Student loan debt has skyrocketed over the last few years, and with COVID the government decided to pause all of the student debt payments. New ideas are being tossed around in Washington on how to proceed next, and they might even be deferred until 2023, while some advocate for canceling student debt.

While legislation is being discussed to tackle the situation, the student debt bubble keeps growing and it cost taxpayers $100 billion so far.

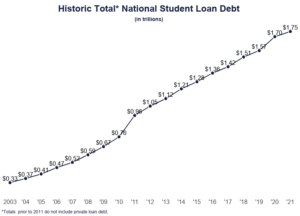

The total amount of student loan debt now stands at over $1.75 trillion, and it is expected to continue to rise.

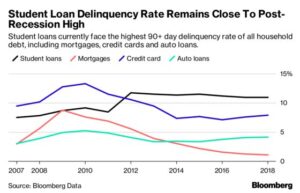

Although there are no more delinquencies or defaults, since payments are deferred until May 2022, and the interest was dropped to 0%, during 2020 Pew estimated that 20% of student loans were in default.

This shows how massive the student loan bubble is, and how the government needs to keep measures in place in order to avoid popping the bubble. As it could trickle down into other areas of the economy, and given the high rate of inflation, it could be devastating for young people.

Student debt already had the highest percentage of default, and when we compare the estimate of default in 2020, to the 2018 levels it is nearly a 100% increase in the percentage of defaults.

Is there a way to short student loans?

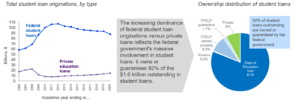

Yes, there is a way to short student loans, however, there are not many choices when it comes to shorting a student loan debt bubble. The reason is that the government is actually the largest creditor in student loan financing.

Source: Navient

While there are some private companies operating in student loan financing, they do not represent the bulk of all of the student loans granted. Additionally, for most of these companies student debt is just a small segment of all of their operations, so it is difficult to get a 100% short exposure to student loans.

Student loan bubble shorting options

Since there are not many stocks trading just related to student loans, there are alternative options. Companies whose operations would be indirectly affected if students could not pay their student loans. Some of these companies include private universities, which would certainly see revenues declining if students could not get access to student loans.

Navient (NAVI)

Navient is one of the largest private student loan lenders, and it is by far the best stock to short student loan debt. Although it provides other credit services student loans are the bulk of the company’s operations. This could be one of the best ways to short the student loan debt bubble, however, you should keep in mind a few things.

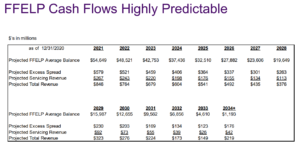

- Half of the loans provided by Navient are under the Federal Family Education Loans Program, or FFEL or FFELP. This means that these loans are guaranteed by the federal government, so in case of default, the government will pay Navient, which means they won’t have any losses.

- The other half of Navient’s student loans are totally private, and therefore the risk of default could hurt the company.

In one of its presentations, the company even states how predictable the cash flows are from the loans generated under the FFELP.

Nelnet (NNI)

Another option you may consider is Nelnet, especially after they have acquired Great Lakes Educational Loan Services, which was one of the largest student loan providers. Nelnet offers several credit services but it does have a sizeable segment when it comes to student debt. Although the total Nelnet exposure to student loans is lower than Navient it should also be considered as a viable way of shorting student loan debt. You should additionally consider that some of the loans are under the FFELP.

University stocks

Another way of getting short exposure to the student loan debt bubble is by shorting for-profit education stocks that might suffer if the bubble implodes and lending requirements increase.

This is not a direct way of shorting student loan debt, but we can only expect that if the bubble pops lending requirements will increase. This will lead to more students not being able to pursue higher education, which in turn affects the profitability of these institutions.

Here are some examples of educations stocks that could be used:

- Grand Canyon Education (LOPE)

- Perdoceo Education (PRDO)

- Adtalem Global Education Inc. (ATGE)

- Laureate Education, Inc. (LAUR)

- Strategic Education, Inc. (STRA)

Why the student debt bubble might never pop

Although there are clear signs that unless the government keeps measures in place, the rate of default and delinquencies in student debt will increase exponentially. This poses a risk, but at the same time given the government intervention, it is difficult to see a scenario where the bubble might actually pop.

Therefore it is important to approach a short student debt trade with caution, and if you are not a seasoned investor it might be better to avoid it all together.