterized by a small body with a long upper shadow. It forms when the market is oversold and may signal a rebound. It is found at the bottom of a downtrend and is considered a bullish signal.

This is one of the most reliable reversal patterns. The inverted hammer is created when the market makes a lower low, followed by a higher low. The candlestick then closes near its high for the period. This type of setup often indicates that sellers are losing control and that buyers are ready to take over.

4. Morning Star

When looking for this bullish reversal, traders should look for a candlestick with a small body that is located below the candlesticks from the previous day. The Morning Star signals that selling pressure is exhausted and buyers are beginning to step in, which could lead to higher prices.

5. Piercing Pattern

This trading indicator comes from candlestick analysis and is used as a bullish reversal signal. The piercing pattern forms when a stock price trades below a support level and then rallies back above that same support level.

The candle should close higher than the midpoint of the previous candle to form this pattern. The first candle is a long bearish candle that creates the support level. The second candle is a short bullish candle that rallies back above the support level. This creates the piercing pattern.

The piercing pattern is a bullish signal that can indicate that the stock is about to enter an uptrend. This pattern can be used as a trade entry point when the stock price breaks above the resistance level.

The key to trading this pattern is to wait for the breakout and then enter the trade. The stop loss should be placed below the support level. The target price can be set at the next resistance level.

6. Bullish Engulfing

This bullish reversal pattern forms when a small black candlestick is followed by a large white candlestick that completely engulfs the previous day's trading range. This pattern suggests that selling pressure has been exhausted and buyers are now in control.

Bullish engulfing patterns often occur at market bottoms following a decline. The bullish engulfing pattern is one of the most reliable reversal patterns. It can be found in all markets and across all timeframes. While it is not as common as some other patterns, it is one of the most reliable.

7. Three Inside Up

This trading pattern is the complete opposite of the Three Outside Up pattern. Here, you will see that the candlestick creates a lower high and a higher low. For this reason, it is sometimes called an “upside-down” version of the Three Outside Up pattern. This trend reversal signal indicates that sellers are starting to take control of price action from the buyers.

The Three Inside Up trading pattern is a strong reversal signal that you should look for when trading the markets. This pattern can occur at the end of an uptrend or downtrend, so it is important to pay attention to the market context before taking a trade.

When you see this pattern, it is a good idea to enter a short trade with a stop loss above the high of the candlestick. The Three Inside Up pattern is created when three consecutive candlesticks have lower highs and higher lows. The first candlestick in the pattern is typically a long red candle, which is followed by two small green candles.

8. Tweezer Bottom

The tweezer bottom is a bullish reversal pattern that signals the end of a downtrend and the beginning of an uptrend. The pattern gets its name from the fact that it looks like a pair of tweezers.

The tweezer bottom is created when the market makes two consecutive lows, followed by a higher low. The pattern is confirmed when the market breaks above the high between the two lows. The tweezer bottom is a relatively rare pattern, so it can be difficult to identify. However, when it does occur, it can be a powerful signal that the market is about to turn around.

9. White Marubozu

A white marubozu is a type of candlestick chart that is characterized by a long white body with no shadow. This indicates that the market is bullish, meaning that prices have been rising during the time period represented by the candlestick.

A white marubozu signals strength and momentum in the market and can be used to identify potential market reversals. However, if prices start to fall after a white marubozu forms, it may be an indication that the market is losing steam and a reversal could occur.

10. Bullish Counterattack

This technical pattern occurs when prices move higher after hitting a support level. The bullish counterattack is a technical pattern that can signal the beginning of an uptrend. It occurs when prices move higher after hitting a support level. This pattern can be used to identify buying opportunities in the market, and it is important to know how to spot them so you can take advantage of them.

The first step is to identify a support level. This can be done by looking at the recent lows in the market, or by using technical indicators such as the moving average convergence divergence (MACD) indicator. Once you have found a support level, you need to wait for prices to start moving higher.

This is the “counterattack” part of the pattern. The next step is to identify the point at which prices start to move higher. This is known as the “breakout point.” You can use technical indicators such as Bollinger Bands or support and resistance levels to help you identify the breakout point.

Once you have found the breakout point, you can enter a long position in the market. The final step is to place a stop-loss order below the support level. This will help you protect your profits in case the market reverses and starts moving lower again.

The bullish counterattack is a simple but effective technical pattern that can be used to trade the markets. By following the steps outlined above, you can identify buying opportunities and place stop-loss orders to protect your profits. So, keep an eye out for this pattern in the market and learn how to trade it.

11. Three Outside Up

This trading pattern is composed of three candlesticks. The first is a bearish candle, the second is bullish, and the third is again bearish. This pattern forms when prices are first pushed lower by sellers, then buyers step in to push prices back up above the opening price of the first candle (hence forming a bull body), only to see selling pressure return and push prices back below the close of the second candle.

This is a bearish reversal pattern and suggests that prices may continue to move lower in the future. If you see this pattern forming, it would be a good idea to wait for the third candle to close before entering a short position.

12. Bullish Harami

When it comes to bullish reversals, the bullish harami is one of the most reliable candlestick patterns out there. The pattern is formed by two candlesticks, with the second candle being much smaller than the first and opening within the body of the first candle.

This type of setup often indicates that sellers are losing control and that buyers are ready to take over. The bullish harami is a great candlestick pattern to keep an eye out for when trading reversals. Not only is it relatively easy to spot on a chart, but it also has a very high success rate.

If you see this pattern forming after a period of selling, likely, the market is about to turn around. The next step is to wait for confirmation. This comes in the form of the candlestick closing above the high of the first candle. Once this happens, it’s a good idea to enter a long position.

Stop-loss can be placed below the low of the second candle and the profit target can be set at previous swing highs. The bullish harami is a two candle pattern, so it’s important to wait for confirmation before taking any trades.

However, once you do see confirmation, the pattern has a very high success rate, making it a great tool for trading reversals.

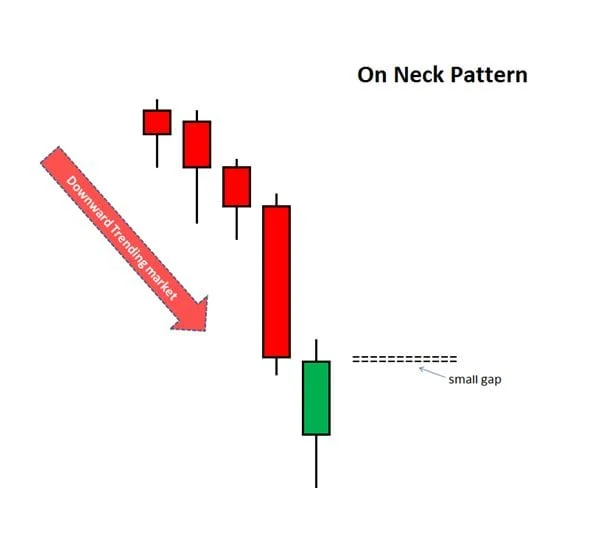

13. On-Neck Pattern

This bullish pattern is created when the stock price forms two consecutive lows, with the second low being lower than the first. The second low is followed by a rally that doesn’t quite reach the level of the first low.

The on-neck pattern is considered a bullish reversal pattern and can be used to enter long positions.

Which candlestick pattern is most bullish?

The hammer is one of the most bullish candlestick patterns. This is because it indicates that the market has found support at the current level and is starting to move back up. The longer the shadow on the hammer, the more significant the reversal is likely to be.

For example, a hammer with a long lower shadow and a small body is more bullish than a hammer with a short lower shadow and a large body.

This also indicates that there is a lot of buying pressure in the market and that the trend is likely to continue. If you see a hammer pattern forming, it is a good idea to enter a long position.

What happens after a bullish reversal?

The answer to this question depends on the context of the market and the specific security in question. To determine what a bullish reversal means for a particular security, it is important to look at the bigger picture.

By considering all possibilities, investors can better prepare themselves for what may come. For example, if the market is in a long-term uptrend, then a bullish reversal may signal the beginning of a new leg up.

On the other hand, if the market is in a long-term downtrend, then a bullish reversal may simply be a false hope before the trend resumes its downward path. However, as a general statement, after a bullish reversal happens, prices tend to continue moving higher.

This is because the underlying fundamentals that caused the original move higher are still in place. It also means that many investors are now more confident in these fundamentals than they were before.

Of course, there are always exceptions to this rule, and no one can predict the future with 100% accuracy. However, understanding reversals and their potential implications can help you make more informed investment decisions.

What is bullish reversal reliability?

Bullish reversal reliability is the likelihood that a stock will reverse course after a period of decline. Many factors go into determining the reliability of a bullish reversal, including the length and magnitude of the decline, overall market conditions, and sector-specific factors.

Investors who are looking for stocks that are likely to experience a bullish reversal can use several technical indicators to identify potential candidates. Some common indicators used to identify bullish reversals include support and resistance levels, candlestick patterns, and moving average convergences.

Once a potential candidate is identified, investors need to carefully consider all of the relevant factors before making a decision. No investment decision should be made without careful consideration of all the risks involved.

Remember, even though a stock may have the potential to experience a bullish reversal, there is no guarantee that it will actually happen.

Is a bullish reversal good?

A bullish reversal is a good sign that the market is healthy and that prices are likely to continue to rise. However, it is important to remember that reversals can be false signals, so it is important to do your own research before investing.

One factor to consider when determining whether or not to invest in a stock experiencing a bullish reversal is the overall market conditions.

If the market as a whole is in decline, the stock will likely continue to decline even after reversing course. Another factor to consider is sector-specific conditions. For example, if the stock belongs to a sector that is currently underperforming, it's less likely to experience a bullish reversal than a stock from a sector that is doing well.

It's also important to look at the individual stock's chart and recent price history to get an idea of how strong the reversal is likely to be. If the stock has been in a long-term downtrend and suddenly reverses course, likely, the reversal is not sustainable and prices will soon resume their decline.

On the other hand, if the stock has been in a strong uptrend and then pulls back sharply, this could be a sign that the trend is still intact and that prices are likely to continue moving higher. Overall, a bullish reversal is good if it occurs in a healthy market and the stock has strong fundamentals. However, sound trading principles still apply and it is important to do your own research before investing.